Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Australia trade finance market attained a value of USD 1051.49 Million in 2025. The market is estimated to grow at a CAGR of 3.80% during 2026-2035 to reach a value of USD 1526.79 Million by 2035. Australia trade finance market is driven by the expansion in export-import activities, free trade agreements with leading countries, and the growth in crucial industries such as mining and manufacturing.

Base Year

Historical Period

Forecast Period

The Australian Government supports a rules-based digital trading environment. By 2030, Australia’s digital trade is expected to reach USD 126.7 billion from USD 32.1 billion in 2018.

Australia has a strong finance sector. According to the November 2024 report, the finance sector accounts for 7.5% of Australia's industry output.

As per industry reports, in 2023, top 5 exporting partners for Australia were China, Japan, South Korea, India, and the USA, accounting for around 62.8% of Australia’s total international trade in exports.

Compound Annual Growth Rate

3.8%

Value in USD Million

2026-2035

*this image is indicative*

Australia has abundant resources of critical materials such as cobalt, lithium, manganese, tungsten, and vanadium which are crucial for renewable energy generation and battery manufacturing. In 2023, the mining industry was a major contributor to Australia's economy, accounting for around 13.6% of total GDP, supporting the Australia trade finance market growth. In December 2022, Australia had 81 major critical minerals projects in the pipeline with an estimated value of between USD 21 billion and USD 29 billion, up from 71 projects and USD 16.5 billion to USD 27.0 billion in 2021. The expanding foreign investment coupled with new mining projects strengthens the demand for trade financing to facilitate international trade.

Trade finance plays a critical role in the manufacturing sector. International factoring companies work with exporters who require payment up front to reduce default risk while their buyers want to ensure their products arrive in good order. Trade finance offers solutions that traditional financing and payment methods cannot provide, benefiting both parties in the process. In 2022-23, manufacturing sector revenue increased by 2.2% compared to 2021-22.

By 2030, Australia’s digital trade is predicted to reach USD 126.7 billion compared to USD 32.1 billion in 2018. Australia is a strong proponent of a rules-based, open global trading system that promotes the digitalisation of trade, fosters trust and confidence in the online environment, reduces trade barriers, and facilitates digital commerce, thus increasing the Australia trade finance industry revenue.

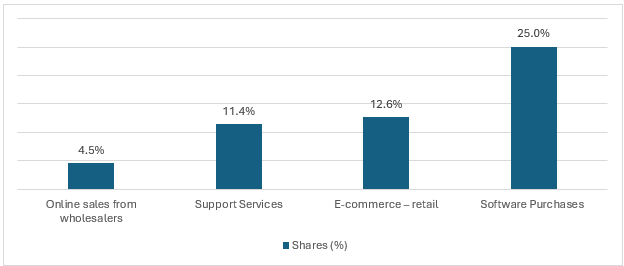

Figure: Digital Activity Increase (%) in Australian Economy, 2021-2022

Australia leads in digital trade rule-making, promoting trade liberalisation and facilitation through active participation in key multilateral forums such as the World Trade Organisation (WTO), United Nations (UN), Organisation for Economic Cooperation and Development (OECD), Asia-Pacific Economic Cooperation (APEC) and G20. It engages with standard-setting bodies like the International Standards Organization and pushes for strong digital trade provisions in its FTAs. By 2030, Australia aims to become a top 10 digital economy globally, supported by digital trade and related technologies, which will likely increase the demand of Australia trade finance market.

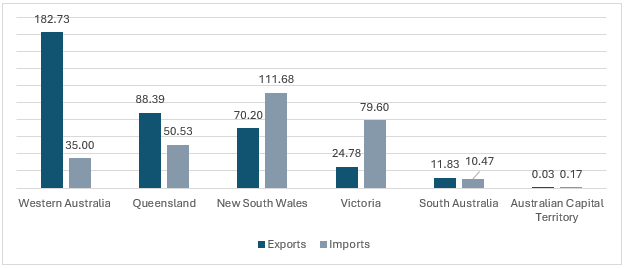

Figure: Australia’s Goods Trade by States (USD Billion), 2022-2023

In 2023, the top 5 trading nations of Australia, including China, Japan, South Korea, India, and the USA, accounted for about 62.8% of Australia’s total international trade in exports. In 2023. Australia’s key exporting commodities included mineral fuels, ores, slag and ash, gems and precious metals, cereals, and meat. Western Australia is a significant exporter of goods, accounting for 46.6% of Australian exports during 2022–2023, while New South Wales is a major importer, accounting for 38.2% of imports during the same period, followed by Victoria with 27.2%.

Significant government support in trade activities in Australia contribute to Australia trade finance market expansion

Australia is considered a safe and reliable trading and investment partner, with the presence of several pro-free trade initiatives and agendas. In the 2022-2023 federal budget, the Australian government allocated USD 129.7 million to establish the foundations for a world-class cross-border trade system, which includes the development of a 'tell us once' trade system. Additionally, the government committed USD 69.47 million to expand the Export Market Development Grants (EMDG) program, aimed at providing financial assistance to regional and rural small- and medium-sized exporters, which is significantly supporting the Australia trade finance market. This funding will support these businesses, which have been adversely impacted by global challenges, in promoting their goods and service such as tourism in new international markets.

The strategic location of Australia provides ample advantages for trade activities

Australia, strategically located between the Indian Ocean to the west and the Pacific Ocean to the east, and in close proximity to the Association of Southeast Asian Nations (ASEAN) to the north, can be characterised as a central state within the Indo-Pacific region. This provides Australia trade finance market an upper hand for trade activities, with most of the country’s principal export partners located in Northeast and Southeast Asia. The growing middle-class demographic of Asia with an anticipated 3 billion consumers by 2030 is further strengthening the demand for Australia’s top exports such as resources, energy and agriculture.

October 2024

The Western Australian Government invested USD 11.54 million to upgrade its southern ports. As part of the project, Accenture will receive USD 9.02 million to boost the performance of over 22 major assets across ports at Albany, Bunbury, and Esperance through hardware and software advancements.

February 2024

HSBC launched HSBC TradePay in Australia, a solution offering businesses a faster, fully digital way to pay suppliers and optimise working capital. With loan processing in under a minute, TradePay enables Just-In-Time financing, allowing companies to control trade payables timing.

Australian banking sector is increasingly deploying advanced technologies such as blockchain, artificial intelligence, and machine learning which aids in streamlining trade finance processes. Banks that are increasingly employing such technologies include HSBC Bank Australia Limited and Australia and New Zealand Banking Group Limited.

In 2022 Australia continued its dominance as the world’s top lithium producer with 52% share. The country was also among the top five producers of cobalt (3%), manganese ore (10%), rare earths (5%), rutile (27%), tantalum (4%) and zircon (25%). Australia’s thriving mining sector makes it an ideal partner in international trade, driving the growth of Australia trade finance market.

Products of trade finance, including letters of credit, supply chain finance, and purchase order finance, involve complex and lengthy paperwork processes. Banks can charge a hefty amount for processing and managing such products, which can add up to the final cost, there by hindering the Australia trade finance market development. Additionally, the time-consuming process can make it less accessible to small and medium-sized enterprises (SMEs).

Cyber fraud, trade-based money laundering, and documentary fraud are among the most common issues in trade finance. The globalisation of trade, the complexity of supply chains, and the rise of digital finance have introduced such risks.

Economic uncertainties and geopolitical risks can reduce international trade due to fluctuating exchange rates and sovereign risk. Such a scenario can reduce export and import of goods, reducing the demand for trade financing services and negatively impact the Australia trade finance market dynamics and trends.

Small and medium-sized enterprises (SMEs) are considered key contributors to Australian employment and economic growth and contribute significantly to Australian goods and services exports. As per 2024 reports, out of the 2.6 million businesses in Australia, 97 are classified by the Australian Bureau of Statistics as 'small' firms, employing fewer than 20 people. An additional 2% are categorised as 'medium-sized' businesses. In 2020-2021, a majority of 93% of exporters were small and medium enterprises (SMEs) in Australia.

Australia’s financial infrastructure is characterised by a well-developed and dynamic ecosystem playing a key role in the nation’s economy. The financial infrastructure includes strong regulatory framework, advanced payment systems, sophisticated financial institutions, and cutting-edge technological innovations. As per Australia trade finance market analysis, Australia has four prominent banks, namely Commonwealth Bank, Westpac, ANZ, and NAB providing several services. According to Australian Banking Association’s June 2023 data, the country has the presence of 97 banks.

According to IMF, in 2022, Australia was ranked the 12th largest economy in the world. Moreover, Australia was recognised as the 9th highest GDP per capita in the world and 3rd highest among the world’s largest 20 economies. The strong and resilient economic framework of Australia is a key factor in the growth of the trade finance market.

“Australia Trade Finance Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Finance Type

Market Breakup by Service Provider

Market Breakup by Offering

Market Breakup by Application

Market Breakup by End User

Market Breakup by Region

By Finance Type Insights

As per Australia trade finance market report, traditional trade finance is being widely employed in which banks serves as intermediaries. According to 2024 data, Australian banks hold assets worth USD 4,127.5 billion. Supply chain finance (SCF) benefits both suppliers and buyers by enabling early payment to suppliers and extended payment terms for buyers. It helps importing businesses unlock working capital and mitigate the risks of bulk purchasing and global transportation.

Prominent providers of SCF in Australia include Fifo Capital Australia Pty Ltd, Australia and New Zealand Banking Group Limited (ANZ), and Citigroup, Inc.

Open account trade finance solutions enable the exporter to ship goods and the importer to receive them before payment is made. Payment for the transaction is then typically due from the importer within 90 days of receiving the goods. Although not a long-term financing solution, it can be sufficient for the importer to receive and resell the goods without requiring upfront payment.

By Service Provider Insights

Banks are constantly investing in advanced trade finance solutions, which is positively impacting the Australia trade finance market. In February 2024, HSBC launched HSBC TradePay in Australia, a solution offering businesses a faster, fully digital way to pay suppliers and optimise working capital. With loan processing in under a minute, TradePay enables Just-In-Time financing, allowing companies to control trade payables timing.

As per the Australia trade finance market, Australia’s four largest retail banks including Westpac Banking Corporation, Commonwealth Bank of Australia, National Australia Bank (NAB), and Australia and New Zealand Banking Group (ANZ) significantly aid the demand for trade finance services by facilitating international trade.

Non-bank lenders include alternative financial institutions, such as development finance institutions (DFIs) and export credit agencies (ECAs). ECAs structure their finance and insurance around non-conventional risks, such as overseas commercial liabilities and political risks.

By Offering Insights

Credit insurance enables companies to offer payment terms to customers both in Australia and internationally. Trade credit insurance protects companies from non-payment across many types of goods and services. The minimum amount of INSURANCE cover available in Australia is USD 3.32 million. This is the required amount under various trade and building licenses.

Given the uncertainties across complex global trade, the letter of credit offers a secured and assured means of payment safeguarding both buyer and seller.

In the 2024-25 budget, the government committed over USD 9.2 million to develop trade partnerships that promote fair global trade rules, enhancing Australia's international competitiveness. This initiative is expected to aid the demand for letters of credit and support the Australia trade finance market revenue.

Bank guarantees are an ideal import financing solution, offering protection to both importers and exporters in international trade. In 2022, Australia imported about USD 289.4 billion worth of goods, about 27.1% increase from 2018. During 2020-2021, the number of importers in Australia increased by 23%, to 320,502.

By Application Insights

As per Australia trade finance industry analysis, trade finance enables the conversion of cross-border trade opportunities into actual transactions by effectively managing the risks faced by both exporters and importers. During 2022-2023, two-way trade in goods was worth around USD 0.66 trillion, equivalent to 40% of Australia’s GDP. In 2022, FDI in Australia surged by 9%. Further, as a percentage of GDP, the stock of foreign investment has grown from 129% in 2003 to 181% in 2023, indicating a growing international trade.

The Australian government is investing in port infrastructure development to ensure its ports are equipped to support trade. In October 2024, the Western Australian Government invested USD 11.54 million to upgrade its southern ports. As part of the project, Accenture will receive USD 9.02 million to boost the performance of over 22 major assets across ports at Albany, Bunbury, and Esperance through hardware and software advancements.

By End User Insights

From 2023 to 2024, the number of trading businesses in Australia rose by 2.8%. This is driving the Australia trade finance market, as more businesses engage in international trade and seek financial support to manage risks, improve cash flow, and facilitate cross-border transactions. In 2021-2022, the Australian trading fleet comprised 55 Australian-registered vessels, including smaller ships and 73 foreign-registered vessels. Queensland recorded the highest discharged volume, totaling 40 million tonnes in 2020-21.

The Australian government is investing in the country’s manufacturing sector owing to its economic importance. In September 2023, it established the National Reconstruction Fund Corporation to drive investment in projects that develop Australia's manufacturing capability and further support the Australia trade finance market. Further, in November 2023, the government launched the “Industry Growth Program” to support SMEs to commercialise and grow their business. Manufacturing, value added as a % of GDP in Australia was reported at 5.39% in 2023.

Trade finance supports business growth by helping stakeholders manage cash flow and working capital. It serves as a tool to free up capital tied up in a company's inventory or receivables. In 2023-2024, New South Wales saw a net increase of 25,569 businesses, the highest growth of any state or territory.

New South Wales plays a pivotal role in Australia's economic growth, accounting for 30.3% of the nation's output in 2022-2023. During the same period, the state exported 17.9% of Australia's trade and imported 38.2% of the country's total trade in goods.

The Port of Melbourne in Victoria is Australia's leading maritime hub for containerised, automotive, and general cargo. In FY 2024, total trade through the port grew by 2.8% year-on-year, reaching 112.0 million revenue tonnes. Imports rose by 3.5% to 62.5 million revenue tonnes, while exports increased by 1.9% to 49.4 million revenue tonnes. Imports from overseas grew by 4.3%, and exports to overseas markets saw a 2.5% rise.In 2022-2023, Victoria remained Australia’s largest food and fibre exporter by value, representing 24% of the national total and supporting the trade finance demand growth.

Trade finance plays a crucial role in international agri-food trade by mitigating risks for exporters and importers, particularly concerning product dispatch, delivery, and payment. In the 2023–2024 period, Queensland's exports of agricultural and food products increased by 6.9% compared to 2022–2023 and were 22.2% higher than the five-year average leading up to 2023–2024. China is Queensland's top goods export market for the 12 months leading up to September 2023, with a value of USD 23.7 billion.

In order to remain competitive, companies in the Australia trade finance market are actively adopting new technologies such as AI, Robotics, API, Cloud, IOT, OCR and Blockchain. Innovations in trade finance is s highly dependent on regulators and legal frameworks. Hence, companies keeping track of regulatory evolutions significantly gain a competitive advantage.

Headquartered in Sydney, HSBC Bank Australia Limited, a subsidiary of HSBC Holdings plc offers a comprehensive range of financial services, including retail and commercial banking, trade finance, treasury and financial markets, global payments solutions, asset management, and securities custody.

Founded in 2009, Ebury is a fintech company focused on international payments, collections, and foreign exchange services. It provides financial solutions primarily for SMEs and mid-sized companies. The company has its presence in 4 major cities of Australia namely Melbourne, Perth, Sydney and Brisbane. The company has grown its global market presence to a network of 31 offices in 21 countries and more than 1,600 employees.

Founded in 2024, SBI Australia offers a wide range of services such as deposits, remittances, trade finance solutions, syndicated loans etc. Synergy of the SBI Global Group and its specialised subsidiaries make SBI Australia the ideal partner for India Related business. SBI Australia also holds an Australian Financial Services License (AFSL).

ScotPac Business Finance is Australia's and New Zealand's largest non-bank SME business lender, providing funding to small, medium, and large businesses, from start-ups to enterprises. Founded in 1988, the company offers a range of financial solutions, including Invoice Finance, Trade Finance, Asset Finance, and Business Loans. ScotPac's extensive reach and tailored services make it a significant player in the financial landscape of Australia.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other Australia trade finance market players include Westpac Banking Corporation, and ANZ Group Holdings Ltd, among others.

June 2024

ScotPac, a trusted non-bank SME lender in New Zealand and Australia, introduced a new product to meet the demand for quick capital with an online application. The Boost Business Loan provided New Zealand SMEs with fast access to funds ranging from $10,000 to $200,000, up to 100% of their monthly sales. This solution offered a simple way for businesses to secure immediate cashflow support.

May 2024

ScotPac, and global business insurance and risk management specialist, Gallagher, formed a preferred partner agreement to provide their clients with easy access to finance and insurance solutions. Through this cross-referral partnership managed by Business Relationship experts from both companies, clients could access top business finance and insurance products seamlessly. This collaboration aimed to save SMEs time when seeking professional services. Clients also became eligible for preferential rates and potential cost savings.

March 2024

ScotPac, launched a new funding solution for SMEs, offering fast and hassle-free access to cash-on-call without minimum repayments or property security. Cash Line functioned as a flexible line of credit, providing eligible businesses with up to $250,000 for a minimum of 12 months. Approvals were granted within 24 hours, with funds deposited within the next 24 hours. This solution allowed businesses to maximise cash flow without principal repayments and eliminated the need for property as security.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is estimated to grow at a CAGR of 3.80% during 2026-2035.

The market is categorised according to finance type, which includes traditional trade finance, structured trade finance and supply chain finance.

The key players are ANZ Group Holdings Ltd., HSBC Bank Australia Limited, Ebury Partners Australia Pty Ltd, State Bank of Australia, Scottish Pacific Business Finance Pty Ltd, Westpac Banking Corporation among others.

Based on the application, the market is divided into international and domestic.

The market is broken down into New South Wales, Victoria, Queensland, Australian Capital Territory, Western Australia, and others.

The Australia trade finance market reached a value of USD 1051.49 Million in the year 2025.

The trade finance market in Australia is estimated to reach a value of USD 1526.79 Million by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Finance Type |

|

| Breakup by Service Provider |

|

| Breakup by Offering |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share