Trends in Subscription-Based Automotive Services and their Future

Subscription-based automotive services are reshaping the mobility landscape by offering consumers flexible access to vehicles without long-term ownership commitments. These services provide a range of options, including short-term rentals, all-inclusive car subscriptions covering insurance and maintenance, and access to high-end or electric vehicles for a monthly fee. According to Expert Market Research, the global car subscription market was valued at USD 10.89 Billion in 2025 and is projected to grow at a CAGR of 28.00%, reaching a value of USD 128.57 Billion by 2035, driven by changing consumer preferences, urbanization, and the growing demand for cost-effective mobility solutions.

The market's growth is supported by increasing digitalization in the automotive sector, automakers’ focus on direct-to-consumer sales models, and the rise of shared mobility trends. Companies are leveraging AI-driven platforms to enhance customer experiences, optimize fleet management, and offer personalized subscription plans. Additionally, regulatory support for sustainable transportation and the growing adoption of electric vehicles within subscription models are expected to further drive market expansion.

Latest Insights on Global Subscription-Based Automotive Services Market: Trends and Developments

In February 2025, FINN secured a €1 billion ABS (Asset-Backed Security) financing program, "ABS II," backed by Citi, Jefferies, and Avellinia Capital to expand its car subscription fleet. The funding will drive growth in Germany and across Europe, strengthening FINN’s market position.

In November 2024, Brisbane-based Karmo acquired rival Motopool, becoming Australia’s largest car subscription business with $33 million in annual revenue. The deal follows Karmo securing a $138 million debt facility from Volkswagen and Toyota Finance, supporting its plan to add 5,000 cars within 12 months.

In August 2024, Kia India launched Kia Subscribe, a flexible car subscription service with tenures ranging from 12 to 36 months. The program includes models like Sonet, Seltos, Carens, and EV6, with monthly rentals starting at Rs 17,999 for the Sonet and Rs 1,29,000 for the EV6. Expanding its Leasing & Subscription services, Kia Subscribe is now available in 14 major cities, including Delhi, Mumbai, Bangalore, and Chennai among others.

In August 2024, Autonomy transitioned from EV subscriptions to Autonomy Data Services (ADS), a SaaS venture with Deloitte. The shift includes USD 2.5 million in funding, a USD 32 million debt-for-equity swap, and the acquisition of subscription-related technology and IP. ADS will offer subscription solutions for OEMs, fleet operators, and automotive industry players.

In April 2024, Helixx Technologies launched a car and van EV subscription service in Southeast Asia, offering brand-new EVs with insurance, maintenance, and interchangeable batteries starting at USD 0.25 per hour or USD 6.0 per day. A key feature is the rapid replacement option, allowing immediate vehicle exchanges to minimize downtime for businesses.

Innovative Mobility Solutions: A Comparative Analysis of Subscription, Ownership, and Rental Models

Subscription vs. Rental: On-Demand Access vs. Predictable Mobility

Subscription-based automotive services provide a seamless, all-inclusive mobility solution with a fixed monthly fee covering insurance, maintenance, and registration. This ensures predictable costs and continuous access to vehicles without administrative complexities. In contrast, short-term rentals operate on a pay-per-use model, offering immediate, flexible access but often at higher per-day rates. While rentals cater to spontaneous, short-term mobility needs, subscriptions leverage AI-driven fleet management and digital integration to deliver a consistent, hassle-free experience.

Subscription vs. Ownership: Flexible Access vs. Long-Term Asset Retention

Automotive subscriptions redefine vehicle access by eliminating large upfront investments and depreciation concerns, providing users with a dynamic, multi-model experience under a single, comprehensive cost structure. Traditional ownership, however, focuses on asset accumulation, customization, and long-term financial benefits through resale value. While ownership suits those prioritizing stability and personalization, subscription models optimize operational efficiency, financial flexibility, and digital-first convenience, revolutionizing modern mobility.

Driving Growth: The Impact of Electric Vehicles on Subscription-Based Automotive Services

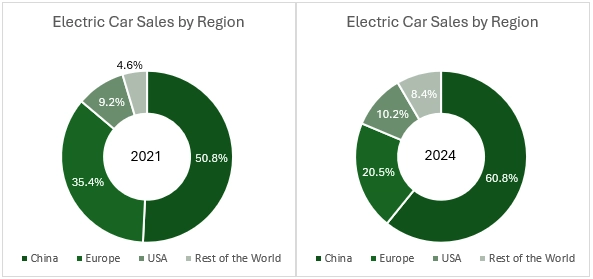

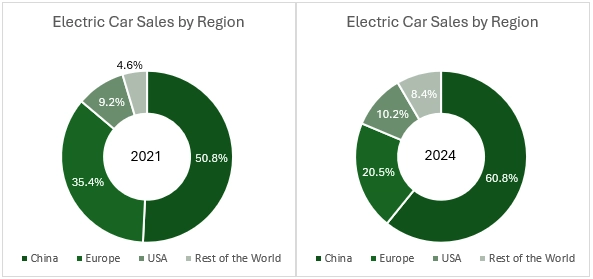

Electric vehicles (EVs) are significantly driving the expansion of subscription-based automotive services. As global demand for sustainable transportation grows, EVs offer a flexible, eco-friendly option, perfect for subscription models that provide access to a variety of vehicles without long-term ownership commitments. Countries like Norway, Iceland, Sweden, and the Netherlands lead global EV adoption, with EVs accounting for over 30% of new vehicle sales. The US and China also rank among the top markets in absolute EV sales, fuelling a rise in demand for subscription services offering these advanced, low-emission vehicles.

EVs bring lower operational costs due to reduced fuel expenses, making subscription services more cost-efficient. Additionally, the increasing availability of charging infrastructure and government incentives further support this trend. As EVs become integral to subscription fleets, they align with sustainability goals, attracting consumers seeking convenient, eco-conscious alternatives to traditional vehicle ownership.

Electric Car Sales by Region

Outlook and Opportunities

The global market for subscription-based automotive services is poised for significant growth, driven by increasing demand for flexible, cost-effective mobility solutions. According to a report by Expert Market Research, the global electric vehicles sales are expected to exceed 121486.76 Thousand Units by 2035. This surge in EV adoption is fuelling demand for subscription models, particularly as consumers seek more sustainable, flexible options without the long-term commitment of ownership.

Younger drivers are more likely to embrace car subscriptions. New data from Wagonex, a car subscription platform, reveals that drivers aged 26-35 years are six times more likely to opt for a car on subscription than those aged 56-65 years. The UK’s is the largest car subscription marketin Europe by revenue in 2024, with nearly 39% of subscription consumers aged 26-35 years and 33% aged 36-45 years. In contrast, only 9% of subscription consumers are over the age of 56 years.

As production scales up and consumer interest intensifies, the cost of subscription services is expected to decrease. With advancements in fleet management technology and the growing integration of electric vehicles, subscription services are projected to become a mainstream alternative to traditional car ownership, offering consumers flexibility, sustainability, and convenience.

Subscription-Based Automotive Services: Shaping the Future of Mobility

The subscription-based automotive services market is growing rapidly, driven by changing consumer preferences, urbanization, and the increasing demand for flexible, cost-effective mobility options. Subscription models offer all-inclusive services, including insurance and maintenance, with a focus on electric vehicles (EVs) and digital platforms for enhanced user experience. As automakers scale up offerings and integrate more EVs, subscription services are expected to become a mainstream alternative to traditional car ownership, providing sustainability, convenience, and flexibility.

Share