Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global electric vehicle market reached a volume of nearly 35161.28 Thousand Units in 2025. The market is projected to grow at a CAGR of 13.20% between 2026 and 2035 and reach around 121486.76 Thousand Units by 2035.

Base Year

Historical Period

Forecast Period

As of 2024, China leads the global competition in EV battery production, holding approximately 66% of the world's capacity for Li-ion battery manufacturing.

BYD Co. Ltd., Tesla Inc., and Volkswagen AG are some major companies in the market.

In 2022, globally, 55% more EV chargers were installed compared to 2021, taking the total number of public charging points to 2.7 million.

Compound Annual Growth Rate

13.2%

Value in Thousand Units

2026-2035

*this image is indicative*

| Global Electric Vehicle Market Report Summary | Description | Value |

| Base Year | Thousand Units | 2025 |

| Historical Period | Thousand Units | 2019-2025 |

| Forecast Period | Thousand Units | 2026-2035 |

| Market Size 2025 | Thousand Units | 35161.28 |

| Market Size 2035 | Thousand Units | 121486.76 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 13.20% |

| CAGR 2026-2035 - Market by Region | North America | 16.4% |

| CAGR 2026-2035 - Market by Country | Brazil | 22.8% |

| CAGR 2026-2035 - Market by Country | India | 20.2% |

| CAGR 2026-2035 - Market by Type | Battery Electric Vehicle | 15.6% |

| CAGR 2026-2035 - Market by Vehicle Type | Light and Medium Commercial Vehicles | 15.2% |

| Market Share by Country 2025 | USA | 6.8% |

Government policies such as the Inflation Reduction Act (IRA) launched by the US government in August 2022 and China’s 14th Five-Year Plan released in December 2021, aid the manufacturing and rapid adoption of EVs. Prominent automotive manufacturers such as Ford, General Motors, and Honda are focusing on the production of electric vehicles and increasing the number and variety of electrified models offered.

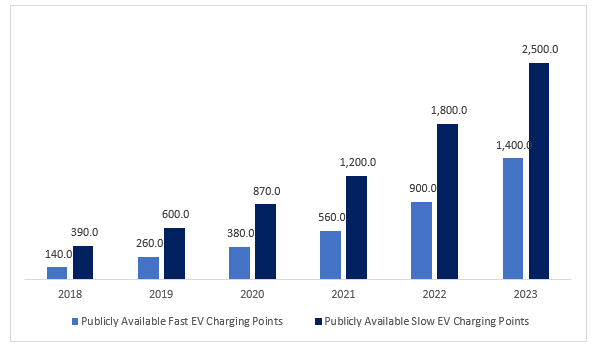

Figure: Global Charging Points (in Thousands), 2019-2025

Some of the factors driving the electric vehicle market growth are the development of EV charging infrastructure and the decreasing cost of lithium-ion batteries. Publicly accessible chargers are increasingly being installed by governments to provide convenience and accessibility for vehicle owners. EV chargers, especially those located along motorways, enable longer journeys and can help address range anxiety, a barrier to EV adoption.

Favourable government initiatives; advancements in EV technology; public charging infrastructure expansion; and innovations in battery technology are favouring the global electric vehicle market expansion

Governments globally are promoting the adoption of EVs to meet their emissions reduction targets. Government policies such as the Inflation Reduction Act (IRA) launched by the US government, Alternative Fuels Infrastructure Regulation (AFIR) in Europe, China’s 14th 5-Year Plan and Production Linked Incentive (PLI) scheme by the Indian Government aid the adoption of EVs.

The incorporation of AI with self-driving features have increased the functionality of EVs. Vehicle control software enhances vehicle performance and safety features. Automakers are also advancing battery technology, and developing solid-state batteries that have higher energy density than lithium-ion batteries.

Governments are strengthening the public charging infrastructure to enable widespread adoption of EVs. In 2023, the global public charging stock increased by over 40% compared to the previous year. At the end of 2023, fast chargers represented over 35% of public charging stock.

Solid-state batteries, sodium-ion (Na-ion) batteries, and lithium-sulphur batteries with higher energy storage are enhancing the range of EVs. The popularity of LFP batteries among Chinese manufacturers due to their low cost is further aiding the market growth.

EV manufacturers are using lightweight materials, including carbon fibre composites and aluminium alloys, to lower energy consumption and prolong battery life. A 10% decrease in vehicle weight can increase the power efficiency of the vehicle by 6-8%.

Furthermore, by 2050, the European Union aims to achieve net-zero emissions. This is expected to increase the adoption of EVs over ICE vehicles. The European Commission aims to install 3.5 million charging points by 2030. Additionally, by 2026, the U.S. government aims to deploy 500,000 EV public chargers. By 2030, 64% of all lightweight vehicles in the USA are expected to be powered by lithium-ion batteries. The introduction of such favourable government initiatives is anticipated to aid the electric vehicle market development in the coming years.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Global Electric Vehicle Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Vehicle Type

Market Breakup by Region

| CAGR 2026-2035 - Market by | Country |

| Brazil | 22.8% |

| India | 20.2% |

| Canada | 17.6% |

| UK | 16.5% |

| Italy | 15.2% |

| USA | XX% |

| Germany | XX% |

| France | 13.4% |

| Japan | XX% |

| Australia | XX% |

| Mexico | XX% |

| China | 9.5% |

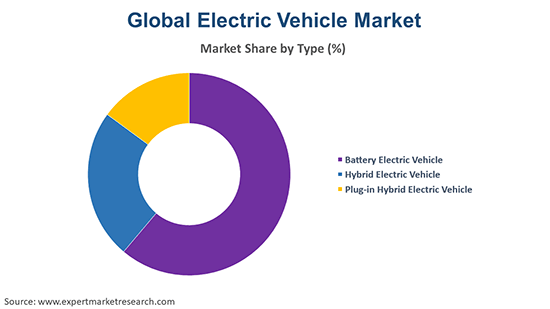

Battery electric vehicles are expected to hold a significant market share due to their increasing average range

The average range of battery electric vehicles increased from 79 miles (127 km) to 217 miles (350 km) between 2010 and 2021, increasing their adoption substantially. Such vehicles offer high efficiency as they are run entirely on a battery-powered electric drivetrain. As of February 2024, the United States boasted more than 61,000 publicly accessible electric vehicle charging stations with Level 2 fast chargers, increasing from 29,000 in 2020. In May 2024, Jeep announced the launch of Jeep® Wagoneer S, the brand's first global battery-electric vehicle (BEV) in the U.S. and Canada.

Hybrid electric vehicles (HEVs) are gaining popularity in short-range trips due to their exceptional fuel efficiency and MPG. In 2022, non-plug-in hybrid cars accounted for 21% of total car imports and 13% of car exports in the EU. Governments across the globe are providing tax credits and incentives for HEV buyers, which is expected to further increase their adoption in the forecast period.

The average range of plug-in hybrid vehicles is from 10 to 30 miles per charge, with some models of vehicles reaching nearly 50 miles using all-electric power. Governments across the globe are providing incentives to support clean mobility. In the United States, the federal government offers up to USD 7,500 tax credits for consumers who purchase electric plug-in vehicles. Additionally, in Germany, plug-in hybrid electric vehicles are funded with a maximum of EUR 6,750.

Major players are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

Headquartered in China and founded in 1995, BYD Co. Ltd. is committed to delivering zero-emission energy solutions, encompassing energy generation, storage, and applications. The company offers various electric vehicles, including passenger and commercial electric vehicles.

Headquartered in the United States and founded in 2003, Tesla Inc. is a leading American electric vehicle and clean energy company. Tesla designs, develops, produces, and markets advanced electric vehicles. The company offers various electric vehicles, including sedans, SUVs and Cybertrucks.

Headquartered in Japan and founded in 1937, Toyota Motor Corp. offers various electric vehicles, which include BEVs such as RZ 300e and mini-commercial vans; HEVs including Crown, Alphard, Vellfire, NXh, and others; and PHEVs like Prius, RAV4, NXh+, and other models.

Headquartered in China and founded in 1969, Dongfeng Motor Group Company Limited provides various electric vehicles under passenger vehicle and commercial vehicle segments. Passenger electric vehicles include M HERO 917, VOYAH FREE, VOYAH DREAM, VOYAH PASSION; Dongfeng Aeolus SKY EV01, Dongfeng E70; and others. Commercial electric vehicles include Dongfeng Kinland, Dongfeng Kingrun, Dongfeng Vasol, and other models.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the electric vehicle market include Hyundai Motor Company, Ford Motor Company, Great Wall Motor Company Limited, CHERY Automobile Co., Ltd., General Motors Co., Volkswagen AG, Volvo AB, Nissan Motor Corporation, Mercedes-Benz Group AG, BMW AG, and SAIC Motor Corporation Limited.

The Asia Pacific is a prominent region in the market due to the presence of leading automotive manufacturers in countries such as China, India, and Japan

In January 2024, BYD, a global leader in the electric vehicle market, launched three new electric passenger cars in Indonesia to further expand its presence in the Southeast Asia region. As per the China Electric Vehicle Charging Infrastructure Promotion Alliance, 716,000 charging piles were added from January 2024 to March 2024, which marked an increase of 13.2% as compared to January 2023 to March 2023.

In Europe, in 2023, the EU passed a new law, which mandates a major expansion of fast-charging stations for heavy-duty electric vehicles. By 2025, powerful stations delivering at least 600 kW, with at least one 150 kW charger included, must be installed every 60 kilometres on core TEN-T routes and every 100 kilometres on the broader network.

In North America, OEMs with over 170 battery-electric models, focus on medium-duty trucks, where electric options compete favourably with diesel in total ownership cost. The increasing expansion of public charging infrastructure in the region is further fuelling the electric vehicle market growth.

Germany Electric Vehicle Market

France Electric Vehicle Market

United Kingdom Electric Vehicle Market

Singapore Electric Vehicle Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market volume was around 35161.28 Thousand Units.

The market is assessed to grow at a CAGR of 13.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach nearly 121486.76 Thousand Units by 2035.

The major drivers include favourable government policies promoting EV adoption and rising government investments in EV charging infrastructure.

The key trends aiding the market include innovation in EV technology and the introduction of low-cost lithium-iron-phosphate (LFP) batteries.

The different types of electric vehicle include battery electric vehicle, hybrid electric vehicle, and plug-in hybrid electric vehicle.

The major vehicle types considered in the market report include passenger car, two-wheeler, light and medium commercial vehicles, and heavy commercial vehicles (HCVs).

The major players in the market include BYD Co. Ltd., Tesla Inc., Toyota Motor Corp., Dongfeng Motor Group Company Limited, Hyundai Motor Company, Ford Motor Company, Great Wall Motor Company Limited, CHERY Automobile Co., Ltd., General Motors Co., Volkswagen AG, Volvo AB, Nissan Motor Corporation, Mercedes-Benz Group AG, BMW AG, and SAIC Motor Corporation Limited.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Vehicle Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Others Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share