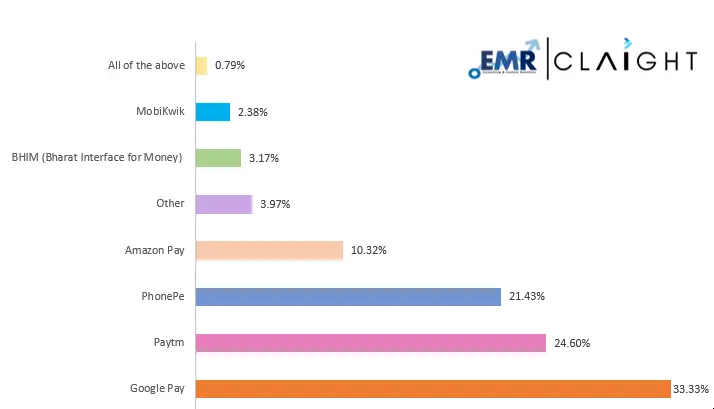

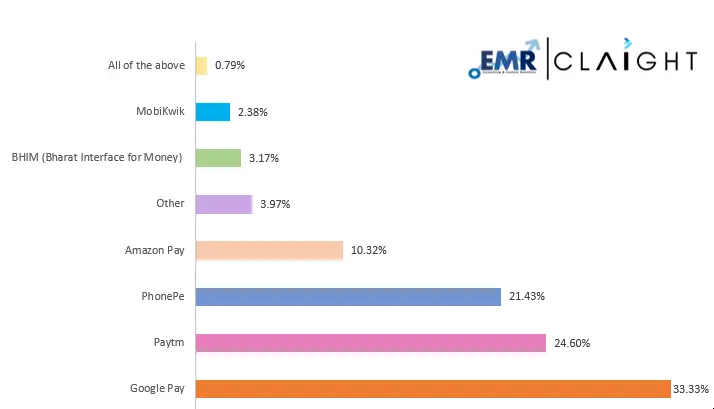

Google Pay came out to be the most frequently used digital payment platform, favored by 33.33% of the respondents. Due to its user-friendly interface, seamless integration with other Google services, and widespread acceptance among merchants it has become a popular app. It is followed closely by Paytm used by 24.60% of the respondents. One of the other popular apps is PhonePe, used by 21.43% of respondents. Then there is Amazon Pay which was chosen by 10.32% of respondents known for providing a convenient payment option for online shoppers. BHIM (Bharat Interface for Money) and MobiKwik are used by 3.17% and 2.38% of respondents respectively. BHIM app is simple to use and due to its government backing it is a reliable option for many users, particularly in rural areas. There were 0.79% of respondents who reported using all the above platforms. This indicates a trend towards diversified usage, where consumers are leveraging multiple platforms to maximize convenience and benefits.

Popular Apps for Digital Payments

India's digital payment landscape has transformed in which the Unified Payments Interface (UPI), a real-time payment system has contributed majorly. UPI’s round-the-clock accessibility, user-friendly nature, and compatibility with multiple platforms have contributed to its widespread adoption by both consumers and businesses. UPI has enabled seamless fund transfers between bank accounts which has become a backbone for digital payments.

Trends Towards Digital Payment Apps

Businesses have also benefited from the digital payment revolution. Digital payment apps have been used by small and medium-sized enterprises which have helped in track transactions, simplify operations, and facilitate cash flow management. Also, the study explores how the adoption of QR Codes has evolved as a strategic tool. That's why business generate free QR codes to streamline payment operations and simplify customer transactions.

Emergence of QR Codes

The study further delves into the significant competition and dynamism in the digital payment industry, emphasizing how user preferences influence the strategic decisions of these platforms. There is also a distinct preference of Generation Z for digital payments, because of convenience, speed, and variety. As consumer preferences continue to evolve, digital payment platforms must adapt and innovate to stay ahead in this dynamic industry.

Share