Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global digital payment market size reached a value of USD 161.42 Billion in 2025. The market is likely to grow at a CAGR of 15.30% during 2026-2035 to attain a value of USD 670.27 Billion by 2035. Satisfying the soaring demand for digital transactions, the digital payment market has greatly proliferated, assisting users globally to embrace remote payments as their new normal.

With the advent of smartphones, it is gaining acceptance everywhere they are helping people to transact without cash, making it convenient and easy to pay to consumers. There are several different types of digital payment methods including mobile wallets, e-commerce, and contactless cards. More businesses and consumers are exploring the benefits of speed, security and convenience, and demand for cashless transactions is growing. According to the market report, the digital payment market will keep growing as it is powered by technological development and an evolving trend towards a cashless society.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

15.3%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Some of the key trends fueling rapid growth in the digital payment market is the growing digitization of payments across organization sectors, enabling consumers to conduct digital transactions effortlessly. According to the Federal Reserve, digital wallet payments increased from 0.50% and 0.23% of total credit and non-prepaid debit card payments in the United States in 2017 to 2.60% by number and 1.47% by value in 2020. As smartphones play an important role in everyday life, they enable secure and efficient payment methods. More businesses are optimizing their platform for mobile payment solutions to meet the increasing need for smartphone devices in dealing with financial transactions. Moreover, improved security capabilities, including biometrics and encryption, related to digital payments, are further encouraging consumers. Furthermore, the growing global connectivity and mobile phone penetration and adoption of mobile payment solutions will also continue to propel the growth of this market.

Digital payment systems have never been more popular with consumers who are increasingly turning to e-wallets (or digital wallets), QR codes, and peer-to-peer (P2P) systems as the primary form of payment. Artificial intelligence and machine learning are being similarly integrated for improving fraud detection and boosting the security of digital payments. Moreover, the continued expansion of these services into emerging markets is opening new markets, facilitating greater financial inclusion, and increasing the overall volume of transactions globally.

In recent years, the digital payment market has witnessed the rise of contactless payments as consumers increasingly prefer cashless transactions due to their convenience and speed. New ways of paying are also the references such as digital wallets and seamless payments. Technology trends which have brought about virtual payments solutions, tap-to-pay, or mobile pay solutions are innovating the way consumers pay. With innovation keeping pace with the advancement of technology, digital payments are being embraced by both businesses and consumers, which is making the transition towards cashless methods that are much quicker and more efficient.

The market is witnessing a paradigm shift as the world is moving towards various digital modes of payments for the sake of consumer convenience. With the increased use of digital payments, a greater emphasis is being placed on strengthening security measures for these systems to address growing concerns about payment frauds. This includes the incorporation of advanced technologies like blockchain and encryption to reduce payment fraud and build a safer transaction experience. Hence, the development of secure digital payment systems will go a long way to build confidence and encourage the widespread adoption of such payment methods across industries and geographies.

The digital payment segment is progressively witnessing consolidation, with industry leaders merging/collaborating with new technologies to leverage a better service ecosystem. Consumers are increasingly turning to cryptocurrency as a payment option, and so are businesses. This has led to a closet surge in the rise of Buy Now Pay Later data disrupting the way consumers choose to spend money. The trend of open banking is also changing the market dynamics by allowing third-party providers to take advantage of available data and offer these services. Furthermore, embedded finance is integrating digital payment methods directly into non-financial platforms, enabling broader market reach from these platforms, as well as better user experience.

There has been heightened concentration in the digital payment industry, particularly from mergers and acquisitions (M&As) between major players. These M&As enable companies to broaden their technology capabilities, customer reach, and geography. The competition is constantly growing, and leading companies are breaking down their resources to create cutting-edge payment solutions. This trend causes the future of the industry, promoting the development of digital payment technologies and services.

Companies within the digital payment sector are finding themselves confronted by regulations and compliance measures that are constantly evolving. Fraud prevention measures are getting increasingly stringent to allow for secure transactions, while the need for data protection is consistently on the priority list, for consumers and businesses. Companies are navigating compliance challenges to protect user trust and enhance security standards all of which will influence the evolution of the industry.

The online payments market is rapidly expanding as these payment methods are more efficient as compared to traditional payment systems like cash transactions, cheques, or money orders. Consumers are increasingly adopting digital payments, and prepaid cards , as these are popular for their ease of use. This shift is part of a larger trend toward convenience, security and speed is slowly replacing dependency on legacy payment methods.

The BFSI sector is highly integrated with digital payments, which is boosting the growth of ecommerce and online shopping. A notable trend in the market is the shift towards digital payments, which are revolutionizing how consumers manage their personal finances, allowing for better bill settlements with greater convenience and thus improving the overall consumer experience. With consumers gravitating towards more efficient financial services, digital payment solutions are emerging as an indispensable tool for businesses seeking to streamline transactions and encourage seamless interactions whether they be in regular purchases or larger, financially involved undertakings.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

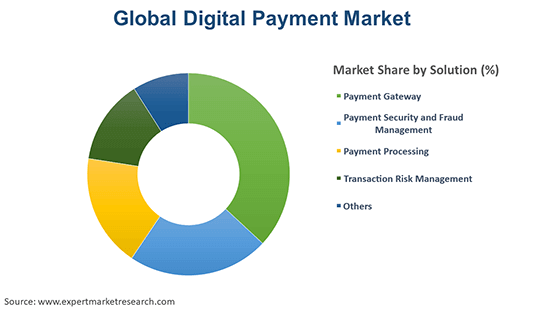

One of the key factors driving the growth of the digital payment market is the integration of Application Program Interface (API). This helps to reduce the screen time of integration, which is the key to providing better customer experience while implementing transactions in an ecommerce app. Moreover, payment gateway and payment processing, both are growing popular in the market as they provide safe message transit as a link between banking institutions and their clientele.

The second highly voted-up segment is the payment security & fraud management, as with the growing number of online transactions, the need to protect our data and prevent fraud becomes more critical. Payment systems are leveraging advanced encryption and authentication technologies to address risk. At the same time, the segment of transaction risk management solutions is developing to offer real-time monitoring, and detect potential threats, while also ensuring compliance with regulatory standards. These initiatives are expected to work together to enhance the overall experience of digital payments, while also ensuring an environment that is secure and trustworthy for all parties involved in the transaction process.

Alternative digital payment methods, including digital currencies like Bitcoin and Ethereum, are on the rise as decentralized and secure transaction options are demanded more frequently by consumers. These modes of payments offer users more financial independence by allowing them to avoid the need for financial institutions and for payment to be used at more establishments online and offline. With the evolving regulatory framework surrounding these currencies, adoption is likely across multiple sectors, including finance and e-commerce.

A major trend noticed in the digital payment market is the rapid shift towards digital wallets, giving consumers the ability to keep their payment information secure on their smartphones. Popular wallets like Apple Pay, Google Pay, and Samsung Pay, have enabled seamless transactions in both online and offline environments. The net banking segment is gaining momentum in the market. These solutions are used to secure loan. Point of Sale (POS) systems add contactless and mobile payment capabilities, allowing businesses to accept many forms of payment.

Cloud-based solutions are being increasingly preferred, boosting the growth of the overall digital payment market. Cloud deployments provide the flexibility, scalability and cost efficiency that organizations require for managing increasing transaction volumes. As these payment solutions can be integrated with cloud services, they make it easier for merchants and financial institutions to expand their service offerings. Furthermore, cloud enables real-time updates, lessening the operational overhead and making it easier for enterprises to stay attuned to changing market dynamics and regulatory obligations. Cloud environments also bolster security features like encryption and multi-factor authentication, making transactions more secure overall.

On-premises deployment is still in high demand among certain businesses that need more control over their payment architecture. The organizations have full control of the payment systems and data on their own servers, so they can deliver solutions that meet their specific high privacy and customizability needs. On-premises solutions can be expensive and need large amounts of upkeep, however, they provide a higher level of security and regulatory compliance which works well for industries such as banking and finance where ownership of data is critical. On-premises solutions have a plethora of benefits as well, and are favored by many enterprises, hence hybrid solutions are becoming increasingly popular.

Large enterprises currently dominate the digital payment market as they require sophisticated payment systems that are able to span a global range of customers. These entities usually have both the capacity and the budget to deploy complex, integrated payment solutions that are capable of handling high transaction volumes. Global enterprises adopt advanced technologies, including AI, machine learning and blockchain, to improve payment security and to expedite processes. On a scale, they are also capable of employing sophisticated fraud detection systems, thereby ensuring compliance and customer confidence. Moreover, these institutions also gain from economies of scale allowing them to reduce transaction costs and thus improve operational efficiency.

On the other hand, SMEs have been rapidly adopting digital payment systems to remain competitive, enabling them to provide the secure and convenient payment channels that customers expect. SMEs generally deploy cheaper, scalable payment solutions like digital wallets, mobile payment systems, and cloud-based services. They focus on using third-party payment service providers to build secure and user-friendly platforms without large upfront investment. This enables them to enhance customer experience and simplify their financial operations with low complexity.

The market for digital payment is rapidly gaining momentum across various industries with each sector utilizing its own innovative solutions to ensure smooth transactions. Digital payment processing plays a crucial role in the BFSI (Banking, Financial Services, and insurance) sector to ensure secure and real-time transacting of funds. This covers mobile banking, online transfers, and integrated payment solutions that streamline customer journeys at the same time as optimizing operations. In similar fashion, digital payments in healthcare are revolutionizing billing systems, enabling patients to make secure, fast payments for services from mobile apps, online portals and even integrated insurance payment systems, resulting in with better patient satisfaction and improved administrative efficiency.

Digital payments are an inherent part of the modern shopping experience in retail and e-commerce. With consumers opting to purchase via mobile wallets, credit cards or Buy Now Pay Later, the market growth is empowering this segment. Telecom and IT businesses are also embracing digital payments to make billing and subscription management easier. Similarly, in the media and entertainment sectors these payment methods serve for subscription services, online content purchases, pay-per-view models, and more. Mobile payment solutions for ticketing, freight services, and fuel payments are used by transportation and logistics sectors. Businesses involved in hospitality and management make use of digital payment methods for booking, reservation, and service payments. Moreover, the education industry is also using online payment systems that can process tuition fees, enrollments in online programs, and donations, making payment processing easier for the institution and students.

North America Digital Payment Market

The market for digital payments is growing in North America as a result of high technology adoption and demand for convenience by the consumer. The United States and Canada are at the forefront of digital payment adoption, backed by well-developed infrastructure that supports mobile wallets, contactless payments and online banking. Tech giants and fintech startups are also increasingly adopting digital payment methods in both e-commerce and mobile payment systems.

Europe Digital Payment Market

With technological advancement and robust infrastructure, the Europe digital payment market experiences a strong trend toward cashless transactions in the region. Those that are notable European leaders in digital wallet use and contactless payments include the United Kingdom, Germany and France. In addition, the Payment Services Directive 2 (PSD2) regulation from the European Union has improved security and promoted competition in the sector, which also fostered digital payment expansion.

Asia Pacific Digital Payment Market

The fastest growing region for the digital payments market is Asia Pacific. The market growth is due to a combination of economic growth, urbanization and increased penetration of smartphones. In fact, tremendous developments in the field are happening in countries such as China and India, for example, where mobile payment systems such as Alipay and WeChat Pay developed in China triggered dramatic changes in everyday transactions. With the grassroot introduction of Unified Payments Interface (UPI), there has been a meteoric rise in digital payments in India, making real-time transactions ubiquitous.

Latin America Digital Payment Market

Increased use of mobile phones and the need for wider access to financial services have contributed to strong adoption of digital payment methods across Latin America. Brazil, Mexico and Argentina are driving the digital payments transformation, on which mobile wallets, QR code payments, and peer-to-peer (P2P) set route as clear alternatives to cash. Financial institutions and fintech entities are likely to take the essential part in the extension of advanced installations in the area, significantly in the regions with limited establishments. Mobile payment platforms such as MercadoPago and PicPay have gained popularity in the market due to the demand for secure, accessible, and easy-to-use financial solutions.

Middle East and Africa Digital Payment Market

The Middle East and Africa (MEA) region embraces digital payments, the extent of adoption varies across different countries. Countries like the United Arab Emirates, Saudi Arabia, South Africa are coming on top of this change, courtesy of government-led initiatives for a cashless society. Mobile payments, digital wallets and contactless cards are becoming increasingly popular, especially in urban areas. In Africa, the rise of mobile payment systems, such as M-Pesa, have transformed financial inclusion and allowed millions of people to access financial services using mobile phones. As mobile penetration increases and digital infrastructure strengthens, the region’s digital payment market is poised for expansion, especially in sectors such as retail and transportation.

Square, Inc. is a popular company that provides merchants with point-of-sale (POS) systems, mobile payment processing, and a suite of financial services tailored to companies of all sizes. The company offers a simple interface and an integrated payment system that allows users to accept payments on their smartphones and tablets.

Fiserv, Inc. is a powerful platform that facilitates transactions between financial institutions and enterprises and enables real-time payments, mobile wallets, and card issuing solutions, among other services. Their payment systems are widely recognized for their security and scalability in financial transactions.

Through products including PayPal, Venmo, and Braintree, PayPal Holdings, Inc. enables users to transfer, receive and store money across a number of platforms. Its broad network and focus on mobile payments have made PayPal a standard-bearer in e-commerce transactions.

Visa Inc. offers secure, fast, and trustworthy payment solutions around the world. It offers payment solutions such as credit and debit card processing, digital wallets, contactless payments, and more. Visa is a giant in consumer payments and business payments due to its huge infrastructure and alliances.

MasterCard Incorporated is a global payment technology company that connects consumers, businesses, and governments worldwide. The company continues to innovate with solutions such as Masterpass, digital wallets and mobile payments, and investments in advanced technology that leverages capabilities like tokenization and biometric authentication to improve security.

Apple Inc. is a significant player in the digital payment market with its platform Apple Pay, which enables users to make secure, touchless payments through its iPhones, iPads, and Apple Watches. The ease of use of Apple Pay on Apple devices and its focus on privacy and security have made it well-liked by consumers and merchants looking for quick and hassle-free payment solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

The leading businesses in the market for digital payments are listed below. Together, these businesses control the majority of the market and set the direction of the sector. To map the supply network, these digital payment companies' financials, strategy maps, and goods are examined.

The study on the digital payment market delivers detailed analysis on region-level perspective depending on specific contemporary industry trends. It considers various segments, such as solution, modes of payment, deployment, enterprise size, and end use. By assessing all these segments, this report presents a thorough discussion of market drivers, regulations, and emerging opportunities observed in the market.

Solution Outlook (Revenue, Billion, 2026-2035)

Deployment Outlook (Revenue, Billion, 2026-2035)

Mode of Payment Outlook (Revenue, Billion, 2026-2035)

Enterprise Size Outlook (Revenue, Billion, 2026-2035)

End Use Outlook (Revenue, Billion, 2026-2035)

Region Outlook (Revenue, Billion, 2026-2035)

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global market for digital payment attained a value of USD 161.42 Billion.

The market is projected to grow at a CAGR of 15.30% between 2026 and 2035.

The market is estimated to reach USD 670.27 Billion by 2035.

The major drivers of the digital payment market include the expanding economies, growing preference for contactless services, increasing availability of smart wallets, and increase in in-app services for booking hotels, flight tickets, offers.

Increasing penetration of smartphones and various government initiatives are the key trends propelling the market's growth.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major players in the market are Square, Inc., Fiserv, Inc., PayPal Holdings, Inc., Visa Inc., MasterCard Incorporated, Apple Inc., One97 Communications Limited, Fidelity National Information Services, Inc. (FIS), Global Payments Direct, Inc., Google LLC, Worldline S.A., Adyen N.V., Aliant Payments, Aurus Inc., Financial Software & Systems Pvt. Ltd., Novatti Group Pty Ltd., ACI Worldwide, Inc., Wirecard, and Authorize.Net, among others.

Layers of device security, such as API private keys and tokenisation, are used to secure digital payments.

The various solutions in the market include payment gateway, payment security and fraud management, payment processing, and transaction risk management, among others.

The different modes of payment in the market include digital wallets, bank cards, net banking, and digital currencies, among others.

Asia Pacific accounted for the largest share of the market.

Opportunities include blockchain adoption, mobile payments, AI-driven security, cross-border transactions, and underserved regions.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment

|

| Breakup by Solution |

|

| Breakup by Deployment |

|

| Breakup by Mode of Payment |

|

| Breakup by Enterprise Size |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share