Europe Textile Manufacturing: The Booming Region of Sustainable Fashion and Technical Textile

The textile sector is a key segment within the manufacturing industry and is a major contributor to the European economy. In 2023, EU export of textile products have increased by 13% in value. Significant manufacturers of textiles in Europe include Germany, Spain, France, Italy, and Portugal. According to a recent study by EMR, the Europe textile market size was valued at USD 187.22 Billion in 2025. The market is projected to grow at a CAGR of 3.00% during the forecast period from 2026 to 2035, reaching a value of USD 251.61 Billion by the end of 2035.

The textile sector in Europe majorly consists of small and medium-sized enterprises. The European manufacturers are regarded as the leaders in the technical and industrial textiles such as non-wovens, such as industrial filters, hygiene products, and materials for the medical and automotive sectors, and high-quality garments.

Smart Textiles in Europe: The Next Technological Revolution

Smart textiles embedded with sensors, and actuators allowing for the interaction between wearer and environment are gaining popularity in industrial sectors. Smart textiles, leveraging advancements in materials, electronics, and biotechnology, play a key role in sensing and monitoring body functions, enabling data transfer through IoT.

Value Chain of Smart Textiles

The smart textiles value chain comprises multiple actors from three distinctive industries, including electronics, textile, and ICT (Information and Communications Technology).

Circular Economy Initiatives in Textile Manufacturing: Key Industry Highlights

EURATEX, the European Apparel and Textile Confederation collaborates with over 200,000 companies in the European apparel and textile sector on various areas, including research, innovation, skills development, sustainable supply chains, and developing projects and initiatives to promote the competitiveness of the European textile ecosystem.

In June 2022, ReHubs completed a Techno-Economic Study (TES) that gathered essential information on textile waste feedstock, as well as the technological, organisational, and financial requirements to recycle 2.5 million tons of textile waste by 2030.

Key Companies that Have Engaged in the Rehubs Initiative and Supported the Techno Economic Master Study (TES) Include:

- As per 2024 data, the average person in the UK discards approximately 14 kilograms of clothing annually, contributing to around 350,000 tonnes of textile waste yearly, of which only 15% is recycled.

- By 2030, the textile recycling market in Europe is expected to achieve economic, social, and environmental benefits for USD 3.6 billion to USD 4.6 billion.

- Reuse accounts for around 57% of the treatment of textile waste collected in France according to a ReFashion report of 2021.

Figure: End of Life of Textile Waste after Sorting in France, Annually, 2021 ReFashion Report

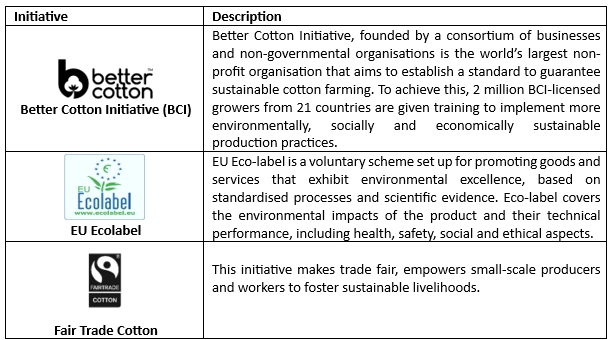

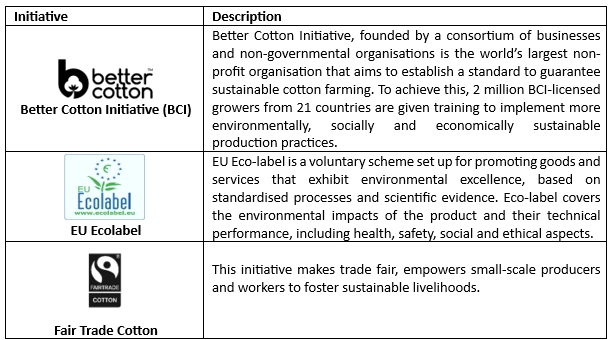

EU Initiatives Supporting Sustainable Cotton Production:

Leading Stakeholders Adopting Sustainable Cotton Challenge 2025 include:

Technological Trends in the Europe Textile Market

- In the EU, Italy, Germany, and France lead in terms of the number of professionals with advanced technology (AT) skills employed in the textile market. The advanced technology skills include Advanced Manufacturing, Big Data, Cloud, AI, Advanced Materials, Security, Industrial Biotechnology, IoT, Robotics, Nanotech, Blockchain, AR/ VR, and Photonics.

- According to 2020 report, Germany plays a major role in the EU27 position by contributing to around 45% of the EU27 textile patents. Spain, Austria, France, Portugal and Denmark follow with a lower share.

- Nanotechnology is being widely used in the textile industry to improve textile attributes, such as fabric softness, durability and breathability, water repellence, and antimicrobial properties, in fibres, yarns and fabrics.

Key Developments in the Market

- In April 2024, BASF's sustainable polyamide PA6 and PA6.6 product range, was certified as Recycled Claim Standard (RCS) for textile applications. This label enables manufacturers to market certified textiles that have been produced using recycled raw materials.

- In March 2024, the Sustainable Transition Fund granted USD 892,480 to support research that will help to shape the sustainable future of the UK fashion and textile industry. It plans to establish a data-driven baseline to ensure future strategy is aligned with environmental targets. This two-year project is led by the Leeds Institute of Textiles and Colour (LITAC) and is supported by the National Environment Research Council, the Arts and Humanities Research Council, and Innovate UK.

- In January 2024, Ohoskin, an Italian manufacturer of an alternative material to animal leather, and Recarbon, a company that has developed a one-stop solution for the circularity of carbon fibre, announced a collaboration to create a new material for the automotive, marine, and furniture industries. The new material will be produced by combining Ohoskin’s leather alternative made from orange and cactus byproducts with ReCarbon’s recycled carbon fibre.

- In September 2023, MYGroup, a Yorkshire-based waste management firm, announced the UK’s first green textiles factory in Hull. The facility constitutes a recycling and remanufacturing process for waste textiles, comprising clothing, accessories, and home furnishings.

Conclusion

- The growing emphasis on sustainability in the textile market coupled with the rising popularity of smart textiles reflects a transformative shift. For instance, a combination of sustainable material and recycled carbon fiber can help producers create lightweight, and sustainable textile products that meet the needs of modern consumers.

- Clothing remains an important segment of the European textile market, as Europe is the birthplace of several renowned high-end or celebrity brands such as Guccio Gucci S.p.A., Valentino, LMVH, and others. Additionally, the skilled labour with advanced technology skills in countries such as Italy, Germany, and France propel the growth of the market.

Share