Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Europe textile market size attained a value of USD 187.22 Billion in 2025. The market is estimated to grow at a CAGR of 3.00% during 2026-2035 to reach a value of USD 251.61 Billion by 2035.

Base Year

Historical Period

Forecast Period

Textile manufacturers are incorporating computer vision technology for fabric pattern recognition and fabric colour matching, to examine fabric quality, saving up on production costs and time.

The major European markets namely, Germany, France, Spain, the Netherlands, Italy, and Poland collectively account for nearly 67% of all intra-EU imports in the apparel sector.

The EU's sustainable textile production strategy targets the establishment of a new sustainable textile ecosystem within the EU market by 2030.

Compound Annual Growth Rate

3%

Value in USD Billion

2026-2035

*this image is indicative*

The textile sector is a key segment within the manufacturing sector and is a major contributor to the European economy. Reportedly, the largest manufacturers of textiles are United Kingdom Italy, Germany, and France. The textile sector in Europe mainly consists of small and medium-sized enterprises. The European manufacturers are regarded as the leaders in technical and industrial textiles such as non-wovens (industrial filters, hygiene products, materials for the medical and automotive sectors), high-quality garments, and interior textiles with a high design content.

The textile market in Europe is driven by various factors, such as the demand for technical textiles, research to develop advanced textiles, rising use of natural fibres to produce textiles, and rising demand for fashion clothing.

Rising demand for natural fibres, demand for sustainable production processes, and adoption of technology by manufacturers are creating several opportunities for Europe textile market development.

| Date | Company | Details |

| Aug 2023 | Gokaldas Exports Limited (GEL) | Gokaldas Exports Limited (GEL) has set its sights on the acquisition of Atraco Group (Atraco), a distinguished apparel manufacturer renowned for its substantial market presence and robust customer networks in both the United States and Europe. |

| Jul 2023 | Lenzing Group | The Lenzing Group partnered with Advance Denim, a leading denim mill, and Officina+39, an Italian chemical company, to introduce groundbreaking innovations in the realm of zero-cotton denim aesthetics. |

| Jun 2023 | Lenzing Group | Lenzing Group joined forces with Swedish pulp producer Södra to drive innovation in textile waste recycling through the OnceMore® process, supported by a substantial EUR 10 million subsidy from the EU's LIFE 2022 program. |

| Apr 2023 | Getzner Textil | Getzner Textil has undertaken a significant expansion of its facility in Bludenz, Austria, encompassing a generous 4,320 square meters and necessitating a substantial EUR 27 million investment. |

| Trends | Impact |

| Adoption of sustainable textile manufacturing | Ecologically produced textiles can be considered as the ‘white space’ for growth opportunities for textile manufacturers. By adopting sustainable and ethical production practices, textile manufacturers can attract eco-minded consumers |

| Demand for technical textiles | The growth of automobile, construction, healthcare, and packaging sectors in European countries such as Germany, Italy, Spain, and France, aid the demand for technical textiles. |

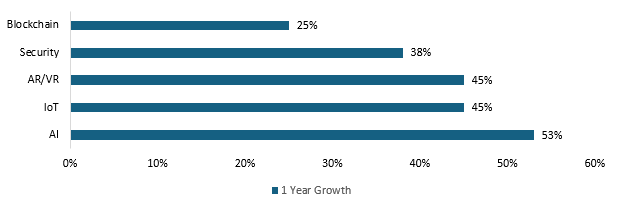

| Adoption of technology | The textile sector in Europe is witnessing a digital transformation with the increased adoption of advanced technologies such as artificial intelligence, the Internet of Things, and Augmented Reality/Virtual Reality. |

| Rising use of natural fibres | Natural fibres like cotton are gaining prominence as renewable raw materials and are playing a crucial role in advancing the EU circular economy due to their biodegradability. |

Figure: Top Five Technological Skills in the Textile Sector with the Highest Growth from 2018 to 2019 Among EU27 Countries.

There is a growing demand for smart fabrics in Europe. These products can communicate with smartphones to process biometric information such as heart rate, temperature, breathing, and stress for use in sporting applications. Further, the adoption of 3D printing has revolutionised the textile manufacturing sector In Europe. 3D printing allows the manufacturers to experiment with innovative materials and recyclable materials. This further helps in allowing the region to reach its zero waste goals.

In 2020, the European Commission (EC) launched the Circular Economy Action Plan (CEAP) pushing the region towards a circular economy. The textile sector is considered a priority sector with the Strategy for Sustainable Textiles launched under CEAP aiming to create a greener production and consumption of textiles. With the rising importance of sustainability and ethical production practices, ecologically manufactured textiles are considered a white space for opportunities for growth in the sector. This is further contributing to the greater uptake of safer and cleaner materials such as wool and cotton for producing textiles.

Europe Textile Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Material Type

Market Breakup by Product Type

Market Breakup by Application

Market Breakup by Region

The wool segment is expected to hold a significant Europe textile market share as it is widely adopted to make winter clothing

According to the Europe textile market analysis, due to its properties such as breathability and thermal insulation, wool is being widely adopted for making winter clothing. Wool, considered a renewable raw material grown by sheep has the potential to lower large amounts of carbon and improve biodiversity. The growing inclination towards a circular economy across Europe is contributing to the greater adoption of wool for textile production.

As per the Europe textile market report, natural fibres such as cotton are increasingly being used in Europe as renewable raw materials majorly due to their biodegradable properties aligning with the region's circular economy initiatives. Cotton has gained popularity in Europe as it is practical versatile, durable, soft, breathable, and biodegradable. Also, as it can be dyed and blended with other fibres, it is being widely used in the European textile and apparel sector.

The Italian city of Como is considered a main centre for manufacturing silk fabrics in Europe due to the abundant presence of mulberry trees that are required for breeding silkworms. The silk produced in Italy is hypoallergenic and is widely used in producing dresses, scarves, tie accessories, etc.

As chemical fibres are durable and can be dyed easily, it finds application in household and clothing textiles in Europe, aiding the Europe textile market growth. In Europe, chemical fibres, such as polyester and nylon make up a large share of clothing and household textiles. Also, due to its characteristics such as affordability, and versatility, it is widely adopted for the production of low-cost, fast fashion, and high-performance textiles for durable clothing in Europe.

By product type, polyester is widely adopted in producing technical textiles, aiding the Europe textile market development

Europe’s technical textile sector supports the use of polyester in various markets, such as medical, packaging, and sports, owing to its properties of chemical resistance, hydrophobicity, UV resistance, etc. Further, when blended with cotton, polyester improves cotton's shrinkage, durability, and wrinkling profile.

In the European clothing market, natural fibres are rising in prevalence with the rising popularity of cotton. While nylon is expected to grow the fastest and polyester holds the largest volume, the demand for natural fibres is still rising driven by rising environmental awareness.

Textile manufacturers compete for better quality, price, development of sustainable fabrics, and certifications.

| Company Name | Year Founded | Headquarters | Products/Services |

| TDV Industries | 1867 | Le Bas des Bois, France | Cotton-rich blends, 100% cotton fabrics, fibre stretch textiles, polycotton compositions, flame retardant materials, etc. |

| Successori Reda S.p.A. | 1865 | Valdilana, Italy | Pure wool fabrics, Merino wool fabrics, active fabrics, etc. |

| Paulo De Oliveira Company | 1936 | Covilhã, Portugal | Formal wear fabrics, sportive fabrics, event and ceremony fabrics, technical fabrics, etc. |

| Lenzing AG | 1890 | Lenzing, Austria | Textile products are offered under the trade market of TENCEL™, ECOVERO™, VEOCEL™, and LENZING™. |

Other key players in the Europe textile market include Aquafil S.p.A., Tirotex Textile Company, Fulgar SpA, Getzner Textil AG, and Lanificio Fratelli Balli S.P.A., among others.

The United Kingdom holds a significant Europe textile market share due to a strong textile manufacturing sector

According to the Europe textile market analysis, the textile manufacturing sector of the United Kingdom produces about GBP 5.8Bn of materials that consist of the widely sought-after cashmere, worsted wool, luxurious tweeds, and distinctive tartans. As of 2020, the country had a presence of 4,200 businesses manufacturing textiles. The United Kingdom's textile sector is transforming with the digitalisation and acceptance of a circular economy.

The textile sector in Germany is concentrated in the regions of North Rhine-Westphalia (199 companies), Bavaria (127 companies), Baden-Württemberg, (121 companies), and Saxony (103 companies). Germany stands out for its significant innovation in the area of technical synthetic textile which encompasses a large share of textile manufacturing.

The EU countries, such as France, Italy, and Germany generally produce high-end luxury apparel. The fashion and luxury markets play a crucial role in the French economy. France also encompasses numerous companies engaged in the production of yarns, fabrics, and textiles for furniture, and technical applications. Additionally, the country's ready-to-wear clothing sector benefits from a well-established distribution network spread across the country.

According to the Europe textile market analysis, the Italian textile sector is transforming to achieve a complex balance between modernisation and technological advancements, while simultaneously maintaining a focus on creativity and craftsmanship. Italy is the second largest producer of textile finishing machinery with a world market share of around 17%. The country is home to around 45,000 textile and fashion companies. A majority of the small and medium textile companies are located in the Italian textile districts, such as Piedmont, Lombardy, Veneto, Emilia, and Tuscany.

Online Trading Platform Market

Optical Brightening Agents Market

Contract Lifecycle Management Software Market

Australia Trade Finance Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Europe textile market attained a value of USD 187.22 Billion.

The market is projected to grow at a CAGR of 3.00% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of USD 251.61 Billion by 2035.

Textile is a flexible material composed of a network of natural or artificial fibres, called yarn.

Prato is considered to be one of the largest industrial districts in Italy, the largest textile centre in Europe, and an important centre for the production of woollen yarns and fabrics, globally.

The market is being driven by the growing fashion and apparel industry, high consumer disposable incomes, and Europe’s dominance in textile research and innovation.

The key trends aiding the market expansion include the growing shift towards sustainable and organic textiles, increasing sales through online platforms, and incorporation of advanced technologies.

Cotton, chemical, wool, and silk, among others, are the different raw material types used in the market.

The major European textile markets are Germany, the United Kingdom, France, and Italy, among others.

The major players in the market are TDV Industries, Successori Reda SpA, LENZING AG, Paulo de Oliveira Company, Tirotex Textile Company, Aquafil S.p.A., Fulgar SpA, Getzner Textil AG, and Lanificio Fratelli Balli SpA, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Material Type |

|

| Breakup by Product Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share