Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Period

Forecast Period

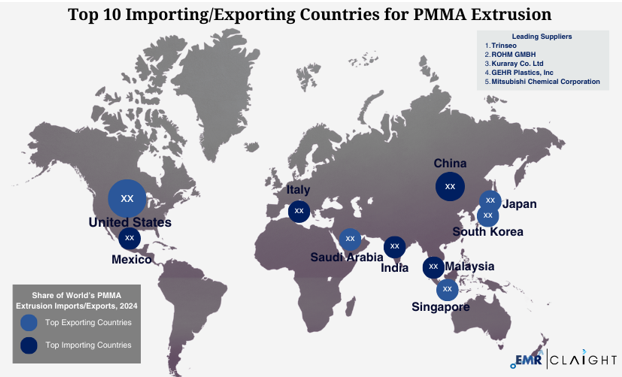

The Expert Market Research pricing report on PMMA EXTRUSION provides insights into the top 10 leading trading countries and regions.

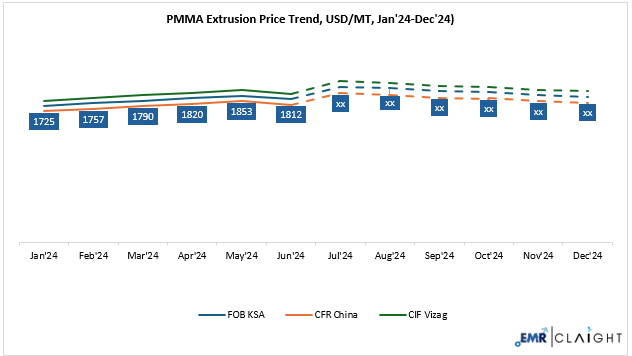

Polymethyl Methacrylate (PMMA) extrusion prices fluctuated in 2024 with global supply and demand, international trade and regulatory policies, and change in price of raw material costs influencing the price changes. Prices varied across different markets such as North America, Asia-Pacific, and Europe, reflecting regional market dynamics and economic forces. During Q1 2025, PMMA prices dipped in North America due to poor demand and reduced feedstock prices, though supply remained stable. Europe experienced steady price increases fuel by firm demand, particularly from the automotive industry and increased raw material prices. Prices in APAC remained largely unchanged or down slightly, as weak demand and few supply interruptions maintained the market in balance.

| PMMA Extrusion Blow Moulding Price (USD/MT) YoY Change, FOB KSA | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 1715 USD/MT | 1895 USD/MT | + 10% | Prices may remain stable or might slightly reduce, due to uneven demand recovery and raw material cost fluctuations |

| November | 1755 USD/MT | 1857 USD/MT | + 6% | |

| December | 1740 USD/MT | 1838 USD/MT | + 6% | |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

In late 2024, PMMA extrusion prices in America remained relatively stable, while regions such as Asia-Pacific and Europe saw a decline in prices. Factors such as declining demand, excess in supply, and decrease in cost of raw materials contributed to fall in prices for these regions in these regions. Despite these developments, uncertainty in market was observed, which lead to change in prices.

In 2024, PMMA extrusion prices remained inconsistent across different regions during 2024. During last quarter, prices in North American remained stable due to balance between supply and demand. While sales in automobile sector weakened growth, consistent demand from construction, home appliances, and consumer sectors helped in maintaining price stability. Lower production costs and faltering demand lead to a price drop in APAC region. By late 2024, prices in Europe dropped due to reduced raw material prices. Declining demand in construction and automotive industry, and rising competition from imports from China also contributed to price drop in Europe.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

In 2025 moderate rise in PMMA extrusion prices based on rising industrial demand, supply chain developments, and geopolitical pressures is expected. Demand from the automotive, construction, electronics, and healthcare sectors would fuel the growth. However, low-cost imports and weak demand could pose a danger to Europe and drive-up costs. Although the worldwide PMMA market is anticipated to expand overall, price trends in 2025 would be influenced by regional market trends, particularly in Europe.

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| South Korea | China | Trinseo (USA) |

| Singapore | Italy | Röhm GmbH (Germany) |

| Saudi Arabia | Mexico | Kuraray Co. Ltd. (Japan) |

| USA | Malaysia | GEHR Plastics (USA) |

| Japan | India | Mitsubishi Chemical Corporation (Japan) |

| China | Germany | Sumitomo Chemical Company (Japan) |

| Netherlands | USA | Chi Mei Corporation (Taiwan) |

| Thailand | Singapore | LG MMA Corporation (South Korea) |

Global trade policies and supply chain disruptions have had a major impact on PMMA extrusion prices. In early November, delayed Asian imports caused regional supply shortages, which kept prices from falling sharply despite overall weak demand, Logistic issues continued to increase the cost of imported material. Moreover, low inventory levels among suppliers created a risk-averse buying environment, which restricted price declines. This pairing of limited supply and high shipping costs sustained price levels, particularly in import-dependent markets.

Economic conditions assisted in keeping the PMMA market stable, particularly in North America. A more robust housing market, expanding economy, and resilient retail sales because of lower interest rates which upheld a reasonable level of demand for PMMA in construction. Prices in Asia and Europe declined due to weaker industries and less expensive raw materials but not so in North America. This was primarily since supply remained tight, and firms controlled their inventories closely. Although demand was not booming, the shortage and intelligent stock control prevented any significant price declines, making the market more stable than in other regions of the globe.

Methyl Methacrylate (MMA), a crucial raw material, involved in making of PMMA Extrusion was in law supply in Europe resulted in hike of extrusion-grade PMMA prices in March. Supply restrictions were largely attributed to hold-ups in shipments from Asia and Saudi Arabia, further compounded by Suez Canal disturbances, impacting the transport of both MMA and PMMA. In North America, costs also increased towards the end of 2024, supported by increased MMA prices and sustained consumption by the automotive and construction sectors. In the Asia-Pacific market, costs increased during third quarter because of shortages in supply and rising production costs of raw materials, with China recording price increases throughout the period.

In 2025 PMMA extrusion prices are expected to gradually increase throughout the year. The demand for PMMA extrusion would increase due to the rising need for durable, lightweight, and high-performance plastics in sectors such as consumer goods, construction, and automation. PMMA's adhesive qualities and flame retardancy properties along with advancements in phosphate methacrylate, would further enhance its performance with applications in industries requiring high durability and safety standards. These developments would improve the performance of PMMA products across various applications. However, availability and supply of methyl methacrylate could also have an impact on additional costs and production prices. Factors like shifts in the price of crude oil, market disruptions, and trade and tariff policies, would also influence price trends.

| Report Features | Coverage - Detail Report Annual Subscription |

| Product Name | PMMA Extrusion |

| Report Coverage | Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). | |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. | |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors | |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details | |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes | |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes | |

| Profitability Assessment: Profit margin evaluations | |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices | |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | Till the end of the subscription |

| Data Access | Lifetime Access, Visualisation |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with Expert Market Research's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Our market research reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to the next quarter market outlook or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimise procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share