Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global PET packaging market reached a value of approximately USD 77.51 Billion in 2025. The market is further expected to grow at a CAGR of about 4.50% between 2026 and 2035 to reach a value of around USD 120.37 Billion by 2035.

Base Year

Historical Period

Forecast Period

Amorphous PET form is expected to grow at a CAGR of 5.6% in the forecast period.

The demand for PET packaging in bottles and jars is anticipated to grow at a CAGR of 5.1% between 2026-2035.

The market in countries such as Canada and the USA is expected to grow at a CAGRs of 5.3% and 4.5% in the forecast period.

Compound Annual Growth Rate

4.5%

Value in USD Billion

2026-2035

*this image is indicative*

| Global PET Packaging Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 74.17 |

| Market Size 2035 | USD Billion | 110.18 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.5% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.8% |

| CAGR 2026-2035 - Market by Country | India | 6.1% |

| CAGR 2026-2035 - Market by Country | Canada | 5.3% |

| CAGR 2026-2035 - Market by Form | Amorphous PET | 5.6% |

| CAGR 2026-2035 - Market by Packaging | Bottles and Jars | 5.1% |

The rising consumer awareness of environmentally friendly goods and western impact are the main drivers of the market development. In addition, the demand for personalised and different-sized products for brand differentiation is growing. For example, the producers use different shapes, colours, as well as designs as a branding tool for the product for the packaging material. In addition, the growing preference among younger people worldwide for carbonated drinks and various ready-to-eat food items can also boost the growth of the PET packaging market.

Many of the manufacturers also follow PET packaging due to its low manufacturing and shipping costs, the minimal specifications for solid waste and storage, and ease of transport. The growing R&D to develop reusable and recyclable packaging solutions and technological advancements like plasma coating, which makes bottles more imperious, also lead to industry development.

With rising environmental awareness, there is a strong demand for sustainable PET solutions. Brands are increasing the use of recycled PET (rPET) to reduce plastic waste, especially in the beverages sector, where companies are committing to fully recyclable bottles. Initiatives like closed-loop recycling, where PET packaging is reused in a circular manner, are gaining traction.

A major trend of PET packaging market is that companies are innovating to create lightweight PET bottles that retain durability, helping to reduce material use and costs. Enhanced PET grades with better barrier properties are being developed to preserve product freshness, especially in food and pharmaceutical applications.

As per the PET packaging market dynamics and trends, Race Eco Chain, a company specialising in plastic waste management, has declared a partnership with Ganesha Ecosphere to create washing facilities aimed at producing PET flakes. Ganesha Ecosphere Ltd is recognised as a prominent PET recycling entity in India. According to a filing by Race Eco Chain with the stock exchange, the board has granted its preliminary approval for this collaboration.

As per the Pet packaging industry analysis, Coca-Cola India, a pioneer in launching 100% recycled PET (rPET) in the Indian beverage sector, is now intensifying its commitment to promoting a circular economy. The company has announced the launch of Coca-Cola in ASSP, featuring 100% recycled PET (rPET) in 250ml bottles, starting in the state of Orissa. This initiative, produced in collaboration with Coca-Cola's bottling partner, Hindustan Coca-Cola Beverages Pvt. Ltd. (HCCBPL), underscores the company's dedication to sustainability by focusing on reducing carbon emissions and encouraging environmental responsibility.

Over the six years from 2018 to 2023, worldwide investments in plastics circularity reached a total of USD 190 billion, averaging USD 32 billion annually, with over half of this amount allocated to North America, which can contribute to the growth of the PET packaging industry. This information is derived from the Plastics Circularity Investment Tracker, as reported by the nonprofit organisation Circulate Initiative and supported by the International Finance Corporation (IFC).

Furthermore, a July 2024 analysis from the Bank of America Institute indicates that more than 90% of extracted materials are either wasted, lost, or remain inaccessible, which impacts the PET packaging industry revenue. BofA Global Research anticipates that "plastic consumption, waste, emissions, and leakage" may increase by 50% to 70% by the year 2040, driven by the growing global demand for plastic.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Polyethylene terephthalate or PET is a polyester type, which, depending on the user's requirement, can be moulded into a variety of packaging containers like boxes and PET bottles. PET packaging is created by the melting of PET resin pellets and the extruder into suitable shapes. It is thermally stable, non-breakable, durable, and microorganism-resistant, preventing the deterioration of packaged material and ensuring quality maintenance. It is also highly resistant to humidity, solvents, and alcohols and has mild resistance to dilute alkaline and halogenated hydrocarbons. Owing to these features, it is commonly used in the packaging of food and beverage items, in personal care products, and pharmaceutical products.

The forms available in the PET can be divided into:

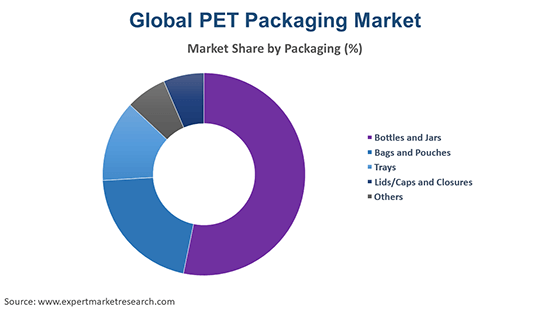

On the basis of packaging, the industry can be segmented into:

Based on filling technology, the industry can be categorised as:

Its major end-users are:

The beverage industry is further divided on the basis of type into bottled water, carbonated soft drinks, milk and dairy products, juices, and beer, among others.

The regional markets include:

The beverage sector holds the largest share and is the primary driver of demand. This dominance is largely due to the widespread use of PET for bottling water, carbonated drinks, juices, and energy drinks, where PET’s durability, transparency, and recyclability make it an ideal choice. Additionally, the demand for convenient, single-serve, and eco-friendly beverage containers has further fuelled PET packaging market opportunities, especially with rising consumer interest in sustainable packaging options.

The food sector follows, utilising PET packaging for items such as sauces, condiments, and ready-to-eat meals. PET is highly valued here for its ability to preserve freshness and prevent contamination, which is essential for maintaining food quality.

The report gives a detailed analysis of the following key players in the global PET packaging market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

Amcor Plc is a global leader in the market, known for its innovative and sustainable packaging solutions. The company's extensive product portfolio caters to a wide range of industries, including food, beverage, healthcare, and personal care. Amcor focuses on sustainability and innovation, investing heavily in research and development to create eco-friendly packaging solutions, which can boost PET packaging market value.

Berry Global Inc. is a prominent player in the market, offering a diverse range of products designed for various applications. The company's strong emphasis on quality and customer satisfaction has bolstered its market position. Berry Global invests in advanced manufacturing technologies to improve the efficiency and quality of its products. The company also focuses on expanding its global footprint through strategic acquisitions and partnerships, enhancing its market presence and customer base as well as PET packaging market revenue.

Graham Packaging Company is well-known for its high-quality PET packaging solutions, catering to the beverage, food, and personal care industries. Graham Packaging emphasizes innovation and sustainability, investing in research and development to create environmentally friendly packaging solutions. The company also engages in strategic collaborations and acquisitions to expand its product portfolio and market reach.

Resilux NV is a key player in the PET packaging market, known for its high-performance packaging solutions. Resilux focuses on continuous innovation and technological advancements to enhance its product offerings. The company also prioritises sustainability, developing eco-friendly packaging solutions that meet the evolving needs of consumers and industries.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

The Asia Pacific dominates the market, representing the majority of the PET packaging market share overall and is expected to grow at a CAGR of 5.8% in the forecast period. India, China, Australia, and Japan are expected to have CAGRs of 6.1%, 5.0%, 3.9%, and 3.5% between 2026 and 2035.

| CAGR 2026-2035 - Market by | Country |

| India | 6.1% |

| Canada | 5.3% |

| China | 5.0% |

| USA | 4.5% |

| Australia | 3.9% |

| Japan | 3.5% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Increasing consumer disposable income has led to a rise in the demand for processed and packaged food and beverages in countries including China, India, Indonesia, Thailand, and Singapore, which has led to a growth of the market in the region. In addition, the fast growth of the e-commerce sector in developing countries like China and India offers market vendors significant opportunities for growth.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global PET packaging market attained a value of about USD 77.51 Billion.

In the forecast period of 2026-2035, the market is projected to grow at a CAGR of almost 4.50%.

By 2035, the market is estimated to reach a value of nearly USD 120.37 Billion.

The major market drivers include increasing consumer disposable incomes, the flourishing e-commerce sector, and the rising consumer awareness regarding environmentally friendly goods.

The growing demand for personalised products, the rising preference for carbonated drinks, and the increasing R&D activities to develop recyclable and reusable packaging solutions are the key trends fuelling the market.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The major forms of PET packaging in the market are amorphous PET and crystalline PET.

The significant packaging segments of PET packaging considered in the market report are bottles and jars, bags and pouches, trays, and lids/caps and closures, among others.

Hot fill, cold fill, and aseptic fill, among others, are the leading filling technologies in the market.

Beverages industry, household goods sector, food industry, and pharmaceutical industry, among others, are the major end-users of PET packaging.

The leading players in the market are Amcor Plc, Berry Global Inc., Graham Packaging Company, Resilux NV, and Plastipak Packaging, Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Form |

|

| Breakup by Packaging |

|

| Breakup by Filling Technology |

|

| Breakup by End-User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share