Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global acetone market size reached a volume of nearly 7.99 MMT in 2025. The market is expected to grow at a CAGR of 3.40% in the forecast period of 2026-2035, to reach a volume of around 11.16 MMT by 2035. The market is supported by the growing demand from key end-use sectors.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3.4%

Value in MMT

2026-2035

*this image is indicative*

Acetone refers to a simple organic compound used in the production of bulk pharmaceuticals, agrochemicals, dyestuffs, other explosives, and downstream chemicals. It is the simplest and smallest ketone, with the chemical formula C3H6O. Acetone is known for its ability to dissolve many plastics and synthetic fibres, as well as its use in the formulation of nail polish removers and paint thinners.

The increased use of acetone as a solvent and high demand in the pharmaceutical, cosmetics, and paints and adhesives sectors are the major factors driving the acetone market demand. It is one of the most common solvents used in nail polish removers and cleansers in cosmetics. The product usage is also driven by favourable characteristics, such as low boiling point and miscibility in water as well as usage of acetone in the production of epoxy resins and polycarbonate. Additionally, the market growth is influenced by the growing demand for household cleaning products due to increasing awareness about hygiene among consumers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Growing applications of acetone in the pharmaceutical sector; growth of the personal care and cosmetic sectors; advancements in the production process of acetone; and regulations and guidelines affecting acetone usage are the major trends impacting the acetone market growth

Acetone is increasingly used in pharmaceutical manufacturing, both as a solvent and in active ingredient processing of pharmaceutical medicines.

The personal care and cosmetic sectors’ growth demands an increased use of acetone, particularly in nail care products like nail polish removers.

Innovations are focused on reducing the environmental impact of acetone production, enhancing safety protocols, and improving the overall efficiency of the production process.

Environmental and safety regulations significantly impact the market as they guide the production, handling, and disposal of acetone, given its volatile and flammable nature.

One of the crucial acetone market trends is the growing usage of acetone in the pharmaceutical sector due to its versatility. Acetone is an excellent solvent for many substances and in pharmaceuticals, it is used to dissolve other substances during the manufacturing process of drugs. Its ability to dissolve a range of chemical compounds without reacting with them makes it ideal for creating consistent and effective pharmaceutical products. Acetone serves as a key intermediate in the synthesis of various pharmaceuticals as it is involved in the production of many active pharmaceutical ingredients (APIs) and is used in the synthesis of steroids, vitamins, and other medications.

Scientists from the Federal University of São Carlos and Minas Gerais in Brazil, in collaboration with the Max Planck Institute of Colloids and Interfaces in Germany, developed an innovative acetone production method in September 2023. This new method simplifies the process, making it safer and cheaper, and it involves propane oxidation and a photocatalytic reaction using iron chloride (FeCl3) as a homogeneous catalyst in the presence of light. This process is direct, eliminating the production of propylene as an intermediate, and is safer as it does not involve high-temperature and high-pressure oxygen reactions or flammable intermediaries.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Acetone Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Application

Market Breakup by Region

Increased applications as a solvent in multiple end-use sectors to aid the acetone market

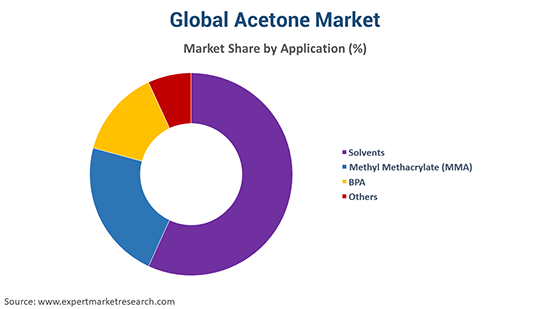

The substance finds wide applications as a solvent, which accounts for a major chunk of the acetone market share. This dominance can be attributed to the increased demand for solvents in various end-use sectors, including pharmaceuticals, paints and coatings, automobiles, and cosmetics. Acetone is a key ingredient in many solvent-based products due to its properties like rapid evaporation and ability to dissolve binders, pigments, and other soluble additives.

The demand for Methyl Methacrylate (MMA) and bisphenol-A (BPA) also influences the market significantly. Acetone is a key component in the production of both MMA and BPA. MMA, used in manufacturing various acrylic-based polymers, relies on acetone for its production process, whereas BPA, a major ingredient in polycarbonates and epoxy resins, also utilises acetone in its production. The growing demand for products made from MMA and BPA, like plastics, coatings, and adhesives, in turn, drives the demand for acetone in these segments.

The market players are making efforts to increase acetone production capacity to meet its growing demand and are also focusing on developing sustainable production methods, offering products with eco-friendly certification

Shell Chemicals, a subsidiary of Royal Dutch Shell, is an energy-producing company. It specialises in the production of chemicals used in plastic, solvents, and industrial products, among others.

INEOS Group Holdings S.A, based in Switzerland, is a petrochemical and speciality chemical provider. The company offers a diverse range of chemical products for various end-use sectors.

Cepsa Química, S.A. is an energy and petrochemical company, based in Spain. It mainly offers chemicals and their derivatives for multiple industrial applications.

Deepak Phenolics Limited, a subsidiary of Deepak Nitrite Limited, which is a leading producer of acetone and phenol, has gained the ISO certification, making it a socially responsible company.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in acetone market are LG Chem, Honeywell International Inc., Versalis S.p.A., Mitsui Chemicals Group, Formosa Chemicals and Fibre Corporation, Altivia, Hindustan Organic Chemicals Limited, SI Group, Inc. among others.

Several market players stand committed to lowering greenhouse gas emissions in the production of chemicals, aiming to balance emissions with an equivalent amount of carbon removal from the atmosphere. This includes shifting to renewable energy sources like solar, wind, or hydroelectric power to run their operations, instead of relying on fossil fuels, and using raw materials that are more sustainable, possibly including bio-based or recycled sources, to produce chemicals like acetone. In July 2022, Shell Chemicals Park Moerdijk announced that it is transitioning towards a net-zero emission production facility for manufacturing sustainable chemicals.

As per the acetone market analysis, the Asia Pacific accounts for almost 46% of the global share, followed by the European Union and North America. China, one of the significant regions in the Asia Pacific, is the centre of acetone production. China is also a significant importer of acetone, importing majorly from countries including Taiwan, Thailand, and South Korea, among others. International manufacturers have shifted their manufacturing units to the region due to affordable infrastructure and labour costs.

The emerging economies, growing industrialisation, and rising purchasing power are expected to continue contributing to the demand for chemicals from regional end-use sectors. China is expected to be a leading consumer and manufacturer of acetone and is anticipated to continue its dominance owing to its increasing consumption as a solvent.

Europe follows the Asia Pacific and it is one of the largest exporters of acetone globally, exporting to countries like Turkey, China, India, and the United States. The acetone market demand in Europe is also supported by the region’s rapidly growing cosmetic market, which uses acetone in regulated measures. The region is expected to witness an increased demand for chemicals with eco-friendly certification, encouraging manufacturers to improve sustainability of the entire production process as per regional standards or in accordance with the EU’s Renewable Energy Directive (EU RED).

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate volume of nearly 7.99 MMT.

The market is estimated to grow at a CAGR of 3.40% between 2026 and 2035.

The major drivers of the industry, such as the rising disposable incomes, increasing hygiene awareness, rapidly growing cosmetic market, and the growing end-use industries, are expected to aid the market growth.

The key trends aiding the market include the growing applications of acetone in the pharmaceutical sector, the growth of the personal care and cosmetic sectors, advancements in the acetone production process, and regulations guiding the use of acetone.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific, with the Asia Pacific accounting for the largest share in the market.

Solvents, methyl methacrylate (MMA), and BPA, among others are the leading applications of acetone in the industry.

The major players in the market are Shell Chemicals, INEOS Group Holdings S.A., Cepsa Química, S.A., LG Chem, Honeywell International Inc., Versalis S.p.A., Mitsui Chemicals Group, Formosa Chemicals and Fibre Corporation, Altivia, Hindustan Organic Chemicals Limited, and SI Group, Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share