Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global beef market size reached an approximate value of USD 453.05 Billion in 2025. The market is estimated to grow at a CAGR of 4.80% between 2026 and 2035, reaching a value of nearly USD 724.03 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.8%

Value in USD Billion

2026-2035

*this image is indicative*

Beef is a culinary term used for meat obtained from cattle. It boasts an abundance of protein, essential vitamins, and minerals, most notably iron and zinc. This protein source falls under the category of red meat as it is derived from mammals, and it is known to possess a higher iron content compared to chicken or fish.

Beef is divided into various cuts, each with its own texture, flavour, and ideal cooking method. Common cuts include sirloin, rib-eye, tenderloin (filet mignon), T-bone, brisket, and chuck. These cuts can be prepared in a variety of ways, from grilling and roasting to slow cooking and braising.

The cooking method for beef can vary greatly depending on the cut. Steaks like sirloin and rib-eye are often grilled or pan-seared, while tougher cuts like brisket or chuck are better suited for slow cooking methods like braising or stewing to become tender. Beef is used in a wide range of dishes across different cuisines. It is a key ingredient in stews, roasts, steaks, burgers, and in many ethnic dishes like Italian Bolognese, Mexican tacos, and Korean bulgogi.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Increase in the purchasing power of consumers

The growing disposable income is a major factor augmenting the beef market demand. Rapid economic development and lifestyle changes have significantly increased the demand for meat products, including beef, especially among the middle class.

With higher disposable income, consumers are often more willing to spend extra on premium food products. This includes high-quality cuts of beef, which are typically more expensive than other types of meat or protein sources. People with more spending power are likely to prioritise quality, taste, and perhaps ethical sourcing, which can drive demand for premium beef products.

As people become wealthier, there tends to be a shift in dietary preferences towards more protein-rich diets, and beef is a key source of high-quality protein. In many cultures, consuming beef is also associated with affluence and status, which further drives its demand as incomes rise.

Technological advancements in the beef production process

Advancements in technology and precision agriculture have revolutionised the beef production process. Precision breeding techniques, such as genetic selection and artificial insemination, have allowed producers to enhance the quality and productivity of their herds. Furthermore, digital tools and data analytics are being employed to optimise feed efficiency, monitor animal health, and improve overall production management.

Technological advancements have led to better methods for monitoring cattle health. Wearable technologies, like smart collars or ear tags, can track individual animal's activity, health, and behaviour patterns. This data helps farmers identify sick animals early, improve breeding programs, and enhance overall herd health.

Furthermore, automation in feeding and watering systems ensures that cattle have consistent and optimal access to nutrition and water. These systems can be programmed to provide the right amount of feed based on the cattle's age, weight, and health status, optimising growth, and reducing waste.

Rising popularity of organic beef products

The surging demand for organic and antibiotic-free animal products is one of the major beef market trends. People are increasingly becoming sceptical about consuming meat with additives and growth enhancers. As a result, there is a growing preference among consumers for natural meat products, leading to a rapid increase in the demand for antibiotic-free beef.

The demand for antibiotic-free beef has led to changes in regulatory policies and industry practices in some regions. For example, there are stricter guidelines on the use of antibiotics in livestock, and more producers are adopting antibiotic-free practices to meet both regulatory requirements and market demand.

To meet this demand, there is an increased emphasis on traceability and transparency in the beef supply chain. Consumers want to be assured that the beef they purchase is genuinely antibiotic-free, which requires robust tracking and certification systems.

Growing importance of animal welfare

The growing awareness of animal welfare among consumers is another trend propelling the beef market growth. There is a significant shift in consumer preference towards organic and ethically sourced beef.

Many consumers are also increasingly concerned about the environmental impact of beef production and the welfare of animals. Natural beef production, which often involves more humane and sustainable farming practices, appeals to these ethical and environmental values.

Companies that are perceived to prioritise animal welfare can experience a positive impact on their brand image. This improved public perception can lead to increased customer loyalty and market share. Conversely, companies associated with poor animal welfare practices may face consumer backlash and declining sales.

There is also an increasing presence of certification programs and labelling that indicate animal welfare standards, such as "free-range," "grass-fed," and "humanely raised." These labels help consumers make informed choices and push producers to adopt higher welfare standards to meet certification requirements.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The comprehensive EMR report provides an in-depth assessment of the market based on Porter's five forces model along with giving a SWOT analysis. The report gives a detailed analysis of the following key players in the global beef market, covering their competitive landscape and latest developments like mergers, acquisitions, investments and expansion plans.

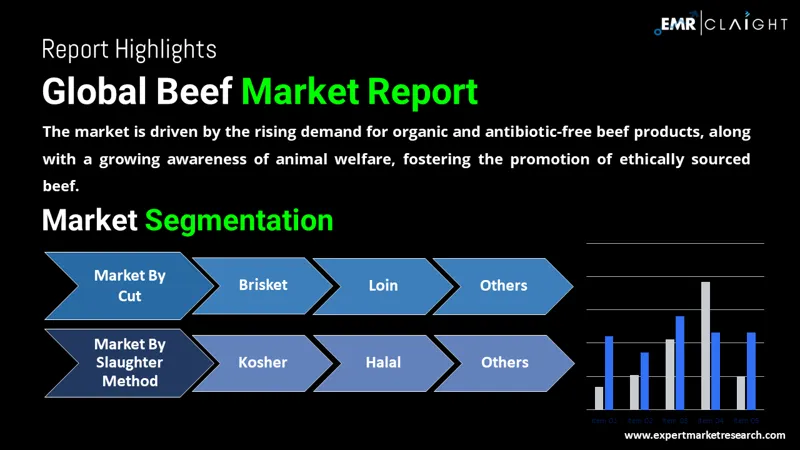

Market Breakup by Cut

Market Breakup by Slaughter Method

Market Breakup by Region

During the forecast period, the ground cut segment is expected to hold a significant beef market share. Ground-cut beef refers to meat that has been finely minced or ground, and it has gained popularity due to its versatility and affordability. Compared to other cuts of beef, the ground cut one offers a cost-effective option, making it accessible and affordable for individuals across different economic sections.

Ground beef is highly versatile and can be used in a wide array of dishes. From hamburgers and meatballs to tacos and lasagna, it is a staple ingredient in many cuisines around the world. This versatility makes it a popular choice for both home cooks and professional chefs.

Ground beef fits well with various dietary trends and preferences. For instance, it can be easily incorporated into low-carb or keto diets, which emphasise high protein and fat intake. It is also easy to season and can be adapted to fit a wide range of dietary preferences and cuisines.

As per the beef market analysis, North America stands out as one of the largest consumers in the global market. Beef plays a significant role in the culinary traditions of countries like Canada and the United States. During festive seasons, consumers in North America indulge in a diverse range of beef cuts, including steaks and roasts. Consequently, major meat manufacturers in the region strive to introduce innovative beef cuts to meet the evolving demands of different consumer segments.

North America, especially the United States, has a high level of economic prosperity and a higher average disposable income compared to many other regions. This economic strength allows consumers to afford beef, which is often more expensive than other protein sources like chicken or pork.

Furthermore, North America has a prominent fast-food culture, with many popular chains that specialise in beef-based products, like hamburgers. The prevalence of these chains, along with a vibrant restaurant sector that often features beef dishes, contributes to high beef consumption.

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis. The report gives a detailed analysis of the following key players in the Global beef market, covering their competitive landscape and latest developments like mergers, acquisitions, investments, and expansion plans.

Tyson Foods, Inc. is one of the largest food companies engaged in the production, processing, and marketing of chicken, beef, pork, and prepared food products. It is a multinational company founded in 1935 and it is currently headquartered in Arkansas, the United States. It offers a wide range of products, including fresh and frozen chicken, beef, pork, and processed food items.

Danish Crown A/S is a Danish meat processing company with a global presence. It was founded in 1887 and is headquartered in Randers, Denmark. With a firm footing in the food and agriculture sector, Danish Crown specialises in the intricate art of producing, processing and distributing pork and beef products. Danish Crown works closely with these farmers to ensure a sustainable and high-quality supply of livestock for its operations.

Perdue Farms Inc. is a prominent player in the food and agriculture sector, established as a privately owned, family-operated company. It is one of the largest poultry producers in the United States. Established back in 1920, Perdue Farms is currently headquartered in Maryland, the US. With a commitment to excellence, the company caters to a diverse clientele and distributes its wide range of products across the United States and the world.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other market players include Agri Beef Co., National Beef Packing Company, LLC, Minerva S.A, JBS SA, St. Helen's Meat Packers Limited, Vion N.V, and Australian Agricultural Company Limited, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached a value of about USD 453.05 Billion.

The market is assessed to grow at a CAGR of 4.80% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 724.03 Billion by 2035.

The major factors driving the market growth include technological advancements to enhance beef production and quality and the growing disposable incomes of consumers.

The market development is guided by the increasing demand for organic and antibiotic-free beef products and the growing awareness about animal welfare, promoting ethically obtained beef.

The major regional markets for beef include North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The various slaughter methods of beef include kosher and halal, among others.

The key players in the beef market include Tyson Foods, Inc, Danish Crown A/S, Perdue Farms Inc, Agri Beef Co., National Beef Packing Company, LLC, Minerva S.A, JBS SA, St. Helen's Meat Packers Limited, Vion N.V, and Australian Agricultural Company Limited, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Cut |

|

| Breakup by Slaughter Method |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share