Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global chocolate market size was valued at USD 48.20 Billion in 2025. The industry is expected to grow at a CAGR of 4.90% during the forecast period of 2026-2035 to reach a valuation of USD 77.77 Billion by 2035. Growing demand for affordable compound chocolate and the global shift toward premium couverture varieties are together driving significant growth and innovation across the chocolate market.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.9%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Chocolate Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 48.20 |

| Market Size 2035 | USD Billion | 77.77 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.90% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.52% |

| CAGR 2026-2035 - Market by Country | India | 7.77% |

| CAGR 2026-2035 - Market by Country | Brazil | 5.35% |

| CAGR 2026-2035 - Market by Sales Channel | B2C | 5.54% |

| CAGR 2026-2035 - Market by Category | Compound Chocolate | 5.58% |

| Market Share by Country 2025 | United States | 18.10% |

The global chocolate market is experiencing strong investment in production capacity to meet rising demand. Supporting this, in March 2025, Clasen Quality Chocolate announced a new manufacturing facility in Frederick County, Virginia, to better serve large grocery chains and food companies with high-quality chocolate and confectionery coatings.

Meanwhile, in February 2025, Olympic Industries in Bangladesh is investing USD 1.66 million to boost chocolate production at its Lolati factory by 3,300 tonnes annually, using advanced imported machinery.

Technology is transforming chocolate production. From AI-driven flavour innovation to precision fermentation crafting sustainable, cocoa-free alternatives, Companies such as California Cultured and Voyage Foods are redefining indulgence. These advances reflected better supply chain resilience and greater chocolate experiences.

As part of broader efforts to build a more sustainable and environmentally responsible chocolate supply chain, Belcolade opened its first carbon-neutral chocolate factory in Belgium in 2023. The facility is powered entirely by renewable energy and incorporates circular water use and zero-waste practices.

Additionally, Barry Callebaut expanded its chocolate factory in Campbellfield, Australia, in 2022. The upgraded facility increases production capacity and adds a new line for liquid chocolate, allowing the company to better serve industrial customers.

Consumers are increasingly prioritising health-focused options, demanding chocolates with healthy or good-for-you ingredients. Consumers are demanding high-protein chocolates. Brands are responding to these trends by introducing functional chocolate options that not only satisfy cravings but also support overall well-being, with a focus on nutrition and energy.

The global chocolate market is expanding, driven by improvements in production methods. Manufacturers are focusing on the origin and flavour of the beans to meet the needs of end consumers. In October 2022, Barry Callebaut introduced a redesigned method of chocolate making through its Cocoa Cultivation & Craft (CCC) principle, featuring 60–80% more cocoa and up to 50% less sugar, highlighting pure cocoa taste and catering to the growing demand for healthier indulgence.

Cocoa production is shifting toward cell-based growing methods, strengthening the supply chains in the chocolate market. As climate change threatens traditional agriculture, plant cell culture is gaining traction by producing real cocoa and coffee in bioreactors. In February 2025, Zurich-based Food Brewer raised USD 5.6 million, backed by chocolate manufacturer Lindt and Puratos’ Sparkalis, to scale cocoa production. This shift offers chocolate makers a stable and scalable supply independent of climate and land pressures.

Advancements in cocoa processing technology are significantly boosting chocolate production by improving ingredient quality, flavour consistency, and manufacturing efficiency. Innovations like precision roasting, automated sorting, and enhanced fermentation methods enable producers to achieve higher yields with better flavour control. These improvements reduce production costs and environmental impact, while supporting scalable, high-performance chocolate manufacturing to meet growing global demand for chocolate products.

Chocolate brands are increasing their production capacities to meet growing consumer demand, strengthening their presence, and aiding the growth of the chocolate market. Ferrero, for example, opened a USD 214 million Kinder Bueno production facility in Illinois in September 2024. This 169,000-square-foot manufacturing campus is an expansion of Ferrero's existing manufacturing facility in Bloomington.

The Expert Market Research’s report titled “Global Chocolate Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Category

Compound chocolate holds a dominant share in the global chocolate market largely due to its affordability, ease of use, and suitability for large-scale production. It is widely favored by manufacturers for use in bakery products, confectionery coatings, and moulded chocolate items. Its stability in various climatic conditions and longer shelf life make it ideal for distribution in diverse markets, especially in regions with limited cold chain infrastructure. As demand for cost-effective yet indulgent chocolate products continue to grow, particularly in emerging economies, compound chocolate remains a dominant and practical solution for mass-market chocolate production.

Market Breakup by Sales Channel

B2B represents a significant segment of the global chocolate market, driven by demand from food manufacturers, bakeries, confectionery producers, and the hospitality sector. Industrial chocolate, used as an ingredient in a wide range of products, from baked goods and dairy items to snacks and desserts, fuels this demand. Major chocolate suppliers cater to B2B clients with customized solutions, including tailored formulations, specialty ingredients, and bulk packaging. As innovation and premiumization trends grow across the food industry, B2B partnerships are increasingly focused on sustainability, consistency, and product quality to meet evolving consumer expectations and regulatory standards.

Market Breakup by End Use

The confectionery segment holds a significant share of the global chocolate market, driven by strong consumer demand for indulgent, convenient, and gift-worthy products. This segment includes moulded chocolates, filled bars, truffles, and seasonal items, appealing to a wide range of age groups. Continuous innovation in flavours, textures, and packaging keeps the category dynamic and competitive. Trends such as premiumisation, impulse purchases, and festive consumption further support growth. With broad availability across supermarkets, convenience stores, and online platforms, chocolate confectionery remains a key revenue driver for both global brands and regional manufacturers in the international chocolate industry.

Market Breakup by Region

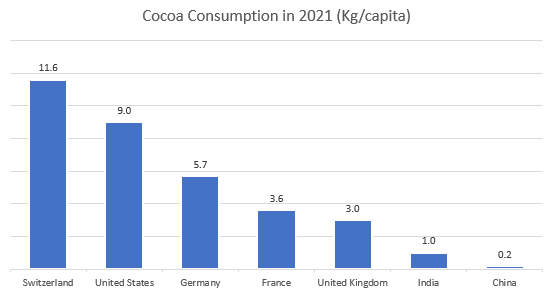

Europe remains the largest and most mature market in the global chocolate industry, driven by high per capita consumption, a strong tradition of chocolate making, and the presence of world-renowned brands. Countries such as Germany, Switzerland, the United Kingdom, and Belgium play a major role in shaping market trends through innovation, premium offerings, and sustainable sourcing practices. The region benefits from well-established retail infrastructure and consumer preference for both every day and artisanal chocolates. Europe’s continued focus on quality, ethical production, and product differentiation secures its leadership in the global chocolate market.

Surging Demand for Compound Chocolate

Increasing product innovation in compound chocolate applications is propelling the chocolate market growth. On average, compound chocolate is significantly cheaper than traditional chocolate, making it a preferred choice for cost-effective production. Reflecting this, in May 2023, AAK launched CEBES Choco 15, a patented, plant-based CBS compound that allows for 15% cocoa in recipes, delivering enhanced cocoa flavour, long shelf life, and efficient processing for industrial and bakery applications. Further, in 2023, Puratos US expanded its Wisconsin chocolate plant with a new production line dedicated to both real chocolate and compound coatings, boosting output.

Globally, demand for pure chocolate is rising, with many markets, such as France and Belgium, requiring chocolate to contain 70% or more cocoa and to use only cocoa butter, ensuring premium. Quality. Supporting this global trend, Masqa in 2023, launched a line of gourmet couverture chocolate products, highlighting the brand's commitment to quality and premium craftsmanship. Additionally, Belcolade introduced its first plant-based white couverture chocolate in 2023. This innovative product offers a premium alternative for consumers seeking plant-based alternatives.

B2B Segment is Driven by the Rising Industrial Application of Chocolate

As demand for cocoa-based ingredients rises in the industrial segment, companies are investing to scale production closer to end markets. In line with this trend, Barry Callebaut in 2022, partnered with the Moroccan government to establish a new production facility in Morocco. This strategic move allows Barry Callebaut to strengthen its position in North Africa and expand its B2B operations. The new facility will support the growing demand for chocolate and cocoa ingredients across the region, ensuring high-quality products for a wide range of industries.

Further, the B2C chocolate segment is seeing increased investment in direct-to-consumer experiences, with brands expanding retail footprints and focusing on freshness and quality to attract end customers. In 2023, Masqa, a D2C brand, entered the F&B sector with the launch of its premium food line. The debut range features couverture chocolate products such as bars, barks, and pebbles, developed in innovative flavours and crafted with culinary precision to cater to refined consumer preferences.

The Confectionery Segment is driven by Rising Consumer Demand for Indulgent Chocolate Products

Rising demand for indulgent, premium products and innovative flavours is driving the confectionery segment growth. Manufacturers and brands are working to expand chocolate offerings by forming strategic alliances and collaborations, enabling innovation across ingredients, formats, and regional markets to better serve evolving consumer preferences.

For instance, in 2024, Cargill launched a new cocoa production line at its Gresik plant in Indonesia to meet growing demand for indulgent foods across Asia. The facility will support bakery, ice cream, chocolate confectionery, and café-style beverages in foodservice, enhancing innovation and responsiveness for regional customers.

Additionally, in 2024, Supernatural launched a dedicated B2B channel, partnering with Milk Bar, King Arthur Baking, and Snack Conscious to supply natural, plant-based sprinkles and inclusions for chocolate-based bakery and snack applications.

Further, in 2023, Mondelēz International invested approximately USD 32.4 million in its Herentals bakery plant in Belgium. The expansion includes a new production hall dedicated to Prince biscuits.

Europe’s Chocolate Market is Characterised by high per capita consumption, strong presence of premium brands, and established retail and artisanal channels.

According to 2025 data, Europe dominates global chocolate production. Germany is the leading producer of chocolate, followed by Italy, France, the Netherlands, Belgium and Poland. Germany is Europe’s largest chocolate manufacturing industry. In 2023, Germany produced close to 1.14 million tonnes of chocolate products, equating to 13.6 kilograms per capita. A growing demand for chocolates is compelling producers to expand their production capacity to meet the demand. In June 2024, Mars announced its plans to invest USD 43.3 million in a chocolate factory in Germany, in part to support production of its Twix brand. A portion of the investment will also go into improving the production lines and supporting more sustainable production.

In North America, an expanding finished chocolate goods sector is propelling the market. Producers are expanding their operations to better serve customers with high-quality chocolate products. In February 2025, Clasen Quality Chocolate announced a USD 230 million investment to build a new facility in Virginia. Investments in the production of industrial chocolate are stimulating market development in the United States. In February 2025, IRCA Group Americas confirmed the opening of a new state-of-the-art chocolate facility in St. Louis. The facility is designed to produce artisanal, industrial, and specialty chocolates for food manufacturers and professionals across the Americas.

| CAGR 2026-2035 - Market by | Country |

| India | 7.77% |

| China | 4.63% |

| Brazil | 5.35% |

| Mexico | 5.50% |

| Australia | 5.20% |

| Japan | 5.02% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Saudi Arabia | XX% |

The global chocolate market is highly competitive, led by major multinational companies such as Mars, Mondelēz International, Nestlé, Ferrero, and Hershey. These players dominate through strong brand recognition, expansive distribution networks, and continuous product innovation. The market also includes regional and premium artisanal brands that cater to niche demands for organic, vegan, and ethically sourced chocolates.

Barry Callebaut AG, founded in 1996 and headquartered in Switzerland is a world-leading manufacturer of high-quality chocolate and cocoa products. The company is engaged in sourcing and processing cocoa beans to produce the finest chocolates, including chocolate fillings, decorations, and compounds.

Headquartered in Singapore, OFI was founded in 2012. It is a global leader in naturally sourced food ingredients and solutions, operating as a subsidiary of Olam Group. The company specialises in sustainable sourcing and innovative processing of cocoa, coffee, dairy, nuts, and spices for manufacturers, retailers, and foodservice providers worldwide. Ofi is the top one global cocoa originator and top third cocoa producer globally.

Cargill, Incorporated is a global food company based in the United States, engaged in agriculture, finance, and industrial products business globally. The finished products are delivered by the company to their customers in foodservice, retail, consumer packaged goods and industrial sectors.

Malaysia-based Guan Chong Berhad is a globally recognised manufacturer renowned for its expertise in producing a diverse range of cocoa-derived food ingredients and premium chocolate products. The company operates eight production facilities and maintains four cocoa trading offices strategically positioned to support its global operations.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the chocolate market report are Fuji Oil Co., Ltd., Mars, Incorporated, Mondelēz International, Inc., Ferrero International S.A., The Hershey Company, Nestlé S.A., Chocoladefabriken Lindt & Sprüngli AG, AUGUST STORCK KG, United Confectionary, S.L.U, pladis Foods Ltd., Meiji Holdings Co., Ltd., LOTTE Corporation, and Arcor Group, among others.

• Comprehensive quantitative analysis of global chocolate market trends.

• Region-wise and segment-wise breakdown for accurate market forecasting.

• Insights into key drivers, challenges, and emerging industry opportunities.

• Competitive landscape profiling top chocolate companies.

• Supply chain analysis with technological and infrastructure developments.

• Strategic recommendations for new entrants and established chocolate providers.

• Trusted industry insights backed by real-world data and expertise.

• Customized reports tailored to your specific business needs.

• Up-to-date trends and forecasts across global chocolate sectors.

• Extensive coverage of emerging and established chocolate markets.

Unlock valuable insights by downloading a free sample of the Global Chocolate Market Report. Stay ahead with expert analysis of market trends, growth drivers, and strategic forecasts. Learn how key players are shaping the future of global chocolate sector and gain a competitive edge in this evolving sector.

Asia Pacific Chocolate Market

Germany Chocolate Market

Africa Compound Chocolate Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 48.20 Billion.

The market is projected to grow at a CAGR of 4.90% between 2026 and 2035.

The key players in the market report include Barry Callebaut AG, Olam Food Ingredients (OFI), Cargill Incorporated, Guan Chong Berhad, Fuji Oil Co., Ltd., Mars, Incorporated, Mondelēz International, Inc., Ferrero International S.A., The Hershey Company, Nestlé S.A., Chocoladefabriken Lindt & Sprüngli AG, AUGUST STORCK KG, United Confectionary, S.L.U, pladis Foods Ltd., Meiji Holdings Co., Ltd., LOTTE Corporation, and Arcor Group, among others.

Compound chocolate dominates the category segment of the market due to the growing demand in the mass production of chocolate products.

Key strategies driving the chocolate market include product innovation, premiumisation, and a strong focus on health-conscious and sustainable offerings. Expansion into emerging markets and investment in e-commerce also support global growth.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Category |

|

| Breakup by Sales Channel |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share