Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global cobalt market size 217.91 KMT in the year 2025. The market is further expected to grow at a CAGR of 8.90% between 2026 and 2035 to reach a volume of almost 511.16 KMT by 2035.

The cobalt market has seen a gradual increase due to the rapid rise in electric vehicles (EV) and their respective battery chemistries. The market is expected to grow at a rapid rate as cobalt consumption will increase in the future, owing to its essentiality in NMC batteries which are mostly used in EVs. All-purpose Li-ion batteries, like those used in power tools and e-bikes, for example, require cobalt for performance, durability, and range. More importantly, The global market growth depends heavily on the U.S. market as manufacturers are increasingly competing to optimize battery efficiency. Cobalt is expected to remain an important element in future battery technologies, as demand for EVs keeps increasing.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

8.9%

Value in KMT

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY

The cobalt market has observed key trends that are closely tied to the growing demand for lithium-ion batteries, which are critical parts of electric vehicles (EVs) and battery electric vehicles (BEVs). The transportation sector observes shifting paradigms to cleaner and greener options, such as the rising global EV volumes, along with the rising demand for electric motors. Lithium-ion batteries use cobalt in their cathode formulation, and it greatly enhances battery performance, energy density, and stability. Plug-in hybrid electric vehicles (PHEVs) and BEV sales are also on the rise, largely due to the support of organizations such as the European Automobile Manufacturers' Association. As demand for electric vehicles increases, the demand for cobalt increases too, which is essential for electric motor efficiency, battery range, and life. As EVs are adopted at an accelerating rate, cobalt is a key element that makes sustainable high-performance solutions possible in the electric vehicle segment and enables both sustained growth and innovation of EV technologies in the future.

The higher penetration of the consumer electronics segment has resulted in a strong demand for cobalt-containing lithium-ion batteries that, as a result, contribute to the cobalt market growth. The market observes a high demand streaming from smartphones, laptops, tablets, and wearable devices, all of which use cobalt in their batteries, creating stronger demand. Also boosting growth are rapid charging capabilities and increasingly long-lasting battery life in portable electronic devices. With an increase in digitalization of mobility, as well as electric car sales, the cobalt market is likely to continue growing, particularly in Europe, with Germany. The markets for electric vehicles are growing even higher. Moreover, the fast-growing sales of information technology (IT) products and telecommunications devices in developing countries boost the demand for cobalt metal. Cobalt also helps sustain the energy demands of consumer electronics and electric vehicles as they become necessary for the long-term operation and sustainability.

The cobalt market value is largely connected to the growth of the EV supply chain, fueled by the growing demand for EVs and battery manufacturing. The Inflation Reduction Act (IRA) has catalyzed investments, which then stimulated the industry growth. Battery producers are increasingly using cobalt for manufacturing EV batteries. Cobalt-based superalloys are used in aerospace applications, aircraft production, battery production and power generation. Furthermore, its function in chemical process also enhances the market growth. Cobalt’s significance across close to a dozen industries continue to grow amid soaring demand for EVs and advanced materials, driving industry and technology progress.

Another cobalt market opportunity is increase in production, just as demand is expected to continue to grow for use in aerospace. This massive cobalt consumption is primarily driven by the production of MAX planes from Boeing and the aircraft industry in general. As global production ramps up, the Democratic Republic of Congo, a key cobalt supplier, assumes a vital role in locking down cobalt reserves. But as the industry grows, so do its challenges, with mining activities and companies coming under increasing environmental scrutiny. Denoting the areas of sustainable growth, local ecosystems will critically require measures to mitigate the effects of mining from an environmental point of view. In addition, while cobalt is a major cost component of stainless steel production, its broader use in other industrial processes creates added value; however, developing such applications sustainably will be essential for the ongoing viability of the cobalt market.

One of the key restraining factors in cobalt market is that there is an increase in the demand of cobalt alloys in the healthcare applications like orthopaedic implants, joint replacements, prosthesis and surgical instruments. Although cobalt incorporates necessary properties for biocompatibility, wear resistance, and durability, its growing application in medical materials for surgical interventions has led to apprehensions. Industry specifications for healthcare products tend to be high quality, and this high quality may make cobalt less available for other industrial applications and lead to supply pressure in light of growing demand in healthcare.

Cobalt sulfate is almost always applied in the production of lithium-ion batteries, which are critical to powering the expansion of electric vehicles (EVs) and energy storage systems. Its demand is primarily fueled by its capacity to enhance battery efficiency and energy density, a requirement in the EV supply chain.

On the other hand, cobalt oxide is widely used in rechargeable batteries, especially nickel-cobalt-manganese (NCM) batteries. These are used in applications ranging from electronics to electric vehicles. The major advantage of cobalt oxide is that it helps them to recharge and live longer, thus contributing to the market growth within renewable industry and electric world.

Cobalt metal is critical in high-end applications, from the production of superalloys in industries like aerospace, power generation, to medical devices. Its high strength, thermal resistance and resistance to wear render it ideal for use in high-tech applications such as in jet engines and in medical implants. The segment for cobalt metal is growing owing to increased demand for lightweight and strong materials in diverse industries, ranging from aerospace and healthcare, promising steady growth within the market.

There is a diverse range of end-use segments driving the cobalt market, with each utilizing cobalt’s beneficial properties. As cobalt is a key ingredient in the cathodes of lithium-ion batteries that power EVs, its demand is primarily driven by the increase in EVs globally. With the rising demand for electric vehicles, the demand for cobalt rises as this metal plays a critical role in the move towards cleaner means of transportation.

Besides batteries for electric vehicles, cobalt is also used in other batteries, including those in consumer electronics, energy storage systems, and electric ships. Cobalt's role in enhancing the performance, energy density, and lifespan of the batteries these devices employ, smartphones, laptops, and power tools among them, is pivotal.

In the industrial metals industry, cobalt is used in manufacturing high-strength alloys employed in aerospace, automotive, and power generation. Metal and chemicals industry uses cobalt metal for catalysts, refining and chemical processes. Finally, cobalt-containing superalloys are crucial for industries that rely on heat-resistant metals, including aerospace applications and gas turbines. The diverse end-use industries for cobalt highlight its key role in modern industrial applications.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

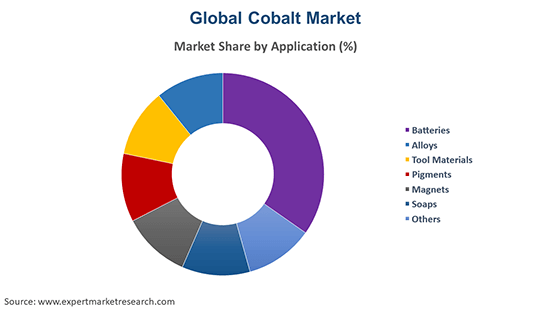

Due to its unique properties, cobalt is essential for diverse applications, making its demand source from numerous industries. Batteries accounted for the largest application segment, with lithium-ion batteries for electric vehicles (EVs) forming a key application area, along with consumer electronics and energy storage systems (ESSs) for renewables. The cobalt in those batteries makes them more efficient, gives them better energy density, and makes them last longer.

When alloyed, cobalt produces strong, heat-resistant materials that are used in aerospace, automotive and power generation industries. These alloys are key components used in engines, turbines and industrial equipment. Cobalt is also one of the key elements for tool materials, for its hardness, wear resistance, high-temperature strength, and anti-fatigue property, which are widely used in cutting tools, drills, and parts of machinery. Cobalt is a component in catalysts, used in refining, petrochemical processing, and the production of synthetic fuel. As pigments, cobalt forms bright blue and green colors in ceramics, glass, and paints.

There has also been an increase in demand for magnets, especially in electric motors and wind turbines, as cobalt-based magnets provide better performance. Finally, cobalt is used as a catalyst in soap production.

An increase in demand for electric vehicles (EVs), and renewable energy storage solutions are driving the North American cobalt market. With the ongoing trend of sustainability and rising emphasis on this agenda continues, cobalt becomes a valuable resource. North American companies have been leaning towards supplying cobalt to increase their market shares and also by considering the ethical ground.

Cobalt demand has exploded in the U.S., led by the innovation of EV tech and the transition to renewable energy. As a result, companies are doubling down on investment in supply chains security, driving new technologies in cobalt extraction, and exploration in recycling solutions to reduce foreign dependency.

The demand for cobalt in Asia Pacific is largely driven by the accelerating production of battery electric vehicles and energy storage systems. China and South Korea are among the largest consumers of cobalt, which is now a staple of lithium-ion batteries, and a number of countries are seeking new mining and recycling technologies.

The cobalt market is booming in India due to the increasing adoption of electric vehicles and renewable energy technologies. The growing local demand for such products is supported by plans introduced by the government to invest in cobalt-based batteries to help develop this industry in the country and to support ambitious goals related to the development of electric mobility.

Europe is also a major player in the cobalt market due to growing demand for electric vehicles (EVs) and storage solutions for renewable energy. The European Union is trying to reduce its dependence on foreign cobalt by supporting local mines and the recycling of cobalt in old batteries. This transformation mirrors the region’s commitment to sustainability and energy transition.

Germany accounts for a huge share of the cobalt market, influencing the market through its automotive industry, where major OEMs like Volkswagen and BMW lead the way in the EV tech investment space. Germany is also at the forefront of the battery recycling industry, which is necessary to ensure a cobalt supply chain that meets demand for electric vehicles and energy storage systems.

In terms of cobalt extraction from nickel deposits, Russia has fully developed and exploited its mineral resources. Though cobalt production in Russia is minimal in comparison to other parts of the world, its strong future investment into battery materials and mining technologies could set it up to become a player in the future global cobalt supply chain.

The growing demand for energy storage systems and electric vehicles is a primary driving factor for the Middle East and Africa cobalt market. Although cobalt mining in the region is still limited, countries like Brazil and Mexico are increasingly seeking to diversify their economies by investing in the cobalt supply chain and exploring sustainable mining and recycling opportunities.

South Korea cobalt market is considered one of the most important countries for cobalt, largely due to its hydraulic battery manufacturing industry. The region’s demand for cobalt remains strong as it feeds the production of lithium-ion batteries for electric vehicles and consumer electronics. South Korea is also increasing its attention toward recycling and alternative sources of cobalt to provide a steady flow to its tech industries.

The report gives a detailed analysis of the following key players in the global cobalt market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

Glencore is one of the world's largest diversified natural resource companies, and a major player in the cobalt market. The business is involved in mining, refining, and marketing for various metals, cobalt included. Glencore boasts some of the richest cobalt reserves in the world. The role of the company is critical in ensuring consistent availability of cobalt, the key metal used in electric vehicle batteries and renewable energy storage.

Vale S.A. is a multinational mining company and one of the largest players in the cobalt supply chain. Although Vale is primarily known for its iron ore production, the company also produces cobalt, through its nickel-rich operations in countries like Canada and Indonesia. The company’s production of nickel and cobalt is vital for satisfying the growing demand for the elements that make up batteries for electric vehicles. Vale is investing in this area and working on clean energy initiatives, supporting the goal of sustainability all over the world.

Missouri Cobalt, LLC specializes in the extraction and production of cobalt in North America. While cobalt is increasingly in demand for electric vehicle batteries, the company aims to be a reliable and responsible source of the metal. The company plans to help bolster the local supply chain, reduce reliance on imports of cobalt from abroad and position the region as a global player.

CMOC International has established itself as a major player in the cobalt sector. CMOC runs massive mining operations in the Democratic Republic of Congo, home to some of the world’s largest cobalt reserves. The company’s production of cobalt is critical for the battery and electronics industries. CMOC is focused on expanding its cobalt production responsibly to increase the sustainability of its operations and make it in line with electric vehicle battery demand.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

The study on the cobalt market delivers detailed analysis on region-level perspective depending on specific contemporary industry trends. It considers various segments, such as product, end use, and application. By assessing all these segments, this report presents a thorough discussion of market drivers, regulations, and emerging opportunities observed in the market.

Application Outlook (Revenue, KMT, 2026-2035)

Product Outlook (Revenue, KMT, 2026-2035)

End-Use Outlook (Revenue, KMT, 2026-2035)

Region Outlook (Revenue, KMT, 2026-2035)

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global cobalt market attained a volume of almost 217.91 KMT.

The market is projected to grow at a CAGR of 8.90% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of almost 511.16 KMT by 2035.

The major drivers of the industry, such as rising disposable incomes, increasing population, increased demand for new energy vehicle-use batteries, rising demand from the developing regions, and rising demand for the metal, are expected to aid the market growth.

The key trend guiding the growth of the market is the emergence of electric vehicles.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Batteries, alloys, tool materials, catalysts, pigments, magnets, and soaps, among others, are the major application segments of cobalt in the industry.

The major players in the industry are Glencore plc, Vale S.A., Umicore, Missouri Cobalt, LLC, CMOC International, Eurasian Resources Group, Freeport-McMoRan, Umicore, Sumitomo Metal Mining Co., Ltd., Norilsk Nickel, Huayou Cobalt, and Jinchuan Group, among others.

Cobalt sulfate dominated the market with the largest share.

The market report covers the forecast period from 2026 to 2035.

The Democratic Republic of Congo dominates the global cobalt market share.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Product |

|

| Breakup by End-Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share