Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global commercial printing market size was valued at USD 797.02 Billion in 2025. The integration of AI-powered workflow automation tools across mid-size print houses is significantly boosting efficiency in customised packaging and corporate collateral print jobs. As a result, the market is expected to grow at a CAGR of 2.20% during the forecast period of 2026-2035 to reach a value of USD 990.78 Billion by 2035.

Personalized, short-run packaging and labels are a significant driver of the commercial printing market, fuelled by brands’ need to engage customers with unique, tailored experiences. Industries like food, beverage, and cosmetics increasingly use digital printing to create region-specific, seasonal, or limited-edition designs. For example, Coca-Cola’s “Share a Coke” campaign featured individual names on bottles, boosting sales and showcasing the power of personalized printing. This demand is especially strong among small and medium enterprises, which benefit from affordable, flexible print runs without holding excess inventory. The rise of e-commerce and direct-to-consumer brands further accelerates this trend, as companies seek customized boxes, inserts, and promotional materials to stand out in competitive online and offline markets.

Notably, sustainable printing initiatives are gaining ground in the commercial printing industry. The EU’s “Green Deal” mandates eco-labelling and traceability in printed packaging, compelling commercial printers to adapt to water-based and biodegradable inks. Meanwhile, North America is seeing a resurgence in localised printing networks, owing to supply chain volatility during various global crises.

Moreover, with rising digitisation, India’s commercial printing market faces reduced demand for traditional print materials as corporates increasingly adopt e-annual reports, digital vouchers, and online catalogues, especially in the BFSI and retail sectors, accelerating the shift toward digital communication channels. However, to counter the effect of the digitisation of commercial printing, service providers are including value-added services, such as data management, consulting, and e-publishing, to retain their clients and to increase the commercial printing market growth.

Base Year

Historical Period

Forecast Period

In 2023, the commercial printing industry generated USD 414 billion in revenue.

Packaging printing contributed USD 186 billion, while office printing brought in USD 221 billion.

In the United States, 90% of businesses have adopted sustainability measures, such as using recycled packaging materials.

The top 50 companies in the market hold around 30% of the share, pushing the growth of the commercial printing market.

Over 60% of businesses dealing with commercial printers have invested in new technologies.

Additionally, approximately 675 million printed books were sold in the U.S. in 2020.

Compound Annual Growth Rate

2.2%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Print advertising is one of the most effective promotional tactics that is driving the industry growth. Print advertising is part of a comprehensive marketing strategy utilised by retail companies that understand their target customers. In 2024, print advertising continues to demonstrate significant effectiveness and trustworthiness among consumers. As per the commercial printing market analysis, 82% of consumers trust print ads when making purchase decisions, surpassing trust levels for digital advertisements. Additionally, print ads boast a 77% brand recall rate, compared to 46% for digital-only brands, highlighting their enduring impact on consumer memory. Print-based advertising is becoming increasingly popular due to its potential for long-term impact on a variety of food and retail businesses.

The recent growth in e-commerce has resulted in lucrative commercial printing market opportunities. As web store purchases keep on increasing, businesses are in search of creative packaging for enhanced customer experience. Companies like Amazon and Shopify consider customised and branded packaging as a means of better representation of their products and development of brand identity. Additionally, subscription boxes continue to fuel demand for special-package solutions alongside direct-to-consumer brands. Hence, printing companies can cash in by offering flexible, high-quality, sustainable packaging options.

Workflow management solutions automate many aspects of commercial print shop operations, boosting the commercial printing market dynamics. Automating repetitive tasks helps speed up turnaround times and profit by decreasing labour costs while maintaining quality. Most printers now use software for the entire workflow, from job scheduling to colour management, allowing customers to turn jobs faster, minimise errors, and enhance the printed outcome. For instance, Kodak's PRINERGY system has over 6,000 installations worldwide, indicating how workflows and automation have become common tools.

Rising demand for hyper-personalisation is fuelling the demand in the commercial printing market. Amazon’s KDP division reported a 12% growth in on-demand book printing in 2023. SMBs now prefer small-batch, localised printing runs to maintain agility. For instance, United States-based company Printify saw its short-run commercial printing orders increase to a considerable extent in 2024. This trend supports reduced inventory and quicker turnaround for retail campaigns and product packaging.

Sustainability has been a key focus area of most of the companies. EU’s Packaging and Packaging Waste Regulation (PPWR) mandates recyclable materials in commercial printing outputs by 2030. This regulatory push fuels innovations like algae-based ink and waterless offset printing, pioneered by firms like Toray Industries. Printers shifting toward cradle-to-cradle (C2C) certification are gaining traction, particularly in eco-conscious regions like Scandinavia and California.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Commercial Printing Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

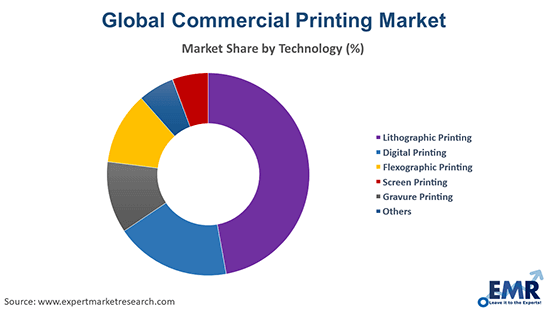

Market Breakup by Printing Technology Type

Key Insight: Due to their resistance and strength, which are particularly suitable for heavy-duty applications, Inkjet is gaining attraction due to its versatility and economical nature. With advancement in inkjet technology, high-resolution and full-colour printing was made possible at competitive speeds with low costs. Companies such as HP and Epson have developed inkjet printers for customised packaging and labels that brands like Coca-Cola and Unilever use for various vibrant and personalised labels efficiently. This flexibility supports targeted marketing strategies and short-run production.

Market Breakup by Application

Key Insight: Due to the growing demand for packaging printing applications, especially in the food and beverage and personal care and cosmetics industries, as well as the growing need for sustainable packaging, the packaging industry is considerably accelerating the commercial printing market growth. The application category is further driven by global shifts in consumer behaviour and retail formats. Smart packaging, featuring printed sensors and QR codes, is gaining momentum, especially in the pharmaceutical and food and beverage sectors.

Market Breakup by Region

Key Insight: The Asia Pacific commercial printing market value is growth rapidly, driven by rising e-commerce activities and associated packaging needs. Companies like Qingdao Haixiang Printing use modern flexographic presses. Further development involves the integration of AI for quality control and process optimisation in print manufacturing, augmenting the market growth. The region also witnesses high adoption of digital printing which is used to cater for diverse and rapidly growing market demands on high-volume, short-run jobs.

By Print Technology, Inkjet Printing Accounts for the Major Share of the Market

The dominance of the inkjet printing is sustained by the technology’s appeal in personalisation, reduced setup times, and compatibility with diverse substrates. For instance, Canon’s ProStream series allows for high-speed inkjet on offset-coated media. Applications in textile, ceramics, and direct mail are rapidly expanding, accelerating demand for this particular printing technology. Japan’s METI supported inkjet-based digital textile printing clusters in Osaka further support this category’s growth.

As per commercial printing market report, offsets remain the popular choice for high-volume jobs as they can efficiently and economically generate identical prints with high quality. Heidelberg’s Speedmaster CX 104 series offers automation levels that reduce wastage, catering to sustainability-conscious clients. Government-funded upgrades in Europe for carbon-efficient presses have further fuelled adoption.

By Application, Packaging Secures the Leading Position of the Market

The packaging application’s growth in the commercial printing market is fuelled by the e-commerce industry's booming demand for packaging and labelling, along with the need for creative packaging solutions to set products apart from one another. Digital embellishment and variable data printing have become game-changers in personalised packaging. The United States FDA’s new food labelling guidelines mandate enhanced readability, which commercial printers are addressing via flexographic and offset technologies. Domino Printing’s launch of food-safe inks for corrugated board has also witnessed a rapid demand in the commercial printing market.

As per the industry analysis, the advertising category is anticipated to grow at a promising CAGR due to the growing need for advertising in all the industries. Print ads cover news, offer in-depth analysis, and distribute tangible promotions and news in large quantities. Digital and gravure print processes are typically employed for short-run advertising materials like brochures, flyers, posters, newspapers, and newsletters, which is also increasing the market size.

By Region, Asia Pacific Registers the Largest Share of the Market

The growth of the Asia Pacific market is propelled by the region’s manufacturing base and booming e-commerce sectors. China alone contributes the majority of the global commercial print volumes. India's SME-heavy print ecosystem is seeing a rapid digitisation push under the “Digital India” campaign. Japan’s focus on smart packaging technologies, including printed electronics and AR tags, is also setting benchmarks. Moreover, localised content demand in languages like Hindi, Tamil, and Bahasa fuels regional growth. Companies like Toppan and Dai Nippon are exporting advanced printing solutions globally, reinforcing the region’s dominance.

The North America commercial printing market is driven by technological innovation apart from customised packaging-related demand. Due to increasing demand for customised orders and variable data applications, companies in the United States are engaging themselves with digital printing. For example, high-quality, short-run jobs have been commonly carried out using HP's Indigo presses. New developments involve the emergence of hybrid printing technologies that merge digital and offset printing for better flexibility and efficiency.

Commercial printing market players are focusing on value-added services, sustainability, and digitization. Firms like HP, Ricoh, and Xerox are investing in AI-powered press management tools that monitor ink usage, predict faults, and optimise output quality. They are strengthening their margins by investing in the latest printing technologies, including digital and hybrid presses, which improve efficiency and lower their costs. Partnerships are also growing between tech startups and traditional print houses to integrate AR/VR into print experiences. Meanwhile, M&A activities are rapidly taking place. One key example includes RR Donnelley’s acquisition of a cloud-printing startup to extend its digital footprint in March 2024. Commercial printing companies are leveraging government incentives to enhance local manufacturing capacities and reduce logistics risks. Players who evolve from service providers to marketing partners, offering analytics, design, and print, are well-positioned to grow in this market.

Founded in 1967 and headquartered in Tennessee, United States, Acme Printing offers a diverse range of services including digital and offset graphic design, finishing, labels, wide format signs, banners, promotional items, digital media, rack cards, brochures, business cards, and flyers. Their comprehensive product portfolio caters to various printing needs.

Established in 1876 and based in Tokyo, Japan, Dai Nippon Printing provides an extensive range of products including textbooks, magazines, wrapping paper, and packaging options. As one of the oldest and largest printing companies in Japan, it offers a broad spectrum of print solutions across multiple industries.

Founded in 1965 and headquartered in Tokyo, Japan, Toppan Printing Co. Ltd specialises in packaging, décor materials, and electronics solutions. Their diverse product portfolio includes innovative printing technologies and materials, serving various industrial and consumer needs with a focus on quality and cutting-edge solutions.

Founded in 1965 and located in Montreal, Canada, Quebecor Inc operates a wide range of commercial printing plants and shops in over 15 countries. The company’s extensive product offerings include various printing services, leveraging its global presence to meet diverse client needs and expand its market reach.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other commercial printing companies are Transcontinental Inc., R.R. Donnelley & Sons Company, The Vomela Companies, RAKSUL INC., Elanders AB, and Quad/Graphics, Inc., among others.

Explore the latest trends shaping the global commercial printing market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customised consultation on commercial printing market trends 2026.

Germany Commercial Printing Market

France Commercial Printing Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the commercial printing market reached an approximate value of USD 797.02 Billion.

The market is projected to grow at a CAGR of 2.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 990.78 Billion by 2035.

Key strategies driving the market include investing in AI-led print management, forming digital integration partnerships, reskilling workforce for smart technology, localising operations, and targeting eco-conscious verticals.

The key challenges are rising raw material costs, tightening environmental norms, and digital alternatives eating into margins.

Major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The most widely used technology in commercial printing is offset printing, sometimes referred to as lithography printing. It is also the most economical choice for high-quality prints for bigger quantities.

The various technologies considered in the market report are offset lithographic, flexographic, inkjet, screen, and gravure, among others.

Packaging, advertising, and publishing are the significant applications of commercial printing.

Key players in the market are Acme Printing, Dai Nippon Printing, Toppan Printing Co. Ltd, Transcontinental Inc., R.R. Donnelley & Sons Company, Quebecor Inc, The Vomela Companies, RAKSUL INC., Elanders AB, and Quad/Graphics, Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share