Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global diaper market attained a value of nearly USD 93.40 Billion in 2025. The market is further expected to grow at a CAGR of 5.90% during the forecast period of 2026-2035 to reach a value of USD 165.69 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.9%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Diaper Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 93.40 |

| Market Size 2035 | USD Billion | 165.69 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.9% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 6.8% |

| CAGR 2026-2035 - Market by Country | India | 7.8% |

| CAGR 2026-2035 - Market by Country | China | 6.5% |

| CAGR 2026-2035 - Market by Product Type | Baby Diaper | 7.0% |

| CAGR 2026-2035 - Market by Distribution Channel | Online Stores | 10.0% |

| Market Share by Country 2025 | Italy | 2.5% |

A diaper refers to an underwear type, which requires the wearer not to use a toilet to urinate or defecate. It consists of synthetic materials or cloth. Cloth diapers comprise of multiple layers and are washable as well as recyclable, like hemp, cotton, and bamboo. On the other side, disposable slides would be discarded and composed of absorbent chemicals after use.

The inner lining of these paint strips is made of polypropylene, which prevents waste from being soiled by absorption or trapping of the exterior paint. The advances made in production technology have in recent years improved the design, biodegradability, and safety of cables, which has resulted in an enormous worldwide momentum.

In ancient times, methods of diapering varied greatly across different cultures. Materials like grass, moss, and linens were used as absorbent layers. With the industrial revolution and mass production of textiles, cloth diapers became more common. These were simply a square or rectangle of linen or cotton folded and placed around the baby's bottom. The first disposable diapers were developed by Marion Donovan after World War II. She used a shower curtain as the waterproof outer layer and combined it with absorbent inner layers.

The diaper market is continuously growing, with significant demand driven by the needs of infants and an ageing population in various countries. Some of the common innovations include improved absorbency materials, better-fit designs, and environmentally friendly manufacturing processes.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Diaper Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Based on product type, the baby diaper market can be segmented into the following:

Disposable diapers, known for their convenience and effectiveness, dominate the baby diaper market. Disposable diapers are a widely used type of diaper designed for single use, offering convenience and ease of use to caregivers. Disposable diapers are easy to use and dispose of, making them a convenient choice for busy parents and caregivers.

Their high absorbency rate reduces the risk of leaks and generally keeps the baby's skin drier for longer periods. There is a growing market for eco-friendly disposables, made with biodegradable materials and less harmful chemicals. Ongoing innovations focus on making diapers thinner, more absorbent, and more comfortable for babies.

On the basis of product type, the adult diaper market can be divided into:

Pad-type adult diapers, also known as incontinence pads or absorbent pads, are a specific category of adult incontinence products designed to manage urinary or faecal incontinence in adults. These pads are contoured to fit the body's shape and come in various sizes to accommodate different levels of incontinence and body types. Many pad-type adult diapers also come with adhesive strips on the underside, which help secure the pad to the underwear.

Pad-type adult diapers are often preferred by people leading active lifestyles due to their discreet nature, further contributing to the diaper market growth. They can be used with regular underwear, making them a flexible option for incontinence management.

Based on the distribution channel, the market can be divided into:

Supermarkets and hypermarkets are easily accessible for most consumers, making them a popular choice for regular diaper purchases. Their widespread presence in both urban and suburban areas ensures that diapers are readily available to a large segment of the population. They typically carry a wide range of diaper brands and types, including standard, eco-friendly, and speciality diapers, catering to diverse consumer needs and preferences.

Due to their large scale, supermarkets often offer competitive prices, including discounts and promotions, which can be a key factor for consumers when purchasing diapers. Additionally, new diaper products are often launched in supermarkets and hypermarkets, benefiting from high foot traffic and visibility.

On the basis of region, the adult diaper market can be divided into:

| CAGR 2026-2035 - Market by | Country |

| India | 7.8% |

| China | 6.5% |

| Canada | 5.6% |

| UK | 5.4% |

| Germany | 4.9% |

| USA | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 4.1% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

North America accounts for a significant portion of the global diaper market share, accounting for the majority of the market share. The market is significantly being supported by the rising demand in the Asia Pacific region, especially India. The advent of biodegradable diapers impacts the market further since they are environmentally friendly in nature as well as reduce environmental pollution.

In addition, increasing online sales, combined with rapid urbanisation, will also foster the market in the Asia Pacific region. In India, the market for diapers continues to grow due to its advantages including comfort, hygiene, and a reduced risk of harm to the skin. In addition, an increase in the awareness of personal hygiene, changes in lifestyles, and a dramatic increase in consumers' purchasing power in India have led to consumers moving from conventional clothes to diapers.

The occurrence of urinary incontinence has risen globally among the increasing population of adults and elderly, which has supported the global diaper market demand. In addition, high birth rates in developing nations, delaying children's toilet training, and the rising developments in baby products shopping online have helped to boost growth in the market.

Furthermore, the demand for biodegradable diapers made from environmentally friendly materials has increased significantly. This trend has led to diaper manufacturers producing goods using raw materials that degrade much faster than conventional clothing. In addition, the continued activities for research and development that are aimed at improving the quality of goods and the introduction of new technology into the production of diapers will further drive the market expansion. For example, the development of absorbing core technology to eliminate the fluff pulp has allowed thinner diapers to be manufactured.

The report gives a detailed analysis of the following key players in the global diaper market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global diaper market attained a value of nearly USD 93.40 Billion.

The market is projected to grow at a CAGR of 5.90% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 165.69 Billion by 2035.

The major drivers of the market are rising demands in the emerging economies, inflating disposable incomes, increasing population, and growing awareness of personal hygiene.

The key trends guiding the growth of the market include the continuing research and development activities and technological advancements.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Disposable diapers, training diapers, cloth diapers, swim pants, and biodegradable diapers are the major product types of baby diapers available in the market.

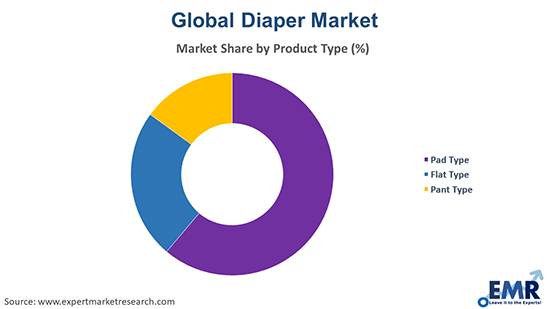

Pad, flat, and pant type are the major product types of adult diaper available in the market.

The significant distribution channels of the diapers are supermarkets and hypermarkets, pharmacies, convenience stores, and online stores, among others.

The key players in the global diaper market are Kao Corporation, Kimberly-Clark Corporation, Procter & Gamble Company, and Unicharm Corporation, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share