Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global erucic acid market reached a volume of 164.20 KMT in 2025 and is projected to expand at a CAGR of 4.40% through 2035. The market is further expected to achieve a volume of 252.57 KMT by 2035. Demand for erucic-acid-based slip agents in food-grade plastic film packaging is growing fast, as processors replace petroleum additives to meet regulatory pressure for safer, biodegradable contact-material ingredients.

Growing demand for high-purity, bio-based feedstocks in industrial lubricants is prompting erucic acid suppliers to pursue more specialized production strategies. In January 2024, Oleon NV completed construction of a new erucic acid derivatives production facility in Malaysia, adding 15,000 tons annual capacity, targeted at specialty lubricants and biodegradable metalworking fluids, built around an upgraded fractional distillation system that boosts purity more than its older process. The move demonstrates how the company is trying to secure long-term partnerships with aerospace and automotive lubricant formulators that are shifting toward bio-derived feedstocks, boosting the erucic acid market growth.

Instead of focusing only on rapeseed oil supply fluctuations, major producers appear more interested in controlling downstream performance applications such as high-load industrial greases, anti-wear additives, nylon-13 monomer production, and personal care emollients. An important trend in the erucic acid market is collaboration between seed developers. For example, in January 2023, Advanta and nurture.farm collaborated to launch Nutrifeed Germination Scheme. This scheme is a trailblazer and aims to protect dairy farmers from the germination failure of forage crops.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.4%

Value in KMT

2026-2035

*this image is indicative*

Government support for oilseed crops is becoming a growth engine for erucic acid suppliers. Under Canada’s Agricultural Partnership programs, rapeseed and canola growers receive funding for yield improvement, agronomy trials and sustainability projects, which indirectly secure feedstock for high-erucic processing plants. At the same time, EU Common Agricultural Policy reforms reward low-carbon crop rotations where Brassica species fit well. For example, Memphis expansion project by PMC Biogenix was designed to increase its capacity for erucic and behenic acids by approximately 50% as well as double its output for C-20 fatty acids, impacting the overall erucic acid market revenue.

The shift towards bio-based lubricants and metalworking fluids, where erucic acid acts as a key building block is another strong growth motivator. Research on high-erucic rapeseed oil highlight several launches of HEAR-based lubricant packages by companies such as Croda, ADM and Oleon, especially for gear oils, hydraulic fluids and food-grade conveyor lubricants. In January 2023, Renewable Lubricants launched Bio-E.P Wire Rope Lubricants, biodegradable vegetable oils formulated with anti-wear, extreme pressure (E.P.), anti-rust, and oxidation inhibitors. These erucic acid market trends align with regional green-industry programs that incentivize low-toxicity, biodegradable lubricants for factories and ports.

In flexible packaging, erucic-acid-derived erucamide remains a critical slip and anti-blocking agent for polyethylene and polypropylene films. Suppliers in China and Europe market erucamide grades tailored for food packaging, clothing bags and stretch films, typically dosed at about 0.05 to 0.2 percent to control friction and prevent film sticking. Technical notes from film-additive producers show how adjusting the erucic content helps tune migration rate and slip behavior over time, reshaping the erucic acid market dynamics. With regulators in North America and Asia tightening rules around migrant additives, film converters lean toward higher-purity, traceable erucic acid sources for long-term contracts more reliably.

Tighter food-safety regulation is indirectly helping the market expand. The European Food Safety Authority set a tolerable daily intake of 7 milligrams per kilogram of body weight, with even lower limits in infant formula. These regulations have compelled producers to segment low-erucic grades for edible uses and reserve high-erucic streams for technical applications, influencing the erucic acid market growth. Chemical companies responding with better analytics and purification trains now position erucic acid as a more controlled, premium industrial input for customers.

The shift towards sustainable sourcing of erucic acid, primarily from rapeseed oil, is a key growth engine. For example, Bunge Limited partners with European farmers to ensure sustainable rapeseed cultivation. This trend drives growth in the erucic acid market value by aligning with global environmental standards, particularly in Europe, where sustainability regulations are more stringent, encouraging eco-friendly production practices. The market notices an increasing number of buyers now request traceable farm-level documentation, reduced pesticide inputs, and certified supply contracts, pushing producers to adopt cleaner cultivation standards that satisfy ESG policies without compromising industrial performance reliability.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Erucic Acid Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Source

Key Insight: Across all the sources considered in the erucic acid market report, rapeseed oil anchors most of the demand because it brings predictable quality. Canola offers processors a way to balance edible and technical volumes without huge capital spending. Tame mustard find applications in more regional, specialized niche categories where agronomy specialists manage smaller growers closely. Fish-derived material usually appears only in legacy or highly customized applications, often where aroma control is critical. Other niche vegetable sources are evaluated mostly for resilience and sustainability.

Market Breakup by Grade

Key Insight: While high erucic grades carry the heaviest technical responsibility in demanding industrial systems and long-running film or lubricant operations and dominate the erucic acid industry, procurement teams evaluate them on performance, reliability and service support rather than only on list price. Low-erucic grades, on the other hand, become relevant when brand risk, regulatory pressure, or consumer perception tighten. They allow formulators to continue using erucic-based chemistry while meeting milder specification requirements and maintaining a safer positioning in the market.

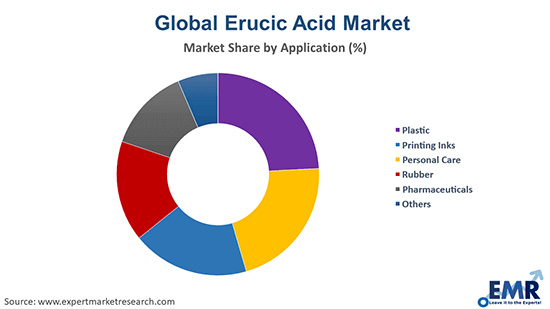

Market Breakup by Application

Key Insight: Plastics command the largest share of the erucic acid market because film producers demand erucamide and related agents for everyday processing operations. Printing ink formulators use erucic derivatives where flow and rub resistance need careful tuning without overhauling pigment systems. Personal care labs look for luxurious feel and deposition benefits that can differentiate their conditioners and creams. Rubber compounding uses erucic-based materials more selectively, mainly when specific mold-release or flexibility characteristics are required.

Market Breakup by Region

Key Insight: According to industry research, Europe holds the dominant share with integrated oilseed, oleochemical and downstream processing assets that treat erucic acid as a familiar feedstock. North America follows with a more concentrated but technically advanced customer base in lubricants, polymers and high-performance packaging categories. Asia Pacific brings the sharpest volume growth as contract manufacturers and regional brands test erucic-based solutions in films, surfactants and care products. Latin America is gathering momentum with erucic imports for specific industrial projects. The Middle East and Africa participate in driving the erucic acid market opportunities mainly through niche lubricants, coatings and trading activity, monitoring how global pricing and logistics patterns evolve over time.

By source, rapeseed oil dominates the erucic acid supply due to industrial-grade consistency

Rapeseed oil remains the primary source for erucic acid because producers know how to control agronomy, oil extraction and fractional distillation at scale. European crushers and Asian processors rely on high-erucic rapeseed contracts that lock in fatty acid profiles suited for lubricants, slip agents and specialty surfactants. This feedstock gives steady C22:1 content, which makes downstream formulation work easier and reduces reformulation risk for B2B customers. In December 2024, Sasol Chemicals launched a rapeseed-derived stearyl alcohol for the personal care industry, creating new streams of the erucic acid market revenue.

Canola represents the fastest-growing source for erucic acid as processors demand more flexible supply outside traditional high-erucic rapeseed belts. Seed developers seek canola hybrids that deliver moderate erucic levels with better agronomic performance. In February 2023, Corteva, Inc. announced plans for the commercial launch of Optimum GLY canola, which is an advanced herbicide-tolerant trait technology for canola farmers. For erucic suppliers, this indicates added opportunities on where to allocate output, either into food systems or industrial chains like lubricants, surfactants and nylon intermediates.

By product, high erucic product grades lead the market share through performance advantages

High erucic product grades dominate the market as they underpin most technical applications where performance matters the most, from slip agents to metalworking additives and reactive intermediates. Producers invest heavily in purification, odor control, and consistency for these grades. Customers in packaging, industrial fluids and polymer modification often qualify only a handful of high erucic suppliers and stick with them for years. This creates a stable, relationship-driven category.

Low erucic grades significantly contribute to the erucic acid market expansion because brand owners in food, pharma and personal care want the functional benefits of C22 chains without breaching regulatory comfort zones. These materials usually carry tighter specifications around contaminants and sensory profile, so producers depend more on better analytics and cleaner processing lines.

Plastic applications account for significant erucic acid consumption because of strong packaging demand

Plastic applications continue to dominate erucic acid demand because erucamide slip agents and related additives are critical for film and sheet specifications across the world. Converters depend on the way these molecules migrate to the surface and tune friction over time, something that is hard to replace without expensive trials. Producers work closely with packaging and industrial film manufacturers to adjust dosage, migration rates and compatibility with new resin blends or recycled content streams.

Personal care has become one of the fastest-growing applications, boosting the erucic acid market penetration as formulators want bio-based emollients and conditioning agents that still deliver a rich, long-lasting skin feel. Erucic-derived esters and quats appear in hair conditioners, skin creams and specialty balms, where they help with combability, softness and substantive deposition.

By region, Europe sustains its leading market position supported by integrated oilseed processing

Europe holds the dominant regional position in the erucic acid market because it combines long-standing rapeseed cultivation with a dense network of oleochemical, lubricant and packaging players. Crushers, refiners and specialty chemical producers operate in close proximity, which simplifies logistics and certificate management for B2B buyers. Many film converters, lubricant blenders and surfactant formulators in the region have erucic-based ingredients embedded directly into their internal material standards, reinforcing steady demand.

The erucic acid market in Asia Pacific is emerging as the fastest-growing industry, mainly because it hosts big packaging, textile and electronics manufacturing hubs that consume slip agents, lubricants and specialty surfactants in large volumes. Processors in China, India and Southeast Asia often look for flexible sourcing that can blend imported rapeseed-based material with regional oilseed production. Regional customers are usually price sensitive yet pragmatic as they value suppliers who can adjust pack sizes, credit terms and technical support.

Leading erucic acid market players now focus on product purity, sustainability traceability, and application-specific customization. Producers are investing in upgraded distillation trains, clean-label derivatives for personal care, and high-performance slip-agent grades for packaging films. Opportunities are strongest in high-erucic industrial lubricants, biodegradable metalworking fluids, and premium conditioning agents, where buyers seek dependable performance with audited supply chains.

Partnerships between seed developers, crushers, and chemical formulators are becoming common to secure predictable C22:1 profiles from cultivation to downstream processing. Erucic acid companies that align with sustainable farming programs, offer application-testing support to packaging and surfactant formulators, and guarantee multi-year supply contracts are positioned to win. Long-term competitive advantage is shifting from commodity pricing to technical expertise, raw-material control, and innovation focused on bio-based industrial chemistry.

Bunge Limited, established in 1818 and headquartered in the United States, focuses on integrating agricultural supply chains with specialty oleochemical products. The company caters to the erucic acid market through partnerships with European rapeseed growers and sustainability-verified sourcing programs, ensuring consistent high-erucic feedstock for industrial lubricants, personal care inputs, and slip-agent applications.

Perdue Farms, founded in 1920 and based in Maryland, United States, extends its agricultural capabilities to value-added oilseed processing that supplies erucic-rich derivatives for food-contact packaging and surface-enhancement applications. The company responds to market needs by developing regionally linked grower programs and offering contract manufacturing support for formulators that require tailored fatty acid profiles.

Vantage Specialty Chemicals, established in 2008 and headquartered in Illinois, United States, focuses on high-end surfactants, emollients, and conditioning agents for personal care and performance industrial markets. The firm leverages erucic-based esters and quats to deliver sensory-rich textures, durable deposition effects, and bio-based ingredients for beauty brands.

Acme Soap Works, founded in 1947 and headquartered in Mumbai, uses erucic-derived additives in specialty soaps, industrial detergents, and cleaning pastes designed for high-wear environments. The company caters to B2B customers by modifying surfactant systems with erucic chains to improve lubricity, residue control, and prolonged protection on metal and machinery surfaces.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Godrej Industries Limited, among others.

Unlock the latest insights with our erucic acid market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 4.40% between 2026 and 2035.

Firms are expanding application-testing labs, forming farmer supply partnerships, upgrading purification technology, co-developing products with packaging and personal care brands, and locking long-term contracts to stabilize margins and demand.

The key trends guiding the growth of the market include the rising implementation of regulations for the use of environmentally friendly additives for polymer production, lubricants, and metals.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading sources of erucic acid in the market are rapeseed oil, canola, tame mustard, and fish, among others.

The major grades of erucic acid in the industry are low and high.

The significant application segments in the market are plastic, printing inks, personal care, rubber, and pharmaceuticals, among others.

The key players in the market include Bunge Limited, Perdue Farms Inc., Vantage Specialty Chemicals, Acme Soap Works, and Godrej Industries Limited, among others.

In 2025, the market reached an approximate volume of 164.20 KMT.

Companies face unpredictable feedstock costs, stringent purity expectations from industrial buyers, complex sustainability compliance requirements, and the growing need to deliver application-specific grades rather than generic erucic acid offerings.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Source |

|

| Breakup by Grade |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share