Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The glass packaging market attained a value of USD 71.50 Billion in 2025. The market is expected to grow at a CAGR of 4.40% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 109.98 Billion.

Governments and regulatory bodies worldwide are enforcing strict rules to curb plastic pollution and promote sustainable packaging. These initiatives are encouraging industries to shift toward eco-friendly materials, such as glass. Bans on single-use plastics and recycling mandates are also significantly influencing packaging choices. In January 2024, Austria implemented an EU-mandated deposit-return system, requiring 10–15% of beverage containers, including glass to be reusable, with full deposit returns. This regulatory momentum is expected to remain a key driver for the market growth.

Premiumization particularly in alcoholic beverages, cosmetics, and gourmet foods is influencing the glass packaging market analysis. Consumers associate glass with quality, purity, and elegance, driving brands to choose it for high-end products. As disposable incomes rise, especially in emerging markets, customers are more inclined to spend on premium goods with upscale packaging. In June 2025, Croxsons unveiled an exclusive premium spirits bottle collection for offering elegant, high-quality glass packaging tailored for the United Kingdom market. This demand reinforces glass as a material of choice for companies aiming to create a premium and sophisticated brand image that stands out on retail shelves.

Base Year

Historical Period

Forecast Period

In 2018, 31.3% of glass food and beverage packaging containers were recycled in the U.S. In some states like California, glass bottle recycling reached over 80%.

As per industry reports, 4.6 million tonnes of container glass were sold in 2022, a 4.3% increase over the previous year. This has positively impacted the market.

Glass packaging is popular due to its safety, inertness, and 100% recyclability. Recycling glass saves on raw materials, energy use, and reduces greenhouse gas emissions by 25-30%.

In the pharmaceutical industry, glass is the material of choice for vials and bottles due to its strength, transparency and ability to undergo sterilisation.

Compound Annual Growth Rate

4.4%

Value in USD Billion

2026-2035

*this image is indicative*

The alcoholic beverage sector, especially beer, wine, and spirits, is fostering the glass packaging market development. Glass protects flavour integrity and offers an aesthetic advantage, making it ideal for branding. As per industry reports, the global wine consumption was estimated to reach 214.2 million hectolitres in 2024. With rising global alcohol consumption, particularly craft and artisanal varieties, the need for attractive, durable, and recyclable packaging grows. Moreover, cultural and social drinking trends in developing countries are also boosting demand.

With the growing environmental awareness, consumers and brands are increasingly favouring sustainable packaging solutions. Glass, being 100% recyclable without loss of quality, fits this need perfectly. This trend is driving companies to adopt glass packaging over plastics and metals. In April 2025, leading glass manufacturer in New Zealand Visy achieved a significant sustainability milestone by incorporating an average of 70% recycled glass into the production of its bottles and jars. Governments are also pushing eco-friendly alternatives through regulations and incentives.

Lightweight glass technology is transforming the glass packaging industry by reducing material usage and transportation costs while maintaining durability and visual appeal. Manufacturers are developing thinner and strong glass containers to offer the same performance but with a smaller environmental footprint. In September 2024, Diageo and Şişecam collaborated to craft the world’s lightest whisky glass bottle. These innovations are addressing sustainability goals by cutting energy use and CO₂ emissions during production and shipping.

Technological innovation in glass production, such as precision forming, automated inspection, and energy-efficient furnaces, is boosting productivity and product quality. In August 2022, Overview introduced its Snap Platform, using AI-powered cameras for real-time glass bottle inspection. Smart glass technologies and digital printing are also emerging, offering new customization possibilities. Such advancements make glass packaging more competitive and versatile across industries, from food and beverage to cosmetics and pharmaceuticals.

The glass packaging market revenue is growing with the surge in e-commerce and direct-to-consumer models. Glass packaging offers a premium unboxing experience and supports branding via customized designs and embossing. In June 2023, Sri Lankan PGP Glass Ceylon partnered with Heineken to introduce screen printed and returnable beer bottles in Asia Pacific Innovations in lightweight and shock-resistant glass are driving suitability for online retail. As e-commerce brands seek differentiation and eco-friendliness, glass provides a competitive edge by combining visual appeal, sustainability, and product protection during last-mile delivery.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Glass Packaging Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

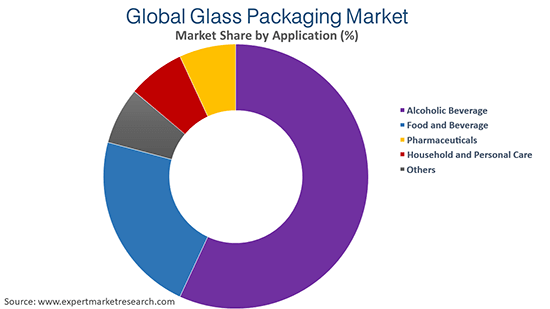

Market Breakup by Application

Key Insight: The alcoholic beverage segment is dominating the glass packaging market, driven by strong demand for beer, wine, and spirits globally. Glass is ideal for preserving flavor and quality, and its premium appearance aligns with brand positioning. Major players continue to prefer glass for its inertness and visual appeal. In December 2023, Diageo partnered with ecoSPIRITS to introduce reusable glass packaging for its spirits brands. As alcohol consumption increases in emerging markets and the popularity of artisanal and luxury drinks rises, this segment continues to lead the glass packaging demand.

Market Breakup by Glass Type

Key Insight: Soda lime glass is largely contributing to the glass packaging industry due to its cost-effectiveness and versatility. As per statistics, soda-lime glass is a prevalent types of commercially produced glass, recording 90% of all production in 2023. Commonly used for beverage bottles, food jars, and household containers, soda lime glass offers good chemical resistance and clarity. Brands extensively use soda lime glass for beer, soft drinks, and food packaging. Affordability and recyclability also make the segment a dominant choice, especially in high-volume markets where economic efficiency and environmental sustainability are key.

Market Breakup by Product

Key Insight: Bottles represents a leading segment in the glass packaging market, as it is widely used in alcoholic beverages, soft drinks, pharmaceuticals, and personal care to offer reusability, recyclability, and ability to preserve product integrity. In February 2025, Mineragua introduced a sleek 12 pack glass bottle set for its sparkling water line. Pharmaceutical firms also rely on glass bottles for liquid medications due to their inertness and chemical resistance. Glass bottles remain a preferred choice in premium packaging given their visual appeal and perceived quality, making them a staple in both mass and niche markets.

Market Breakup by Region

Key Insight: North America contributes to the glass packaging market, driven by high demand in the alcoholic beverage, pharmaceutical, and food sectors. The United States, in particular, is witnessing strong glass bottle usage due to rising demand for premium spirits, wine, and craft beer. As per industry reports, the total American wine consumption in 2023 touched 18,500 million liters. Sustainability concerns have led to major investments in recycling and refillable solutions. Additionally, the pharmaceutical industry's reliance on chemically stable containers has kept demand strong for glass vials and bottles, reinforcing North America’s position as the dominant market.

Higher Glass Packaging Adoption in Food and Beverage & Household and Personal Care

The food and non-alcoholic beverage segment is a major contributor to the glass packaging market. Glass is favoured for packaging sauces, jams, juices, and dairy products due to its chemical stability and transparency. Several brands are using glass to enhance product freshness and consumer trust. Health-conscious consumers prefer glass over plastic, particularly for organic and preservative-free foods. Additionally, glass containers are often reused or recycled at home, reinforcing sustainability credentials, making this segment resilient and steadily growing.

Household and personal care is boosting the glass packaging market expansion. Products like perfumes, essential oils, and high-end skincare are commonly packaged in glass to enhance luxury appeal and preserve formulation quality. Cosmetic brands use elegantly crafted glass containers to differentiate in a competitive market. In October 2024, Berlin Packaging introduced the Luxe Refill Collection, featuring new 50ml, 30ml, and 15ml luxury and refillable glass jars for various cosmetics formulations. Glass is further used in premium segments where aesthetics, brand identity, and product integrity outweigh cost and convenience factors.

Surging Preference for Borosilicate & De-Alkalized Soda Lime Glass Packaging

Borosilicate glass packaging market value is growing, with increasing pharmaceutical and laboratory applications to offer superior thermal and chemical resistance. Several brands use borosilicate for vials, ampoules, and high-quality cosmetic containers that require sterilization and chemical inertness. In March 2023, SCHOTT invested EUR 75 million to begin producing amber borosilicate tubing in Gujarat, India, improving regional supply of pharma-grade glass for light-sensitive drugs. Borosilicate’s performance in harsh conditions also secures its position in specialized markets in premium cosmetics, where safety and longevity are paramount.

De-alkalized soda lime glass is widely used for enhancing chemical resistance and suitability for sensitive products. This glass type offers a balance between cost and performance, bridging the gap between regular soda lime and borosilicate glass. De-alkalized soda lime glass packaging minimizes the risk of chemical interaction between the glass and its contents, making it ideal for sensitive products, such as pharmaceuticals, injectable solutions, and acidic formulations. Companies use de-alkalized glass for injectables and liquid medicines, as it reduces leaching risks while remaining more affordable than borosilicate options.

Glass Jars to Record Significant Usage

Glass jars are gaining traction in the glass packaging market as they are predominantly used in the food industry for packaging products, such as sauces, jams, baby food, and spreads. In May 2025, Valiant Packaging introduced a line of airtight flint glass jars with stylish lids for food storage. The wide-mouth design of jars allows for easy access and resealing, which adds to consumer convenience. In recent years, cosmetic and skincare brands have also adopted glass jars for creams and balms, emphasizing luxury and sustainability.

Surging Glass Packaging Demand in Europe & Asia Pacific

Europe is a major player in the glass packaging market owing to mature recycling infrastructure and strong environmental policies that favour reusable and recyclable packaging. Germany, France, and Italy lead in glass container usage for beverages, cosmetics, and pharmaceuticals. Companies, such as Verallia and Bormioli Luigi continue to launch lightweight and eco-friendly glass packaging solutions. High consumer preference for sustainable packaging and regulatory pressure to reduce plastic usage is further making Europe a robust and innovative market for glass packaging.

Asia Pacific glass packaging industry value is driven by rising urbanization, population growth, and increasing disposable incomes. China and India are seeing rising demand for glass containers in pharmaceuticals, cosmetics, and food and beverage sectors. In April 2025, AGI Greenpac invested ₹700 crore to build a new container glass factory in Madhya Pradesh, India to produce glass bottles and jars for alcoholic beverages and cosmetics. The expansion of local manufacturing, growing environmental awareness, and increased use of premium packaging are rapidly elevating Asia Pacific’s role in the global glass packaging landscape.

Key players in the glass packaging market are adopting a range of strategies to strengthen their market position and respond to evolving consumer and regulatory demands. With sustainability, companies are investing in recyclable and lightweight glass to reduce environmental impact and carbon footprint. Many are integrating closed-loop recycling systems and using post-consumer recycled glass to enhance eco-efficiency. Product innovation is another major strategy, with firms developing durable, aesthetic, and customized packaging to attract premium segments, particularly in cosmetics, food, and beverages.

Companies are also leveraging smart glass technology and improved barrier properties to extend product shelf life. Geographical expansion through mergers, acquisitions, and partnerships is helping players tap into emerging markets where demand for eco-friendly packaging is rising. At the same time, investments in automation and advanced manufacturing processes are boosting productivity and reducing operational costs. Brand differentiation through design and labelling innovations, along with supply chain optimization, enables quicker market response. Overall, these strategies help to maintain competitiveness in the global glass packaging industry.

Founded in 1932 and headquartered in Luxembourg, Ardagh Group S.A. is a global leader in glass and metal packaging and operates over 60 facilities worldwide. The company is known for pioneering sustainable packaging solutions, including lightweight glass and 100% recyclable containers, supporting the circular economy and carbon reduction goals.

Established in 1975 and headquartered in Texas, the United States, Couronne Co., Inc. specializes in decorative glass packaging. The company is recognized for blending style with sustainability, offering recycled glass products for home décor and packaging. Couronne has built a niche through its eco-conscious designs and strong presence in the wholesale and retail markets.

Founded in 1914 and headquartered in Osaka, Japan, Nihon Yamamura Glass Co., Ltd. is a veteran in the glass container industry. Known for technological innovation, the company has developed high-performance glass bottles and vacuum glass solutions and supports Japan’s sustainability goals through energy-efficient production and recycling initiatives.

Koa Glass Co., Ltd., established in 1949 and based in Tokyo, Japan, focuses on producing high-quality glass containers, particularly for the pharmaceutical and cosmetics sectors. The company is known for its precision moulding technology, lightweight designs, and commitment to quality. Koa Glass continues to innovate with eco-friendly and custom packaging solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the glass packaging market are PGP Glass Private Limited, The Dow Chemical Company, O-I Glass, Inc, Toyo Seikan Group Holdings Ltd, Gerresheimer AG, HEINZ-GLAS GmbH & Co. KGaA, Wiegand-Glas Holding GmbH, and Verallia Packaging, among others.

Unlock key insights into the evolving glass packaging market trends 2026 and beyond. Download your free sample report today for data-driven forecasts, emerging opportunities, and strategic market intelligence. Stay ahead of competitors with expert analysis on growth drivers, challenges, and innovations in glass packaging across industries. Get your sample now!

Saudi Arabia Glass Packaging Market

United States Glass Packaging Market

Latin America Glass Packaging Market

Global Pharmaceutical Glass Packaging Market

Saudi Arabia Pharmaceutical Glass Packaging Market

North America Cosmetic and Perfume Glass Packaging Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 71.50 Billion.

The market is projected to grow at a CAGR of 4.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 109.98 Billion by 2035.

The key strategies driving the market include increasing demand for sustainable and recyclable materials, premiumization of products, growth in the beverage and cosmetics industries, innovations in lightweight and durable glass, regulatory support for eco-friendly packaging, and brand differentiation through aesthetic, transparent, and customizable glass designs.

Key trends aiding market expansion include the growth of branded generics, changing lifestyle of consumers, and rising alcohol consumption.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Alcoholic beverage, food and beverage, pharmaceuticals, and household and personal care, among others, are the major applications of glass packaging in the market.

Borosilicate glass, de-alkalized soda lime glass, and soda lime glass are the leading glass types in the market.

Bottles, and jars, among others, are the major products of glass packaging in the market.

The key players in the market report include Ardagh Group S.A., Couronne Co., Inc., Nihon Yamamura Glass Co. Ltd., Koa Glass Co., Ltd., PGP Glass Private Limited, The Dow Chemical Company, O-I Glass, Inc, Toyo Seikan Group Holdings Ltd, Gerresheimer AG, HEINZ-GLAS GmbH & Co. KGaA, Wiegand-Glas Holding GmbH, and Verallia Packaging, among others.

The alcoholic beverage segment is dominating the market, driven by strong demand for beer, wine, and spirits globally.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Glass Type |

|

| Breakup by Product |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share