Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India sports and fitness goods market attained a value of USD 5.24 Billion in 2025. The industry is expected to grow at a CAGR of 7.40% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 10.70 Billion.

India sports and fitness goods market is gaining strong momentum, supported by a surge in both public and private infrastructure investments. These developments are not only enhancing access to recreational spaces but are also shaping consumer behaviour by embedding fitness more deeply into daily life.

At the government level, initiatives to develop urban and semi-urban infrastructure have created new demand channels for fitness-related goods. There is a clear push to upgrade public parks, build modern stadiums, and establish community health and wellness centres. These projects aim to make fitness more accessible, especially in rapidly growing cities and tier-2 towns. For instance, in March 2025, the PM Palem stadium in Visakhapatnam underwent a ₹40 crore renovation to prepare it for upcoming IPL matches, a move that reflects broader efforts to create world-class sporting facilities.

Further, the growing disposable income among Indian consumers is driving investments in quality sports and fitness products, further adding to the India sports and fitness goods market expansion. According to industry reports, the per capita disposable income in India grew 8% in 2024. As the purchasing power of individuals increases, they are more willing to spend on health and wellness. Additionally, the rising health awareness is prompting consumers to prioritize fitness, further driving the market growth.

Base Year

Historical Period

Forecast Period

According to Indian sports and fitness goods market statistics, India exported sports equipment worth USD 546 million in the year 2021-22.

The retail market for sports and athleisure products in India is expected to reach INR 402 billion by 2025.

Global downloads of health and fitness apps increased by 46% between Q1 and Q2 2020.

Compound Annual Growth Rate

7.4%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The integration of digital technologies in fitness equipment is revolutionising the India sports and fitness goods industry. In December 2024, Hyderabad-based fitness as well as wellness startup Portl introduced Portl UltraGym, its new an all-in-one portable training system to increase the accessibility of strength training at home. Consumers are also increasingly inclined towards customised exercise routines and interactive feedback, leading to greater engagement and better outcomes.

The adoption of home fitness solutions is accelerating, with the higher sales of home fitness equipment. In January 2025, QNET India unveiled its advanced home gym equipment MyHomePlus HomeGym as a perfect solution for its customers to stay fit. The rapid urban lifestyle changes and the rise of work-from-home culture are also influencing individuals to establish personal gyms at home. Additionally, businesses are investing in corporate wellness initiatives to incorporate fitness for rendering employee benefits to enhance productivity and reduce absenteeism.

The rise of online platforms is transforming the way consumers are purchasing sports and fitness goods, adding to the India sports and fitness goods market revenue. E-commerce offers a wider range of products, convenience, and competitive pricing, making it a preferred channel for many consumers. This shift is driven by improved digital retail websites and enhanced logistics, facilitating easy access to quality products. The growing trend of online shopping is expected to continue propelling the market forward. According to industry reports, India gained 125 million online shoppers over the last three years and expects 80 million to join by 2025.

Consumers are becoming increasingly environmentally conscious, leading to a demand for sustainable as well as eco-friendly sports goods. Brands are responding by using recycled materials and reducing packaging waste, adopting less impactful production methods. This trend is reflecting a broader shift towards sustainability in the sports goods industry. In January 2025, leading sports equipment manufacturer, via its flagship brand Marino Meerut Gym and Gymnastic Works, launched its new range of eco-friendly fitness equipment.

The increasing focus on women's sports is fuelling the greater demand for sports goods tailored to female athletes. Brands are coming up with women-specific products, particularly in footwear, apparel, and equipment categories, to cater to this growing segment. This trend reflects a broader shift towards inclusivity and representation in the sports goods industry. In July 2024, Campus Activewear unveiled its 'You Go Girl' campaign for launching its newest women's sneaker collection.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India Sports and Fitness Goods Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

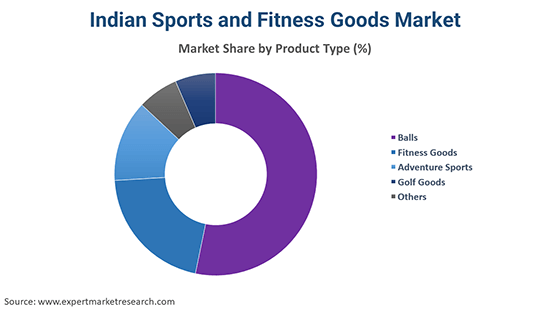

Breakup by Product Type

Key Insight: The balls segment forms a foundational category in the India sports and fitness goods market, covering products, such as cricket balls, footballs, basketballs, and more. Cricket remains the primary driver, with several manufacturers dominating production. With India’s large youth population and growing grassroots sports initiatives, demand remains high across school, club, and professional levels. Football is also rising in popularity, supported by the rise in leagues. In May 2025, the footballing landscape of Maharashtra witnessed significant transformation through the imminent launch of Maharashtra State Men’s Football League. As sports participation expands in both urban and rural areas, the balls segment continues to be a reliable and growing product category.

Breakup by Fitness Goods

Key Insight: Cardiovascular training goods have grown essential in the India sports and fitness goods market for improving heart health, stamina, and overall fitness. The demand is surging due to the surging knowledge of lifestyle diseases and the popularity of at-home workouts. As per industry reports, almost 44 crore Indians are likely to be obese by 2050. Urban consumers are particularly drawn to compact, tech-integrated machines that support app-based fitness routines. Both commercial gyms and individual users are investing in these machines to support fat-burning, endurance training, and weight management goals.

Breakup by Cardiovascular Training Goods

Key Insight: Treadmills remain the most popular cardiovascular training equipment in India due to their accessibility and effectiveness. Widely used in gyms, homes, and rehabilitation centres, they cater to all fitness levels. Advanced features, such as foldable designs, smart screens, and heart rate monitoring are making them user-friendly. In September 2022, D2C fitness brand Flexnest launched Flexpad, India’s first smart connected walking pad. With increasing concerns about sedentary lifestyles and cardiovascular health, treadmills are a staple in urban fitness routines, appealing especially to working professionals and ageing populations seeking indoor, weather-proof cardio solutions.

Breakup by End Use

Key Insight: Home consumers have emerged as a dominant end-user segment of the India sports and fitness goods market. With convenience and hygiene as top priorities, many urban Indians are setting up personal gyms. In February 2024, four IIT-Delhi graduates developed Aroleap X, a smart, patented, and wall-mounted home gym equipment offering 100 hours of fitness content with higher suitability for apartments. Compact, multi-functional, and smart-connected fitness products, such as foldable treadmills, exercise bikes, and resistance kits are growing increasingly popular. Influencer-led fitness challenges, app-based guided workouts, and wearables are also accelerating the home fitness trend.

Breakup by Region

Key Insight: North India holds a prominent place within the India sports and fitness goods market, driven by both manufacturing and consumption. States, such as Punjab and Uttar Pradesh are well-known hubs for sports goods manufacturing. These areas produce a vast range of products including cricket gear, fitness accessories, and balls, contributing significantly to domestic demand and exports. Additionally, the region is witnessing a rise in urban fitness culture, supported by gyms, fitness centres, and government-led initiatives promoting active lifestyles. In October 2024, the government of Delhi commenced the process of establishing automated fitness centres at 5 different locations in the city.

Increased Adoption in Fitness Goods and Adventure Sports

Fitness goods is witnessing an exponential growth in the India sports and fitness goods market, fuelled by a nationwide health and wellness wave. Brands, such as Decathlon, FITTYFY, and Cultgear are offering affordable and premium ranges for home users and gyms. Urbanisation, rising health consciousness, and increased disposable incomes have led to more investments in personal fitness setups. Moreover, influencer-led fitness trends and government fitness initiatives, including Fit India Movement are accelerating the market growth.

Adventure sports equipment is gaining traction in India, aligned with rising interest in trekking, rock climbing, mountain biking, kayaking, and skiing. As per the India sports and fitness goods market analysis, in December 2023, Nepal granted 466 climbing permits, inclusive of 40 Indians. With regions, such as Himachal Pradesh, Uttarakhand, and the Western Ghats becoming adventure tourism hubs, the market for safety gear, climbing tools, and all-weather outdoor wear is expanding. The surge in government support for tourism and private sector participation in organising adventure events have also spurred this demand.

Strength Training Goods to Gain Traction to Enhance Body Strength

The demand for strength training goods is gaining ground in the India sports and fitness goods industry as they focus on building muscle, improving posture, and enhancing overall body strength. As more Indians embrace holistic fitness, demand for these goods is growing across gyms, homes, and rehabilitation centres. The rise of bodybuilding, CrossFit, and functional fitness is further driving the interest in this segment. In February 2025, global gym franchise Crunch Fitness marked its entry in India via a Master Franchise Agreement.

Surging Adoption in Stationary Bikes and Ellipticals in India

Stationary bikes are growing in popularity due to their low-impact nature and suitability for all age groups as they are ideal for cardiovascular endurance, fat burning, and joint-friendly workouts. In November 2024, connected fitness leader Speediance introduced its new VeloNix stationary bike. Urban consumers are increasingly preferring upright, recumbent, and air bikes for home use, driven by affordability and space efficiency. Brands provide a variety of models with Bluetooth connectivity, calorie tracking, and virtual cycling programs. The rise of digital fitness platforms and spin classes has also made stationary biking a trendy, accessible option across the country.

Elliptical trainers offer a smooth, low-impact alternative to treadmills, making them ideal for seniors and people recovering from injuries as they engage both upper and lower body muscles, improving overall cardiovascular fitness. Popular in both commercial gyms and home setups, ellipticals are favoured for their joint-friendly design. Indian and global brands are offering models with features such as magnetic resistance, heart rate monitors, and Bluetooth integration. With growing awareness around sustainable fitness, ellipticals are gaining ground, particularly among women and middle-aged users.

Health Clubs and Gyms & Hotels and Corporate Offices to Witness Higher Presence

Health clubs and gyms are the largest institutional buyers of sports and fitness equipment in India. With growing memberships and premiumisation of services, these facilities are investing heavily in cardiovascular, strength, and functional training equipment. Franchised gym chains are expanding into Tier II and III cities, driving market penetration. In May 2025, Global fitness brand easyGym opened its first outlet in Delhi. With a ₹250 crore investment, the company plans of establishing 100 gyms in India through the next five years. Additionally, boutique fitness centres are focusing on HIIT, Pilates, and CrossFit, further contributing to specialised equipment demand.

Hotels and corporate offices have grown popular in the India sports and fitness goods market for integrating fitness zones as part of wellness initiatives for employees and guests. Business-class hotels are upgrading gyms with high-quality treadmills, ellipticals, and strength stations to enhance guest satisfaction. Corporates are installing compact gyms and wellness corners to boost employee productivity and morale. The shift towards holistic employee well-being has made fitness equipment procurement a strategic priority in office infrastructure.

South India and West and Central India to Record Significant Demand

South India is emerging as a dynamic region in the India sports and fitness goods market due to its robust fitness culture and tech-savvy population. Cities, such as Bengaluru, Chennai, and Hyderabad are witnessing increased demand for home and commercial fitness equipment, yoga accessories, and smart wearables. The popularity of running, cycling, and marathon events has also surged in the region, encouraging the adoption of fitness gear. As per the India sports and fitness goods market analysis, in April 2025, more than 35,000 participated in the TCS World 10K Bengaluru marathon.

West and Central India, especially Maharashtra and Madhya Pradesh, are experiencing rapid growth in the sports and fitness goods sector. Mumbai and Pune are largely driving the demand for high-end fitness equipment, adventure sports gear, and wearable technology. The region’s corporate culture supports wellness initiatives, while expanding residential developments include in-built gym and sports facilities. In Central India, cities, such as Indore and Bhopal are embracing fitness through organized clubs and increasing gym memberships.

Key players in the India sports and fitness goods market are adopting a range of strategic approaches to capture the growing consumer demand, driven by rising health awareness, fitness culture, and youth engagement in sports. Product innovation and customization is encouraging brands to introduce advanced, ergonomic, and sport-specific equipment to cater to both professionals and amateurs. Companies, such as Cosco and Nivia are expanding their product lines for including eco-friendly and technologically enhanced gear. Collaborations with athletes, fitness influencers, and sports leagues is helping to increase visibility and credibility. E-commerce expansion is crucial, with players investing heavily in online retail through platforms, such as Amazon, Flipkart, and their own websites to reach wider audiences. Many brands are also entering tier II and III cities, offering affordable fitness goods to tap into emerging markets. Additionally, companies are focusing on local manufacturing to reduce costs and align with the Make in India initiative, ensuring price competitiveness and supply chain efficiency. Combined, these strategies are shaping a dynamic and fast-growing sports and fitness goods ecosystem in India.

Founded in 1980 and headquartered in Delhi, Cosco (India) Limited is a leading manufacturer of sports and fitness equipment. The company offers a wide range of products, including basketballs, footballs, volleyballs, handballs, cricket gear, tennis rackets, table tennis equipment, and fitness accessories.

Founded in 1957, Bhalla International operates under the brand name Vinex and is based in Meerut, India. The company produces fitness products, including track and field equipment, agility training tools, boxing gear, and playground equipment. Vinex is also known for its extensive product range and has received multiple certifications, including over 100 World Athletics certifications.

Founded in 1969, Sareen Sports Industries, headquartered in Meerut, is an Indian manufacturer of cricket equipment and apparel, including bats, balls, protective gear, and clothing. Sareen Sports is renowned for its SS Sunridges line of bats used by several international cricketers.

Founded in 1931, Sanspareils Greenland is headquartered in Meerut, India. The company specializes in manufacturing cricket equipment, including bats, balls, gloves, and protective gear. SG is also recognized for its high-quality products and has been a preferred choice for many professional cricketers worldwide.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the India sports and fitness goods market are Nivia Sports Private Limited (Freewill Sports Pvt. Ltd.) and others.

Stay ahead in the evolving fitness landscape—download a free sample of our India Sports and Fitness Goods Market Report 2026. Discover emerging trends, product innovations, and regional insights driving market growth. Explore the latest updates on India sports goods trends 2026 and position your business for success with expert-backed data and forecasts.

Middle East and Africa Sports and Outdoor Toys Market

Southeast Asia Sports and Outdoor Toys Market

Singapore Sports and Fitness Goods Market

United States Sports Nutrition Market

North America Sports Nutrition Market

United States Sports Tourism Market

Europe Sports Nutrition Market

Paraguay Sportswear Market

Colombia Sportswear Market

Mexico Sportswear Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 5.24 Billion.

The market is projected to grow at a CAGR of 7.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 10.70 Billion by 2035.

The key strategies boosting the market include the focus on women fitness, rising urbanisation, and expanding ecommerce.

Key trends aiding Indian sports and fitness goods market expansion include the advancements in manufacturing technologies to develop products like smart tennis racquets and others, an increase in the number of gyms and fitness centres and growing influence of social media on potential customers.

The major regions in the market are West and Central India, North India, South India, and East India.

In the sports and fitness goods market, product types include balls, fitness goods, adventure sports equipment, golf goods, and more.

Fitness goods available in the market encompass cardiovascular training goods and strength training goods.

The market offers a range of cardiovascular training goods such as treadmills, stationary bikes, rowing machines, and ellipticals.

The major end-use segments for sports and fitness goods include health clubs/gyms, home consumers, hotels and corporate offices, hospitals, medical centres, and public institutions.

The key players in the market report include Cosco (India) Limited, Nivia Sports Private Limited (Freewill Sports Pvt. Ltd.), Bhalla International – Vinex Sports, Sanspareils Greenland Private Limited (SG), Sareen Sports Industries and Sansparelis Greenland Private Limited.

Home consumers is a dominant end-user segment of the market due to their convenience and hygiene.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Fitness Goods |

|

| Breakup by Cardiovascular Training Goods |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share