Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The industrial gases market attained a value of USD 104.20 Billion in 2025. The market is expected to grow at a CAGR of 6.80% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 201.18 Billion.

Green hydrogen and the broader energy transition are transforming the industrial gases market dynamics. Green hydrogen offers a zero-carbon fuel alternative critical for decarbonizing heavy industries, power generation, and transportation. As countries commit to net-zero goals, demand for green hydrogen surges, pushing gas producers to invest in electrolysers, large-scale hydrogen production, and distribution infrastructure. In March 2024, Egypt targeted USD 40 billion in green hydrogen investments via multiple MoUs, positioning itself as a renewable energy hub. This shift accelerates innovation in low-carbon gas technologies, including blue hydrogen (from natural gas with carbon capture) and green ammonia.

Gas producers are adopting smart sensor-driven systems, real-time consumption tracking, predictive maintenance, and remote control to optimize operations and safety. Predictive maintenance uses data analytics to foresee equipment issues before failures occur, minimizing downtime. Remote control capabilities allow operators to manage processes safely from afar, enhancing response times and reducing risks. In January 2025, InflowControl launched the Gas AICV®, the world’s first autonomous inflow control valve designed exclusively for gas reservoirs.

This digital transformation supports sustainability goals and meets growing demand for reliable, safe gas delivery.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.8%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Industrial Gases Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 104.20 |

| Market Size 2035 | USD Billion | 201.18 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.80% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 7.8% |

| CAGR 2026-2035 - Market by Country | India | 9.0% |

| CAGR 2026-2035 - Market by Country | China | 7.5% |

| CAGR 2026-2035 - Market by Type | Hydrogen | 8.8% |

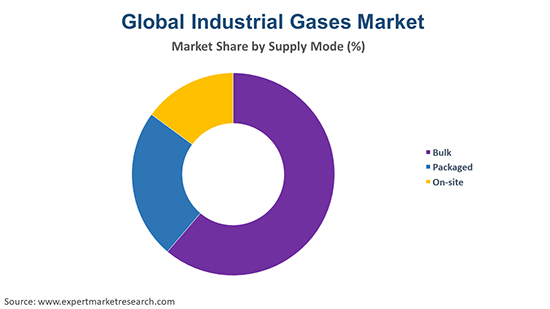

| CAGR 2026-2035 - Market by Supply Mode | On-Site | 7.6% |

| Market Share by Country 2025 | UK | 3.5% |

The surge in global manufacturing, especially automotive, electronics, and aerospace, is boosting the industrial gases market revenue. This can be attributed to the surging need to cater to cutting, welding, and steelmaking applications. In October 2024, Linde India launched a 250 TPD air separation unit in Ludhiana, India for supplying oxygen, nitrogen, and argon to nearby automotive plants via pipeline. Advanced fabrication techniques and rising output in Asia and North America have also led companies to scale up supply capacity.

The appetite of the semiconductor industry for ultra-high purity gases is growing rapidly as tiny impurities can cause defects in microchips. According to the Semiconductor Industry Association (SIA), the global semiconductor sales hit USD 57 billion during April 2025. As chips become smaller and more complex, the demand for gases with extremely low contamination levels is increasing sharply to ensure high-quality, reliable semiconductor manufacturing. This drives rapid growth in the need for ultra-high purity gases.

Advancements, such as cryogenic distillation, PSA, membrane separation, and smart digital are fostering the industrial gases industry value for improving purity, energy efficiency, reliability, and safety. In December 2024, Toray Industries constructed a pilot plant in Japan for its proprietary all-carbon CO₂ separation membrane. The plant aims to develop mass production techniques and is expected to start operations in 2026. These advancements add significant value by making industrial gas production cleaner, safer, and more cost-effective.

Some nuclear energy facilities are exploring using surplus electricity and heat to produce hydrogen and oxygen for offering low-carbon and round-the-clock industrial gas supply. In March 2023, Constellation Energy commenced hydrogen production at its Oswego plant in New York. This facility employs a low-temperature electrolysis system powered by nuclear energy to produce hydrogen, marking the first nuclear-powered clean hydrogen production facility in the United States. Such approaches help to integrate clean energy production with industrial gas supply, advancing a more sustainable and low-carbon energy future.

Strict regulations, carbon ceilings, HFC restrictions, and green energy goals, are pushing industrial gas industry players toward low-carbon solutions in hydrogen, oxygen, and carbon dioxide sectors. In October 2023, Air Liquide invested EUR 140 million to launch a low-carbon gas platform in Québec, Canada, for producing hydrogen, oxygen, nitrogen, and argon. Governments and international bodies are enforcing these rules to reduce environmental impacts and combat climate change. This transition helps the industry to comply with regulations, while meeting the growing demand for cleaner industrial gases.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Industrial Gases Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Breakup by Product

Key Insight: Nitrogen leads the industrial gases market due to its extensive usage across food packaging, electronics, chemicals, and metallurgy. With its inert properties, nitrogen helps in preserving food, preventing oxidation in electronics manufacturing, and providing safety in chemical processes. In the semiconductor industry, ultra-high purity nitrogen is essential during wafer fabrication. In January 2025, INOXAP's introduced its new 1,700 TPA UHP nitrous oxide plant in Chennai to support India's semiconductor, solar PV, and electronics industries. Low cost and wide applications further make nitrogen the most consumed industrial gas globally, driving continuous infrastructure investment and supply chain development.

Breakup by Application

Key Insight: Manufacturing dominates the industrial gases market, driven by high demand for nitrogen, oxygen, and argon in welding, cutting, and material processing. These gases are critical in automotive, machinery, and electronics production. In May 2025, Linde expanded its ultra-high-purity gas supply to Samsung’s advanced semiconductor facility in Pyeongtaek, South Korea for supporting chip production. As global manufacturing expands, especially in emerging markets, the need for industrial gases continues to rise. Integration of smart gas delivery systems further enhances efficiency in advanced manufacturing environments.

Breakup by Distribution

Key Insight: The packaged segment is largely contributing to the industrial gases industry due to their flexibility, portability, and widespread usage in various industries. These gases are typically supplied in high-pressure cylinders or dewars and are essential in metal fabrication, laboratories, healthcare, and small-scale manufacturing. Companies offer a range of packaged gases tailored for specific industrial needs. In July 2022, Linde inaugurated India’s first-ever women-led packaged gas plant in Trichy, India to serve the local medical as well as industrial gases demand. Convenience and broad applicability also make the segment a core supply model, especially in regions with decentralized demand.

Breakup by Region

Key Insight: Asia Pacific industrial gases market is driven by rapid industrialization, urbanization, and large-scale manufacturing. China, India, South Korea, and Japan host expanding industries including semiconductors, steel, chemicals, and healthcare. Major investments by leading firms underscore the region’s demand to focus on renewable energy and electronics. In April 2025, BPCL and Sembcorp partnered to build green hydrogen and renewable energy facilities, including green ammonia projects for expanding India’s clean gas infrastructure The growing population and supportive government policies continue to fuel long-term market dominance.

Hydrogen & Carbon Dioxide to Gain Popularity

Hydrogen records a significant share in the industrial gases industry with primary usage in refining, ammonia production, and clean energy solutions. With the global push for decarbonization, hydrogen is at the forefront of green energy innovations. Several firms are investing heavily in large-scale hydrogen projects in Saudi Arabia, the Netherlands, and the United States. In June 2024, Wärtsilä unveiled the world’s first large-scale, 100% hydrogen-ready engine power plant, enabling carbon-free operations in power generation. Hydrogen is further poised for future leadership due to its pivotal role in energy transition.

Carbon dioxide (CO₂) is used extensively in the food and beverage sector for carbonation, packaging, and preservation, as well as in fire suppression systems and enhanced oil recovery. This gas plays a role in water treatment and pharmaceutical production. With increasing focus on sustainability, CO₂ capture and utilization are gaining prominence. Companies are investing in carbon capture technologies to reuse CO₂ in industrial processes, making it a key player in the evolving circular economy and decarbonization initiatives.

Surging Industrial Gases Application in Metallurgy and Glass & Energy

The metallurgy and glass segment is driving the industrial gases market expansion with growing adoption in steelmaking to increase furnace temperatures and reduce fuel consumption. In May 2024, Linde built and operated a USD 150 million on-site air separation unit in Boden, Sweden for supplying oxygen, nitrogen, and argon to H2 Green Steel’s green steel plant. With rising infrastructure projects and construction demand, especially in Asia and the Middle East, gas usage in metallurgy and glass is substantial.

The energy segment is a fast-growing industrial gases consumer, especially with the transition to cleaner fuels. Hydrogen is increasingly used in refining processes and as a clean fuel in power generation and transport. Air Products and Linde are investing in green and blue hydrogen projects globally. Oxygen also plays a role in gasification and combustion processes. As countries push for net-zero goals, industrial gases, such as hydrogen are becoming central to sustainable energy infrastructure, boosting demand in this segment significantly.

On-site & Cylinder Distribution to Boost Industrial Gases Demand

On-site industrial gases market share is growing with wide usage in refineries, electronics manufacturing, and steel production to render high purity and uninterrupted supply. On-site setups reduce logistics costs, ensure reliability, and offer environmental benefits by minimizing transportation emissions. The preference for this model is also growing due to long-term cost savings and energy efficiency. Rising prominence in emerging hydrogen economies and large semiconductor projects is also driving the segment growth.

Cylinder supply is essential, particularly for smaller-scale operations, research labs, and medical facilities. Gases are compressed and stored in steel or aluminium cylinders, often delivered via distributors. Companies offer extensive cylinder portfolios for oxygen, acetylene, and specialty gases. In August 2024, Luxfer launched a new lightweight and efficient 70-bar portable calibration gas cylinder, built to top industry standards for precision use. As digital tracking and safety features improve, cylinders are likely to remain important in localized and developing market segments.

Thriving Industrial Gases Penetration in North America & Europe

North America records a significant share in the industrial gases market, driven by advanced manufacturing, energy production, and healthcare infrastructure. The United States leads in innovation and large-scale industrial gas projects. In May 2025, the FERC approved the construction of the CP2 LNG plant, projected to export 28 million metric tons/year, making it the largest U.S. LNG export facility. Strong regulatory frameworks and technological advancements further support steady growth.

| CAGR 2026-2035 - Market by | Country |

| India | 9.0% |

| China | 7.5% |

| Canada | 6.4% |

| France | 5.3% |

| Italy | 4.8% |

| USA | XX% |

| UK | XX% |

| Germany | XX% |

| Japan | 4.7% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Europe industrial gases market dominance remains critical due to its advanced industries and sustainability focus. The region leads in automotive, pharmaceuticals, and high-end manufacturing, which demand high-purity gases and precision supply systems. Europe is also at the forefront of the global energy transition, investing heavily in green hydrogen, carbon capture, and clean industrial processes. This blend of innovation, regulatory support, and sustainability goals sustains Europe’s strategic importance.

Key players operating in the industrial gases market are deploying key strategies to drive growth and maintain competitiveness. One major strategy is technological innovation, with companies investing in advanced gas production, storage, and distribution technologies to improve efficiency and reduce environmental impact. This includes the development of green hydrogen, carbon capture and storage, and energy-efficient air separation units. Strategic partnerships and joint ventures are also widely used to expand geographic presence, enter emerging markets, and leverage shared expertise.

Mergers and acquisitions further enable companies to consolidate market share, diversify product portfolios, and strengthen supply chains. Capacity expansion is another critical strategy, particularly in high-growth regions such as Asia-Pacific, where rising demand from sectors like healthcare, manufacturing, and electronics is fuelling investment in new production facilities. Sustainability is a growing priority, with firms focusing on low-carbon solutions and aligning operations with global climate goals. Companies are also enhancing their service offerings via integrated gas solutions, including on-site gas generation and digital monitoring.

Founded in 1902 and headquartered in Paris, France, Air Liquide is a global leader in industrial gases and has pioneered hydrogen energy technologies and carbon capture solutions. The firm’s achievements include advancements in clean energy, healthcare gases, and the development of hydrogen refuelling infrastructure for sustainable transportation.

Linde AG, established in 1879 and based in Dublin, Ireland, is a major player in the global gases and engineering sector and has developed innovative cryogenic and gas processing technologies. Linde's contributions to clean hydrogen, sustainable energy solutions, and global LNG projects have cemented its position as an industry innovator.

Praxair, founded in 1907 and headquartered in Connecticut, the United States, is known for its expertise in atmospheric gases. Before merging with Linde, Praxair was recognized for developing advanced gas supply systems and environmentally efficient production methods and plays a significant role in industrial gas applications for electronics and healthcare.

Founded in 1940 and headquartered in Allentown, the United States, Air Products Inc. specializes in atmospheric and process gases. The company has led major hydrogen and gasification projects with a focus on sustainable technologies, such as the world’s largest green hydrogen plant and innovations in low-carbon and energy-efficient industrial gas solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the industrial gases market include INOX-Air Products Inc., Iwatani Corp., Messer, SOL Group, Strandmøllen A/S, and Taiyo Nippon Sanso Corp., among others.

Unlock the latest insights and stay ahead with our Industrial Gases Market Report 2026. Discover key industry drivers, competitive dynamics, and investment opportunities tailored to your sector. Download a free sample now to explore cutting-edge industrial gases market trends 2026 and make informed, data-driven decisions for future growth.

Indonesia Industrial Gases Market

Mexico Industrial Gases Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 104.20 Billion.

The market is projected to grow at a CAGR of 6.80% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 201.18 Billion by 2035.

The key strategies driving the market include technological advancements, strategic partnerships, capacity expansions, mergers and acquisitions, and focus on sustainable production. Demand from healthcare, electronics, and energy sectors, along with the shift toward hydrogen economy and clean energy solutions, further fuels market growth and competitive differentiation.

The key trends guiding the market include rising investments in the healthcare and medical sectors, technological advancements and innovations, and the rising demand for industrial gases in the food and beverage sector.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

The major types of the product include nitrogen, oxygen, carbon dioxide, argon, and hydrogen, among others.

The significant applications of industrial gases are manufacturing, metallurgy, energy, chemicals, and healthcare, among others.

The various supply modes considered in the market report include packaged, bulk, and on-site.

The key players in the market report include Air Liquide, Linde AG, Praxair Technology, Inc., Air Products Inc., INOX-Air Products Inc., Iwatani Corp., Messer, SOL Group, Strandmøllen A/S, and Taiyo Nippon Sanso Corp., among others.

Manufacturing dominates the market, driven by high demand for nitrogen, oxygen, and argon in welding, cutting, and material processing.

Various gases, such as oxygen, nitrogen, and hydrogen, are crucial in industrial applications for processes like welding, manufacturing, electronics, food preservation, and chemical production.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by Supply Mode |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share