Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Mexico industrial gases market size reached around USD 744.96 Million in 2025. The market is projected to grow at a CAGR of 4.00% between 2026 and 2035 to reach nearly USD 1102.72 Million by 2035.

Base Year

Historical Period

Forecast Period

Grupo Infra and Praxair México are the two major companies that control about 70% of the Mexican oxygen market.

Mexico has 14 free trade agreements (FTAs) with nations including the USA, Canada, Japan, and Australia as well as the EU. This has promoted trade and aided the growth of the country’s manufacturing sector.

Industrial gases play a pivotal role in the food processing sector. In 2021, bakery and tortilla production accounted for 25% of total food processing in Mexico, followed by meat and dairy processing.

Compound Annual Growth Rate

4%

Value in USD Million

2026-2035

*this image is indicative*

Industrial gases, primarily nitrogen, oxygen, carbon dioxide, hydrogen, and argon are widely deployed in end-use sectors such as automotive, healthcare, food processing, steel manufacturing, and metal fabrication. Mexico’s manufacturing sector is expanding due to the availability of low-cost skilled labour, which further supports the Mexico industrial gases market growth.

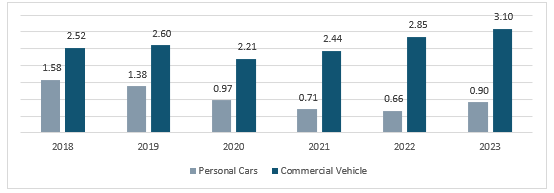

Mexico is the world’s seventh-largest manufacturer of automobiles and produced about 4.0 million cars in 2023. Industrial gases are crucial for automotive manufacturing processes, such as brazing.

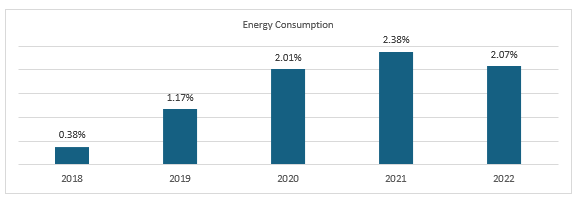

Figure: Share of Primary Energy Consumption from Solar, Mexico, 2018-2022

Industrial gases, like hydrogen, oxygen, nitrogen, and argon are widely used in the development of PV cells. Renewable energy as a whole is expanding in Mexico, but solar panel manufacturing is one of the largest and fastest-growing segments. Juarez is Mexico's and Latin America’s largest solar panel manufacturing location majorly driven by SunEdison Inc.’s investment in Juarez. The company manufactures over one million solar panels each year in the location.

Figure: Automotive Production in Mexico (in Million Units), 2019-2025

As of July 2020, Mexico was home to over 60 solar parks with an installed capacity of 4.8 GW.

Significant use of gases in the manufacturing sector; growing adoption of renewable energy; expansion of the food processing sector; and growing use in healthcare applications are the key trends impacting the Mexico industrial gases market.

In 2022, the manufacturing sector of Mexico contributed 21.47% to Mexico’s GDP. The availability of low-cost and skilled labour has made Mexico an advantageous location for companies looking to outsource their manufacturing. Industrial gases are widely used in producing electronics, glass, steel, automobiles, as well as chemicals.

The food processing sector in Mexico is the 3rd largest in the Americas. Industrial gases such as oxygen, nitrogen, and carbon dioxide are employed for food processing applications such as freezing and chilling, packing in a modified atmosphere, and product temperature control.

In November 2022, Mexico announced its plans to double its renewable energy capacity by 2030. Mexico’s solar energy sector is the second largest in Latin America. Industrial gases, like hydrogen, oxygen, nitrogen, and argon are widely employed in the synthesis of PV cells.

The healthcare sector is heavily reliant on the supply of industrial gases such as CO2 for a range of critical applications, including surgeries. For instance, CO2 is commonly used for insufflation during laparoscopic surgeries as it is inexpensive, nonflammable, colorless, and has higher blood solubility than air, reducing the risk of complications in case venous embolism occurs.

Mexico ranks as the world's seventh-largest producer of passenger vehicles, with an annual output of around 3.5 million units. Notable automakers in Mexico include Audi, BMW, Ford, General Motors, and Honda. Industrial gases play a crucial role in automotive manufacturing. For instance, car indicator lamps contain argon and nitrogen, and automotive air conditioning heat exchangers are often assembled in a controlled hydrogen or nitrogen atmosphere.

The Mexican transportation sector accounts for 26% of the country’s total GHG emissions and is the largest source of emissions in Mexico. The electrification of the vehicle fleet is among the measures to comply with Mexico’s Nationally Determined Contribution (NDC) to lower GHG emissions. The country aims at reducing its emissions by 35% by 2030. Hydrogen is a crucial industrial gas that finds use in fuel cells to generate electricity without emitting GHG. Fuel cell and hydrogen heavy-duty trucks and buses could provide Mexico’s transportation sector a zero-carbon alternative.

“Mexico Industrial Gases Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by Supply Mode

Based on type, nitrogen dominates the Mexico industrial gases market share

Nitrogen gas is chemically inert, making it suitable for use in industrial applications where chemical cross-reactivity between substrates is undesirable. It is being adopted in multiple applications, such as food processing, beverage and brewery, steel, and oil and gas recovery, among others. Nitrogen is used in steelmaking processes such as melting, and ladle processing, improving its hardness and formability. In 2022, the steel sector contributed 1.0% to the GDP, equivalent to USD 14.1 billion.

Oxygen is an essential gas for surgeries and trauma care. Mexico is considered a top location for medical tourism, and the city of Tijuana is known to treat cancers. According to the Mexico industrial gases market analysis, oxygen therapy is gaining traction in Mexico, as an alternative method of cancer treatment and is also used to cure other infections caused by flesh wounds or diseases such as Alzheimer’s and HIV/AIDS.

Based on application, chemicals account for a significant share of the Mexico industrial gases market

The chemical sector in Mexico is undergoing significant improvement with the incorporation of digital technologies and diversification of supply chains, and investment in improved energy efficiency and resource management.

From January – October 2022, Mexico exported 20% more chemical products to the United States as compared to the same period in 2021.

According to the National Institute of Statistics and Geography, industrial production in Mexico grew 2.8% year-on-year in November 2023, driven by the construction industry.

The manufacturing sector is crucial to the Mexican economy, contributing significantly to both the GDP and international trade. In 2022, Mexico manufacturing output was USD 265.67 billion, a 15.48% increase from 2021.

The market players are focusing on providing robust pipeline networks, reliable and economical industrial gas supply, and large-scale development of carbon-free hydrogen using renewable energy

Air Liquide is a world leader in gases, technologies and services for industry and health. Headquartered in France, the group is dedicated to developing solutions that contribute to climate and energy transition, with a focus on hydrogen.

AOC MÉXICO, S.A. of C.V also known as AOC is dedicated to the production, conditioning, analysis, and distribution of industrial, special, and medicinal gases. The company has a strong presence in Mexico, with office branches in Chihuahua, Coahuila, Durango, Jalisco, New Lion, Sonora, and Tamaulipas.

Quimobásicos is a joint venture of CYDSA and Honeywell, largely offering refrigerant gases. The company has a strong presence in Mexico.

Founded in 1879, Linde is a leading industrial gas company worldwide and a major technological provider in the gas industry. The company serves a diverse group of industries which include healthcare, chemicals and energy, manufacturing, metals and mining, food and beverage, and electronics, among others.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the Mexico industrial gases market are Infra, SA de CV, and Exel Air, among others. Manufacturers are upgrading their product portfolios and incorporating the latest capabilities to innovate their offerings and meet the evolving demands of consumers.

Asia Pacific Industrial Gases Market

North America Industrial Gases Market

Indonesia Industrial Gases Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 744.96 Million.

The market is projected to grow at a CAGR of 4.00% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 1102.72 Million by 2035.

The different types are nitrogen, oxygen, carbon dioxide, argon, hydrogen, and acetylene.

The supply modes include onsite, packaged, and bulk.

The applications include chemicals, manufacturing, metallurgy, food and beverages, healthcare, electronics, and others.

The growing demand from the food processing sector, an increase in steel manufacturing and metal fabrication applications, and Mexico’s move towards clean energy generation are some of the key factors driving the adoption of industrial gases.

The key players in the market include Air Liquide S.A, AOC MÉXICO, S.A. of C.V, Quimobásicos, S.A. de C.V., Linde plc, Infra, SA de CV, and Exel Air, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

|

Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Supply Mode |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share