Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global industrial wastewater treatment market size was valued at USD 15.06 Billion in 2025. The industry is expected to grow at a CAGR of 6.40% during the forecast period of 2026-2035 to reach a valuation of USD 28.01 Billion by 2035.

The industrial wastewater treatment market is rapidly expanding, driven by stringent environmental regulations, the need for sustainable water management, and advancements in treatment technologies. Industries such as chemical manufacturing, food and beverage, oil and gas, and pharmaceuticals are adopting innovative solutions to address rising concerns over water pollution and resource conservation. As per USDA, Australia’s foodservices sector reached USD 39.1 billion in 2023, contributing increasingly to wastewater from food preparation. The sector’s growth amplifies demand for advanced wastewater treatment solutions, driving expansion in the market.

According to the National Health Expenditure Account, the United States healthcare spending rose by 4.1% to USD 4.5 trillion in 2022, leading to higher healthcare-related wastewater production. The growth in medical facilities drives demand for advanced wastewater treatment technologies to comply with health and environmental standards, supporting the industrial wastewater treatment market growth.

Key trends include the integration of advanced filtration systems, zero-liquid discharge technologies, and smart water monitoring systems powered by IoT. The growing focus on recycling and reusing wastewater further fuels market demand. Additionally, the adoption of biological treatment methods, such as activated sludge and membrane bioreactors, enhances operational efficiency. As industries aim for compliance and sustainability, the industrial wastewater treatment market continues its upward trajectory.

Base Year

Historical Period

Forecast Period

As per Ministry of Mines, with 2,036 operational mines in fiscal year 2023-24, the Indian mining industry contributes significantly to industrial wastewater production. This growing sector highlights the need for advanced wastewater treatment technologies to address pollution, offering substantial opportunities for the wastewater treatment market.

Australia’s fast food and takeaway services sector, which generated USD 23 billion in 2023, contributes to increased wastewater from food preparation, as per industry reports. The sector’s growth amplifies demand for advanced wastewater treatment solutions, driving expansion in the industrial wastewater treatment market.

According to the National Health Expenditure Account, the United States healthcare spending rose by 4.1% to USD 4.5 trillion in 2022, leading to higher healthcare-related wastewater production. The growth in medical facilities drives demand for advanced wastewater treatment technologies to comply with health and environmental standards, supporting the industrial wastewater treatment market.

Compound Annual Growth Rate

6.4%

Value in USD Billion

2026-2035

*this image is indicative*

The global industrial wastewater treatment market is expanding due to heightened concerns over water pollution and stricter environmental regulations. Advanced technologies, such as membrane filtration, reverse osmosis, and biological treatment methods, are increasingly sought after to ensure efficient water recycling, pollution control, and compliance with regulatory standards. In February 2025, Cedar Rapids embarked on a USD 318 million project to modernise its Water Pollution Control Facility, incorporating advanced technologies to enhance plant capacity and efficiency, meeting both current and future needs.

Sustainability is becoming a focal point in the industrial wastewater treatment sector, with eco-friendly technologies gaining traction. Zero-liquid discharge (ZLD) systems, which minimize water wastage and facilitate complete wastewater recycling, are being widely adopted. These green solutions help reduce environmental impacts, conserve water resources, and contribute to global sustainability targets. In February 2025, BrightWave launched algae-based technology in England, using wastewater treatment plants to produce biogas, offering a sustainable approach to both wastewater management and energy production.

The integration of IoT and automation in industrial wastewater treatment market is on the rise. IoT sensors allow for real-time water quality monitoring, while automation optimises operational efficiency. These technological innovations improve control over treatment processes, reduce energy consumption, and enable predictive maintenance, delivering cost-effective solutions for industrial facilities. In February 2025, Element3 achieved a significant milestone by producing battery-grade lithium carbonate from wastewater in the Midland Basin, recovering over 85% of lithium from produced water with low concentrations, demonstrating sustainable lithium extraction.

Tighter environmental regulations on wastewater disposal are driving demand for efficient treatment solutions. Industries face increasing pressure to meet local and international wastewater discharge standards, prompting investments in advanced technologies. As per the industrial wastewater treatment market analysis, in February 2025, Ingersoll Rand acquired SSI Aeration and its subsidiaries, strengthening its wastewater treatment offerings. SSI, with USD 30 million in annual revenue, manufactures energy-efficient aeration systems. The acquisition enables Ingersoll Rand to combine technologies for comprehensive wastewater treatment solutions, with SSI’s facilities joining the company’s Industrial Technologies segment.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Industrial Wastewater Treatment Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Coagulants play a vital role in removing suspended solids and impurities from industrial wastewater. They are highly relevant in industries like chemical manufacturing and food processing, where water treatment is critical to meet environmental standards. The market for coagulants is driven by increased regulatory pressures and growing industrial awareness about water treatment. They remain a foundational product for wastewater treatment plants, owing to their effectiveness in purifying water in various industrial applications.

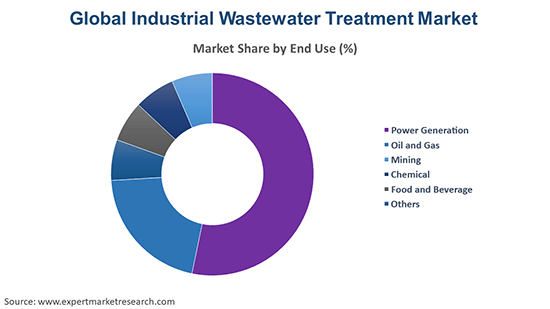

Market Breakup by End Use

Key Insight: The power generation sector is a major consumer of industrial wastewater treatment chemicals, particularly for cooling water systems. With power plants facing rising regulatory pressures to minimize water pollution, the demand for wastewater treatment solutions is strong. Additionally, the need for water conservation in the power sector is propelling the growth of treatment technologies that can facilitate the recycling of wastewater.

Market Breakup by Region

Key Insight: North America remains the dominant region in the industrial wastewater treatment market, driven by advanced infrastructure, stringent environmental regulations, and a well-established industrial base. The U.S., in particular, leads in the adoption of innovative wastewater treatment technologies. Veolia's commitment to doubling its desalination capacity by 2030 is significantly influencing the industrial wastewater treatment landscape in the United States. As the world's leader in desalination, Veolia's expansion enhances its ability to provide sustainable water solutions to industries facing water scarcity and stringent environmental regulations.

Role of Flocculants and Corrosion Inhibitors in the Industrial Wastewater Treatment Market

Flocculants are crucial in facilitating the aggregation of fine particles, aiding in the treatment of wastewater in industries such as mining, food, and beverage. They are often used in tandem with coagulants to improve the efficiency of water treatment. Their market relevance has risen due to increasing concerns over water conservation and pollution control, making flocculants a key component for industries seeking to recycle and reuse water.

Corrosion inhibitors are essential for preventing the deterioration of pipelines and equipment in industries like oil and gas and power generation. With the rise in industrial activities, the demand for corrosion control is surging, especially in industries where the water used is chemically aggressive. The use of corrosion inhibitors ensures system longevity and operational efficiency, driving their steady growth in the industrial wastewater treatment market.

Water Treatment Challenges in the Oil & Gas and Mining Industries Boosting the Market Growth

The oil and gas industry is one of the largest consumers of water treatment chemicals due to the high water usage in drilling, hydraulic fracturing, and refinery operations. Water used in these processes must be treated to meet environmental standards before disposal or reuse. Regulatory frameworks are evolving to support these initiatives. In Texas, House Bill 49 permits oil companies to treat and sell fracking wastewater, including discharging it into rivers or using it for agricultural irrigation. This legislation aims to repurpose the vast amounts of wastewater generated from oil and gas extraction in the Permian Basin.

The mining industry generates large amounts of wastewater that requires treatment due to the presence of heavy metals and toxic substances. The demand for industrial wastewater treatment market in mining is driven by the need for environmental compliance and water reuse. Recent incidents, such as the 2025 tailings dam collapse in Zambia, which released approximately 50 million liters of acidic and toxic waste into the Kafue River, underscore the critical need for advanced wastewater management. As mining operations expand globally, especially in emerging regions, the demand for efficient treatment solutions will continue to rise.

Growing Demand for Industrial Wastewater Treatment in Asia Pacific and Latin America

Asia Pacific is experiencing rapid growth in the industrial wastewater treatment market, driven by booming industrial activities in countries like China and India. Increasing urbanization, coupled with growing concerns over water scarcity and pollution, has led to a surge in demand for wastewater treatment solutions. In May 2025, the Punjab Pollution Control Board issued an ultimatum to dyeing units in Ludhiana to adopt zero-liquid-discharge technology by 2025, highlighting the region's commitment to addressing untreated industrial wastewater.

Latin America is emerging as a key region for the industrial wastewater treatment market, with countries like Brazil and Mexico investing in water treatment technologies due to rapid industrial growth and environmental concerns. Mexico's industrial hubs are focusing on cleaning up contaminated rivers and implementing stricter regulations to prevent further pollution. As industrial activities increase, demand for wastewater treatment chemicals and technologies is expected to rise, particularly in the mining and oil sectors.

Key players in the industrial wastewater treatment market are focusing on developing advanced technologies to enhance efficiency and sustainability. They are investing in innovative solutions like membrane filtration, biological treatment, and chemical treatment methods to meet evolving environmental regulations and optimize water reuse. These companies are also strengthening their R&D capabilities to create customized solutions tailored to the specific needs of diverse industries.

Additionally, key players are forging strategic partnerships and acquisitions to expand their market presence and enhance their service offerings. Collaborating with local players in emerging markets is enabling global companies to tap into new growth opportunities. They are also enhancing customer engagement through digital platforms and offering comprehensive wastewater management solutions that go beyond treatment, focusing on system optimization and maintenance services.

Solenis, headquartered in Delaware, United States was established in 2014. The company provides innovative water treatment and process chemicals, offering solutions to various industries, including pulp and paper, water treatment, and industrial manufacturing. Solenis focuses on sustainability and improving operational efficiency, helping customers reduce their environmental impact through advanced technology.

Ecolab, founded in 1923 and based in Minnesota, United States, is a global leader in water, hygiene, and energy technologies. The company serves industries such as foodservice, healthcare, and manufacturing. Ecolab offers sustainable solutions that help improve water usage, ensure food safety, and enhance energy efficiency, promoting a cleaner, healthier world.

Suez, established in 1858 and headquartered in Paris, France, is a multinational company focused on water and waste management. Specialising in providing sustainable solutions for water treatment, recycling, and waste recovery, Suez aims to help cities and industries manage natural resources more efficiently and reduce their environmental footprint.

Kemira OYJ, based in Helsinki, Finland, was founded in 1920. It is a global leader in providing water treatment chemicals and process solutions for industries such as paper, oil and gas, and water treatment. Kemira focuses on sustainability, helping customers improve their environmental performance and reduce resource consumption.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the industrial wastewater treatment market report are SNF Floerger, Feralco Group, and Ixom, among others.

Download a free sample of the Industrial Wastewater Treatment Market Report 2026-2035 to explore key trends, growth forecasts, and actionable insights. Contact us today to discuss how these insights can drive your business decisions in the evolving industrial wastewater treatment market.

Asia Pacific Water and Wastewater Treatment Market

Industrial Wastewater Treatment Units Market

South Korea Wastewater Treatment Market

Packaged Wastewater Treatment Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 15.06 Billion.

The market is projected to grow at a CAGR of 6.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 28.01 Billion by 2035.

Key strategies driving the market include adoption of advanced membrane technologies, increased regulatory compliance, water recycling initiatives, and investment in zero-liquid discharge systems. Industries are prioritizing sustainable operations, reducing environmental impact, and lowering operational costs, which in turn fuels innovation and partnerships in treatment and monitoring solutions.

The key trends guiding the market growth include the growing concern regarding discharge of untreated industrial wastewater into water bodies and the launch of new technologies which comply with the ‘treat-to-discharge’ disciplines of recycling, reuse, and non-liquid dumping.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Coagulants, flocculants, corrosion inhibitors, scale inhibitors, biocides and disinfectants, chelating agents, anti-foaming agents, and PH stabilizers, among others, are the leading types of industrial wastewater treatment in the market.

Power generation, oil and gas, mining, chemical, and food and beverage, among others, are the significant end uses in the global industrial wastewater treatment market.

The key players in the market report include Solenis, Ecolab, Suez, Kemira OYJ, SNF Floerger, Feralco Group, and Ixom, among others.

North America remains the dominant region in the market, driven by advanced infrastructure, stringent environmental regulations.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share