Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global insurance fraud detection market value reached around USD 6.77 Billion in 2025. This growth is primarily driven by the increasing number of fraudulent claims and the rising financial losses faced by insurance companies globally. The need to mitigate fraud risks has led to the widespread adoption of advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics to detect suspicious activities. Insurers like Allstate and AXA are using AI-powered fraud detection systems to identify patterns and prevent fraudulent claims. As a result, the industry is expected to grow at a CAGR of 26.10% during the forecast period of 2026-2035 to attain a value of USD 68.82 Billion by 2035. Stringent government regulations and industry standards aimed at reducing insurance fraud are further boosting market growth. As the complexity of fraud schemes increases, the demand for more sophisticated fraud detection solutions is expected to rise.

Base Year

Historical Period

Forecast Period

In 2023, the Association of British Insurers (ABI) reported detecting around 84,400 fraudulent claims worth a staggering EUR 1.1 billion in the UK. This highlights the ongoing prevalence of insurance fraud and underscores the growing need for insurance fraud detection tools and services. This surge in detected fraud drives the market for fraud detection solutions, as insurers aim to enhance their ability to identify suspicious activities and mitigate financial losses.

The increasing complexity of fraudulent activities, such as organised fraud rings, synthetic identity fraud, and claim padding, has led insurers to adopt more sophisticated fraud detection strategies. With the rising number of fraud cases, the insurance fraud detection market is expanding rapidly, with solutions aimed at identifying patterns, flagging suspicious claims, and automating the detection process. This market growth is further fuelled by the need for real-time monitoring and analytics to stay ahead of fraudsters.

The Indian insurance sector is expected to reach an impressive USD 200 billion by 2027, marking a substantial growth trajectory for the industry. As the sector expands, the volume of claims and transactions will inevitably rise, which could lead to an increase in fraudulent activities. This expanding market offers a significant opportunity for insurance fraud detection services to flourish, as insurers in India will need to implement more robust fraud detection mechanisms to protect themselves from rising fraud risks. With more digital transactions, online claims, and data being processed, fraudsters may find new avenues to exploit. This highlights the growing importance of advanced fraud detection technologies.

Compound Annual Growth Rate

26.1%

Value in USD Billion

2026-2035

*this image is indicative*

Fraud analytics require a range of computational technologies to analyse the processes and infrastructure of organisations to identify vulnerabilities in which fraud can occur. Such systems track and analyse data from various data sources; identify irregularities and alleged and suspicious conduct on all channels and provide monitoring in real-time for fraud prevention. Fraud analytics refers to the foundation of all fraud detection tools for insurance companies. Most suppliers offer conventional rules-based computational fraud models, while some prefer strategies for artificial intelligence and machine learning. Fraud detection tools detect fraud proactively and help fulfil compliance requirements.

The main driving factors driving the growth of the insurance fraud detection market are the need for companies to efficiently handle enormous numbers of identities, boost operational efficiency, increase customer experience, maximise the use of advanced analysis techniques, and strict regulatory compliance. The lack of awareness among organisations, combined with a lack of integration of fraud detection options through organisational networks, of the value of fraud detection solutions and inappropriate implementation may restrict the industry growth.

Rise in digital insurance platforms, adoption of advanced technologies, and shift towards cloud-based solutions are the key trends propelling the market growth.

The shift towards digital insurance services has led to a surge in online transactions, creating new opportunities for fraudulent activities. Insurers are investing in robust fraud detection systems to secure digital platforms and protect against cyber threats, which can contribute to the insurance fraud detection market value. For instance, insurance companies are increasingly adopting AI in their platforms to combat fraud. A study by Coalition Against Insurance Fraud and SAS revealed that 80% of insurers utilise predictive modelling for fraud detection, up from 55% in 2018. The use of text mining has also increased from 33% to 65% since 2018. Moreover, the U.S. Department of the Treasury announced the implementation of enhanced fraud detection processes, including machine learning AI, to boost the digital insurance sector to address increased fraud and improper payments since the pandemic.

Insurance companies are increasingly using AI, machine learning, and big data analytics to enhance fraud detection capabilities. These technologies enable the analysis of large datasets to identify suspicious patterns and anomalies, improving the accuracy and efficiency of fraud detection processes and further offering avenues for increasing insurance fraud detection market revenue. The European Union has been proactive in establishing guidelines that support the integration of digital technologies in financial services, including insurance. For instance, the EU's Digital Finance Strategy aims to foster innovation while ensuring consumer protection and market integrity, thus creating an environment conducive to the adoption of AI and ML technologies in fraud detection. The insurance sector is rapidly integrating AI as per a recent survey which showed that 77% of participants are currently at various stages of AI adoption within their value chain. This marks a notable increase from the 2023 survey, where only 61% of respondents reported having implemented or being in the process of implementing AI into their workflows, according to research conducted by Conning.

Predictive analytics is transforming how insurers detect and prevent fraud by using historical data, machine learning algorithms, and statistical modelling to identify potential fraudulent claims before they are processed. This proactive approach allows insurers to flag suspicious activities early in the claims lifecycle, which can significantly reduce losses. Some companies are now leveraging social media data to uncover fraudulent behaviour. For instance, if a claimant posts about participating in activities inconsistent with their injury claim, this can trigger further investigation. A report highlighted that 42% of insurers are now using predictive analytics specifically for fraud detection. Additionally, tools like SAS Detection and Investigation for Insurance use predictive modelling to score millions of claims automatically, identifying hidden relationships and detecting fraud patterns efficiently.

The shift towards cloud-based solutions is enabling insurance companies to enhance their fraud detection capabilities by providing scalable and flexible platforms that can integrate advanced analytical tools without extensive IT infrastructure investments. This trend supports real-time data processing and analysis, which is crucial for effective fraud detection. For example, FRISS Fraud Detection is a cloud-based solution that integrates AI and predictive models to screen claims in real-time. It helps insurers catch fraudulent activities before payouts are made, thereby protecting their financial interests. Duck Creek Technologies also provide cloud solutions that allow insurers to automate various processes, including fraud detection during underwriting. By leveraging data from multiple sources, these platforms can quickly identify suspicious behaviour and streamline the claims process.

Stricter regulations and data privacy laws are compelling insurers to adopt comprehensive fraud detection solutions that ensure compliance while safeguarding customer information. This trend of insurance fraud detection market emphasises the need for secure and transparent fraud detection mechanisms. For instance, the California Consumer Privacy Act (CCPA), enacted in 2020, is a comprehensive data privacy law that applies to organisations handling the personal information of California residents. Under this law, insurers must ensure that their fraud detection systems comply with consumer rights established by the CCPA, which includes restrictions on the excessive collection of personal data. Furthermore, they are obligated to be transparent about how data is used in fraud prevention efforts.

Moreover, motor injury fraud is one of the main focuses of the fraudsters, representing 35% of all fraudulent claims identified by Aviva, a multinational insurance company. The volume of injury claims suspected of fraud increased by 19%, amounting to over £23 million, with £6 million attributed to rejected crash-for-cash claims.

Insurance companies are readily strengthening their efforts against fraudsters who seek to exploit the insurance market through false claims and trick innocent people into buying fake insurance policies. The rise of ‘crash for cash’ scams is becoming a significant issue, where fraudsters intentionally stage accidents to file insurance claims, putting innocent lives at risk. Furthermore, these people may also submit claims for incidents that never took place which can impact insurance fraud detection demand. For instance, the Insurance Fraud Bureau in the UK is currently investigating over 6,000 suspected fraudulent motor insurance claims that may be linked to this crash for cash schemes, with the total potential fraud estimated to exceed £70 million.

This has led some insurers to explore blockchain to create a transparent, immutable record of insurance claims and policyholder information. Blockchain enables real-time, traceable verification, helping prevent document tampering or duplication. This technology further reduces fraudulent claim submissions by providing a secure record of transactions.

Deploying advanced fraud detection systems, especially those utilising artificial intelligence and machine learning, requires substantial financial investment. This can be a significant barrier for small and medium-sized insurers with limited budgets, impacting insurance fraud detection market dynamics and trends. According to a report by the National Association of Insurance Commissioners (NAIC), smaller insurers often struggle to allocate resources for sophisticated fraud detection technologies, impacting their ability to effectively combat fraud. Fraudsters continually develop new methods to exploit vulnerabilities, making it challenging for detection systems to keep pace. The Federal Bureau of Investigation (FBI) has reported an increase in high-end insurance fraud schemes, highlighting the need for continuous updates and improvements in detection technologies.

Stringent data protection laws necessitate that insurers handle customer information with utmost care. For instance, the General Data Protection Regulation (GDPR) in the European Union imposes strict guidelines on data processing and sharing. Non-compliance can result in hefty fines, compelling insurers to balance fraud detection efforts with adherence to privacy regulations.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Insurance Fraud Detection Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

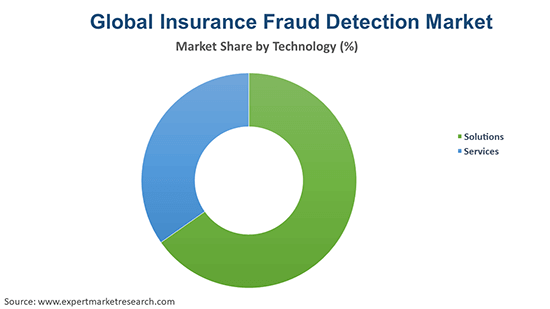

Market Breakup by Technology

Market Breakup by Organisation

Market Breakup by Deployment

Market Breakup by Service

Market Breakup by Solution

Market Breakup by Application

Market Breakup by Region

Market Insights by Technology

Fraud detection services are offered by specialised firms that provide consultancy, integration, and managed services to help insurers implement and optimise fraud prevention solutions. Companies like PwC and Deloitte provide services to help insurers enhance their fraud detection capabilities using AI and data analytics. Ernst & Young (EY) also offers fraud risk management services, helping insurance companies assess their risk profile and improve fraud detection systems. In the UK, the National Fraud Authority works with insurers and third-party service providers to enhance collaboration and strengthen the fraud detection ecosystem. The Indian government is also increasingly focusing on fraud detection in insurance, with the Insurance Regulatory and Development Authority of India (IRDAI) advocating for improved fraud risk management systems across the sector.

Solutions hold a significant insurance fraud detection market share due to the increasing adoption of advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics by insurance companies to effectively detect and prevent fraudulent activities. These solutions enable insurers to analyse vast amounts of data, identify suspicious patterns, and make informed decisions, thereby enhancing operational efficiency and reducing financial losses due to fraud.

Market Insights by Organisation

Large enterprises hold the highest share compared to small and medium-sized enterprises (SMEs). This is primarily due to their substantial financial resources, extensive customer bases, and the complexity of their operations, which necessitate robust fraud detection systems. Large enterprises are more likely to invest in advanced technologies and comprehensive solutions to effectively manage and mitigate fraud risks. For example, Allianz and AXA have integrated AI-based fraud detection systems that analyse vast amounts of historical claims data to identify patterns of suspicious activity. Governments, including the U.S. Department of Justice and the UK’s Financial Conduct Authority (FCA), have introduced regulations and initiatives to support the implementation of such technologies, recognising the role of advanced fraud detection systems in maintaining market integrity. The European Commission has encouraged large insurers to adopt AI and analytics through the Digital Finance Strategy, promoting insurance fraud detection market growth.

SMEs in the insurance sector are more likely to face challenges in adopting complex fraud detection technologies due to resource constraints. However, there is growing adoption of affordable, scalable solutions tailored to SMEs. Companies like Shift Technology offer AI-driven fraud detection solutions that are accessible to smaller insurers, providing a balance between cost and performance. In India, the Insurance Regulatory and Development Authority of India (IRDAI) has worked to enhance fraud detection capabilities in the sector, with a particular focus on SMEs through awareness campaigns and partnerships. SMEs are also benefiting from cloud-based fraud detection services, which provide flexible, lower-cost options compared to traditional on-premises solutions.

Market Insights by Deployment

On-premises deployment holds the largest share compared to cloud-based solutions. This preference is primarily due to the immediate assistance on-premises systems provide in identifying and alerting possible fraudulent risks. Additionally, on-premises solutions offer enhanced control over data security and compliance, which is crucial for insurance companies handling sensitive customer information and can contribute to the demand of insurance fraud detection market.

Market Insights by Service

Professional services hold a larger share compared to managed services. Professional services encompass consulting, training, and support, assisting organisations in implementing and optimising fraud detection systems. These services are crucial during the initial deployment and customization phases, ensuring that the solutions align with the specific needs and regulatory requirements of the insurance company. The demand for professional services is driven by the necessity for expertise in integrating advanced technologies like artificial intelligence and machine learning into existing systems.

Managed services are increasingly popular among insurance companies looking to outsource their fraud detection and prevention operations. This segment involves third-party service providers managing the end-to-end fraud detection process, including data analysis, claims monitoring, and incident management. Companies like Cognizant and Capgemini offer managed services to handle fraud detection on behalf of insurers, providing 24/7 monitoring and real-time fraud prevention. In India, the Insurance Regulatory and Development Authority of India (IRDAI) has been promoting the use of managed services to help smaller insurers implement sophisticated fraud detection systems without significant capital investment.

Market Insights by Solution

Fraud analytics account for a significant market share. This dominance is due to the increasing adoption of advanced analytics and technology, which has led to an increase in the use of insurance fraud detection solutions and further boosted the insurance fraud detection industry revenue. Fraud analytics solutions can improve the accuracy of fraud detection by leveraging the capabilities of artificial intelligence (AI), machine learning, and predictive modelling.

Authentication involves verifying the identity of individuals involved in the insurance process to prevent fraudulent activities. This includes tools such as biometric verification, multi-factor authentication (MFA), and digital signatures. Insurers like Lloyd’s are adopting advanced authentication methods to safeguard policyholder data and claims processes.

Governance refers to the frameworks and policies insurers adopt to ensure ethical practices, transparency, and compliance with regulations. Strong governance is essential in mitigating fraud risks, with insurers implementing regular audits and checks to monitor claims processes. Companies like MetLife have adopted comprehensive governance frameworks to ensure the integrity of their claims handling. Government regulations, such as the U.S. Sarbanes-Oxley Act and the UK’s Financial Conduct Authority (FCA) guidelines, mandate that insurance companies maintain strong governance to protect consumers and reduce fraud risks.

Compliance ensures that insurers meet regulatory standards designed to prevent fraud and protect consumers. Compliance with laws such as the General Data Protection Regulation (GDPR) and Insurance Distribution Directive (IDD) is critical to maintaining industry standards and protecting against fraud. Insurers like AIG and Prudential are actively working to comply with these regulations, using compliance tools to ensure fraud detection systems align with legal frameworks. Governments globally, including the U.S. Securities and Exchange Commission (SEC) and the European Commission, have reported the need for strict compliance with anti-fraud regulations, driving the demand for insurance fraud detection market.

Market Insights by Application

Claims fraud holds a significant market share due to the high frequency and financial impact of fraudulent claims within the insurance industry. Claims fraud encompasses various deceptive activities, such as exaggerated losses, staged incidents, or entirely false claims, all aimed at receiving unwarranted payouts. The significant financial losses associated with such fraudulent activities have led insurance companies to prioritise the development and implementation of advanced detection systems specifically targeting claims fraud.

Identity theft in the insurance sector involves the illegal use of personal information to make fraudulent claims or purchase insurance policies. Insurers are adopting advanced identity verification tools, such as biometric recognition, AI-driven identity checks, and multi-factor authentication (MFA) to combat identity theft. Payment and billing fraud involves fraudulent claims related to billing errors, false medical bills, or inflated repair costs. As per insurance fraud detection market analysis, insurance companies are leveraging fraud detection systems that use AI and machine learning to analyse billing data and identify discrepancies or patterns indicative of fraudulent claims. For instance, Aetna uses AI to detect inflated billing and unnecessary treatments in healthcare insurance claims. The U.S. Department of Health and Human Services and the National Insurance Crime Bureau (NICB) have raised awareness about the need for more advanced fraud detection systems to tackle payment fraud, particularly in health insurance claims.

Money laundering in insurance typically involves using insurance policies to conceal illicit funds. This can occur through practices like over-insuring assets or making large, suspicious claims to launder money. To detect such activities, Lloyd's of London and Zurich Insurance have implemented anti-money laundering (AML) frameworks to monitor and report suspicious transactions. The Financial Action Task Force (FATF) has set global standards for combating money laundering, and government bodies, such as the U.S. Department of Justice and the Financial Conduct Authority (FCA) in the UK, continue to push for stronger AML measures within the insurance sector. The European Union's 5th Anti-Money Laundering Directive has mandated enhanced due diligence for high-risk transactions, which insurers are increasingly adopting to prevent money laundering.

North America Insurance Fraud Detection Market Dynamics

The region's growth is primarily fuelled by the rising number of insurance fraud cases, which the FBI estimates costs the industry over USD 40 billion annually. Insurers are increasingly adopting advanced technologies such as AI and machine learning to enhance their fraud detection capabilities and boost the insurance fraud detection demand growth. For instance, in October 2023, Shippo and Cover Genius launched Shippo Total Protection, an innovative solution aimed at improving claims processing and customer experience, reflecting the region's focus on leveraging technology to combat fraud effectively.

Asia Pacific Insurance Fraud Detection Market Drivers

The market growth in the region is attributed to increased investment in advanced technologies aimed at reducing instances of insurance fraud. Countries like India are witnessing a surge in their life insurance sectors that can significantly impact the insurance fraud detection demand forecast. For instance, non-life insurance companies have indicated a year-on-year (Y-o-Y) increase of 27.53 per cent in premiums for October, primarily fuelled by advancements in standalone health and multi-line insurance sectors. Additionally, the recovery in motor sales has contributed positively to the growth of general insurers.

Europe Insurance Fraud Detection Market Growth

The European insurance fraud detection market is also witnessing robust growth, driven by stringent regulatory compliance and increasing digitalisation in the insurance sector. In 2023, the market was identified as lucrative, particularly in countries like the UK, Germany, and France, offering ample insurance fraud detection market opportunities. The adoption of digital insurance procedures has led to a heightened focus on cybersecurity measures due to rising concerns about cyber-attacks.

Furthermore, compliance with regulations such as the General Data Protection Regulation (GDPR) compels organisations to invest in comprehensive fraud detection solutions to protect sensitive data from unauthorised access.

Latin America Insurance Fraud Detection Market Opportunities

As economies in Latin America expand, the insurance sector is growing, leading to a higher incidence of fraud and a subsequent need for effective detection solutions. As per the insurance fraud detection industry analysis, countries like Brazil have established regulatory bodies, such as the Superintendence of Private Insurance (SUSEP), to oversee and enforce anti-fraud measures within the insurance industry. The shift towards digital platforms has expanded the avenues for fraud. Insurers are adopting advanced technologies, such as AI and machine learning, to analyse large datasets and identify suspicious patterns effectively.

Middle East and Africa Insurance Fraud Detection Market Trends

These regions are gradually adopting advanced analytics for fraud detection due to rising incidents of insurance fraud. For instance, initiatives aimed at improving regulatory compliance and enhancing operational efficiency are driving the growth of the insurance fraud detection industry across these regions. As digital transformation grows in these markets, insurers are beginning to recognise the importance of implementing robust fraud detection systems.

Additionally, companies such as Network International have deployed cloud-hosted fraud management solutions to assist banks in the MEA region in preventing fraud. By utilising advanced analytics, these solutions have significantly reduced fraud rates.

Startups in the insurance fraud detection market are leveraging advanced technologies to enhance the accuracy and efficiency of identifying fraudulent activities. They employ AI and machine learning algorithms to analyse large datasets, uncover suspicious patterns, and detect anomalies in real-time. For instance, companies in the insurance fraud detection market like Shift Technology provide AI-powered solutions that assist insurers in automating fraud detection and claims processing, thereby reducing false positives and operational costs.

Shift Technology

Founded in 2013, Shift Technology is a French startup that offers AI-powered solutions to help insurance companies detect and prevent fraudulent claims. Their technology analyses vast amounts of data to identify suspicious patterns, enabling insurers to process claims more efficiently and reduce losses due to fraud.

Unfrauded

Established in 2019, Unfrauded is a Tunisian startup specializing in AI-driven insurance fraud detection. Their platform leverages deep learning models to assess vehicle damage from images, assisting insurers in identifying false claims. Unfrauded's innovative approach has garnered recognition, including the National First prize in the Orange Social Venture Prize (OSVP) 2020 for Africa and the Middle East.

The report presents a detailed analysis of the following key players in the global insurance fraud detection industry, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions. Companies in the market are increasingly adopting advanced technologies to combat fraudulent activities. They are implementing artificial intelligence (AI) and machine learning algorithms to analyse vast datasets, identify suspicious patterns, and detect anomalies in real time. For instance, AI systems can scrutinise claims data to uncover trends indicative of fraud, enabling insurers to prevent fraudulent claims more effectively.

Founded in 1956, FICO is an American data analytics company specialising in credit scoring services. Its widely recognised FICO Score assesses consumer credit risk, playing a pivotal role in lending decisions.

Established in 1911, IBM is a multinational technology corporation headquartered in New York, the United States. The company provides a broad spectrum of products and services, including hardware, software, cloud computing, and consulting.

BAE Systems is a British multinational aerospace, defence, and security company formed in 1999 through the merger of British Aerospace and Marconi Electronic Systems. Headquartered in London, it is one of the world's largest defence contractors, offering products and services such as military aircraft, naval vessels, cybersecurity solutions, and advanced electronics.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other major players in the insurance fraud detection market are SAS Institute, Experian, Lexisnexis, Iovation, Friss, SAP, Fiserv, and ACI Worldwide, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 6.77 Billion.

The insurance fraud detection market is assessed to grow at a CAGR of 26.10% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 68.82 Billion by 2035.

The market is being driven by the growing use of advanced analysis techniques, increasing occurrence of insurance frauds, significant improvements in the cyber security infrastructure, increasing use of artificial intelligence (AI) and the Internet of Things (IoT)-enabled fraud detection solutions, and rising incidence of inaccurate claims.

The key trends boosting the market growth are stringent regulations, need for enterprises to efficiently handle massive quantities of identities, and rapid digitisation of the insurance sector.

The major regions in the market are North America, Latin America, Europe, the Middle East and Africa, and the Asia Pacific, with North America accounting for the largest share in the market.

On the basis of technology, the global insurance fraud detection market can be divided into solutions and services.

Based on organisation, the market can be divided into small and medium-sized enterprises and large enterprises.

Deployment is classified into cloud and on-premises.

Services can be divided into professional and managed services. Professional services are further segmented into consulting services, training and education, and support and maintenance.

Solutions can be divided into fraud analytics, authentication, and governance, risk, and compliance, among others.

The market can be broadly categorised based on its applications into claims fraud, identity theft, payment fraud and billing fraud, and money laundering.

The major players in the market are FICO, IBM, BAE Systems, SAS Institute, Experian, Lexisnexis, Iovation, Friss, SAP, Fiserv, and ACI Worldwide, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Technology |

|

| Breakup by Organization |

|

| Breakup by Deployment |

|

| Breakup by Service |

|

| Breakup by Solution |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share