Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Mexico bread market size reached around USD 11.44 Billion in 2025. The market is projected to grow at a CAGR of 5.40% between 2026 and 2035 to attain a value of nearly USD 19.36 Billion by 2035.

Base Year

Historical Period

Forecast Period

The growing interest in healthy and organic foods driven by the rising awareness of health is catering to the increase in demand for artisanal bread in Mexico.

Grupo Bimbo SAB de CV, Grupo Mi Pan, and Rustic Pan SA de CV are a few of the major companies in the market.

Tortillas play a major role in the Mexican diet and are considered the most popular and staple food among the economically weaker section of the population.

Compound Annual Growth Rate

5.4%

Value in USD Billion

2026-2035

*this image is indicative*

Bread refers to a baked food product made from moistened, kneaded, and fermented dough. It is available in different forms, including flat bread, leavened, loaves, buns, and rolls, among others. Bread is a staple food and an integral part of various cultures. It is also a good source of vitamin B and complex carbohydrates.

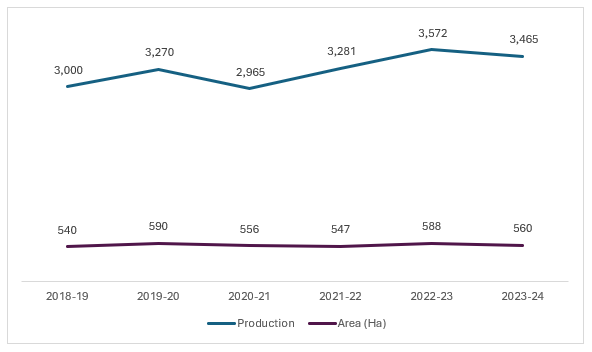

Figure: Annual Wheat Production in Mexico (2018-2024)

.

.

Mexico is experiencing a growth in wheat production, attributed to the implementation of the national plan in 2019, offering a subsidy of USD 302 per tonne up to 15 tons for wheat commodities. Through the price guarantee programme, small and medium-sized farmers receive semi-annual financial support for the production of wheat. There are over 2,200-2,500 types of bread in Mexico, with production largely concentrated in the State of Mexico, Michoacán, Veracruz, Puebla, Oaxaca, Mexico City, and Sonora.

Some of the major factors driving the Mexico bread market growth include the eating out culture and demand for healthy bread. The increasing demand for healthier, more functional breads is leading to the greater adoption of artisanal breads across Mexico. The eating-out trend and rapidly changing consumer lifestyle and expanding the demand for bread as it is primarily used for convenience meals such as wraps and sandwiches.

Growing demand for healthy bread; the rising availability of different bread types; expanding customers’ lifestyles; and the rising demand for gluten-free bread are aiding the Mexico bread market expansion

| Date | Company | Details |

| January 2023 | Grupo Bimbo | Artisanal bread brands Pullman and Plusvita launched Artesano Australiano featuring rustic crust, thicker slices, and softness. |

| September 2022 | Grupo Bimbo | Announced the launch of Cruapán, a combination of sliced bread and the croissant to its bread and pastries category. |

| Trends | Impact |

| Growing demand for artisanal and healthy breads | Breads with locally sourced ingredients such as quinoa and chia and made using less sugar are widely preferred in Mexico. |

| The trend of eating out | The eating-out trend and rapidly changing consumer lifestyle expand the demand for bread in convenience meals. |

| Availability of different varieties of bread | There are around 2,200-2,500 types of bread in the country, prepared from around 50 types of dough. |

| Escalating demand for gluten free breads | Due to rising consumer awareness, gluten-free breads and associated items are becoming popular in Mexico. |

In Mexico, Grupo Bimbo SAB de CV, Con Alimentos SA de CV (Pronto), and artisanal companies like Rustic PAN and Kind Food México Artisanal Bakery are leading bread producers. Some popular types of bread in Mexico are the bolillo, a bread similar to a French baguette; the pan dulce, a sweet bread; and the telera, a soft, spongy, savoury bread. Mexico is widely known for its sweet bread, including concha, and pan de muerto.

Furthermore, the presence of favourable government initiatives such as the national plan for subsidising the production of wheat in Mexico and the MasAgro project are anticipated to improve the production of wheat, further supporting the Mexico bread market growth. In Central Mexico, including the Mexico City metropolitan area, the bakery sector’s preference for flours rich in protein content is supporting the production of crispy and hollow bread types.

The EMR’s report titled “Mexico Bread Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Product

Market Breakup by Distribution Channel

Market Breakup by Region

Artisanal bread is expected to hold a significant market share due to the extensive presence of artisanal bakeries in the country

Artisanal bread is anticipated to hold a significant portion of the Mexico bread market share in the coming years. Mexico has the presence of about 37 thousand small artisanal bread businesses, that employ more than 1.5 million Mexicans. The superior nutrition and flavour profile of artisanal bread are further propelling its demand among Mexicans.

Sales of bread from specialist retailers are likely to increase in Mexico in the forecast period

Specialist retailers are anticipated to hold the largest market share in the coming years. The increasing desire for sweet and savoury bread is leading to the emergence of small independent specialist bread shops and larger chains like Esperanza across Mexico. Setting up bakery franchises in Mexico involves low investment and high profitability, as a result of which the country has the presence of several specialist retailer franchises. Some of the key units include Hackl Artisan Bakers, Kiko Donuts, The Trough, Sharon’s, and La Xurería, among others.

Major players in the Mexico bread market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

| Company Name | Year Founded | Headquarters | Products/Services |

| Grupo Bimbo SAB de CV | 1945 | Mexico | Offers bread under various brands including Tia Rosa, Oroweat, Mrs Baird’s, Sara Lee, El Globo, Wonder, Artesano, Fargo, Plusvita, Pullman, Pantodos, and PYC. |

| Grupo Mi Pan | 1976 | Mexico | Offers frozen breads, industrial breads, cakes, etc. |

| Rustic Pan SA de CV | ---- | Mexico | Salty breads, sweet breads, and cakes. |

| Campbell Soup Company | 1869 | United States | provides an extensive range of bread products, encompassing sandwich breads, breakfast breads, buns and rolls, frozen breads etc. |

Other key players in the Mexico bread market include Pan Rol SA DE CV, and GRUMA, S.A.B. de C.V.

Central Mexico accounts for a significant market share due to the presence of the Mexico City metropolitan area, the bakery sector’s preference for flours rich in protein content, and the rising production of crispy and hollow bread types. Mexico City is also home to four key food ordering platforms, namely Uber Eats, Sin Delantal, Rappi, and Didi Food, which drive the demand for fast foods, like burgers.

Baja California is anticipated to grow with the highest CAGR in the coming years due to the presence of key supermarkets, including Walmart, Superama, and Chedruai, selling whole wheat bread in their bakery sections. Fast-food chains in Baja California, including Burros & Fries, Beverly Burger’s, McDonald’s, and In-N-Out Burger, among others, are further fuelling the Mexico bread market expansion.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was around USD 11.44 Billion.

The market is projected to grow at a CAGR of 5.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach nearly USD 19.36 Billion by 2035.

The market drivers include government investments in bread production and the significance of bread in Mexican diet.

The key trends include growing interest in healthy and organic foods and an increase in the demand for artisanal bread in Mexico.

The different types of breads include leavened bread and flat bread.

The major distribution channels for bread include supermarkets and hypermarkets, convenience stores/variety stores, specialist retailers, and online.

The major players in the market include Grupo Bimbo SAB de CV, Grupo Mi Pan, Rustic Pan SA de CV, Campbell Soup Company, Pan Rol SA DE CV, and GRUMA, S.A.B. de C.V. among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Product |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share