Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America battery storage service market size reached a value of nearly USD 237.54 Million in 2025. The market is projected to grow at a CAGR of 13.20% between 2026 and 2035 to reach around USD 820.73 Million by 2035.

Base Year

Historical Period

Forecast Period

Favourable tax credit schemes, such as the Inflation Reduction Act (IRA) in the USA, aid the adoption of battery storage systems and consequently their services.

Altairnano, Ecoult, and General Electric Company are a few of the major companies in the market.

The rising popularity of renewable energy and the decreasing cost of battery technology aid the market for battery storage services.

Compound Annual Growth Rate

13.2%

Value in USD Million

2026-2035

*this image is indicative*

As renewable energy adoption continues to grow in the USA and Canada, the installation of utility-scale battery energy storage systems is growing. As governments across North America are focused on meeting their net zero carbon goal, they are further driving the demand for battery storage systems.

Some of the factors driving the North America battery storage service market growth are the rising adoption of renewable energy and the growing applications of battery-powered backup systems. With the rising focus on sustainability, the market for vanadium flow batteries is expected to increase owing to their high rate of recyclability.

Increasing demand for renewable energy; introduction of favourable tax credit schemes; reducing battery technology costs; and technological advancements and innovations are aiding the North America battery storage service market

Rising demand for renewable energy aids the demand for battery storage services, like construction and installation, and annual preventive maintenance.

The Inflation Reduction Act (IRA) in the USA aids the adoption of battery storage systems and consequently their services.

Reducing battery technology costs contribute to the popularity and adoption of battery storage systems in the energy market.

Implementation of the Industrial Internet of Things (IIoT) can help battery storage system operators oversee their systems remotely and enhance their overall performance.

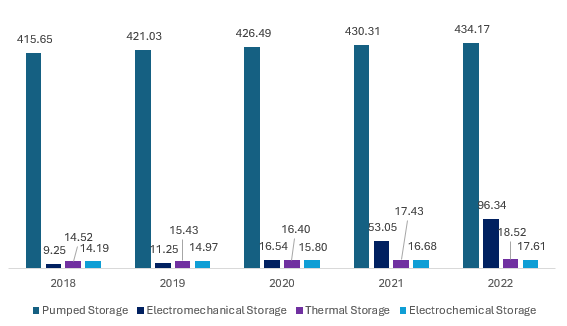

Figure: USA Energy Storage Service Market by Technology (2019-2035); USD Million

The rising demand for battery storage systems stimulates the market expansion. The rapid growth of the energy storage system (ESS) market in North America is driven by national and regional regulatory authorities and energy customers installing wind, solar PV, and other renewable energy-based power systems. Additionally, the adoption of battery-based backup power systems for industrial facilities, offices, and homes has supported the demand for battery storage systems and their services.

Furthermore, favourable tax credit schemes are likely to aid the North America battery storage service market growth. For instance, the 2023 Federal Budget in Canada introduced a 15% Clean Electricity Investment Tax Credit (ITC) supporting stationary power storage systems that eliminate the use of fossil fuels. The initiative demonstrates that Canada comprehends the role energy storage plays in its energy transition.

North America Battery Storage Service Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Service Type

Market Breakup by Deployment

Market Breakup by Battery Type

Market Breakup by Country

By deployment, offsite is expected to hold a significant market share as it helps in maximising the benefits of energy storage.

Offsite, such as SCADA maintenance, remotely monitors and controls the components of the battery storage system using a programmable logic controller (PLC). Using the human-machine interfaces, operators can monitor in real-time and issue start/ stop commands, and charging/ discharging commands for the battery management system. SCADA systems help in maximising the benefits of energy storage by providing real-time monitoring, control, and data acquisition. The rising importance of adopting SCADA systems to save time aids the North America battery storage services market development.

With the growing effort to increase the energy density of storage systems, there is also a rising risk of battery malfunctions. As a result, the demand for onsite battery management systems (BMS) is rising. The use of onsite energy storage systems by manufacturing facilities calls for the safety of workers on site. This caters to a greater deployment of services to keep the working of the battery efficient and errorless.

Lithium-ion batteries are expected to dominate the North America battery storage services market share due to their cost-effectiveness

By battery type, lithium-ion batteries are expected to hold the largest market share as the majority of storage systems currently operational rely on lithium batteries. Due to their cost-effectiveness and high efficiency, lithium-ion batteries are a popular choice. Lithium batteries offer the most economically viable option for storage periods, ranging from 30 minutes to three hours.

To store electricity when supplies are abundant, the demand for flow batteries, an electrochemical device, is increasing. Power stacks and balance-of-system components in flow batteries require greater routine maintenance to ensure that their performance does not degrade within the project's lifetime.

Major players in the North America battery storage service market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

Glidepath Federal Solutions LLC was founded in 2017 and is headquartered in the United States. It distinguishes itself as a proficient owner-operator and all-encompassing developer of eco-friendly energy and storage infrastructures.

Convergent Energy and Power, headquartered in the United States, was founded in 2011. It offers a wide range of services and solutions, including smart grid applications, grid-scale project development, interconnection and permitting services.

ZGlobal Inc was founded in 2005 and is headquartered in the United States. It offers a comprehensive array of specialized services, which include power engineering, market analytics, portfolio and risk management, infrastructure development, and energy scheduling.

General Electric Company, founded in 1892, is headquartered in the United States. The company provides battery storage services through its extensive range of Reservoir Solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the North America battery storage service market include Stem, Inc., Fluence Energy, Inc., OCI Solar Power LLC, and CODA Energy Holdings LLC, among others.

The United States of America accounts for a significant market share due to the wider adoption of flow batteries. An increase in the adoption of flow batteries provides an opportunity for services like annual maintenance, new air filters and topping off the electrolyte. Battery storage systems are flexible and crucial to meet the energy needs of various stakeholders, such as energy markets, utilities, and customers in the USA.

The Canadian market, meanwhile, is driven by the growing government investments in renewable energy. In its 2023 federal budget, the Canadian government included a 15% refundable tax credit for investments in stationary power storage systems that do not make use of fossil fuels. Additionally, the governments of Canada and Ontario are working together to develop the largest battery storage project in the country, the 250-megawatt (MW) Oneida Energy storage project, propelling the North America battery storage service market expansion.

Warehousing and Storage Market

Online Trading Platform Market

Optical Brightening Agents Market

Contract Lifecycle Management Software Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was nearly USD 237.54 Million.

The market is projected to grow at a CAGR of 13.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 820.73 Million by 2035.

The major market drivers include government investments in renewable energy and the growing popularity of lithium-ion batteries.

The key trends include the growing adoption of renewable energy and technological advancements and innovations.

The different types of batteries include lithium-ion battery and flow battery, among others.

Major deployments of battery storage services include onsite and offsite.

The major players in the market include Glidepath Federal Solutions LLC, ZGlobal Inc, Convergent Energy and Power, General Electric Company, Stem, Inc., Fluence Energy, Inc., OCI Solar Power LLC, and CODA Energy Holdings LLC, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Service Type |

|

| Breakup by Deployment |

|

| Breakup by Battery Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share