Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America laminate flooring market attained a volume of 135.40 Million Sq. Metres in 2025. The industry is further expected to grow at a CAGR of 3.50% between 2026 and 2035 to reach a volume of almost 191.00 Million Sq. Metres by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3.5%

Value in Million Sq. Metres

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The industry in North America is the largest market for laminated flooring owing to the emerging renovation activities in the region. Furthermore, various initiates are being taken by the government to revive and restore several educational and public buildings, consequently enhancing the industry growth for laminate flooring. The rising global concerns regarding the usage of timber and new technological innovations will continue to propel the market growth in the upcoming years.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The laminate flooring is referred to as a durable and versatile flooring solution, composed of melamine resin and fibreboard materials. It contains four layers, namely wear layer, the core layer, design layer, and back layer, which are blended using intense heat and pressure. Currently, it is available in a wide variety of designs and colours, which enhance its aesthetic appeal among users. Due to its resistance power against scratching, staining, denting, and fading, the product has gained preference as a flooring material over the years.

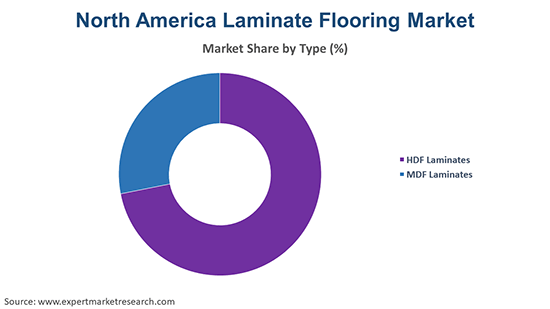

On the basis of type, the laminate flooring industry is bifurcated into:

On the basis of sector, the industry is divided into:

The report also covers the regional markets of laminate flooring like:

The laminate flooring industry in North America is driven by the ease of installation of the product, which reduces the intermediary of skilled labour and is comparatively an economically smart option as compared to the solid hardwood, engineered wood, and stone floor coverings. The product can even replicate tiles, stones as well as wood patterns, offering great diverse options for the customers. Furthermore, the growing population and enhancing standards of living have led to a rise in the demand for modern housing, especially in emerging nations, which has consequently contributed to the growth of the industry. Besides, significant investments in the real estate sector, increasing construction activities, and the escalating demand for wood-based flooring materials have flourished the growth of the industry globally. The industry is further aided by the rising introduction of laminate flooring with advanced features, such as better wear layers, custom prints and designs, high-quality visuals, enhanced locking mechanisms, and improved chemical resistance.

The report gives a detailed analysis of the following key players in the laminate flooring industry in North America, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

Saudi Arabia Vinyl Flooring Market

Australia Industrial Flooring Market

North America Vinyl Flooring Market

India Vinyl Flooring Market

United States Flooring Market

Laminate Flooring Market

Outdoor Flooring Market

Vinyl Flooring Market

Wood Flooring Market

Bamboo Flooring Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the North America laminate flooring market reached a volume of 135.40 Million Sq. Metres.

In the forecast period of 2026-2035, the market is projected to grow at a CAGR of 3.50%.

By 2035, the market is estimated to attain a volume of nearly 191.00 Million Sq. Metres.

The market is being driven by the increasing living standards, ease of installation of laminate flooring, and increasing construction activities.

The increasing demand for customised and wood flooring, surging investments in the real-estate sector, and the rising demand for modern housing are the key trends fuelling the market development.

The major countries of laminate flooring in North America include the United States of America and Canada.

HDF laminates and MDF laminates are the major types of laminate flooring.

The significant sectors of laminate flooring considered in the market report are residential and commercial.

The major players in the market are Armstrong Flooring, Inc., Shaw Industries, and Tarkett, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Sector |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share