Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global oilfield services market size was valued at USD 331.91 Billion in 2025. Growing rig count and capital reinvestments by upstream players in unconventional basins, particularly the Permian and Haynesville, are significantly increasing demand for drilling fluids, cementing, and directional services, particularly in North America. As a result, the market is expected to grow at a CAGR of 6.50% during the forecast period of 2026-2035 to reach a value of USD 623.04 Billion by 2035.

Global market growth is also propelled by increasing exploration activity and robust recovery in upstream investments. As of 2023, global upstream oil and gas expenditure reached USD 538 billion according to Rystad Energy. This resurgence has been the result of sustained efforts by governments like the United Kingdom’s North Sea Transition Authority, which approved 27 oil and gas exploration licences in 2023. The revival reflects a re-balancing act between energy security and decarbonisation goals.

Innovative technological integrations are further shaping the oilfield services market dynamics. For example, digital twin technologies in rig operations and AI-based predictive maintenance solutions are reducing downtime. Saudi Arabia's National Industrial Development and Logistics Programme has made large investments into oilfield infrastructure to boost localisation of services, targeting local content by 2030. Such programmes are pivoting oilfield services from traditional models to tech-forward ecosystems that support long-term resilience.

Emerging regions like Sub-Saharan Africa are also receiving increased foreign direct investments, with TotalEnergies and Shell actively engaging in seismic and offshore operations, boosting the overall oilfield services market development. The shifting landscape is making room for mid-size players to tap into niche opportunities. As the energy sector continues to evolve, the role of oilfield service providers becomes even more strategic as suppliers and as enablers of digital and sustainable field development.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.5%

Value in USD Billion

2026-2035

*this image is indicative*

Digital technologies are defining the future of the oilfield services industry. Companies like BP and Halliburton have adopted AI-driven production optimisation systems that integrate real-time data analytics with cloud computing. These systems have reduced downtime to a significant extent. In March 2023, the United Kingdom government allocated EUR 100 million to support digital transformation in upstream energy, facilitating enhanced reservoir modelling and remote operations. Digital twins, automation, and edge computing are improving well performance, especially in mature fields. These innovations enable operators to extend asset life, reduce operating costs, and improve field economics across both onshore and offshore assets.

The introduction of hybrid technologies in offshore operations is redefining the oilfield services market trends. In February 2022, Petrobras launched a new subsea processing system using low-energy separation technology, reducing emissions. Moreover, Equinor’s tieback projects in the North Sea are creating room for leaner operational models in offshore environments. The continued emergence of floating production storage and offloading (FPSO) units is also supporting modular field developments and reducing time-to-market for deepwater projects.

As per the oilfield services market report, national programmes are increasingly prioritising domestic oilfield capabilities. Saudi Aramco’s IKTVA programme and Nigeria’s Nigerian Content Development Act are reshaping market dynamics by mandating minimum local content thresholds. This shift is encouraging joint ventures and capacity-building within local firms. Such efforts are ensuring supply chain security while reducing logistics costs. Governments are giving tax reliefs and long-term contracts to firms meeting localisation criteria.

The bundling of services under integrated contracts is fast gaining traction in the global industry. Operators are shifting towards full-field lifecycle contracts to simplify procurement, reduce interface risks, and gain performance-linked pricing. In April 2025, ADNOC Offshore awarded a five-year integrated drilling services (IDS) contract worth USD 1.63 billion, covering everything from well design to execution. These models have become attractive as they ensure project continuity and reduce downtime to a significant extent. The integration of seismic, drilling, and completion services into single workflows is particularly valuable for large offshore and frontier basin developments. This structure allows service providers to optimise operational timing, reduce non-productive time, and enhance safety outcomes, accelerating the oilfield services market growth.

Environmental mandates are steering the market towards greener methods. Baker Hughes, for example, offers a zero-flaring well testing technology that captures emissions on site. Similarly, Weatherford offers biodegradable drilling fluids in shale plays. Norway’s government-backed LowEmission research centre is collaborating with oilfield service firms to develop carbon-negative cementing solutions. ESG scoring is now embedded in procurement decisions for international E&P firms. As COP28 outcomes push for methane reduction, service providers that offer carbon capture at the wellsite, electrified drilling rigs, or waterless fracking systems are seeing preference in tenders.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The oilfield services market trends reflect ongoing changes driven by technological innovation, shifting energy consumption patterns, and the need for higher operational efficiency. Oilfield service providers are increasingly focusing on digital oilfield technologies, automation, and advanced data analytics to enhance drilling performance, reservoir evaluation, and production management. The adoption of artificial intelligence, IoT-based monitoring systems, and smart equipment is helping companies improve decision-making, reduce downtime, and optimize overall field operations. Rising investments in offshore exploration and deepwater projects continue to support demand for specialized oilfield services across key oil-producing regions.

In addition, environmental responsibility and regulatory standards remain important factors influencing oilfield services market trends. Companies are implementing sustainable practices such as emissions control solutions, efficient water management, and low-impact drilling techniques to meet global compliance requirements. Market participants are also emphasizing cost optimization, integrated service offerings, and strategic collaborations to manage oil price volatility and remain competitive.

The EMR’s report titled “Global Oilfield Services Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

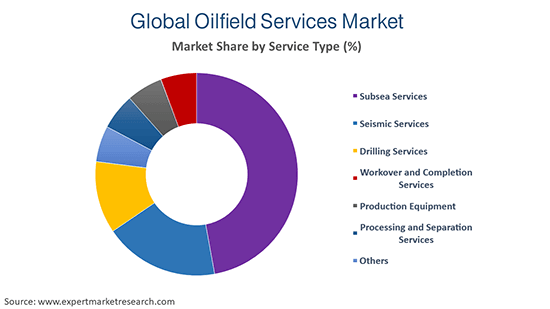

Market Breakup by Service

Key Insight: The services considered in the market report include drilling, subsea, seismic, completion, production equipment, and processing services. Drilling remains vital due to operational necessity, while the subsea segment is boosted by innovation. Seismic and processing services are growing due to enhanced imaging and reservoir analytics. Workover services gain traction in mature fields. Completion services benefit from new horizontal well technologies.

Market Breakup by Type

Key Insight: The oilfield services market report considers equipment rental, field operation, and analytical services. Field operations lead in volume due to integration into routine workflows. Analytical services are expected to emerge as the fastest-growing category with the rise in data-heavy and net-zero mandates. Equipment rental remains critical for cost-efficient asset mobilisation. Each category supports unique demands across drilling, completions, and production phases.

Market Breakup by Application

Key Insight: Both onshore and offshore operations boost the oilfield services market opportunities. Onshore remains dominant due to quicker payback periods. Offshore, however, is expanding fast with technological upgrades and policy support. Each serves distinct geological and economic needs. Offshore projects, especially in ultra-deepwater zones, are gaining momentum due to enhanced drilling capabilities, reduced costs, and increased energy demand.

Market Breakup by Region

Key Insight: Regionally, North America continues to stimulate the oilfield services demand growth, by its robust infrastructure, advanced technologies, and sustained investment in shale and tight oil exploration. The Middle East and Africa are witnessing strong growth, primarily fuelled by large-scale greenfield developments, particularly in Saudi Arabia, UAE, and offshore West Africa. Europe, in contrast, concentrates on revitalising mature oilfields, utilising enhanced oil recovery (EOR) techniques and digital optimisation. Meanwhile, Asia Pacific and Latin America are making strategic progress through revised licensing frameworks and regulatory reforms that attract foreign investment.

By Service, Drilling Services Account for the Significant Share of the Market

Drilling services dominate the global market due to their indispensable nature in both conventional and unconventional fields. Recent advances such as rotary steerable systems (RSS) and managed pressure drilling (MPD) are revolutionising how drilling is conducted in high-pressure reservoirs. In May 2018, United States Department of Energy committed USD 7 million for cost-shared research and development in unconventional oil and natural gas (UOG) recovery, indirectly benefitting global service providers. Integrated platforms are now being used to combine rig data and downhole sensor feedback in real-time. These advances are reducing non-productive time and lowering drilling risks.

The subsea services category is witnessing accelerated growth in the oilfield services market, driven by deepwater and ultra-deepwater projects off the coasts of Brazil, Guyana, and Angola. With companies like Aker Solutions and TechnipFMC introducing modular subsea compression systems, installation time has dropped significantly. Further, the United Kingdom Export Finance recently supported a USD 400 million package to aid subsea operations in Ghana. Robotics and autonomous underwater vehicles (AUVs) are now routinely deployed for inspection and repair, minimising human risk. The rapid evolution of compact, all-electric subsea systems is reducing emissions while allowing better control of remote wells.

By Type, Field Operation Dominates the Global Market

Field operation services have largely contributed to the global market value, covering everything from equipment deployment to site logistics. Recent enhancements in real-time crew scheduling, IoT-driven maintenance alerts, and safety management are giving operators better control. Such advancements lower operational risk and increase efficiency. Governments in the Middle East and Latin America are also funding workforce upskilling initiatives, allowing smoother operations. Field operation remains dominant due to its integration across the upstream lifecycle, and its increasing alignment with digital asset management systems.

With more complex field development challenges, analytical and consulting services are surging the overall demand in the oilfield services market. These include reservoir simulation, energy transition planning, and ESG compliance advisory. Schlumberger’s Delfi digital platform, for instance, provides reservoir models with predictive analytics capabilities. The United Kingdom government has encouraged consultancy-led low-carbon field plans through its Net Zero Technology Centre. These services help firms maximise recovery while aligning with sustainability goals.

By Application, Onshore Operations Occupy a Substantial Share of the Market

Onshore fields hold the majority market share due to their logistical simplicity and cost benefits. In countries like the United States, China, and Argentina, onshore shale activity remains strong. AI-based geo-steering tools and pad drilling techniques are increasing productivity in tight oil plays. Governments are supporting these developments with licensing incentives and infrastructure upgrades. For instance, India's Discovered Small Field (DSF) policy encourages faster monetisation of marginal fields. The wide adoption of electric fracturing units is making onshore development more sustainable.

Offshore projects, especially deepwater, are gaining pace in the oilfield services market share due to recent large discoveries like the Nokhatha and Julaiah fields in Kuwait, the Mopane field in Namibia, and the Baleine field in Ivory Coast along with cost rationalisation. Offshore fields often contain large, untapped resources, presenting significant opportunities for production growth. These operations benefit from advanced technological innovations such as subsea drilling and floating production systems, allowing for deeper exploration and more efficient extraction. Asia Pacific nations like Malaysia and Indonesia are also offering production sharing contracts for offshore blocks. Floating LNG and all-electric subsea architecture are transforming cost dynamics.

By Region, North America Secures the Largest Market Share

North America continues to dominate the global industry with its advanced infrastructure. Innovations such as autonomous drilling rigs and smart completions are widely deployed. The United States and Canada also offer favourable royalty regimes and pipeline connectivity. Massive investments in the Permian Basin, coupled with energy independence drives, are sustaining activity. Government programmes supporting CO2 capture and enhanced oil recovery are integrating environmental goals into field development. The region’s mature ecosystem enables rapid adoption of new technologies and supports oilfield service consumption.

Growth in the Middle East and Africa market is boosted by investments with projects in Saudi Arabia, UAE, and Angola. Saudi Aramco is executing multi-billion-dollar field expansions aligned with Vision 2030. Governments are introducing local content laws and tax reforms to attract investors. Infrastructure upgrades like FPSOs and modular rigs are helping bypass traditional constraints. These regions are experiencing the highest growth due to project pipeline maturity, political support, and increased accessibility to service technologies.

Global oilfield services market players are aligning with operators through long-term integrated service agreements and innovation partnerships. The focus has moved to digital enablement of rigs, remote surveillance, and carbon-conscious operations. Players are investing in modular and mobile units to target marginal fields with shorter life cycles. There is also a surge in M&A activity to consolidate capabilities in analytics, automation, and sustainable chemistry.

Growth opportunities for oilfield services companies lie in developing regions with untapped reserves and in brownfield optimisation through smart services. Agile firms offering bundled and scalable solutions stand to benefit most. With technological advancements and a focus on efficiency, safety, and sustainability, leading companies are driving innovation and ensuring the successful extraction of oil and gas resources across diverse geographies and environments. Their expertise is vital in meeting the growing global energy demand.

Schlumberger Limited, founded in 1926, headquartered in Houston, United States, delivers cutting-edge digital solutions like the Delfi platform, transforming reservoir modelling and predictive analytics in complex fields. Their investment in AI and carbon technology is widening their lead.

Founded in 1941, Weatherford International plc, based in Houston, provides integrated well services with a sharp focus on automation and remote operations. The company’s Vero automated connection integrity tool is now used in over 25 countries.

Established in the year 1908, Baker Hughes Company, headquartered in Houston, is innovating zero-emission well testing and hydrogen-ready compressors. The firm collaborates with Aramco on AI-driven reservoir insights under long-term contracts.

Halliburton Energy Services, Inc., founded in 1975, leads in managed pressure drilling and has launched a live digital operations centre for wellbore monitoring. The company is expanding in Africa with new modular service bases.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are China Oilfield Services Limited, Ranger Energy Services, Inc., SLB, Superior Energy Services, NOV, ARCHER OILFIELD ENGINEERS, Expro Group, and TechnipFMC plc, among others.

Explore the latest trends shaping the global oilfield services market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on oilfield services market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the oilfield services market reached an approximate value of USD 331.91 Billion.

The market is projected to grow at a CAGR of 6.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 623.04 Billion by 2035.

Key strategies driving the market include investing in digital platforms, local talent development, and emission-reducing technologies while pursuing integrated contracts and agile delivery models.

The key market trends include the growing prevalence of shale gas and the increase in investments in offshore activities.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The dominant types of oilfield services include equipment rental, field operation, and analytical and consulting services.

The leading service types include subsea services, seismic services, drilling services, workover and completion services, production equipment, and processing and separation services, among others.

The applications include onshore and offshore.

The key players in the oilfield services market include Schlumberger Limited, Weatherford International plc, Baker Hughes Company, Halliburton Energy Services, Inc., China Oilfield Services Limited, Ranger Energy Services, Inc., SLB, Superior Energy Services, NOV, ARCHER OILFIELD ENGINEERS, Expro Group, and TechnipFMC plc, among others.

The leading segments of oilfield services encompass equipment rental, field operations, and analytical and consultancy services.

The North America region held the largest share in the market.

Oilfield services are crucial for exploration, production, maintenance, and efficient operation of oil and gas extraction processes.

The key challenges are volatile commodity prices, skilled labour shortages, and ESG pressures are challenging margins. Regulatory uncertainties and geopolitical tensions add further complexity to project execution and service contract visibility.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Service |

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share