Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global organic acids market was valued to reach a market size of USD 31.49 Billion in 2025. The industry is expected to grow at a CAGR of 6.90% during the forecast period of 2026-2035. Organic acids have a significant economic role and range of applications, including pharmaceuticals, moving markets, food, chemical processes, and assisting technological developments. Also, use of organic acids is expected to grow with growing consumer demand for organic foods. North America, Europe and Asia Pacific are likely to be major markets, thus aiding the market growth to attain a valuation of USD 61.37 Billion by 2035.

Base Year

Historical Period

Forecast Period

In Japan, about 59% of its dairy cows are confined within Hokkaido and growing demand for such a silage additive such as Lupro-Cid NA evidence the increased adoption rate of organic acids within feeds for quality improvement as well as animal health promotion. Thus, this increases the demand for organic acid in the agricultural market and aids in boosting the growth of the organic acids market.

Organic acids-which are basically citric acid, lactic acid, malic acid as well as succinic acids-are currently being rapidly used within the food and drinks industry to prolong shelf-life, boost flavors, thus ensuring food safety. The demand for organic acids is growing constantly as one of the essential requirements in packaged food and related processed items.

The rising focus of sustainability with increasing environmental regulations has hastened the development of the demand for biodegradable plastics, for which organic acids are significantly important in this trend. Organic acids such as lactic acid are produced to manufacture environment-friendly materials called PLA, or polylactic acid, replacing traditionally used plastics. This kind of switch is substantially responsible for elevating the market growth in organic acids especially in environmental conscious industries.

Compound Annual Growth Rate

6.9%

Value in USD Billion

2026-2035

*this image is indicative*

Organic acids market shows great growth potential with an array of diverse applications including food and beverages, agricultural, pharmaceuticals, and plastics. Such acids like citric, lactic, acetic, and formic are necessary ingredients in food preservation, improving flavor, and serving as the main material for bioplastic production. A growing demand in the food and beverage sector due to consumers preferring organic acids as a natural preservative and clean-label products drives the market. Organic acids in the agricultural sector, too, are becoming increasingly important for silage additives and crop protection, thereby promoting organic acids market growth.

Organic acids opportunities are driven by the sustainability trend. Organic acids find applications in biodegradable plastics, especially polylactic acid (PLA), which is increasingly being adopted as an environmentally friendly alternative to petroleum-based plastics. Advances in biotechnological production methods are now opening new avenues of low-cost and sustainable organic acid production.

Versatility, however, is seen in such trends as increased demand for organic acids in animal feed, pharmaceuticals, and personal care products. Their rising adoption in green technologies and sustainable solutions in most industries will thus benefit as regulations on synthetic chemicals get tighter.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Two of the key growth drivers for the organic acid market are the rising demand for bio-based chemicals and the increasing applications in various industries, thus shaping the growth of organic acids market. Bio-based organic acids from renewable resources are gaining traction as consumers and industries look for sustainable alternatives. Moreover, the food and beverages, pharmaceuticals, and agriculture industries need organic acids for preservation, flavoring, and pH regulation. This demand is further fueled by government policies that promote sustainability and the growing consumer preference for eco-friendly products.

The organic acids market is driven by sustainable production, biodegradable plastics, agricultural applications, and growing demand in food and beverages, reflecting eco-conscious and health-focused trends.

The organic acids market is increasingly shifting towards sustainable and environment-friendly production technologies. With the advancement of biotechnology and renewable feedstocks, such as plant-based sugars, organic acid manufacturing is becoming less harmful to the environment. For instance, Cargill has been focusing on producing lactic acid from renewable resources, which could be used in bioplastics and other green applications. This trend is inline with the global sustainability goals; hence, manufacturers and consumers are looking for eco-friendly alternatives to traditional chemical processes, which is driving the demand for organic acids in eco-conscious markets, thus augmenting the organic acids demand growth.

Organic acids, especially lactic acid, are increasingly being used to produce biodegradable plastics like polylactic acid (PLA), which is an alternative to petroleum-based plastics. The growing focus in the world on plastic waste reduction and sustainability is also helping in promoting the organic acids market. Companies like NatureWorks are at the forefront of this trend as they produce PLA, which is made from lactic acid. With more and more consumers and businesses seeking more sustainable packaging solutions, it is expected that demand for organic acids in biodegradable plastics production.

Organic acids are widely used in animal feed and agriculture, mainly to improve the health of animals and crops. Formic acid is used in silage additives, which enhances the quality and digestibility of feeds for livestock. Organic acids are used in agriculture as natural pesticides and preservatives. The factors driving the demand for organic acids in agriculture include the rising organic farming industry and a growing demand for healthier, antibiotic-free livestock, thus placing organic acids at the heart of increasing productivity and sustainability in food production systems, thereby boosting the organic acids market revenue.

Organic acids are constantly in demand because of the role they play in the food and beverage industry for preservation, flavor enhancement, and quality maintenance. Citric acid is one of the organic acids widely used in beverages, confectioneries, and processed foods for their tart flavor and preservative qualities. With the increase in natural and clean-label products being sought by consumers, natural sources of organic acids have been preferred over synthetic chemicals. This trend is quite notable regarding the growing demand for healthier, organic, and plant-based foods, thereby increasing the demands of the organic acids market.

Significant attention has been given to organic acids owing to their significant nutritional value and antimicrobial advantages. Key nations in the production scene for feed acidifiers include USA, Brazil, China, Japan, and Mexico; demand is growing in places like the Middle East, Latin America, and Asia-Pacific.

Good-quality forage is important to high milk yield and efficacy, shaping new organic acids market opportunities. Leading companies provide solutions to optimize nutrient content and harvested feed quality and enhance hygiene of by-products and farm-produced compound feed. Bad-quality forage may cause disease. Companies like BASF provide organic acids that offer advantages such as efficacious silage of difficult crops, decent silage for other feed types difficult to ensile, and higher intake of feed and energy. Such solutions are expected to boost the global organic acids market.

One of the most significant technologies transforming the organic acid market is renewable bio-based organic acid production through resources such as plant biomass or agricultural waste, shaping new organic acids market dynamics and trends. Significant microbial fermentation process advances, especially for genetically modified bacteria and yeast, allow for a more sustainable and economic form of production. These allow it to move away from dependence on petrochemical-based processes and to improve efficiency. Companies such as BASF and Archer Daniels Midland are investing in these innovations, keeping up with rising demand for sustainable production practices from industries such as food, pharmaceuticals, and agriculture.

Organic acids are used in stimulation treatments of gas and oil wells, shaping new trends in the organic trends market. These acids are thought to be less reactive to mineral acids, which makes them a better alternative for corrosion treatment and prevention in industries. Organic acids are suggested for use in environments with high temperatures, or in cases of protracted contact between acid and pipe.

Organic acids such as citrate and lactate are employed as buffer solutions. Other types, such as citric and oxalic acids, are said to be useful in rust removal. Organic acids are more useful in their dissociated form as they have the capability of chelating metal ions, speeding up rust removal. Due to these features, organic acids are a reliable solution to prevent and mitigate corrosion in metal and other constructions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

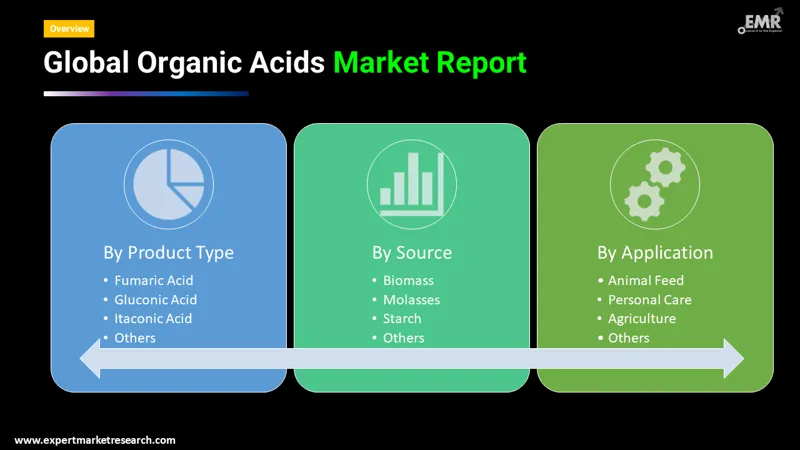

“Organic Acids Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

By type, the market is classified into:

By source, the market is segmented into:

By application, the market is divided into:

By region, the market is classified into:

By Type Analysis

As per organic acids market analysis, acetic acid, lactic acid, citric acid, fumaric acid, gluconic acid, and itaconic acid hold increasing market shares of the organic acid market, widely used in food, pharmaceuticals, and industrial applications. Acetic acid is generally produced for food preservation and for manufacture of vinegar. Lactic acid has increasing demand in the food and cosmetic industries, and citric acid is used in beverages as well as cleaning agents. Food and polymer use make up most of fumaric acid applications while gluconic acid serves a need in health and cleaning agents. Itaconic acid usage is gaining, especially to be applied to biodegradable plastics and green solutions. Thus, all the aforementioned end markets require alternative, green options, propelling the market growth.

Market Analysis by Source

With growing demands on sustainability, organic acid sources are picking up steam from molasses, biomass, chemical synthesis, starch, and agro-industrial residue. Molasses and biomass are cost-effective and renewable sources. The chemical synthesis is popular to produce high-quality acids; starch and agro-industrial residue are emerging low-cost alternatives. Technological advancements in biotechnology are improving the efficiency of biomass and residue-based production methods, supporting greener processes. These sources meet the increasing demand for organic acids in various industries.

Application Insights

As per organic acids industry analysis, organic acids are increasingly being applied in various applications because of the numerous benefits they offer. In animal feed, organic acids such as citric acid and formic acid enhance feed preservation and digestion, thus reducing microbial growth and enhancing animal health. In food and beverages, citric and lactic acids are essential for flavor enhancement and preservation. In pharmaceuticals, organic acids such as fumaric acid find application in drug formulation to enhance stability. Organic acids, such as acetic acid, are applied in agriculture for pest control and enhancing plant growth.

North America Organic Acids Market Opportunities

The North America organic acids market is boosted by increasing demand in animal feed and food preservation. The United States Department of Agriculture supports bio-based initiatives to reduce synthetic preservatives. Organic acids are increasingly being used in Canada's agricultural sector for improved feed efficiency, in line with its goals of sustainable farming. The region's focus on renewable sources for organic acid production aligns with global sustainability trends, further bolstering its competitive position in the market.

Asia Pacific Organic Acids Market Trends

The organic acids market in the Asia Pacific is on an upswing due to industrialization and rapid urbanization of countries such as China and India. Food & beverage in the region emphasizes health-conscious food products that are on a rise, besides which the various countries are investing in biotechnological development to produce organic acid. Increased farming activities have also increased with feed preservatives demand growing rapidly.

Europe Organic Acids Market Dynamics

Organic acids in Europe are majorly dictated by stringent environmental laws, which facilitate the production of environmentally friendly products. Organic acids market in this region is expected to rise, with a major demand in pharmaceutical and food industries, where they serve as natural preservatives and functional elements. Other drivers that advance the organic acids market are the EU's Green Deal and plans for sustainable agriculture.

Middle East and Africa Organic Acids Market Drivers

Demand for organic acids is increasing in the food preservation and feed application market in the Middle East and Africa, hence expanding the market. Improving food security remains a priority for governments, as is well portrayed in South Africa, which aims to increase agricultural productivity. Organic acids, particularly citric and lactic acid, have increased industrial usage.

Latin America Organic Acids Market Insights

Organic acids are gaining popularity in Latin America due to the emerging food & beverage sector. Brazil and Argentina are leading producers, driven by the increasing consumption of processed and convenience foods. Rising health concerns among consumers are increasing demand for natural preservatives, thereby opening growth opportunities for organic acids.

Organic acids market players are focusing on developing bio-based production methods, enhancing product quality, and expanding applications across food, pharmaceutical, and agricultural industries. Sustainability is emphasized by investments in renewable feedstocks and green chemistry. The organic acids companies are looking to meet increasing demand for organic acids in preservatives, animal nutrition, and bioplastics while meeting stricter regulatory standards. It focuses on increasing market presence and achieving global environmental goals by way of partnerships and regional expansion.

BASF SE was originally founded in 1865 as a Ludwigshafen, Germany-based company that primarily manufactures organic acids such as formic, citric, and propionic acids. Its products for food preservation, animal nutrition, and industrial processes highlight an emphasis on green production for sustainability.

Founded in 1918 in Dallas, Texas, Celanese Corporation is the largest producer of acetic acid, catering to the food, adhesives, and textile industries. Advanced manufacturing technology used ensures high-quality scalable solutions.

Dow Chemical Company, founded in 1897 and headquartered in Midland, Michigan, produces organic acids like acrylic acid for coatings, adhesives, and chemical intermediate uses. Its innovativeness is seen to follow circular economy principles and environmental stewardship principles.

Eastman Chemical Company was founded in 1920 and has its headquarters in Kingsport, Tennessee. It provides organic acids, such as acetic acid, to industries like packaging, coatings, and pharmaceuticals. They focus on sustainability and green chemistry for multiple applications.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other organic acids market players includeMyriant Corporation, and Henan Jindan Lactic Acid Technology Co. Ltd., among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The organic acids market is assessed to grow at a CAGR of 6.90% between 2026 and 2035.

The major market drivers is the growing increasing usage of organic acid in the food and beverage and pharmaceutical industries.

The key market trends include applications of organic acids in creating biodegradable plastics, encouragement by governments to use organic acids, and applications in textiles.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The various product types in the market for organic acids include acetic acid, lactic acid, citric acid, fumaric acid, gluconic acid, and itaconic acid, among others.

The various sources of organic acids in the market include molasses, biomass, chemical synthesis, starch, and argo-industrial residue.

The different applications in the market for organic acids include animal feed, food and beverages, pharmaceuticals, chemical and industrial, agriculture, and personal care, among others.

The major players in the organic acids market are Celanese Corporation, BASF SE, Eastman Chemical Company, Dow Chemical Company, Henan Jindan Lactic Acid Technology Co. Ltd., and Myriant Corporation, among others.

Organic acids create a protective layer between oxygen and food, acting as an antibacterial agent and extending the shelf life by preventing growth of foodborne pathogens and microorganisms that could spoil the food.

In 2025, the market reached an approximate value of USD 31.49 Billion.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 61.37 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Source |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share