Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global smart lighting market size reached a value of USD 19.50 Billion in 2025 and is projected to grow significantly in the coming years. The market is further expected to grow at a CAGR of 20.00%, reaching a value of approximately USD 120.74 Billion by 2035.

This growth is driven by the increasing adoption of smart lights, which offer energy-efficient solutions and advanced control features. IoT devices play a crucial role in enhancing the functionality of smart lighting, enabling users to manage ambient lighting, adjust brightness, and create dimmable settings through various platforms. Smart lighting systems are increasingly incorporating voice-controlled features, with integration with popular smart assistant platforms. The use of WiFi, Bluetooth, SmartThings, ZWave, and ZigBee technologies allows for seamless connectivity and user-friendly operation. With smart lights becoming more versatile and efficient, the smart lighting market presents various avenues for market growth and technological innovation in the coming years.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

20%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The smart lighting market is rapidly expanding, driven by the increasing demand for connected lighting solutions. Smart lighting technologies, including smart street lights, offer energy efficiency and enhanced control. These systems leverage IoT devices to enable remote management and automation. Sensors integrated into smart lighting systems play a key role in optimising energy usage by adjusting lighting levels based on ambient conditions. The integration of these advanced technologies enhances the functionality and efficiency of smart lighting, allowing for more sustainable and convenient solutions in both residential and commercial settings. With growing urbanisation and a focus on sustainability, the adoption of smart lighting and connected lighting systems is set to continue its upward trajectory in the coming years.

| Global Smart Lighting Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 19.50 |

| Market Size 2035 | USD Billion | 120.74 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 20.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 23.1% |

| CAGR 2026-2035 - Market by Country | India | 26.5% |

| CAGR 2026-2035 - Market by Country | China | 22.1% |

| CAGR 2026-2035 - Market by Offering | Hardware | 22.4% |

| CAGR 2026-2035 - Market by Light Source | LED Lamps | 22.6% |

| Market Share by Country 2025 | UK | 3.3% |

The smart lighting market is witnessing significant growth, driven by the increasing demand for energy conservation and environmental protection. Traditional incandescent lamps are being replaced by LED smart lighting, which offers more energy-efficient and sustainable alternatives. LED lights, particularly LED smart lights, are transforming the lighting industry by reducing energy consumption and minimising greenhouse gas emissions. As LED technology continues to advance, it plays a crucial role in lowering carbon footprints, further promoting energy efficiency. The smart lighting segment of the market, which includes smart-controlled LED lights, is expected to grow as more consumers and businesses adopt these solutions. The shift to LED smart lighting not only helps reduce greenhouse gas emissions but also provides long-term cost savings. With growing concerns about environmental impact and the need to mitigate greenhouse gas emissions, the adoption of LED smart lighting is poised to shape the future of the lighting industry.

The smart lighting market is rapidly expanding, driven by the increasing penetration of smart lights across residential, commercial, and urban applications. The adoption of smart lighting has been accelerating due to the growing demand for energy-efficient solutions and enhanced control. One of the key drivers of this growth is the shift from traditional incandescent lamps to more efficient LED-based smart lights, which offer greater longevity and lower energy consumption. Smart lighting companies are capitalising on this demand, offering innovative solutions that integrate with other smart home technologies. The rise of LED-based smart lights has further been supported by the adoption of IoT devices, enabling users to control their lighting remotely. The COVID-19 pandemic played a significant role in boosting the adoption of smart lighting, as more people looked for ways to improve home energy efficiency. Additionally, the demand for LED lights has increased due to their ability to support the transition to smart lighting and reduce overall energy consumption. As a result, the market is poised for continued growth.

The smart lighting market is expanding with the increasing adoption of smart lights in various applications. These lighting systems integrate networked components, such as sensors and Internet of Things (IoT) technology, to offer enhanced functionality. Ambient sensing capabilities enable the lighting fixtures to adjust based on environmental conditions, while voice control adds further convenience. Smart lighting systems are also becoming integral to smart lighting applications, providing seamless integration with other smart home devices. As demand for more energy-efficient and automated lighting systems grows, the market for smart lighting continues to thrive.

The smart lighting market is experiencing significant growth with the adoption of smart lighting systems across various sectors. These systems utilise both wired and wireless communication protocols, including Bluetooth, WiFi, ZigBee, DALI, EnOcean, and Sigfox, to enable seamless networking and control. The integration of lighting control modules and advanced luminaires enhances the performance of smart fixtures and smart lamps. Additionally, the rise of smart home lighting systems is contributing to the demand for more intuitive and energy-efficient solutions. As consumers seek greater control over their lighting, smart lighting systems continue to evolve, offering improved automation and connectivity for both residential and commercial environments.

The smart lighting market is driven by the widespread adoption of LED technology, with LED chips playing a crucial role in enhancing energy efficiency. LED chips are integral to the performance of LED lamps, which are gaining popularity in the household lamp segment due to their cost-effectiveness and longer lifespan. As consumers prioritise energy efficiency, LED solutions offer a more sustainable alternative to traditional lighting options. With the growing demand for smart lighting systems, LED technology continues to dominate the market, providing both economic and environmental benefits.

The global smart lighting market is seeing substantial growth as consumers and businesses increasingly adopt energy-saving lighting products. These smart lighting solutions are contributing to energy conservation by reducing dependence on non-renewable power sources. By replacing traditional lighting with more efficient technologies, such as LED-based smart lights, greenhouse gas emissions and carbon emissions are significantly lowered. This shift supports sustainable energy-saving practices, helping reduce the environmental impact of excessive energy consumption. Smart lighting systems also promote further energy conservation by providing enhanced control over lighting usage, ensuring optimal efficiency in both residential and commercial settings. As energy-saving becomes a priority, smart lighting offers an effective way to achieve sustainability goals, making it a key component in the broader push toward reducing carbon footprints and fostering a greener future.

The smart lighting market is experiencing remarkable growth, driven by the increasing adoption of smart lights across both residential and commercial sectors. Smart lighting systems offer energy-saving benefits through advanced control systems and the use of LED bulbs, which are significantly more efficient than traditional incandescent bulbs. LED lights, including LED bulbs, LED-based smart lights, and other LED forms, help reduce energy consumption and costs while providing better illumination. These systems are often integrated with sensors, which enable automatic adjustments based on environmental factors such as ambient light levels or motion detection. The integration of these sensors makes smart lighting even more efficient, allowing for optimal energy-saving lighting. However, while the benefits of smart lights are evident, compatibility concerns with older lighting systems, such as incandescent bulbs, can arise when transitioning to more modern solutions. Additionally, the use of a heat sink in LED lights enhances their longevity and prevents overheating, contributing to their longer lifespan. Despite these concerns, the continued development and refinement of smart lighting technologies are expected to drive their wider adoption, offering users a smarter, more energy-efficient way to manage lighting. As consumers increasingly prioritise sustainability and energy efficiency, the demand for smart lights and LED-based lighting solutions will continue to rise, reshaping the future of lighting across the globe.

In Australia’s smart lighting market, hardware innovations such as LED bulbs, sensors, and control systems offer significant benefits. LED technology is highly energy-efficient, reducing energy consumption and lowering electricity costs, which is especially valuable in Australia’s energy-conscious market. Smart lighting hardware, integrated with sensors, allows for automated adjustments based on environmental conditions like motion or light levels, enhancing both convenience and energy efficiency. The long lifespan of LED bulbs further reduces maintenance costs, making smart lighting a cost-effective choice. Additionally, hardware solutions enable better integration with other smart devices, offering greater control and customisation, which enhances user experience and sustainability.

Software in Australia's smart lighting market plays a pivotal role in providing advanced control and automation. With intuitive apps and interfaces, users can remotely manage and monitor their lighting systems, adjusting brightness, scheduling, and setting moods from their smartphones or smart assistants. The software allows seamless integration with other smart home systems, such as IoT devices, enabling unified control. Additionally, software optimises energy usage through data analytics, further contributing to energy conservation. The ability to update and upgrade software over time ensures that smart lighting systems remain innovative, offering long-term sustainability. In a market focused on environmental impact, software solutions enhance both functionality and energy-saving efforts.

Wired connectivity in Australia's smart lighting market offers stable and reliable connections, ensuring consistent performance without interference. It provides high-speed communication, which is ideal for large-scale installations, such as in commercial or industrial settings. Wired systems are typically more secure, as they are less susceptible to hacking compared to wireless networks. Additionally, they offer lower latency, allowing for instant response times when controlling lighting systems. For areas where wireless connectivity may be unreliable, wired solutions ensure robust and uninterrupted smart lighting operation.

Wireless connectivity in Australia’s smart lighting market offers significant flexibility and ease of installation. Without the need for extensive wiring, wireless systems are quicker and less disruptive to set up, making them ideal for both residential and commercial applications. Wireless connectivity also allows for easy scalability, enabling users to add or remove devices as needed. The integration with other IoT-enabled devices, such as voice assistants or smart thermostats, is seamless. Moreover, wireless systems can be controlled remotely, providing enhanced convenience and better energy management.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

In Australia’s smart lighting market, indoor lighting solutions offer enhanced comfort, convenience, and energy efficiency. Smart indoor lights allow users to customise lighting for various activities, from bright, focused light for reading to dim, ambient lighting for relaxation. Integrated with motion sensors, these systems can automatically adjust lighting based on occupancy, ensuring energy is not wasted in empty rooms. Additionally, voice control and mobile apps enable seamless management, offering easy adjustments without the need for manual switches. Energy-efficient LED technology reduces electricity consumption and lowers bills. The integration of smart indoor lighting with other home automation systems further increases convenience, providing a personalised, smarter home experience that aligns with sustainability goals.

Smart outdoor lighting in Australia enhances safety, security, and aesthetics. With features like motion detection, smart outdoor lights can automatically illuminate pathways, driveways, or garden areas when movement is detected, reducing the risk of accidents or intrusions. These systems can be controlled remotely, allowing users to adjust lighting brightness or create schedules for when lights should be turned on or off. Smart outdoor lights, using energy-efficient LED technology, also contribute to energy savings and reduce environmental impact. Furthermore, outdoor lighting solutions can be integrated with home automation systems, allowing for enhanced control and customisation. In the Australian market, smart outdoor lighting promotes both practicality and sustainability.

New installation of smart lighting systems in Australia offers a range of benefits, including seamless integration with modern infrastructure. These systems are designed with the latest energy-efficient technologies, such as LED lights, which reduce electricity consumption and operational costs. New installations allow for customised solutions tailored to specific needs, whether residential or commercial. With advanced features like motion sensors, remote control, and automation, new smart lighting systems enhance convenience, safety, and sustainability. Additionally, they ensure compatibility with other smart home devices, offering a fully integrated experience.

Retrofit installation of smart lighting in Australia allows existing lighting systems to be upgraded without major renovations. This offers a cost-effective way to enhance energy efficiency and reduce maintenance costs. By replacing traditional bulbs with LED smart lights, retrofit installations significantly lower energy consumption and carbon emissions. These solutions also improve control through smart features like motion sensing, scheduling, and remote management. Retrofit installation allows both residential and commercial properties to benefit from the advantages of smart lighting without the need for complete rewiring or system overhauls, providing a practical, sustainable upgrade.

LED lamps are gaining significant traction in Australia's smart lighting market due to their energy efficiency and long lifespan. These lamps consume less power than traditional lighting options, such as fluorescent lamps, reducing electricity bills. LED technology also offers instant lighting without flicker, ensuring consistent illumination. With the ability to integrate with smart systems, LED lamps can be controlled remotely and automated for optimal energy use, contributing to sustainability and reducing carbon emissions in both residential and commercial spaces.

Fluorescent lamps remain a popular option in Australia’s smart lighting market due to their cost-effectiveness and efficiency. These lamps are more energy-efficient than incandescent bulbs, reducing electricity consumption. Fluorescent lamps also provide a brighter light output, making them suitable for larger spaces such as offices and warehouses. Though not as efficient as LED lamps, they still offer a longer lifespan and lower environmental impact compared to traditional incandescent lighting, making them a viable option for specific applications in both residential and commercial settings.

Europe is witnessing significant growth in the global smart lighting market, driven by increasing demand for energy-efficient and sustainable lighting solutions. The region has implemented stringent regulations on energy conservation and carbon emissions, prompting both residential and commercial sectors to adopt smart lighting systems. The widespread use of LED technology and smart controls in cities, homes, and offices supports these goals. European countries, particularly the UK, Germany, and France, are leading the way in integrating smart lighting with IoT devices and renewable energy sources. As consumers seek greater control over energy consumption and governments promote sustainability, Europe is expected to remain a key player in the smart lighting market, contributing to further technological advancements and the adoption of innovative solutions.

The Asia Pacific region is experiencing rapid expansion in the smart lighting market, driven by technological advancements and growing urbanisation. Countries such as China, India, and Japan are leading the market due to increasing investments in infrastructure, smart cities, and energy-efficient solutions. The region's growing population and rising urban development are creating significant demand for advanced lighting systems, particularly in residential, commercial, and outdoor spaces. The adoption of LED-based smart lighting, integrated with sensors and control systems, is growing rapidly. Moreover, government initiatives supporting energy conservation, and the adoption of sustainable technologies are further boosting market growth. As the region continues to embrace digital transformation, smart lighting is becoming a critical component of the modern, energy-efficient urban landscape, improving both convenience and sustainability.

In North America, the smart lighting market is growing steadily, supported by a strong focus on energy efficiency and sustainability. The United States and Canada are major contributors to this growth, driven by consumer demand for smarter homes and the adoption of smart city initiatives. LED lighting solutions, combined with advanced control systems, are increasingly being integrated into residential, commercial, and industrial spaces.

Latin America is gradually embracing smart lighting solutions, with countries such as Brazil, Mexico, and Argentina showing increasing interest in energy-efficient lighting technologies. The market is driven by the need for cost-effective and sustainable alternatives to traditional lighting, alongside growing urbanisation. Smart lighting is seen as a viable solution to combat energy inefficiencies and reduce carbon footprints. Government policies promoting energy conservation and sustainability are encouraging the adoption of smart lighting in both urban and rural areas. As awareness grows, Latin America is expected to witness further market expansion, with a rising demand for LED-based smart lights and automation systems.

| CAGR 2026-2035 - Market by | Country |

| India | 26.5% |

| China | 22.1% |

| UK | 18.3% |

| USA | 17.8% |

| Germany | 16.5% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 13.8% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The global smart lighting market is highly competitive, with several key companies leading the way in innovation and market share. Prominent players include Philips Lighting (Signify), Osram Licht, General Electric, Cree, and Acuity Brands, all of which offer advanced smart lighting solutions, such as LED-based systems and integrated control platforms. These companies are expanding their market share through strategic partnerships, acquisitions, and the development of energy-efficient products. With increasing demand for energy-saving and connected lighting solutions, these companies continue to drive the growth and evolution of the smart lighting market.

The global smart lighting market has experienced significant growth, driven by advancements in technology and increasing consumer demand for energy-efficient lighting solutions. This market encompasses various products, including smart bulbs, sensors, and control systems, that offer enhanced functionality, automation, and energy savings. With the rise of smart homes and IoT integration, the market is expected to expand further.

Component Outlook (Revenue, Billion, 2026-2035)

Connectivity Outlook (Revenue, Billion, 2026-2035)

Installation Type Outlook (Revenue, Billion, 2026-2035)

Light Source Outlook (Revenue, Billion, 2026-2035)

Application Outlook (Revenue, Billion, 2026-2035)

Region Outlook (Revenue, Billion, 2026-2035)

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global smart lighting market attained a value of USD 19.50 Billion.

In the forecast period of 2026-2035, the market is projected to grow at a CAGR of 20.00%.

By 2035, the market is estimated to reach a value of about USD 120.74 Billion.

Key factors driving the growth of the smart lighting market include the capability of lights to connect with IoT devices and produce various ambient lighting effects using only smartphones or tablets, which has boosted its popularity and demand in both commercial and residential settings.

Technological advancements and innovations and the surging adoption of Internet of Things (IoT) are the major trends guiding the market growth.

The major regions in the market are North America, the Asia Pacific, Europe, Latin America, and the Middle East and Africa.

The leading components of smart lighting in the market are hardware, software, and services.

The significant connectivity in the market include wired and wireless.

New installation and retrofit installation are the major installation types of smart lighting considered in the market report.

LED lamps, fluorescent lamps, compact fluorescent lamps, and high intensity discharge lamps, among others, are the leading light sources in the market.

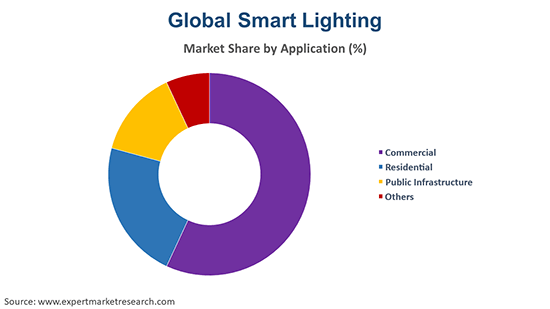

The significant applications of smart lighting are commercial, residential, and public infrastructure, among others.

The key players involved include Signify S.A., Acuity Brands Lighting, Inc., Honeywell, Legrand S.A., OSRAM GmbH, Cree Lighting, General Electric Company, Itron Inc., IDEAL INDUSTRIES, INC., Häfele America Co., Wipro Lighting, YEELIGHT, Sengled Optoelectronics Co., Ltd., and Verizon, Schneider Electric, among others.

Europe led the market, holding the largest share of revenue. The region is at the forefront of developing safety and consistent performance standards for specific indoor commercial smart lighting applications, including garages, roadways, and parking areas.

North America is expected to have the largest market share in the smart lighting market, driven by advancements in technology, high adoption of IoT devices, and increasing demand for energy-efficient and automated lighting solutions across commercial and residential sectors.

Drivers include IoT integration, energy efficiency, and automation. Opportunities lie in expanding smart cities, sustainability trends, and technological advancements.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Connectivity |

|

| Breakup by Installation Type |

|

| Breakup by Light Source |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share