Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global spritzer market attained a value of USD 1.35 Billion in 2025 and is projected to expand at a CAGR of 6.40% through 2035. The market is further expected to achieve USD 2.51 Billion by 2035. Premium spritzers are being increasingly adopted by hospitality groups and corporate event organizers seeking sessional alcohol options with strong brand presentation and predictable margins.

On the one hand, changing social drinking patterns and evolving urban lifestyles are becoming instrumental in driving the demand for lighter alcoholic beverages. Consumers prefer smaller portions that will accompany long socializing times rather than high quantity consumption in a short time, boosting the spritzer market growth. On the other hand, retailers focus on the RTD categories that can be sold at a faster pace and have a more defined shelf segmentation. Such factors have convinced beverage companies to make spritzers central to their strategic portfolios rather than just a trendy product in short-term forecasts.

Recent product activity in the market indicates a definite move to premiumization-led portfolio restructuring by global beverage groups. One of the most contrasting moves came from Diageo, which broadened its premium canned spritzer offerings in North America in September 2024 as part of its ready-to-drink alcohol strategy. These launches centered around lower sugar formulations, wine-based alcohol structures, and slimmer packaging formats targeting urban retail and on-trade channels, reshaping the spritzer market dynamics. Premium RTD segments are outperforming mainstream flavored alcohol formats, which is why producers are shifting innovation budgets to higher-margin spritzer lines instead of volume-driven extensions.

Product positioning has been more strategic in the spritzer market. Top-ranked brands are reducing the number of SKUs and giving preference to uniquely flavored products, cleaner ingredient labels, and regulated alcohol levels. Europe continues to be a high-potential market due to its aperitif culture, while North America keeps leading fast commercialization through convenience retail and event-based consumption. For example, in March 2025, Stock Spirits Group launched Limoncè Aperitivo, a zesty, lower-ABV citrus aperitif made with 100% Sicilian lemons, designed for refreshing spritzes and to tap growing demand for lighter aperitivo drinks in Europe. Instead of permanent product expansions, companies are increasingly depending on limited runs and seasonal launches to test demand elasticity. This strategy keeps pricing intact and, at the same time, maintains brand freshness on the crowded RTD shelves.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.4%

Value in USD Billion

2026-2035

*this image is indicative*

Premiumization continues to drive the spritzer market growth. Companies who make beverages are deliberately trying to take spritzers away from cheap alcopops by using wine bases, botanicals, and refined carbonation profiles. In December 2025, Cointreau introduced two ready-to-drink canned Margaritas, Original and Passionfruit, delivering bar-quality cocktails conveniently in 125 ml recyclable cans. Campaigns for alcohol moderation, backed by the government in Western Europe, are favoring low-ABV products, thus giving producers additional regulatory space to grow premium spritzers without increasing their compliance risks.

Regulatory pressure on high-alcohol beverages is paving the way for more spritzers to be launched. Advertising bans and responsible consumption guidelines in the United Kingdom and some parts of Europe are limiting brand investments in high-alcohol products and directing them into low-alcohol alternatives. Spritzers, being below the standard alcohol level, give companies the opportunity to keep their marketing activities visible and at the same time, they are in line with public health messages. This spritzer market trend has resulted in quicker approval of new product variants and less regulatory hurdles for cross-border launches. In April 2025, Hawkesbury introduced a 1.25 L vodka spritzer in lightweight, recyclable PET bottles with fruit-forward flavors.

Packaging is now a key element of competition rather than a mere cost factor. Spritzer makers are opting for slim cans with more recycled content to align with the ever-changing sustainability requirements. Companies are ramping up their investments in lightweight packaging for its whole RTD line, reshaping the spritzer market dynamics. EU packaging waste directives are fast-tracking the change, and brands that combine packaging innovation with the regulatory framework are experiencing a less complicated retailer onboarding process and gaining wider acceptance for their distribution. In June 2023, Spritzer rolled out 100% recyclable label-free PET bottles for its natural mineral water to reduce plastic use and streamline recycling.

The continuous relevance of bars and casual dining restaurants is making spritzers more visible in on-trade channels. Operators tend to choose spritzers as light alcohol alternatives to cocktails, which help in increasing the number of table turnovers and better inventory control, creating new spritzer market opportunities. In June 2025, Cann launched its first bottled THC-infused aperitif spritz, marking a premium move to compete with traditional high-end alcohol and elevate cannabis beverages. Other beverage companies are also crafting spritzers that are specifically targeted at on-trade menus, which include draught-friendly and large-format versions.

Flavor localization is becoming the most preferred strategy for boosting growth in the spritzer market. Rather than doing global rollouts, spritzer brands are creating region-specific versions to gauge consumer reaction. Citrus and tea-flavored spritzers are being introduced in some Asia Pacific markets as a part of product release strategies that are limited in scope. Regulatory easing for RTD imports in certain parts of the APAC region has facilitated quicker pilot launches. In September 2025, Misfit debuted in Karnataka, India, blending fruit-forward refreshment with self-expression appeal. Such controlled experiments allow companies to adjust formulations accurately prior to the decision of production on a large scale.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Spritzer Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

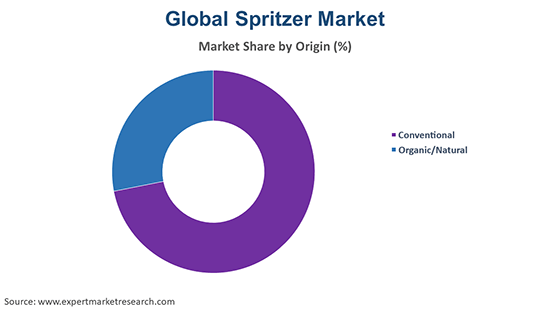

Market Breakup by Origin

Key Insight: Conventional spritzers remain volume anchors across origin-based segmentation, principally because they are scalable and operational with high reliability. Organic/natural variants, though significantly smaller in size, are nevertheless driving the innovation playbooks from the perspective of cleaner labels and more selective sourcing. This dual-track strategy supports better risk management while opening up new growth opportunities within the spritzer market.

Market Breakup by Flavour Type

Key Insight: As per the spritzer market report, citrus flavors are easier to formulate and widely adopted, making them the preferred choice for brands launching scalable, mass-appeal spritzer portfolios. But the berry segment is rapidly gaining ground as brands are looking for ways to set themselves apart and make a strong visual impact. For instance, Q Mixers launched a limited-edition Cranberry Pomegranate spritz flavor in October 2025. Tropical, caramel, chocolate, and blended flavors tend to be trend- or region-led, gaining traction as limited runs or localized offerings rather than permanent spritzer portfolios. Brands are cautious about their flavor portfolios as they do not want to make them too generic or lose their exclusive appeal.

Market Breakup by Sales Channel

Key Insight: The sales channels for spritzers are changing along with the way consumers make purchases. Hypermarkets maintain their dominance when it comes to volumes and visibility of the brand. On the other hand, online channels are about the facilitation of trials and deepening of the relationship with the customer. Departmental and traditional stores remain a means of reaching the local population, especially in the case of urban clusters, accelerating the spritzer market revenue growth. Businesses are customizing their channel strategies based on the SKU types. Such a selective method results in better inventory turnover, and it also helps in maintaining the brand image consistently across different formats.

Market Breakup by Region

Key Insight: Regional segmentation reveals significantly different growth dynamics. The North American market leads through the scale, innovation, and diversity of its channels. While the spritzer market in Asia Pacific keeps growing at a quicker pace due to its structured retail systems and consumer preferences that have been changing over time. Across Europe, growth is driven by aperitivo culture, premiumization, and sustainability-focused packaging strategies. MEA shows selective, regulation-led expansion, favoring non-alcoholic spritzers, premium mixers, and hospitality channels. Latin America’s market development is supported by urban social drinking trends, affordable spritzer formats, and locally inspired flavors.

By origin, conventional spritzers dominate the market due to pricing control, scale efficiencies, and stable sourcing

Conventional spritzers dominate the majority of the consumption as they offer operational flexibility, and their cost structures are predictable. Major beverage corporations prefer conventional recipes as these allow them to have tighter control over flavor consistency, carbonation stability, and shelf-life performance. Such products fit well into the existing production lines, thus lowering the reformulation risks and reducing the dependency on suppliers. Commercially, conventional spritzers can be easily scaled in different regions, which makes them ideal for national retail programs and multi-location hospitality contracts, accelerating the spritzer market value. In June 2025, Roseade USA launched refreshing lemonade-style spritzers featuring crisp effervescence and clean wine finishes to broaden casual ready-to-drink options.

Organic and natural spritzers represent the fastest-growing category as brands are getting more inclined towards ingredient transparency expectations of consumers. Manufacturers are changing their recipes with natural sweeteners, botanical extracts, and simple labels to attract health-conscious consumers. Even though the supply of organic ingredients will be more complicated, companies are willing to take on higher costs to have a strong brand image in the longer run.

By flavor type, citrus spritzers lead the market as they deliver freshness, balance, and broad palate acceptance

The dominant flavor segment in the spritzer market scope is citrus, mainly because of their broad usage and familiarity among consumers. The lemon, lime, and orange flavors go well with low-alcohol spirits, and do not overpower carbonation. Beverage manufacturers prefer citrus spritzers for these reasons, in addition to the fact that they can be sold successfully both in retail stores and bars. Besides, citrus can be used for a premium product when combined with botanicals or wine-based spirits. In December 2023, Spritzer Berhad launched Spritzer Sparkling Lemon with zero calories and zero sweeteners, debuting its first flavored sparkling water extension.

Berry-flavored spritzers are gaining popularity rapidly, driven by their visual appeal and the perception of being an indulgent treat. With flavors like raspberry and blackberry, companies can separate their products in terms of color yet keep them free from artificial ingredients. Manufacturers are using these flavors for seasonal changes and special editions, typically launched during summer seasons. Additionally, depending on the amount of sweetness and level of dryness, berry spritzers can be used to achieve a higher price point.

By sales channel, hypermarkets lead distribution due to scale, visibility, and promotional leverage

Hypermarkets and supermarkets continue to retain their dominance owing to their capability to offer high SKU visibility. Beverage companies generally choose these channels for national rollouts and seasonal promotions. Big-box retailing enables controlled pricing strategies and coordinated merchandising, allowing brands to manage margins, promotions, and shelf visibility more effectively. The location of the product on the shelf near beer and RTDs drives an increase in impulse purchases. Besides that, supermarkets also offer data-driven insights which assist producers in refining their assortment strategies. In December 2024, Spritz Society partnered with V8 to debut a first-of-its-kind canned Bloody Mary Spritz, blending white wine, tomato-inspired flavors, and spices in a ready-to-drink format.

Online channels are rapidly gaining momentum across the spritzer market scope, driven by evolving purchasing behavior and lifestyle preferences. DTC brands can efficiently bundle flavors and test limited editions through direct-to-consumer platforms. E-commerce also facilitates subscription models, thereby increasing repeat purchase visibility. Beverage companies are leveraging digital platforms as a source of gathering feedback without entirely depending on retail physical resets.

North America clocks in the leading market position due to premium RTD adoption and strong on-trade recovery

North America emerges as the leading regional market mainly because of the strong acceptance of premium RTDs and the changing drinking habits. Drink companies are placing the United States at the center of spritzer innovation, using it as a primary testing ground for new formats and flavor combinations. Local consumption habits favor sessional alcohol products, notably through hospitality and event-driven settings. Besides, producers benefit from sophisticated cold-chain logistics and category management systems.

Asia Pacific is becoming the fastest developing regional spritzer market as a result of the rising demand for lighter alcohol formats. Customers exhibit strong preference for low-sugar and well-balanced flavor profiles. Provincial retail systems thus stimulate step-by-step structured product introductions, which consequently help brands to effectively manage the risk of rollout. Beverage companies are increasingly experimenting with formulations that can better reflect local taste preferences. On-trade expansion and carefully controlled retail growth further fuel the development. In December 2025, Sazerac Company began rolling out its BuzzBallz premixed spritz-style cocktails in India, introducing berry and tropical flavour variants.

Competition in the market is getting tougher as brands are shifting their focus from volume expansion to portfolio discipline. Leading spritzer market players are prioritizing formulation refinement, limiting alcohol content, and packaging aesthetics that help to place the product as a premium item on the shelf. Companies are also tightening their distribution strategies, instead of a broad rollout, choosing selective retail and on-trade partnerships. This opens up opportunities for margin protection and brand storytelling.

Spritzer companies are getting noticed through authenticity-led positioning, while large-scale players are using their operational scale for supply and pricing stabilization. Seasonal launches and limited formats are now favored over permanent SKU additions. The competitive edge lies in execution speed, packaging compliance, and channel fit. Brands that tailor product design to consumption occasions are seeing stronger repeat purchase behavior and long-term relevance in both mature and emerging spritzer consumption markets.

Hoxie Spritzer was founded in 2015 and its main office is in California, United States. This company is concentrating on clean-label wine spritzers that have low alcohol content and they are also making sure that the ingredient sourcing is transparent. Their products highlight low sugar content and carbonation that is well balanced.

The Union Wine Company was set up in 2005 and its main office is located in Oregon, United States. The company uses the knowledge of its wine-making to come up with wine-forward spritzers under contemporary branding. It is prioritizing affordable pricing while maintaining credible quality standards, boosting the spritzer market growth.

Barefoot Cellars started its operations in 1965 and is located in California, United States. The brand utilizes its mass-market wine strength to come up with the spritzers that can be used in an accessible manner. Barefoot mainly concentrates on flavor familiarity and extensive retail presence.

State Mineralbrunnen AG started its operations in 1747, and its main office is located in Germany. The company is combining its mineral water expertise with light alcoholic beverage formulations, allowing its products to tap into European aperitif culture.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Unlock the latest insights with our spritzer market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

Natural Hydration Consumer Behaviour Analysis

Online Beverage E Commerce Trends

Drinking Water Quality Regulations Trends

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 6.40% between 2026 and 2035.

Stakeholders are refining formulations, tightening SKU portfolios, strengthening on-trade partnerships, investing in sustainable packaging, and using controlled regional launches to protect margins while building long-term brand equity.

The wide range of flavours available in the market and growing urbanisation are the key trends helping in the growth of the market.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading origins of spritzer in the market are conventional and organic/natural.

The major flavour types of spritzer in the market are caramel, chocolate, tropical, citrus, and berries, among others.

The significant sales channels in the market are hypermarkets and supermarkets, departmental stores, traditional store formats, and online.

The key players in the market include Hoxie Spritzer, Union Wine Company, Barefoot Cellars, and State Mineralbrunnen AG, among others.

In 2025, the market reached an approximate value of USD 1.35 Billion.

Managing ingredient costs, meeting packaging regulations, balancing premium pricing, maintaining flavor consistency, and navigating alcohol distribution rules remain persistent challenges for spritzer producers across regions and channels.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Origin |

|

| Breakup by Flavour Type |

|

| Breakup by Sales Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share