Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global tuberculosis treatment market reached a value of about USD 1.87 Billion in 2025. The market is expected to grow at a CAGR of 7.57% during the forecast period of 2026-2035 to attain a value of USD 3.88 Billion by 2035. The growth of the market is driven by the rising favourable government policies to increase demand for tuberculosis (TB) diagnostics.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.57%

Value in USD Billion

2026-2035

*this image is indicative*

Tuberculosis (TB) is an infectious disease that primarily affects the lungs. Tuberculosis bacteria spread from person to person via tiny droplets released into the air by coughs and sneezes, it can also attack other organs, such as the kidneys, spine, and brain. Not everyone who is infected with tuberculosis bacteria (germs) becomes ill. There are two kinds of tuberculosis:

The prevalence of tuberculosis is rapidly rising and is likely to continue rising in the coming years as well, driven by the rising number of smokers. Majority of people who have TB germs in their bodies do not develop TB disease, instead, they have latent tuberculosis infection. Tuberculosis can spread when a person with active TB disease sneezes, coughs, sings, talks, or even laughs, anything that involves releasing germs into the air. While latent TB does not get transmitted, active pulmonary infection is highly contagious.

Inactive tuberculosis does not cause symptoms; however, they can be diagnosed with a positive skin reaction test or blood test. Active TB patients may exhibit any of the following symptoms:

There are two types of tuberculosis screening tests, namely Mantoux Tuberculin Skin Test (TST) and Interferon-Gamma Release Assay (blood test) (IGRA).

A healthcare provider will inject a small amount of purified protein derivative (PPD) under the skin of the forearm for the TST.

Additional tests to determine whether an infection is active or whether the lungs are infected include sputum and lung fluid testing, X-ray of the chest, and/or CT scans (computed tomography).

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

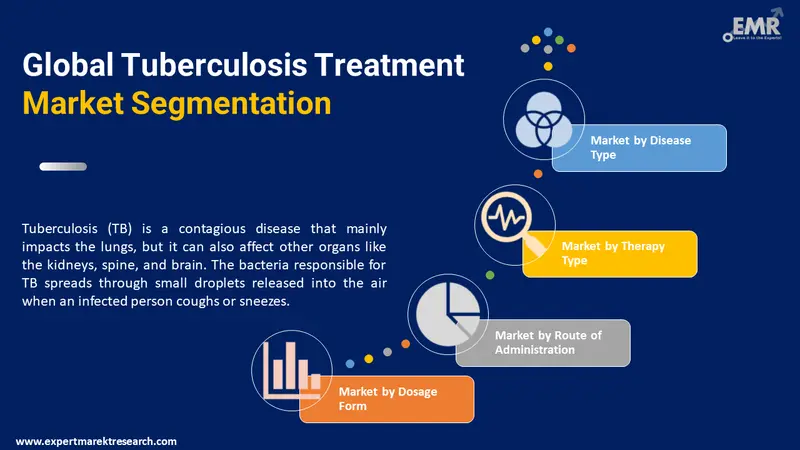

According to the market research report, the market can be categorised into the following segments:

Market Breakup by Disease Type

Market Breakup by Therapy Type

Market Breakup by Route of Administration

Market Breakup by Dosage Form

Market Breakup by Distribution Channel

Market Breakup by Region

More than 1.7 billion people (roughly 22% of the world's population) are estimated to be infected with tuberculosis. The global incidence of tuberculosis peaked around 2003 and appears to be slowly declining. According to the World Health Organization (WHO), 9.9 million people became ill with tuberculosis (TB) in 2020, with 1.5 million deaths.

As per the records, in 2021, there was 7,860 tuberculosis cases reported in the United States. The incidence rate in the United States has reached close to 2.4 cases per 100,000 people.

Antibiotics are typically used to treat tuberculosis (TB) in the initial treatment, which goes on for several months. The standard treatment is 6 months of antibiotics (isoniazid and rifampicin). For the first 2 months of the 6-month treatment period, 2 additional antibiotics (pyrazinamide and ethambutol) are administered. Extrapulmonary tuberculosis (TB that occurs outside the lungs) can be treated with the same antibiotic combination as pulmonary tuberculosis.

If tuberculosis is in areas such as the brain or the sac surrounding the heart (pericardium), the patient may be given a corticosteroid such as prednisolone, alongside the antibiotics for several weeks. This will aid in the reduction of swelling in the affected areas.

If latent tuberculosis is thought to be drug-resistant, it is not always treated. If this is the case, the patient may be monitored on a regular basis to ensure that the infection does not become active. For latent tuberculosis patients, the most common prescription includes Rifampicin and isoniazid in combination for 3 months, and Isoniazid alone for 6 months.

The increased public-private partnership, favourable government policies to boost the demand for tuberculosis (TB) diagnostics, and the rising incidence of tuberculosis in high-burden countries are the factors driving the global tuberculosis treatment market.

In the forecast year, the limitations of existing tuberculosis diagnostics will impede the market growth.

The report gives an in-depth analysis of the key players involved in the global tuberculosis treatment market, sponsors manufacturing the therapies, and putting them through trials to get FDA approvals. The companies included in the market are as follows:

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global tuberculosis treatment market reached a value of about USD 1.87 Billion in 2025, rising favourable government policies to increase demand for tuberculosis (TB) diagnostics.

The market is expected to grow at a CAGR of 7.57% during the forecast period of 2026-2035 to attain a value of USD 3.88 Billion by 2035.

The increased public-private partnership, favourable government policies to boost the demand for tuberculosis (TB) diagnostics, and the rising incidence of tuberculosis in high-burden countries are the key factors driving the global tuberculosis treatment market growth.

Tuberculosis can be categorized into two types- active tuberculosis and latent tuberculosis.

The treatment types can be divided into first line therapy and second line therapy.

The route of administration includes oral and parenteral, among others.

The dosage types can be categorized into tablets, capsules, and injections, among others.

The distribution channels used in the market include hospital pharmacy, retail pharmacy, and online pharmacy.

The key players in the market include Johnson and Johnson Services, Inc., Lupin Ltd, Novartis AG, Macleods Pharmaceuticals Ltd., Otsuka Pharmaceutical Co., Ltd, Pfizer Inc., AstraZeneca Plc, Cipla Ltd, Alkem Laboratories Ltd, Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Viatris Inc. (Mylan N.V.), and Teva Pharmaceutical Industries, Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Disease Type |

|

| Breakup by Therapy Type |

|

| Breakup by Route of Administration |

|

| Breakup by Dosage Form |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share