Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The UAE copper rod and busbar market size reached around USD 891.94 Million in 2025. The market is further estimated to grow at a CAGR of 7.30% during 2026-2035 to reach a value of USD 1804.40 Million by 2035.

Base Year

Historical Period

Forecast Period

The UAE has a robust construction sector that is launching residential and commercial projects worth billions of dollars. In 2022, Dubai recorded real estate transactions of worth USD 143.8 billion, a rise of 73% from 2021.

The presence of key automotive manufacturers in the UAE, such as BMW, and W Motors aids copper rod demand for automotive electrical systems.

The Dubai Electricity and Water Authority (DEWA) plans on increasing Dubai's EV Green Charging Stations from 370 in 2023 to around 1,000 by 2025.

Compound Annual Growth Rate

7.3%

Value in USD Million

2026-2035

*this image is indicative*

Refining copper into copper rods has strengthened the UAE's position, globally. UAE-based companies such as Ducab and UCR have annual copper rod production capacities of around 180,000 tons and 220,000 metric tons respectively. These companies supply copper rods both domestically as well as internationally.

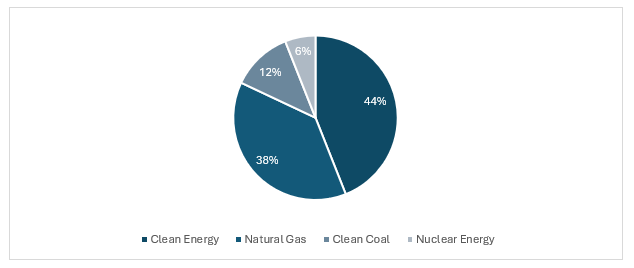

Figure: The UAE Energy Strategy 2050 Targets

Copper products are widely used in the country in various markets, including construction and transportation, which contributes to the UAE copper rod and busbar market growth. In 2023, Dubai completed the construction of 3,520 buildings compared to 1,941 buildings in 2022.

The UAE's air transport market, which uses copper rods and other products for manufacturing aerospace components, is expected to expand by 170% by 2037. This would translate into 101 million more passenger trips and increased demand for aircraft.

The UAE supports the renewable energy sector through intensive research and development and governmental support. Solar power is now available in the country at around 1.35 cents per kilowatt hour. According to the International Renewable Energy Agency (IRENA), the country is expected to install over 18 GW of solar energy by 2030.

Significant growth of the construction sector; rising use of HVAC; expanding aerospace sector of the UAE; and significant growth in EV adoption are the key trends impacting the UAE copper rod and busbar market growth

Dubai is a tax-free city with a high return on investments. Additionally, since it is a prosperous nation, the citizens can pay for large construction projects. The ease of financing, political stability, and security are contributing to the growth of Dubai’s construction sector and aiding the demand for copper products.

The country is witnessing escalating demand for sustainable and energy-efficient HVAC systems. Geothermal heating and cooling HVAC systems are widely used in the UAE residential and commercial sector. These systems provide heating and cooling without producing GHG emissions.

The UAE aims to be known as a hub for aerospace manufacturing and maintenance, repair, and overhaul. The UAE is concentrating on developing advanced manufacturing facilities and capabilities for composite parts and aerospace structures to become a major supplier to original equipment manufacturers (OEMs).

The number of EVs in Dubai reached 25,929 in December 2023 from 15,100 in 2022. Further, Dubai’s aim to have half of the city’s cars transition to EVs by 2050, will boost the demand for EV charging infrastructure and grid.

The UAE is expanding its electric distribution and transmission network to connect renewable energy and non-conventional fuel-based plants with the transmission grid. Dubai’s total length of transmission and distribution electricity lines reached 42,586.71 kilometres in 2022 from 41,930 kilometres at the end of 2021.

Copper busbars are widely deployed in air conditioning and refrigeration systems. Copper products have impressive strength, resistance to corrosion and high efficiency. HVAC products are crucial in the UAE to ensure a comfortable and healthy indoor environments in the residential, industrial, and commercial sector. The UAE’s large-scale construction projects, ranging from skyscrapers to infrastructural projects aid the demand for HVAC systems and consequently copper products.

“UAE Copper Rod and Busbar Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by End Use

Market Breakup by Sales Channel

Market Breakup by Region

Based on type, copper rods account for a significant share of the UAE copper rod and busbar market

Dubai is home to automotive producers, including W Motors and Jannarelly Automotive, aiding the demand for copper rods for automotive electrical systems.

Common engineering applications for copper round bars include electrical components, transformers, architectural structures, and building components. Copper is an impressive conductor of heat and electricity. As a result, copper rods can save energy bills for homeowners while increasing the general effectiveness of plumbing and electrical systems.

Solid copper busbars for EVs are processed by stamping, CNC bending, finish treatment, and insulation. The finish can be bare copper, nickel plating, tin plating, and silver plating. The insulation can be PVC, epoxy powder coating, and PE heat shrink tube. They are widely used in energy storage systems, charging piles, electric forklift, and electric car battery pack. The efficiency of electric and hybrid vehicles can be improved by utilising copper busbars, which aids the UAE copper rod and busbar market development.

Based on end use, the construction sector dominates the UAE copper rod and busbar market share, significantly contributing to the overall market revenue

Abu Dhabi’s construction sector expanded by 13.1% in 2023 over 2022, aiding the demand for copper products. A total of 122,658 real estate units comprising residential and commercial units were sold in 2022 in Dubai, an increase of 47% from 2021.

Further, the UAE's prime location along major trade routes, namely the Persian Gulf and the Gulf of Oman has fueled massive growth in its maritime and shipbuilding sectors. Copper busbar are widely deployed in marine power distribution due to its reliable quality, cost-effectives, and resistance to mechanical damage and corrosion.

The manufacturers are engaged in providing high-quality products and introducing the latest capabilities to innovate their products and meet the growing demands of consumers.

Founded in 1978, Ducab specializes in copper and aluminum wire production, with a focus on renewable energy.

Founded in 2021, Aeris Stream Copper Manufacturing LLC specializes in the production of copper rods and wires. ASCM has successful partnerships with global firms in countries like Russia, China, South Korea, Poland, and Turkey, and is now expanding its presence into the GCC region.

Founded in 2012, Emirates National Copper factory is an export-oriented Company and the only copper busbar manufacturing facility in the UAE.

Headquartered in the UAE, UCR utilises advanced southwire continuous rod casting technology for manufacturing premium copper rods.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the UAE copper rod and busbar market are Fujairah Gold FZC, and Bahra Advanced Cable Manufacture Co. Ltd., among others.

The net production value of Abu Dhabi’s transportation sector is USD 800 million. Abu Dhabi also contributes 21.1% to UAE’s transportation equipment production. Abu Dhabi’s transportation sector manufactures transportation equipment, motor vehicles, ships and boats, and railroad rolling stock.

Further, the growth in tourism aids the growth of the construction and hospitality sectors, which increases the demand for copper products for wiring, air conditioning, and refrigeration. In 2023, Dubai recorded 17.15 million international tourists, a 19.4% increase over 2022.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market reached a value of USD 891.94 Million in 2025.

The market is further estimated to grow at a CAGR of 7.30% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 1804.40 Million.

The factors driving the market include the increasing adoption of EVs, growing inclination towards renewable energy, and the establishment of UAE as a hub for for aerospace manufacturing and MRO.

The major end uses include construction, industrial equipment, transport, and non-industrial.

Direct and distributors are the two major sales channels in the market.

The key regional markets for copper rod and busbar are Abu Dhabi, Dubai, and Sharjah.

The key players in the market include Dubai Cable Company (Private) Limited, Aeris Stream Copper Manufacturing LLC, Emirates National Copper Factory LLC, Union Copper Rod LLC, Fujairah Gold FZC, and Bahra Advanced Cable Manufacture Co. Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by End Use |

|

| Breakup by Sales Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share