Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United Arab Emirates LED lighting market reached a value of AED 3935.05 Million in the year 2025. The market is further expected to grow at a CAGR of 8.40% between 2026 and 2035 to reach a value of AED 8815.42 Million by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

8.4%

Value in AED Million

2026-2035

*this image is indicative*

| United Arab Emirates LED Lighting Market Report Summary | Description | Value |

| Base Year | AED Million | 2025 |

| Historical Period | AED Million | 2019-2025 |

| Forecast Period | AED Million | 2026-2035 |

| Market Size 2025 | AED Million | 3935.05 |

| Market Size 2035 | AED Million | 8815.42 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 8.40% |

| CAGR 2026-2035 - Market by Type | Streetlight | 17.7% |

| CAGR 2026-2035 - Market by Application | Commercial | 46.6% |

| Market Share by Application | Commercial | 14.9% |

The growth of the United Arab Emirates LED lighting market is driven by several infrastructure projects and the rising awareness about the usage of energy-efficient systems. The market is witnessing exponential growth owing to reviving the real estate industry. In 2020, Ras Al Khaimah Economic Zone (RAKEZ), the UAE-based customizable solutions provider, entered into an agreement with Smart4Power, the UAE-based energy efficiency solutions provider, to introduce a retrofit project that covers nine buildings, including a district cooling plant. In this project, Smart4Power will take many energy and water conservation measures, like LED light replacements, improvement of cooling systems, the addition of adiabatic cooling for chillers, and installation of water-saving devices.

The United Arab Emirates LED lighting market value is increased by the increasing infrastructural developments in the retail, commercial, and industrial sectors. As the LED lights do not emit any greenhouse gases such as carbon dioxide, nitrous oxide, methane, and chlorofluorocarbons, they are observing a boost in demand in the ongoing and upcoming green-building projects in the country, as a result aiding the market growth of LED lighting. The government of the United Arab Emirates has taken initiatives to promote the sales of energy-efficient lighting products, like LED lights, and prohibit the use of ineffective light bulbs, thereby bolstering the demand for LED lighting in the country.

The LED lighting market in the United Arab Emirates is accelerated by the growing population, escalating disposable income, extending tourism, rapid urbanisation, the establishment of malls, and massive construction boom. However, the blue LEDs and cool-white LEDs often cross the safe zone of the blue light hazard that is marked in the eye safety specifications, acting as a hindrance to the growth of the LED market in the United Arab Emirates.

As per the United Emirates LED lighting industry analysis, in recent years, there have been significant advancements in the efficiency and longevity of LEDs. Modern LEDs are much more energy-efficient compared to traditional incandescent bulbs as they use 75 percent less energy and have an overall lifespan of 25,000 to 50,000 hours, significantly reducing the demand for regular replacements. These advancements contribute not only to energy preservation but also to the reduction of the country's overall carbon footprint.

Additionally, smart LED lighting solutions are another significant trend that aids the overall United Arab Emirates LED lighting industry revenue. They can be integrated with other smart home devices, such as motion sensors, thermostats, and security cameras, creating an interconnected home automation system. This not only enhances convenience for users but also contributes to energy efficiency and cost savings by optimising lighting usage based on natural light levels. Furthermore, intelligent LED lighting is utilised in commercial and industrial settings to improve productivity, safety, and energy efficiency, aiding the growth of the United Arab Emirates LED lighting industry.

Dubai’s Roads and Transport Authority (RTA) announced in July 2024 that it has completed the replacement of 900 lighting units with energy-efficient LED lighting along a 9km stretch of Sheikh Rashid Street. This initiative aims to improve the sustainability of road lighting which can also align with the city's goals of energy conservation and promoting a green economy.

The key players in the market include Philips Lighting (Signify Holding), OSRAM GmbH, GE Lighting (Savant Technologies LLC), Panasonic Holdings Corporation, Cree Lighting USA LLC, Zumtobel Group and Eaton Corporation amongst others.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

LED is an abbreviation of light-emitting diode, which is a semiconductor device that radiates light when an electric current passes through it. LEDs are recognized as modern technology and are employed for energy-efficient lighting. The use of LED lights helps reduce electricity bills by lowering around 85% of the energy consumption as compared to incandescent or halogen lights. As per the United Arab Emirates LED lighting market analysis, they also have a longer lifespan, offer better light quality, and are durable, owing to which they are extensively used in industrial and home products, such as modular lighting, kitchen under-cabinet lighting, task lighting, refrigerated case lighting, and recessed downlights.

The LED lighting industry in the United Arab Emirates is segmented on the basis of type into:

Currently, panel light is the most popular product category in the country, accounting for the largest share.

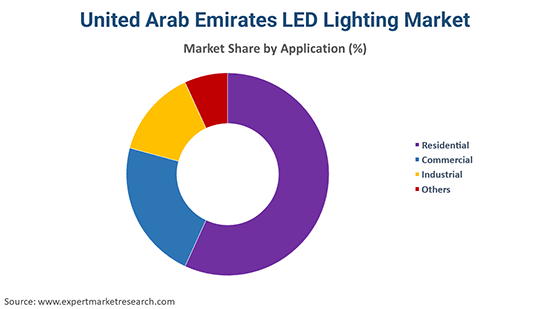

On the basis of application, the market is divided into:

| CAGR 2026-2035 - Market by | Type |

| Streetlight | 17.7% |

| Panel Light | 16.6% |

| Bulb | 16.0% |

| Down Light | XX% |

| Flood Light | XX% |

| Tube Light | XX% |

| CAGR 2026-2035 - Market by | Application |

| Commercial | 17.1% |

| Residential | 14.9% |

| Industrial | XX% |

| Others | XX% |

| Market Share by | Application |

| Commercial | 46.6% |

| Industrial | XX% |

| Residential | XX% |

| Others | XX% |

Amongst these, a large proportion of the LED lighting systems are installed in commercial spaces.

The report gives a detailed analysis of the following key players in the United Arab Emirates LED lighting market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

Dubai’s Roads and Transport Authority completed the first two phases of its energy conservation projects, under which they installed 19,968 LED light bulbs which fuels the expansion of the United Arab Emirates LED lighting industry. The program has successfully conserved around 16.7 million kilowatts of energy over a span of two years. This program aims to improve the sustainability and livability of the city on a global scale. This initiative is a part of RTA's commitment to promote sustainability through an eco-friendly transportation system and reduce overall emissions in the coming years.

United States LED Lighting Market

Philippines LED Lighting Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the United Arab Emirates LED lighting market attained a value of nearly AED 3935.05 Million.

The market is projected to grow at a CAGR of 8.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around AED 8815.42 Million by 2035.

The major drivers of the market are growing population, escalating disposable income, increasing tourism, and massive construction boom.

The key trends guiding the growth of the market are the increasing establishment of malls, initiatives taken by the United Arab Emirates government to promote the sales of energy-efficient lighting products, and rising usage in residential applications.

Panel light, down light, flood light, streetlight, tube light, and bulb, among others, are the various types of LED lighting in the market.

The leading applications in the market are residential, commercial, and industrial, among others.

The major players in the United Arab Emirates LED lighting market are Signify holding, OSRAM GmbH, Savant technologies LLC, Panasonic corporation, and Larsa Lighting LLC, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share