Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States LED lighting market reached a value of USD 12.39 Billion in 2025. The market is further estimated to grow at a CAGR of 5.30% during 2026-2035 to reach a value of USD 20.77 Billion by 2035.

Base Year

Historical Period

Forecast Period

The State legislative bodies across the country are determined to phase out the sales of 4-foot linear fluorescents by 2024, which is likely to create greater opportunities for LED products.

There is a growing preference for LED lighting solutions offering advanced lighting features, such as dynamic beam and colour control.

The growing trend of indoor agriculture in the region supports the demand for indoor LED lighting solutions.

Compound Annual Growth Rate

5.3%

Value in USD Billion

2026-2035

*this image is indicative*

LED lights are a great energy-efficient and long-lasting lighting option that emit less heat and uses up to 90% less energy than incandescent bulbs, while still providing high-quality light output. The United States is witnessing a rapid shift towards energy-saving methods keeping in line with the country’s climate goals. It is anticipated that the majority of the lighting installations in the country would use LED technology by 2035, resulting in energy savings surpassing 569 TWh annually from LED lighting, which is equitable to the energy output of more than 92 1,000 MW power plants per year.

The development of sustainable green buildings in the country is anticipated to strengthen the adoption of LED lighting to reduce energy usage and lower the frequency of replacing the luminaires.

There is a rising demand for ENERGY STAR-rated LED lighting in residential applications as they use nearly 75% less energy and last around 25 times longer than incandescent lighting.

Favourable government initiatives; increasing adoption in the commercial sector; climate change strategies; and development of smart homes are the key trends impacting the United States LED lighting market growth

The government schemes such as the Solid-State Lighting Program, set out by the US Department of Energy (DOE) have been aiding in fostering the country’s scientific capabilities and leveraging private funds to boost innovation for developing efficient and flexible lighting products such as light-emitting diode (LED) technologies.

In the commercial sector, particularly in agricultural applications, LED lights are becoming a common phenomenon for aiding the growth of plants and minimizing crop loss.

The phasing out of compact fluorescent lamps (CFLs) by 2025, as part of the central government’s climate change strategy, is anticipated to provide an opportunity for market growth.

The adoption of smart home technologies in the USA is driven by the security, flexibility, and convenience offered by them.

Installing smart LED bulbs is the easiest method for citizens to begin upgrading homes and provides homeowners with remote control over their electricity consumption. Educational institutes, such as the University of Michigan also uses smart LED lights owing to their extended lifetime and energy efficiency.

There is a rise in the number of high-tech plant factories across the United States adopting indoor farming and LED lights to overcome the loss of crops created due to climate change. LEDs enable the speedy year-round crop cycles in addition to positively impacting the quality and levels of vitamins and antioxidants present in plants.

The Smart Street Lighting NY program launched by the New York government in 2018 aims at replacing at least half of New York's more than 1 million streetlights with sustainable and energy-efficient alternatives, such as LED lighting, by 2025. Further, several programs and incentives provided by utility providers in New York, such as Central Hudson Commercial Lighting Prescriptive Rebates, Con Edison Instant Lighting Incentives and Con Edison Lighting and Controls, among others, are expected to encourage citizens to install and upgrade their traditional lighting to LED lighting.

By 2035, the US is likely to witness a widespread adoption of LED lighting and according to the U.S. Department of Energy, it can result in energy savings of about 569 TWh per year.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“United States LED Lighting Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

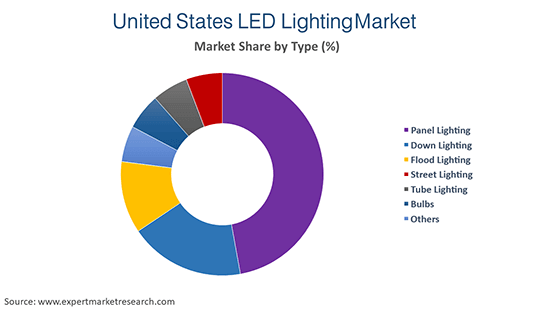

Market Breakup by Type

Market Breakup by Technology

Market Breakup by Application

Market Breakup by End Use

Market Breakup by Region

Based on technology, regular LED lighting is a significant contributor to the market revenue

The regular LED lighting technology is recognised for its exceptional energy efficiency. The minimal heat emission of LEDs and their ability to emit light in a particular direction, eliminating the need for reflectors and diffusers, make them ideal for numerous uses.

Meanwhile, smart LED lighting offers up to 80% savings on conventional lighting and aids in improving the convenience and creativity of users by providing the option to customise the area as per their requirements. In smart LED lighting systems, each light source is linked to a smart system that offers reliable and superior-quality illumination.

Based on application, indoor solutions account for a significant share of the United States LED lighting market

There has been an extensive adoption of LED lighting, such as downlight lamps and luminaries in indoor spaces due to their benefit of sustainability. The rising adoption of home automation technology is anticipated to support the demand for smart LED lighting that can be controlled remotely.

Cities such as Detroit, Los Angeles, and San Jose are replacing traditional street lighting with LED lighting to enhance outdoor safety.

The city of Boston announced the use of LED fixtures as a replacement for electric lighting to light up the sidewalks. As part of this, it selected Ameresco, Inc to begin auditing and retrofitting of around 80,000 streetlights and other exterior lightings in July 2021. Lesser energy used by LED lights to power the lamps and low maintenance make them suitable for city lighting projects.

Government initiatives such as Energy Efficiency Investment Fund (EEIF) set out by the Department of Natural Resources and Environmental Control (DNREC) offers grants to commercial and industrial customers in the State of Delaware to help them replace ageing, inefficient equipment and systems with energy-efficient substitutes (like LED solutions), enabling businesses to reduce their energy consumption and improve environmental performance.

States such as California and New York are expected to hold major positions in the market owing to their developed infrastructure, technological innovations, and adoption of energy efficiency practices. New York City, in particular, has a highly developed urban infrastructure that includes advanced lighting systems. The city has been implementing LED street lighting to improve energy efficiency and reduce maintenance costs, thus supporting the United States LED lighting market development.

In 2023, as part of the New York state’s Smart Street Lighting NY programme, the New York Power Authority (NYPA) partnered with the Town of Irondequoit to convert 500,00 streetlights to LED technology by the year 2025, supporting the goals of the Climate Leadership and Community Protection Act to lower the electricity demand by three per cent by 2025, which is the most aggressive clean energy law in the nation.

The market players are investing in research and development to create innovative lighting solutions integrated with smart technology.

Headquartered in the Netherlands, the company is a global leader in lighting for professionals and consumers, and lighting for the internet of things. The company provides 3Dprinted lighting, indoor luminaires, outdoor luminaires, lighting electronics, among others.

The company is a global leader in optical solution with specialization in sensing, illumination, and visualization technologies. Headquartered in Austria, the company has a strong R&D infrastructure in over 40 locations supported by a workforce of around 22,000 employees worldwide.

Eaton is a power management company headquartered in Ireland. The company is listed on NYSE with the symbol ETN. The company specializes in power management, manufacturing, sustainability, hybrid power, industrial clutches and brakes, e-mobility, and energy transition, among others.

Acuity Brands, Inc. is engaged in manufacturing and distributing lighting and building management solutions for commercial, institutional, industrial, infrastructure, and residential markets.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the United States LED lighting market are SMART Global Holdings, Inc, GE Lighting, Inc., and Hubbell Incorporated., among others.

Middle East and Africa LED Lighting Market

Asia Pacific LED Lighting Market

Latin America LED Lighting Market

United Arab Emirates LED Lighting Market

Philippines LED Lighting Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market reached a value of USD 12.39 Billion in 2025.

The market is estimated to grow at a CAGR of 5.30% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 20.77 Billion by 2035.

The key types are bulb, downlight, streetlight, tube lights, high bay, troffers, track lights, suspended pendants, and others.

The key regional markets for LED lighting are New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West.

The end uses include residential, commercial, industrial, and highway and roadway.

The key technologies include smart LED lighting and regular LED lighting.

The key players in the market include Signify N.V., ams-OSRAM AG, Eaton Corporation plc, Acuity Brands, Inc, SMART Global Holdings, Inc, GE Lighting, Inc., and Hubbell Incorporated, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share