Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States ATM Services market value reached approximately USD 7.92 Billion in 2025. The market is projected to grow at a CAGR of 2.50% between 2026 and 2035, reaching a value of around USD 10.14 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

2.5%

Value in USD Billion

2026-2035

*this image is indicative*

The United States ATM services industry growth is being aided by the growing adoption of turnkey ATM programs, which minimises ATM ownership costs. The market is expected to witness steady growth, with multiple banks pooling their ATMs to a single turnkey service provider. ATMs offer ease of access to cash at any point in time and enable individuals to perform quick self-service transactions, including bill payments, deposits, and transfers between accounts.

ATMs are easily accessible as they are installed in locations like supermarkets, convenience stores, shopping centres, and offices, among other places. ATM providers are increasingly outsourcing ATM installation, maintenance, and other services to reduce their overall costs and increase the United States ATM services market revenue.

The United States ATM service market dynamics and trends are driven by the rising adoption of contactless ATMs that utilise near-field communication (NFC), allowing users to access their accounts and withdraw cash without needing a physical ATM card. Additionally, ATMs are a crucial resource for unbanked and underbanked individuals.

There is a rising popularity of crypto ATMs across the United States. Crypto ATMs offer convenience and accessibility for individuals considering the purchase and sale of cryptocurrencies, thus, driving the United States ATM services demand growth.

According to the National ATM Council, the 2016 data on the top 10 U.S. banks with the largest ATM fleets demonstrates a strong physical banking infrastructure across the nation. JPMorgan Chase & Co. led an impressive network of 18,623 ATMs, making up 17.5% of the market share among these top banks. This significant ATM presence underscores the bank’s dedication to accessibility and customer service. Bank of America Corp. closely followed with 16,062 ATMs, representing 15.1% of the market. Further, Wells Fargo & Co. ranked third with 12,800 ATMs, capturing 12.1% of the market. PNC Bank secured the fourth spot with 8,996 ATMs, translating to an 8.5% market share. U.S. Bancorp was fifth, operating 5,001 ATMs, which accounted for 4.7% of the market, indicating a strong presence, particularly in the Midwest. BMO Harris Bank held a 4.5% market share with 4,775 ATMs, reflecting its strategy to offer widespread ATM services, especially in the Midwest and other key regions. BB&T managed 3,361 ATMs in 2016, securing a 3.2% market share, showing a notable physical presence in the Southeastern U.S. Citizens Bank and Citigroup Inc. each operated 3,200 ATMs, with each holding a 3% share of the ATM market. Fifth Third Bank secured a spot in the top ten with 2,650 ATMs, holding 2.5% of the market share. This reflects the bank’s dedication to maintaining a strong ATM network, especially in the Midwest. Their efforts are contributing to the growth of the United States ATM services market revenue by modernising older machines and expanding the use of advanced, contactless ATMs.

According to ATMIA estimates, the U.S. ATM network expanded by approximately 21,000 terminals from 2021 to the end of 2022. Further, the total number of active ATMs in 2023 ranged between 520,000 and 540,000. This growth in the total number of ATMs resulted in bolstering the United States ATM services industry revenue.

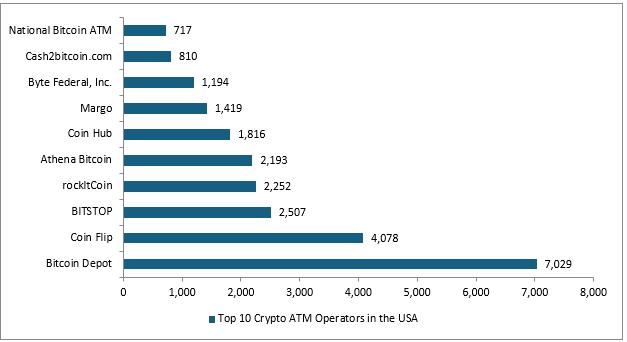

Figure: Top 10 Crypto ATM Operators in the United States

The top 10 operators run 24,015 crypto ATMs (79.1%). There are 196 other operators, who run 6,348 Crypto ATMs (20.9%).

NCR Corporation

Diebold Nixdorf, Incorporated

FCTI, Inc.

Hitachi Channel Solutions, Corp.

“United States ATM Services Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Deployment

Market Breakup by Management

Market Breakup by Type

Market Breakup by Application

Market Breakup by Region

The United States ATM services demand growth has led banks to utilise ATM management services to optimise operations, enhance efficiency, and remotely monitor and assess ATM condition and reliability. Effective ATM management is essential for maintaining reliability and security. These services reduce downtime, improve customer satisfaction by ensuring ATMs are well-stocked with cash, and provide banks with up-to-date, real-time information on ATM performance.

The demand for the United States ATM services market is growing because bank-owned ATMs, which are directly managed and operated by banks, ensure their reliability. Banks handle all aspects of operation and maintenance for these ATMs, including cash loading, annual maintenance contracts (AMC), and security. Banks set up ATMs across various locations known as onsite and offsite ATMs.

Onsite ATMs are located at the premises of the bank branch, whereas offsite ATMs are placed at locations away from the bank premises, such as railway stations, colleges, and others. Offsite ATMs allow for the ease of cash withdrawal to travellers, students, and the public.

The companies specialise in ATMs, self-service kiosks, and digital banking solutions, merging innovation with strong security to improve customer experiences and operational efficiency for financial institutions and retailers.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the United States ATM services market reached an approximate value of USD 7.73 billion.

The market is projected to grow at a CAGR of 2.5% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 9.54 billion by 2035.

ATM manufacturers are developing multi-functional ATMs that can help customers pay bills, transfer funds, exchange currencies, charge mobile phones, and video conference with a live teller.

ATMs conveniently provide access to cash on a 24/7 basis, without the need for a teller or other bank representative.

The major drivers of the market include cash accessibility, a rising number of service providers, cardless transactions, and increased dependency of the population on modern ATMs.

Key trends aiding market expansion include the technological advancement of ATMs, the growing popularity of Bitcoin ATMs, and the widespread availability of ATM services across the country.

Based on deployment, the market is broken down into onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs.

The market is broken down into New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West.

The competitive landscape consists of NCR Corporation, Diebold Nixdorf, Incorporated, FCTI, Inc., Hitachi Channel Solutions, Corp., Euronet Worldwide, Inc., Prineta LLC, and Payment Alliance International among others.

The different applications of ATM services are withdrawals, transfers, deposits, and others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Deployment |

|

| Breakup by Management |

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share