Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global urea market size reached a volume of 178.80 MMT in 2025. It is expected to grow at a CAGR of 0.90% between 2026 and 2035 driven by the growing demand as a fertiliser from the agriculture sector. The market is expected to reach a volume of 195.56 MMT in 2035. The growth of the global urea market reflects its critical role in supporting agricultural productivity worldwide. Urea remains one of the most widely used nitrogen-based fertilizers, essential for improving soil fertility and enhancing crop yields. The rising global population and increasing food demand are key factors driving the sustained consumption of urea in the agriculture sector.

Base Year

Historical Period

Forecast Period

Governments of agrarian-based economies are introducing favourable initiatives to push low-cost production of urea by subsidising gas procurement policies for fertiliser companies that can increase urea market value.

With the increased concerns regarding urea shortage amid geopolitical issues, interests in utilising technological interventions like coal gasification in urea production has grown.

North America, a significant market for urea, is focusing on expanding its capacity, to reduce the region’s reliance on imports.

Compound Annual Growth Rate

0.9%

Value in MMT

2026-2035

*this image is indicative*

| Global Urea Market Report Summary | Description | Value |

| Base Year | MMT | 2025 |

| Historical Period | MMT | 2019-2025 |

| Forecast Period | MMT | 2026-2035 |

| Market Size 2025 | MMT | 178.80 |

| Market Size 2035 | MMT | 195.56 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 0.90% |

| CAGR 2026-2035 - Market by Region | Latin America | 1.3% |

| CAGR 2026-2035 - Market by Country | India | 1.3% |

| CAGR 2026-2035 - Market by Country | Saudi Arabia | 1.2% |

| CAGR 2026-2035 - Market by Application | Urea Formaldehyde (UF) and Melamine Resins | 1.7% |

| Market Share by Country 2025 | India | 19.5% |

Urea has been widely used as a fertiliser in the agricultural sector to provide plants with nitrogen to promote their growth, among its other applications. Due to its high nitrogen content and enhanced convenience of applications, storage, handling, and transportation, the use of urea over other nitrogen fertilisers has increased, which aids global urea market size.

Further, the rising consumption of meat and dairy products for high protein diets has surged the utilisation of feed grade urea, which ensures healthy growth and improved milk production and reproduction in animals, and aids in lowering feeding costs.

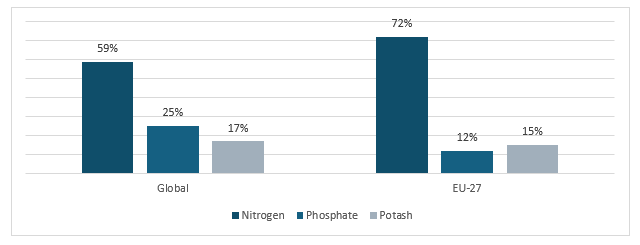

Figure: Fertiliser Production by Nutrient, 2020

Expanding agriculture sector; increasing use of feed grade urea; applications of urea in the automotive sector; and growing use in urea-formaldehyde resin production are the key trends impacting the market share of urea.

As per urea market dynamics and trends, the rapidly growing agriculture sector is driving the demand for urea as one of the most essential nitrogenous fertilisers used in agricultural practices.

The consumption of meat and dairy products is increasing worldwide due to their high protein content. This boosts the incorporation of feed-grade urea in the diet of cattle and other ruminants as it promotes healthy growth, milk production, and reproduction.

The adoption of urea in the automotive sector is experiencing an increase, as the most basic function of the automotive urea solution is to transform the nitrogen oxides in automobile exhaust into harmless nitrogen and water, thereby saving energy, protecting the environment and aiding urea demand.

A crucial industrial use of urea is in the production of urea-formaldehyde (UF) resins and glues. In the European Union, UF resins are majorly used in the construction sector to produce building materials, including particle boards and plywood.

In APAC countries like India, urea is subsidised for agricultural purposes. The government provides subsidies to fertiliser producers depending on the cost of production at each plant, and the manufacturers are required to sell the fertilisers at the maximum retail price (MRP) determined by the government.

As per the urea market analysis, the government has funded grants in the USA to boost fertiliser production to address price hikes caused by the Russia-Ukraine war, spur competition, and ensure food security. Further, in the Canadian Saskatchewan province, the government is committed to developing a competitive business environment with a suite of incentives to support the agricultural market and address high fertiliser prices.

A significant percentage of the population in developing countries depend on agriculture for their livelihood. Favourable agricultural policies in developing and developed countries globally, such as the Atmanirbhar Bharat Abhiyan in India, the U.S. Agricultural Policy in the USA, and the Swiss Agricultural Policy in Switzerland, have encouraged the growth of the agricultural market. Additionally, the growing population is increasing the demand for food and the need for food security.

The urea market is driven by the increasing use of urea-based fertilizers in agriculture to boost crop yields and its growing application in industrial sectors like chemical manufacturing and automotive industries.

Global fertilizer production exhibited notable trends over the years across various nutrient types. Potassium fertilizer production increased from 35.02 million tonnes in 2010 to 46.6 million tonnes in 2021, as reported by “Our World in Data”. This increase was driven by the growing demand for high-yield crops and the expansion of agricultural activities worldwide. As per the urea industry analysis, despite some volatility, including a 6.8% decline in 2019, potassium production rebounded with a 5.0% growth in 2020 and continued to rise by 3.8% in 2021.

Nitrogen fertilizer production grew from 107.36 million tonnes in 2010 to 118.5 million tonnes in 2021, which boosted urea industry revenue. However, production faced challenges, including a slight decline of 1.7% in 2021 due to factors such as fluctuating natural gas prices, which are a critical input for nitrogen fertilizer production, and environmental regulations affecting production capacities.

Phosphate fertilizer production remained relatively stable but showed a gradual increase from 44.09 million tonnes in 2010 to 48.2 million tonnes in 2021, according to the International Fertilizer Industry Association (IFA). The rise in production was influenced by the increasing need for phosphate fertilizers to support root development and crop maturity, essential for improving agricultural output.

Overall, total fertilizer production increased from 186.47 million tonnes in 2010 to 213.3 million tonnes in 2021. This growth underscores the ongoing global demand for fertilizers to boost agricultural productivity and ensure food security. Despite minor fluctuations, such as a slight dip in overall growth in 2020, the fertilizer market demonstrated resilience and a capacity to recover.

These trends highlight the importance of consistent fertilizer production in supporting the growth of the urea industry. The steady increase in nitrogen fertilizer production, despite occasional challenges, indicates a resilient demand for urea, driven by its vital role in enhancing agricultural productivity.

According to the International Fertilizer Association, Urea production and trade data from 2018 to 2023 show notable trends. In 2018, urea production was 171.6 million tonnes (Mt), increasing to 176.6 Mt in 2019, a 2.9% year-on-year (YoY) growth. By 2020, production reached 181.2 Mt, reflecting a 2.6% YoY increase. Production slightly dipped to 179.6 Mt in 2021, a 0.9% decline, likely due to market fluctuations. In 2022, production rose to 183.6 Mt, a 2.2% increase, driven by heightened agricultural demand.

Trade data in the urea industry also indicate significant changes. In 2018, trade was 48.3 Mt, increasing slightly to 48.6 Mt in 2019. By 2020, trade had surged to 52.1 Mt, a notable 7.1% YoY increase. In 2021, trade remained relatively stable at 52.3 Mt, with a minimal 0.4% YoY growth. Trade increased to 53.3 Mt in 2022, a 1.9% rise, but decreased to 51.2 Mt in 2023, reflecting a 3.9% decline, potentially due to changes in global market dynamics and supply chain issues.

The consistent rise in urea production is mainly driven by the growing use of urea-based fertilizers in agriculture and expanding industrial applications, while trade variations reflect market adjustments and logistical challenges.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Competitive factors in the global urea market include production capacity, cost efficiency, and technological advancements. Leading producers such as China and India dominate with high production volumes, with China alone producing over 50 million tonnes annually. Cost-efficient production methods and economies of scale provide a competitive edge.

“Global Urea Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Application

Market Breakup by Region

| CAGR 2026-2035 - Market by | Application |

| Urea Formaldehyde (UF) and Melamine Resins | 1.7% |

| Fertiliser | 1.5% |

| Melamine (Cyanurates) | XX% |

| Animal Feed | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Region |

| Latin America | 1.3% |

| North America | 0.8% |

| Europe | XX% |

| Asia Pacific | XX% |

| Middle East | XX% |

| CAGR 2026-2035 - Market by | Country |

| India | 1.3% |

| Saudi Arabia | 1.2% |

| Mexico | 1.1% |

| China | 1.0% |

| UK | 0.7% |

| USA | XX% |

| Canada | XX% |

| Germany | XX% |

Based on application, fertiliser dominates the global market, supported by the growing demand for nitrogen rich fertilisers to boost crop production

Urea is considered an ideal nitrogen fertiliser owing to its high nitrogen content (approximately 46%) and low transportation and storage costs. A combination of nitrogen-rich urea-starch composites and melamine supports the development of controlled-release fertilisers that reduce nutrient losses due to run-off and leaching and aid urea market expansion.

The fertiliser segment is closely followed by animal feed applications of urea. Feed grade urea is a widely used source of non-protein nitrogen (NPN) for animals and enhances the profitability of livestock farmers by reducing feeding costs.

The market players offer high-quality urea at a competitive price to meet the growing global demand, especially from the agricultural sector.

Yara International ASA, headquartered in Norway, is the world’s leading crop nutrition company and a provider of environmental and agricultural solutions.

IFFCO is one of India's biggest co-operative societies for urea industry which is wholly owned by Indian Co-operatives and has its production units in Kalol, Kandla, Phulpur, Aonla, and Paradeep. The company operates in multiple segments including fertiliser production to general insurance.

PT Pupuk Kalimantan Timur (PKT), headquartered in Indonesia is one of the leading urea and NPK fertilizer producers in Asia and sells its products in domestic as well as foreign market. The company has an annual production capacity of 3.4 million tons of urea and 350 thousand tons of NPK.

QAFCO is a global leader in fertiliser production and runs as a joint venture between the Government of Qatar and several foreign shareholders. QAFCO has a strong presence with 6 world-class plants, having an annual capacity of 3.8 MMT of ammonia and 5.6 MMT of urea.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the global urea market are National Fertilizers Limited, EuroChem Group AG, Saudi Arabian Fertilizer Company, CF Industries Holdings, Inc, and Nutrien Ltd, among others.

| 2025 Market Share by | Country |

| India | 19.5% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

There is a significant amount of intra-regional trade within the Asia Pacific region. Indonesia, with its substantial natural gas reserves, is one of the major ammonia and urea exporters in the Asia Pacific. The Asia Pacific region is also a major contributor to the global agriculture production, with countries such as India being the agriculture powerhouse and a leading producer of milk, pulses, and spices along with the world's largest area under wheat, rice, and cotton. This supports the urea market development, with urea being one of the most important nitrogenous fertilisers required during agricultural processes.

Meanwhile, within North America, beef consumption has increased in the USA, owing to its affordability compared to vegan alternatives. With people getting comfortable preparing beef barbeques and briskets, the need to boost meat production has increased. Feed-grade urea finds applications to help stem weight loss in cattle by improving their rumen function.

Agricultural Commodity Distribution Networks

Bulk Fertilizer Storage And Handling Systems

SCR Chemicals and Emission Control Reagents

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global market attained a volume of 178.80 MMT in 2025.

The market is projected to grow at a CAGR of 0.90% between 2026 and 2035.

The key applications include fertiliser, urea formaldehyde (UF) and melamine resins, melamine (cyanurates), animal feed, and others.

The key regional markets for urea are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The key exporters include China, South Korea, and Thailand.

The major drivers are the rising population, the increasing requirement for fertilisers amidst the demand for food, and the presence of favourable government initiatives.

The key trend includes research activities aimed at developing innovative processes and devices by using technologies like electrocatalysis for manufacturing environmentally friendly urea as one of the alternative solutions to industrial urea production, reducing energy usage.

The key players in the market include Yara International ASA, Indian Farmers Fertilisers Cooperative Limited, PT Pupuk Kalimantan Timur, Qatar Fertilizer Company, National Fertilizers Limited, EuroChem Group AG, Saudi Arabian Fertilizer Company, CF Industries Holdings, Inc, and Nutrien Ltd, among others.

The Asia Pacific region is the largest consumer of urea.

Yara International, CF Industries Holdings Inc., OCI Nitrogen, and EuroChem Group AG are some of the major suppliers.

Environmental regulations, fluctuating raw material prices, and supply chain disruptions are some major challenges.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach 195.56 MMT by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share