Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Vietnam warehousing market attained a value of USD 5.84 Billion in 2025. The market is expected to grow at a CAGR of 11.20% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 16.88 Billion.

A key driver of the Vietnam warehousing market is the deployment of fully automated robotic fleets in parcel sortation centres, which boosts throughput and operational precision in response to the surge in e-commerce. For example, in early 2025, the postal and courier firm Viettel Post deployed around 200 automated-guided vehicles (AGVs) across one of its Hanoi warehouses to sort packages for major online retailers. This innovation allows processing capacity to increase by roughly 3.5 times and cuts delivery times by 8-10 hours, aligning warehousing capabilities with Vietnam’s high-growth digital-commerce ecosystem.

The growth of the Vietnam warehouse market is further driven by strong economic growth. With rising manufacturing, retail and e-commerce, the demand for efficient storage and distribution is escalating. As per the General Statistics Office of Vietnam, Vietnam’s GDP was estimated to rise by 7.09% in 2024. Increasing foreign direct investment (FDI) and industrial production boost warehousing needs, particularly near manufacturing hubs and ports. This growth encourages developers and logistics firms to invest in modern warehouse infrastructure, supporting the country’s evolving supply chains.

The Vietnam warehousing industry is embracing technologies, such as warehouse management systems (WMS), automation, and robotics. These technologies improve inventory accuracy, reduce labour costs, and speed up operations. In August 2024, Nissin Logistics Vietnam partnered with MEKSMART to implement a custom NISSIN-WMS across their major warehouses in Binh Duong and Bac Ninh provinces. The push towards Industry 4.0 practices enables better supply chain visibility and efficiency. Although automation adoption is still in early stages compared to developed markets, rising labour costs and demand for high service quality encourage increased investment in tech-enabled warehouses.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

11.2%

Value in USD Billion

2026-2035

*this image is indicative*

Vietnam’s government is heavily investing in infrastructure improvements such as highways, ports, and airports, adding to the Vietnam warehousing industry. In December 2024, Viettel inaugurated Vietnam's first fully integrated logistics centre in Lang Son province, featuring AI-powered cameras and autonomous robots, to streamline logistics operations. This enhanced connectivity reduces transportation costs and transit times, making warehousing more efficient. Improved infrastructure supports multi-modal logistics, integrating road, rail, and sea transport, essential for warehouse accessibility and distribution networks.

Vietnam’s e-commerce market is growing, driven by rising internet penetration and smartphone usage. According to industry reports, Vietnam recorded 78.44 million internet users at the beginning of 2024, reflecting the country’s rapidly expanding digital landscape. This surge in online activity is driving strong demand for flexible and scalable warehousing solutions that can support faster order fulfilment, efficient inventory management, and seamless last-mile delivery to meet growing e-commerce expectations. Warehouses are increasingly designed for smaller, frequent shipments and integrated with advanced inventory management systems. The trend pushes logistics providers to develop multi-channel fulfilment centres to handle diverse product categories and maintain customer satisfaction through speedy deliveries.

Rapid urbanization is boosting the Vietnam warehousing market expansion as it increases retail consumption, creating demand for urban logistics and warehousing facilities. As per Open Development Vietnam, about 57.3% of Vietnam's population is likely to reside in urban areas by 2050. Proximity to large consumer bases enables faster delivery times and lower last-mile costs. Warehousing facilities are increasingly located near urban centres or major transport corridors to optimize distribution to retail stores and consumers, supporting the growth of modern trade.

Vietnam’s growing food processing, pharmaceutical, and agricultural export sectors drive demand for temperature-controlled warehousing. Cold chain facilities ensure product safety and compliance with international standards. In March 2025, LOTTE Global Logistics commenced construction of a USD 34 million cold chain facility in Đồng Nai Province to provide comprehensive logistics services. Increasing consumer preference for fresh and frozen foods domestically also stimulates cold storage development. Investments in modern refrigeration and monitoring technologies make this trend a rapidly expanding segment in the Vietnam warehousing market.

Sustainability is gaining importance in Vietnam’s logistics sector. Warehousing developers are incorporating energy-efficient designs, solar panels, and waste reduction practices to minimize environmental impact. In July 2023, Frasers Property Vietnam unveiled the Eco Logistics Centre in Binh Duong Province, marking the company's first LEED-certified ready-built warehouse in the country. Green warehouses help companies comply with global ESG standards, attracting multinational tenants. With sustainable logistics practices, consumers and investors prioritize eco-friendly operations, pushing the market towards greener warehouse development.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

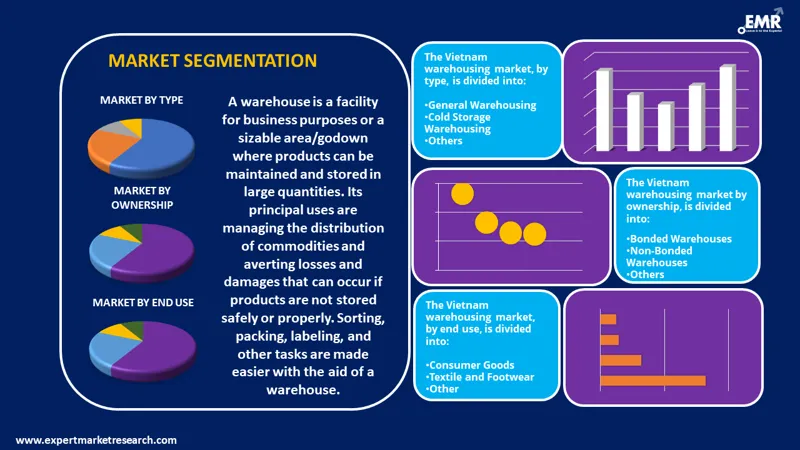

The EMR’s report titled “Vietnam Warehousing Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Types

Key Insight: General warehousing dominates the Vietnam warehousing market, driven by strong demand from manufacturing, retail, and e-commerce sectors for offering flexibility and cost-effective storage. For instance, in September 2023, French logistics giant FM Logistic opened its second Vietnam distribution centre in Binh Duong, featuring advanced warehousing and e-commerce services. Strategic locations near ports and industrial zones enhance supply chain efficiency. Companies operate expansive general warehouses with modern tracking systems. The sector's growth is fuelled by Vietnam’s rising exports and foreign investment in production, making general warehousing a critical logistics backbone.

Market Breakup by Ownership

Key Insight: Bonded warehouses are at the forefront of the Vietnam warehousing market expansion owing to the country’s rising export-import activities. These facilities are vital for textiles, electronics, and pharmaceuticals as they enable the efficient inventory management and reducing upfront costs. Their strategic location near ports and logistics hubs further strengthens their dominance within Vietnam’s warehousing landscape for catering to the thriving international trade demands. For instance, in July 2025, Vietnam Post Logistics simultaneously launched three new bonded warehouses in Vinh Phuc, Ha Nam, and Hai Phong, strategically located close to international seaports, optimizing import-export flows.

Market Breakup by End Use

Key Insight: The consumer goods segment is contributing to the Vietnam warehousing market share due to rapid urbanization and rising disposable incomes. As per industry reports, 60% of households in Vietnam are expected to earn more than USD 5,000 annually by 2027, further fuelling the demand for household items, electronics, and daily essentials. The growth of e-commerce giants has further accelerated the need for sophisticated warehousing solutions to support last-mile delivery and inventory turnover. This sector’s vast product range demands flexible, high-capacity warehouses in urban and peri-urban industrial zones, making it the largest driver of warehousing demand nationwide.

Market Breakup by Region

Key Insight: Southern Vietnam warehousing market revenue is rising due to its strategic role in manufacturing, export, and logistics. In July 2024, Bình Dương's Department of Industry and Trade reported nearly USD 13.8 billion in export revenue during the first five months of 2024, marking a 13% year-on-year rise for the southern industrial hub. The region houses major industrial hubs, such as Binh Duong, Dong Nai, and Ho Chi Minh City, offering proximity to Cat Lai Port and Cai Mep-Thi Vai deep-sea port. Global firms have launched large-scale non-bonded warehouses here to serve consumer goods, textiles, and retail sectors, making the South Vietnam market dominant.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Rising Demand for Cold Storage Warehousing in Vietnam

The cold storage warehousing demand in Vietnam is largely supported by increased demand for temperature-controlled logistics in food, pharmaceuticals, and agriculture. Growth in frozen seafood exports, vaccine distribution, and fresh produce supply chains is propelling this market. According to the Vietnam Association of Seafood Exporters and Processors, Vietnam’s frozen seafood export turnover was anticipated to reach USD 7.2 billion in 2023. The government's push for food safety and the expansion of modern retail also contribute to the need for efficient, high-standard cold chain infrastructure across key urban regions.

Non-Bonded Warehouses to Gain Preference in Vietnam

Non-bonded warehouses are adding to the Vietnam warehousing industry value, as they store domestic goods that do not require customs clearance for serving retail, FMCG, and manufacturing. Companies provide non-bonded warehouse services in industrial zones for offering inventory control and distribution support. In January 2024, BW Industrial began construction of a new logistics project in VSIP Bac Ninh 2, further providing flexibility and localized storage solutions for Vietnam’s growing internal market. These facilities are also expanding with the rise of e-commerce and domestic supply chain needs.

Surging Warehouses Penetration in Textile and Footwear & Retail in Vietnam

The textile and footwear industries in Vietnam are a key source of exports, requiring large amounts of warehousing for raw materials, semi-finished and finished goods. Many companies have large manufacturing bases in Vietnam, necessitating logistics hubs near industrial parks. Adding to this, the warehouses that support these types of logistics are required to include advanced inventory control systems, enabling companies to accommodate fluctuations in demand during peak seasons and achieve export deadlines. The sector's use of turnaround and demand for strong quality control capabilities further drives the warehouse demand, including distributions throughout the industrial parks in the region.

The retail segment of the Vietnam warehousing market is rapidly evolving with the proliferation of supermarket chains, convenience stores, and online shopping sites. Retailers invest in warehouses that offer efficient storage and distribution to multiple outlets across urban centres. For instance, in April 2023, Thailand’s Central Retail Corporation unveiled plans to invest USD 1.45 billion into Vietnam for supermarket expansion in urban centres between 2023 and 2027. This segment steadily increases warehousing demand but remains secondary to consumer goods and textile industries.

Northern Vietnam to Witness Higher Warehouse Demand

Northern Vietnam is a fast-growing region in the Vietnam warehousing industry, primarily due to its industrial base in Bac Ninh, Hung Yen, and Hai Phong, and connectivity to Hai Phong Port. The region supports electronics, automotive, and light manufacturing sectors and witnesses the entry for new entrants. In November 2024, Japan’s Mitsubishi Estate began construction of its Logicross Hai Phong ready-built warehouse, marking the logistics brand’s entry into northern Vietnam’s Hai Phong to support industrial and distribution growth. With growing infrastructure, including highways and ring roads, and access to China’s supply chain, the North’s warehousing market is rising quickly but still trails behind the South in scale and maturity.

Key players in the Vietnam warehousing market are employing strategies to stay competitive and meet the rising demand driven by e-commerce, manufacturing, and international trade. A primary strategy is investing in modern, high-tech warehouses equipped with automation, smart inventory systems, and cold chain facilities to support food, pharmaceuticals, and electronics sectors. Strategic location selection, especially near ports, airports, and industrial zones, such as Hai Phong, Ho Chi Minh City, and Da Nang, is also vital for reducing transportation costs and improving delivery speed.

Numerous companies are establishing joint ventures with international logistics providers to gain capital, expertise, and access to advanced technologies. Likewise, players are concentrating on scalable, build-to-suit warehouses that meet and attract multinational tenants focused on operational efficiency and reliability. Sustainability is also becoming more important, as companies are actively seeking out green building certification as well as energy efficiency stamp or tracking highlighted in the operations. Finally, digitalization is becoming an important driver of change in logistics through WMS, the integration of the internet of things (IoT), and data and data analytics for revolutionizing logistics and other business landscapes.

Sumitomo Warehouse (Vietnam) Co., Ltd. is a logistics organization established in 2012 in Ho Chi Minh City, Vietnam offering a variety of integrated logistic services including warehousing, freight forwarding, and distribution. Sumitomo Warehouse is backed by the Japanese company, Sumitomo, and has the location capacity of bonded storage and general storage with ISO 9001 certification to prioritize safety, efficiency, and supply chain support over borders.

FNM Shipping Vietnam, headquartered in Ho Chi Minh City and part formed in 2015, offers total freight solutions for air, sea and land routes. FNM emphasizes transparency and tailored solutions, supporting clients with multilingual service, warehousing, and customs clearance expertise.

Formed in 2006, Yusen Logistics Co., Ltd. (Vietnam) is headquartered in Binh Duong and is a subsidiary of the Japan-based Yusen Logistics Group. The company delivers full-service logistics comprising warehousing, cold chain solutions, and transport and is renowned for its advanced warehouse management systems and reliable services in temperature-sensitive and bonded cargo handling.

Founded in 2011, Vinatech Group is headquartered in Vietnam and is a leading manufacturer of shelving and racking systems. The company specializes in high-quality and customizable storage solutions, including ASRS and shuttle racks. With ISO 9001 certification and advanced ERP systems, Vinatech promotes automation, innovation, and sustainability in industrial storage.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Unlock key insights into Vietnam’s booming logistics sector with our Vietnam Warehousing Market Report 2026. Discover emerging trends, market drivers, and competitive strategies shaping the industry. Download your free sample today to stay ahead with expert forecasts and analysis of Vietnam warehousing market trends 2026 and beyond.

WMS Solutions And Logistics Tech In Vietnam

Vietnam 3PL Services And Contract Logistics

Vietnam Urban Micro-Warehousing Market Trends

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 11.20% between 2026 and 2035.

Key strategies driving the market include investing in modern, automated facilities, expanding near logistics hubs, and forming joint ventures with global partners. Companies are adopting smart warehouse management systems, offering customized storage solutions, and emphasizing sustainability to meet rising demand from e-commerce, manufacturing, and cold chain logistics sectors.

The key market trends driving the growth of the market are mass production and reduced tariff barriers, providing benefits like cost competitiveness, economies of scale and scope, reduced labour cost, and technological integration.

The major regional markets are Southern and Northern Vietnam.

The market is broken down into general warehousing, cold storage warehousing, and others.

The ownerships in the market are bonded warehouses and non-bonded warehouses, among others.

Based on end use, the market is divided into consumer goods, textile and footwear, retail, food and beverage, wooden products, healthcare, chemicals, and others.

The key players in the market report include Sumitomo Warehouse (Vietnam) Co., Ltd., Fnm Shipping Vietnam, Yusen Logistics Co., Ltd., and Vinatech Group, among others.

In 2025, the market reached an approximate value of USD 5.84 Billion.

General warehousing dominates the market, driven by strong demand from manufacturing, retail, and e-commerce sectors for offering flexibility and cost-effective storage.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Types |

|

| Breakup by Ownership |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share