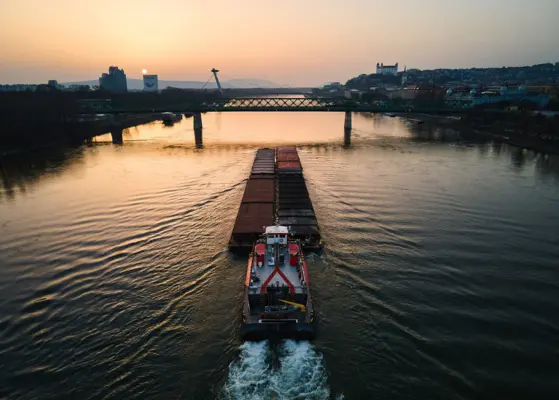

Cost Efficiency of Barge Transport Compared to Rail and Road Freight

Cost pressure is turning into one of the key factors that influence decisions about freight transportation in bulk and heavy cargo segments. Therefore, shippers that deal with commodity trading characterized by extremely low margins, view transportation as a strategic cost center. In such a situation, barge transportation has regained its status as a cost-effective mode of transport over rail and road freight, especially for the long-distance and high-volume shipments. The benefits are reinforced by deliberate investments from barge operators, terminal owners, and logistics companies, which are collectively scaling inland waterway economics through coordinated efforts.

The transportation of bulk goods by barge can be 30 to 40% less costly than rail cars on a per-ton-mile basis. These savings are quite considerable for the agriculture, mining, energy, and construction materials industries, where freight costs have a direct bearing on the profitability and pricing flexibility of a product.

Structural cost advantages of barge transport

The fundamental cost advantage of barge transportation is the economics of capacity. One covered barge alone can hold as much cargo as 15 railcars or more than 60 trucks. Such a scale significantly cuts down on labor, fuel, and congestion-related inefficiencies. Although transit times are slower, bulk shippers generally value stable and predictable cost structures more than speed, especially when inventory planning is closely linked to production cycles.

Fuel efficiency is an extremely important factor here. Inland barges are significantly more fuel-efficient per ton-mile than trucks and trains. Since the price of diesel has been unstable over the last few years, this efficiency has resulted in barge customers experiencing more stable freight rates.

Rail and road cost pressures

Rail freight, traditionally regarded as the most significant competitor to barges in bulk transport, is now experiencing an increase in operating costs. The rail transport sector is struggling with rising labor costs, rising maintenance expenses, and congestion on major routes. Although rail transport is the faster transport mode, its pricing flexibility has decreased substantially, particularly for small-scale shippers.

Moreover, trucking rates have been pushed up by the shortage of drivers, the costs of meeting regulatory requirements, and the rising insurance premiums. In the cases of heavy and low-value bulk goods, it is quite difficult for these increases to be absorbed. Thus, several industrial shippers are now rethinking the usage of trucking and considering it more as a short-haul and last-mile solution rather than as a means for long-distance bulk transport.

Integrated terminal strategies lower total logistics cost

Barge line companies are no longer competing on the economics of their vessels alone. Many are making substantial investments in terminal infrastructure to lower the total cost of landed delivery to their customers. Modern inland terminals, with automated unloading systems, fast conveyors, and increased storage capacity, have significantly reduced dwell times and handling losses.

Shippers are increasingly using the performance of the total end-to-end cost of logistics partners as the main criteria for their choice instead of focusing on mode-specific pricing only. Those companies that provide a full range of services including barge transportation, terminal handling, and storage are capturing greater market shares because they make procurement easier and decrease the risk of coordination.

Operators with integrated terminal assets continuously experience greater customer loyalty levels that are higher than average. These companies are able to deal with short-term disruptions more efficiently, thus, they can keep their clients immune from sudden price hikes caused by events such as torrential weather or shortage of capacity.

Long-term contracts and pricing stability

One of the less obvious benefits of barge transportation is pricing over time. Spot rates in trucking may change drastically within a short period, while barge freight prices are often fixed with longer-term contracts. Such contracts lead to a stable pricing pattern determined by volume commitments instead of daily market rate fluctuations.

Commodity producers who plan multi-seasonal production often rely on such stability. Agricultural exporters, for instance, are gradually becoming more willing to commit to annual or long-term barge contracts that coincide with the harvest cycle. In this way, they can fix transportation costs at the beginning of the season, which enables them to have a better estimate of their margins.

Barge operators equally derive advantages from this system. Long-term agreements improve fleet utilization and enable operators to raise capital to upgrade vessels and towboats.

Explore the Barge Transportation Market Report for insights on pricing, fleet investment, and inland freight strategies.

Capital Efficiency and Investor Interest

Cost efficiency is also reshaping investor preference toward inland barge transportation. Compared to rail networks, which require continuous high capital expenditure, barge operations can scale capacity more selectively. Fleet upgrades and terminal expansions are modular, allowing operators to align spending as per the demand growth.

This capital efficiency has attracted private equity and infrastructure investors looking for stable cash flows tied to industrial activity. Over the past few years, multiple inland terminal acquisitions and joint ventures have been announced, signaling confidence in the long-term economics of barge logistics.

For B2B customers, this investor interest translates into better-funded partners with the ability to modernize assets and expand capacity. It reinforces the perception of barge transportation as a resilient and scalable logistics solution rather than a legacy mode.

Share