Role of Inland Waterways in Bulk Commodity Logistics

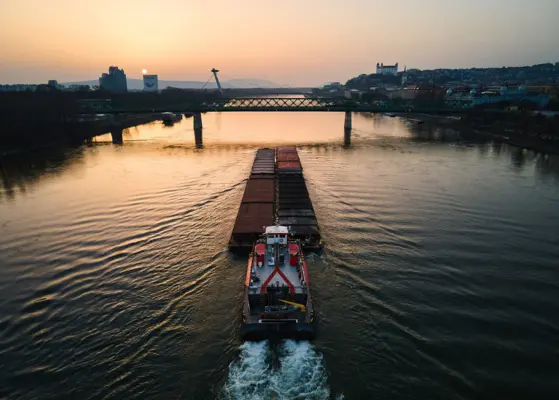

Bulk commodity logistics is characterized by scale, strict cost management, and predictable movements. Over the last few years, inland waterways have been going through a silent redeployment, particularly for coal, grains, iron ore, fertilizers, and petroleum products. While road and rail are still the first choice for shipping time-dependent cargoes, inland barge transportation has become the option of choice for high-volume bulk shipments owing to their consistency and affordability. This change has been shaped by the concerted efforts of barge operators, terminal developers, and logistics firms that view inland waterways as a competitive asset for the future rather than just a traditional mode of transport.

According to industry estimates, the cargo moved by inland waterways exceeds 600 million tons yearly in the United States alone with bulk commodities representing a significant percentage of total barge volumes. These shipments play a vital role for energy producers, agribusiness exporters, and construction material suppliers that are heavily dependent on long-haul, nonstop transportation.

Infrastructure-led efficiency gains

The revitalization of inland waterways is due to the improvement of infrastructure that helps to diminish the uncertainty in bulk transport planning. Programs for lock renovation, projects for dredging, and automation of terminals have enhanced the vessel turnaround times and load reliability. Prominent barge operators who are mainly operating on the Mississippi River system are collaborating with port authorities to coordinate fleet deployment with river capacity, considering that this is the area where congestion used to negatively impact seasonal grain exports. Meanwhile, the terminal operators are also adding more covered storage and installing high-capacity conveyors to facilitate quicker bulk transfers.

Fleet modernization and commodity specialization

Barge transportation companies are increasingly segmenting fleets by commodity type. Rather than relying on general-purpose barges, operators are introducing specialized vessels designed for dry bulk, liquid bulk, and hazardous materials. Covered hopper barges with improved sealing systems have now become common for grain and fertilizer shipments, reducing cargo loss and contamination risk.

Fleet modernization is also tied to fuel efficiency targets. Newer barges, when paired with modern towboats, can move one ton of cargo more than 600 miles on a single gallon of fuel. This efficiency advantage is central to why bulk commodity shippers continue to favor inland waterways. In contrast, rising diesel costs and labor shortages have placed sustained pressure on trucking rates, making long-haul road transport less attractive for low-margin bulk goods.

Digital planning and contract logistics

Bulk commodity transportation relies heavily on predictive accuracy. One of the ways inland barge operators are responding to the evolving trends is by equipping their operations with digital freight planning tools. Through these platforms, commodity producers can commit to barge capacity several months in advance and at the same time, they can check vessel availability offering real-time updates. From a B2B perspective, this is changing the way long-term supply agreements are arranged.

Supporting agricultural and energy exports

Inland waterways make a significantly larger contribution to export-oriented bulk logistics as compared to the other modes of transport. It is estimated that about 60% of grain exports from the United States are carried by barge operations. This emphasizes the role of river transport as a strategic link that connects producers with global markets.

Agribusinesses are seizing the opportunity by setting up production facilities in the vicinity of rivers. Elevators that store grain before it is transported, are being built next to the river paths to allow for faster loading so that barge arrivals can be matched in time.

On the other hand, refiners of petroleum and manufacturers of chemicals are increasing their stocks of products that can be easily delivered by barge operations so that they can have more options for their distribution. In those situations where a liquid bulk needs to be transported, especially if it involves items that have special requirements, using an inland barge not only ensures safety but also is a way to achieve further scalability of the operation.

Explore the Barge Transportation Market Report for insights into capacity, fleet upgrades, and inland logistics strategies.

Strategic implications for bulk logistics players

The increased involvement of inland waterways is significantly altering the competitive landscape of bulk commodity logistics. Players that control both transportation and terminal facilities are gaining stronger pricing power along with increased operational flexibility. Such vertical integration enables them to provide package services that small-scale players find difficult to imitate.

With increased investment in infrastructure and improvements in fleet efficiency, inland waterways are poised to gain a larger market share in bulk logistics. This is not a short-term response to higher fuel prices but a fundamental shift in the way bulk commodities are transported in large economies.

Share