Impact of River Infrastructure Modernization on Freight Movement

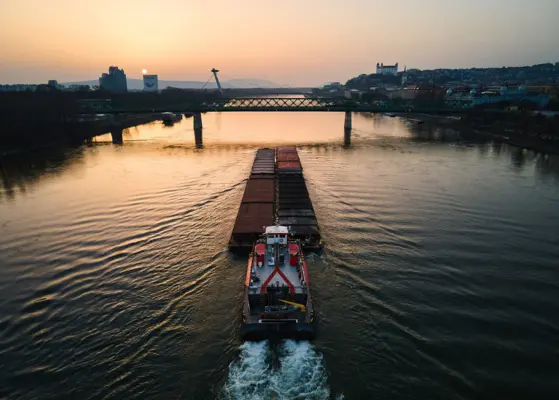

River infrastructure has traditionally been a minor issue until there were problems with the infrastructure. For many years, inland waterways have been maintained with old locks, minimal dredging, and terminals designed for reduced trade volumes. But in the present day, modernization of infrastructure on the inland routes is recognized as key to enhancing freight transport, with a strong emphasis on enhancing barge transportation.

For barge operators and their customers, these enhancements collectively impact the transit time, efficiency of loading, asset utilization, and agreement reliability. As governments along with private stakeholders invest more funds into river infrastructure, the competitiveness of inland freight in the market is expected to evolve.

Lock upgrades and throughput reliability

Locks are essential parts of inland navigation. Currently, in the United States, 54% of the Inland Marine Transportation System's (IMTS) structures are more than 50 years old and 36% are more than 70 years old, when the vessels were smaller, and there was less traffic. If such facilities fail or operate under capacity, the delay impact will be felt beyond the immediate area to the whole logistics network.

Moreover, reliability from a B2B perspective is as important as the price. Bulk shippers want logistics partners who can give them timely delivery without fail. By eliminating so many unexpected interruptions, modernized locks help operators schedule even more accurately and meet the terms of their contracts at the busiest time of the year.

Dredging and navigability improvements

Dredging remains one of the most practical yet underappreciated infrastructure investments. Maintaining channel depth ensures that barges can operate at optimal load levels throughout the year. When channels are not adequately dredged, operators are pushed to reduce cargo loads, increasing per-unit transport costs.

Terminal modernization and faster cargo handling

River infrastructure upgrades cover a wider area than navigation channels. Significant modernization of inland terminals is taking place to cater to higher freight volumes and to meet customer expectations. Unloading automation, renewal of conveyors, and enlargement of storage yards are gradually becoming standard features.

Operators at terminals are investing in machinery that shortens the time a vessel stays in port. The direct result of loading and unloading quicker is better utilization of the fleet, which means operators can carry more cargo with the same number of barges.

Several large logistics companies have signaled that terminal upgrades are central to improving service for industrial clients. These capital investments are supported by long-term volume contracts, which justify the spending and align supply chain partners around shared operational and commercial objectives.

Public funding and private alignment

Investments in the infrastructure of inland waterways are usually public-funded, but their viability is increasingly subject to the cooperation of the private sector. Barge carriers and terminal operators are now aligning their capital expenditure with public authorities to ensure that investments are made on the basis of actual freight traffic rather than potential capacity growth.

This cooperation has improved over the past few years. Barge carriers are now exchanging traffic forecasts and operating data with public bodies to enable informed investment decisions on projects that would have the highest economic return. In exchange, they have adjusted their fleet and terminal investment strategies to make optimal use of the improved infrastructure.

Refer to the Barge Transportation Market Report for insights on inland freight infrastructure and strategy trends.

Economic implications for inland freight

The overall outcome of infrastructure development is that the value proposition for barges has improved. Even though barges are slower compared to other modes of transport, they have an advantage when it comes to predictability, which is becoming an important factor for bulk cargo carriers.

The effects of improved logistics stability are not limited to transport economics. The reduced volatility of logistics is contributing to stable pricing of bulk commodities and improving export competitiveness.

Institutional investors are also taking advantage of the improved logistics stability. Logistics assets backed by infrastructure are considered more secure investments, especially if they are supported by public funding and long-term freight demand.

Share