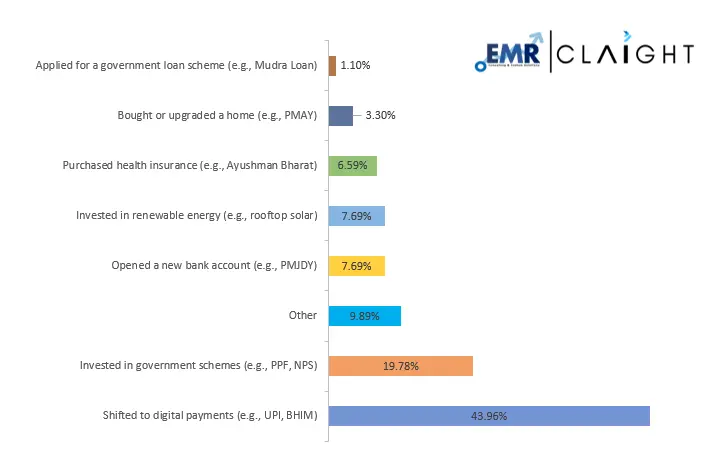

The study shows a significant shift among Indians towards digital payments and government financial schemes, highlighting a strong response to government policies. Investments in renewable energy and long-term savings plans are also notable. This reflects a broader move towards sustainable and secure economic practices.

In recent years, the response of Indian citizens to government policies has taken a distinct shift towards embracing digital and financial empowerment initiatives. The data reveals a significant move towards modern financial practices, reflecting a broader transformation in how individuals engage with the economic landscape of the country.

Financial Behaviour in Response to Government Policies

Notably, a substantial 43.96% of respondents have shifted to digital payments systems like UPI and BHIM, illustrating the widespread adoption of digital transactions spurred by government advocacy and the convenience they offer. Meanwhile, investments in government schemes such as PPF (Public Provident Fund) and NPS (National Pension System) have engaged 19.78% of the populace, underscoring a proactive approach to long-term financial planning. Other financial actions, including opening new bank accounts under initiatives like PMJDY (Pradhan Mantri Jan Dhan Yojana) and investing in renewable energy sources like rooftop solar, are each chosen by 7.69% of respondents, highlighting diverse financial engagement driven by governmental incentives.

The trending inclination towards renewable energy investments and health insurance, specifically through government-promoted schemes like Ayushman Bharat (6.59%), aligns with global moves towards sustainable living and health security. This is particularly relevant in the current global context where sustainability and health have become paramount. The comparatively lower percentages for home purchases/upgrades (3.30% through PMAY, Pradhan Mantri Awas Yojana) and applications for government loans like Mudra Loan (1.10%) suggest a more cautious approach in the real estate and entrepreneurial sectors, potentially due to economic uncertainties.

Financial Behaviour In Response To Government Policies

Prime Minister Narendra Modi's quotes on these matters often emphasize the transformative potential of digital technologies and sustainable practices for economic inclusion and environmental stewardship. His advocacy for digital payment systems and renewable energy echoes in the choices people are making, reflecting a direct correlation between governmental rhetoric and public action.

This study not only explores the shifts in financial behaviours among Indians but also reveals insights into how policies can mold personal finance choices. The findings highlight the government’s role in shaping economic activities through incentives and support systems, thus fostering a more inclusive and sustainable economic environment. This continued alignment of policy and public response is crucial for achieving the broader goals of economic resilience and sustainability in India.

Share