Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global air freight market size was volumed at 122.83 MMT in 2025. The market is expected to grow at a CAGR of 12.00% during the forecast period of 2026-2035 to reach a volume of 381.49 MMT by 2035. Market expansion is being supported by strategic investments and partnerships across the logistics ecosystem. For example, in early 2025, DHL Express partnered with Emirates SkyCargo to expand its global air freight capacity, targeting high-demand trade lanes in Asia and the Middle East. Additionally, increasing freighter conversions and development of regional cargo hubs are further reinforcing long-term market growth. The industry is witnessing strong and sustained growth, underpinned by the rising demand for fast, reliable logistics solutions in a rapidly evolving global trade environment. E-commerce remains a primary growth catalyst, with approximately 2.77 billion online shoppers globally fueling cross-border transactions. This surge in digital commerce has significantly increased the need for efficient air cargo services, particularly for high-value, time-sensitive goods such as electronics, pharmaceuticals, and perishables.

In line with this air freight market trend, industry performance indicators show positive momentum. According to March 2025 data, global air cargo demand, measured in cargo ton-kilometers (CTK), grew by 4.4% year-on-year, reaching the highest level ever recorded for the month. Concurrently, available cargo capacity (ACTK) rose by 4.3%, reflecting ongoing investments in fleet expansion, freighter conversions, and airport infrastructure. Technology is playing a critical role in this transformation, reshaping the air freight market dynamics. The integration of AI, IoT, and blockchain is enhancing supply chain visibility, operational efficiency, and cargo security. Additionally, rising global demand for temperature-sensitive products, such as vaccines and fresh produce, is accelerating the need for advanced cold chain logistics.

Base Year

Historical Period

Forecast Period

According to the International Air Transport Association (IATA), the air cargo sector has experienced a remarkable surge in demand, with an impressive 18.4% year-on-year growth recorded in January 2024. This significant increase reflects the ongoing recovery and expansion of global trade, driven by factors such as the rise in e-commerce and the need for speedy delivery of goods. The robust growth in air cargo demand has led businesses to rely on air freight for its efficiency and reliability in transporting high-value products, leading to air freight market expansion.

As per industry reports of 2023, the North America to Asia route accounted for 26.9% of all air cargo movements, highlighting its critical role in global logistics. This route serves as a vital corridor for trade between two of the world's largest economies, facilitating the swift movement of goods ranging from electronics to perishables.

Furthermore, Hong Kong International Airport processed an impressive 4,199,196 metric tons of freight in 2023, solidifying its position as one of the world's busiest air cargo hubs. The airport's extensive infrastructure and connectivity enable it to handle diverse cargo types efficiently, catering to the increasing demand from global markets. This substantial volume processed at Hong Kong International Airport exemplifies the airport's pivotal role in facilitating international trade and supporting economic growth in the region.

Compound Annual Growth Rate

12%

Value in MMT

2026-2035

*this image is indicative*

The pharmaceutical and healthcare sectors are driving increased demand for air freight, requiring fast, secure, and temperature-controlled transport of critical medical products, boosting the air freight market value. In May 2025, Pharma.Aero and TIACA initiated a collaborative project to leverage air cargo in expanding healthcare access in underserved regions while supporting agricultural economies. This highlights air freight’s vital role in delivering vaccines, biologics, and temperature-sensitive medications globally. Reflecting this trend, IAG Cargo reported a 22% year-on-year increase in tonnage for its Constant Climate product in 2024, compared to 2023. This cold chain solution caters specifically to pharmaceuticals, including vaccines and biotech products, reinforcing air cargo’s pivotal role in global pharmaceutical supply Chains.

The rapid expansion of e-commerce is a major catalyst for global air freight demand. With over 28 million e-commerce stores globally and approximately 33% of the total population shopping online, consumer expectations for fast, reliable delivery continue to rise. Notably, 52% of online shoppers seek products from international markets, driving cross-border shipment volumes. This surge in global online retail necessitates agile, efficient air cargo services to handle high-value and time-sensitive goods, accelerating the air freight market growth.

Environmental sustainability is increasingly influencing the industry, with major players investing in greener operations to meet regulatory requirements and customer demand. In 2025, FedEx partnered with Neste to introduce sustainable aviation fuel (SAF) at Los Angeles International Airport, aiming to reduce carbon emissions in its cargo flights. This initiative reflects a broader industry commitment to decarbonizing air freight through eco-friendly fuels, optimized flight operations, and carbon offset programs.

Technological advancements are transforming air freight operations, with AI and automation adoption accelerating significantly since 2024. In January 2025, Accelya launched its AI-driven FLX One Cargo platform, which leverages machine learning to optimize cargo management, enhance predictive analytics, and improve route planning. This innovation enables better demand forecasting, cargo screening, and real-time tracking, increasing security and operational efficiency while reducing errors, accelerating the air freight market development. Automated warehouse management and digital customs solutions further streamline processes, lowering costs and minimizing delays.

The air freight market is witnessing robust growth in the transportation of time-sensitive and high-value perishables. Miami International Airport, a key import gateway for Latin America, reported that fresh cut flowers accounted for 40% of perishables tonnage by October 2023, up from 38% in 2022. The value of these imports rose 7% to USD1.2 billion, underscoring strong demand. Similarly, Kempegowda International Airport in Bengaluru recorded a 124% increase in mango exports in 2023, setting a new three-year tonnage record. These trends highlight growing reliance on air freight for transporting premium perishables, driving demand for specialized handling and rapid delivery solutions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The air freight market is experiencing significant transformation, driven by globalization, the growth of e-commerce, and innovations in supply chain management. Current trends highlight increased use of advanced logistics technologies, such as AI-driven route planning, real-time cargo tracking, and automated warehousing solutions. Sustainability initiatives are also shaping the industry, with carriers adopting fuel-efficient aircraft and exploring eco-friendly shipping practices. Analysts note that fluctuations in global trade, fuel prices, and geopolitical events strongly impact freight rates and operational efficiency.

Moreover, shifting manufacturing hubs and evolving consumer demand are redefining cargo routes and capacity planning. The Asia-Pacific region remains a key market due to its export-oriented economies, while North America and Europe focus on high-value, time-sensitive shipments. Collaboration between carriers, freight forwarders, and digital logistics platforms is becoming essential to meet expectations for faster and more transparent deliveries. The integration of predictive analytics and smart logistics strategies positions the air freight sector for sustainable growth in a highly competitive, technology-driven market.

The EMR’s report titled “Global Air Freight Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Destination

Key Insight: The international destination leads the market, driven by the growth of cross-border e-commerce, globalized supply chains, and the demand for efficient delivery of high-value goods. Key international airports in regions like Asia-Pacific, Europe, and North America serve as vital cargo hubs for pharmaceuticals, electronics, and perishables.

Market Breakup by Service

Key Insight: Freight services largely drive the air freight market revenue, as they provide efficient, reliable, and cost-effective transportation for large volumes of goods across both international and domestic routes. Express services, although smaller in share, are experiencing fast growth with the explosive rise of e-commerce and the increasing demand for time-sensitive deliveries. Express services are projected to capture a growing share of air cargo as businesses and consumers prioritize speed for high-value and urgent shipments.

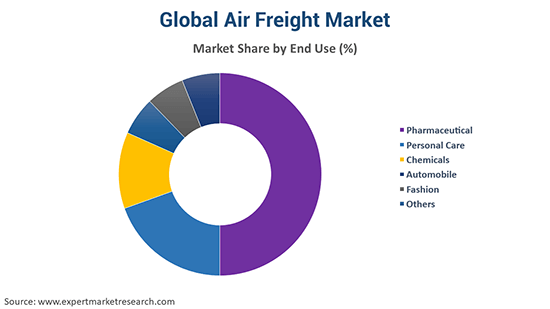

Market Breakup by End Use

Key Insight: The commercial end use continuously dominates the air freight market, driven by manufacturers, retailers, and wholesalers who rely on air freight for the rapid, reliable transport of bulk goods, industrial components, electronics, and perishables, essential for global supply chains and just-in-time deliveries. The private category, on the other hand, is being supported by rising demand for secure, personalized, and expedited shipping of high-value or time-sensitive goods, such as luxury items and artwork. Institutional shipments remain a niche but stable market, focusing on specialized or humanitarian cargo.

Market Breakup by Region

Key Insight: Asia Pacific clocks in the largest share in the air freight market, driven by its strong manufacturing base, booming e-commerce, and extensive trade flows across key hubs such as China, Japan, and South Korea. North America follows closely, with the United States benefiting from advanced logistics, high e-commerce penetration, and major air freight hubs. Europe remains a critical market, characterized by well-established routes and robust intra-regional trade. The Middle East and Africa are experiencing rapid growth, capitalizing on their geographic position as global transit points and investing in logistics hubs, with Saudi Arabia and the UAE leading the charge. Latin America is also steadily growing, driven by rising e-commerce and ongoing efforts to modernize logistics.

By destination, the international category dominates the market due to the expansion of global e-commerce

International air freight continues to be the largest destination category, driven by the expansion of global e-commerce, cross-border supply chains, and demand for rapid, reliable delivery of high-value goods. International shipments account for the majority of air freight volume, supported by major cargo hubs in the Asia Pacific, North America, and European regions. The scale and complexity of international commerce ensure this category’s continued dominance in the market.

The domestic category’s growth in the air freight market is fueled by the surge in internal e-commerce, demand for same-day and next-day deliveries, and investments in regional air cargo infrastructure, especially in emerging economies. Airlines are dedicating more resources to domestic cargo operations, leveraging digitalization and improved logistics networks to meet rising demand for time-critical shipments within national borders. As consumer expectations for rapid delivery intensify, domestic air freight is set to outpace international growth rates.

Freight services account for the largest share of the market due to its ability to efficiently transport large

The dominance of freight services is driven by its ability to efficiently transport large, diverse shipments for industries such as manufacturing, retail, and pharmaceuticals. Freight’s reliability and capacity for bulk cargo make it indispensable for global supply chains. Long-term contracts and established trade flows ensure steady demand, while ongoing investments in fleet expansion and digital cargo management support continued growth.

As per the air freight market report, the explosive rise of e-commerce, coupled with increasing consumer demand for speed and reliability, is fueling the express category’s rapid expansion. Express air freight is favored for time-definite, high-value shipments, and logistics providers are investing in technology and fleet upgrades to meet the growing demand. As next-day and same-day delivery expectations become the norm, express services are set to capture a growing share of the industry globally.

By end use, the commercial category secures the major share of the market driven by the high volume and frequency of shipments

Commercial end use applications dominate the market owing to the high volume and frequency of shipments across manufacturing, retail, and pharmaceutical industries. Globalized production and just-in-time logistics further fuel the demand for air freight. Companies prioritize air cargo for its speed, security, and ability to support complex international supply chains, making it a critical enabler of global commerce.

Factors like increasing demand for personalized, secure, and expedited delivery of high-value and time-sensitive goods, such as luxury items and personal effects are boosting the private end use category’s growth in the air freight market. Rising global mobility, coupled with the growth of premium logistics services and direct-to-consumer models, is accelerating the adoption of private air freight. As consumers and businesses prioritize speed and security for high-priority shipments, private air freight is becoming an increasingly important niche within the broader market.

Asia Pacific captures the leading position in the market owing to its status as a manufacturing hub for electronics, automotive, and high-value goods

The Asia Pacific air freight market’s dominance stems from the region’s status as a manufacturing hub for electronics, automotive, and high-value goods. Rapid e-commerce growth across China, Japan, South Korea, and Southeast Asia drives demand for expedited cross-border shipments. Significant investments in airport infrastructure, advanced logistics technologies, and expanding cold chain capabilities for pharmaceuticals and perishables further propel growth. Regional trade agreements like RCEP and the rise of low-cost carriers enhances connectivity.

Latin America notes fastest air freight market expansion owing to e-commerce growth in Brazil and Mexico and exports of high-value agricultural products are boosting air cargo volumes. The market is driven by government diversification strategies, investments in logistics hubs, and a shift toward healthcare and technology sectors. Leveraging free trade zones and strategic locations, these regions are attracting global logistics players and are poised for significant future growth in the industry.

The global market is dominated by major international airlines, integrated logistics providers, and leading freight forwarders. Leading air freight market players are prioritizing the expansion of global networks, fleet modernization, and the integration of advanced digital technologies to optimize efficiency and elevate customer experience.

Key differentiators for air freight companies include automation, real-time tracking, and sustainable aviation initiatives. Fueled by e-commerce growth, increasing demand for expedited shipments, and penetration into emerging markets, companies are forging strategic partnerships, augmenting capacity, and customizing services for high-growth sectors such as pharmaceuticals and electronics. Adapting to regulatory changes and technological innovation remains essential for sustained competitive advantage.

Deutsche Post AG was founded in 1949 and is headquartered in Bonn, Germany. The company offers a broad range of services under the DHL, DHL Express, DHL Global Forwarding, and DHL Supply Chain brands-from letter mail and parcel delivery to comprehensive logistics services.

Founded in 1907 and headquartered in Atlanta, Georgia, UPS is a global logistics leader with extensive air freight operations through UPS Airlines. The company provides time-definite shipping, cargo, and supply chain solutions, serving over 220 countries with a strong focus on efficiency, reliability, and global trade facilitation.

Established in 1971 and headquartered in Memphis, Tennessee, FedEx Corp. is one of the largest express transportation companies worldwide. Its FedEx Express division operates a vast air fleet, delivering time-sensitive freight globally. Known for speed and innovation, FedEx continues to drive competitiveness in the air cargo and logistics industry.

Founded in 1985 and headquartered in Dubai, United Arab Emirates, The Emirates Group operates Emirates SkyCargo, one of the world’s leading air freight divisions. With a modern fleet and expansive global network, it specializes in transporting perishables, pharmaceuticals, and high-value goods, reinforcing Dubai’s role as a global logistics hub.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Cargolux International Airlines S.A., Schenker AG, DSV A/S, Nippon Express Co., Ltd., Kuehne+Nagel International AG, Hellmann Worldwide Logistics SE & Co. KG, Air France-KLM S.A., AirFreight.com, C.H. Robinson Worldwide, Inc., CEVA Logistics, DB Schenker, DHL International GmbH, DIMOTRANS Group, GEODIS, Rhenus Group, and Ziegler Group, among others.

Explore the latest trends shaping the global air freight market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on air freight market trends 2026.

United States Chartered Air Freight Transport Market

Africa Cross Border Road Freight Transport Market

Saudi Arabia Freight and Logistics Market

Australia Road Freight Transport Market

Peru Road Freight Transport Market

Chile Freight and Logistics Market

Australia Freight Logistics Market

Australia Air Freight Market

Air Freight Software Market

Vietnam Air Freight Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the air freight market reached an approximate volume of 122.83 MMT.

The market is projected to grow at a CAGR of 12.00% between 2026 and 2035.

Key strategies driving the air freight market include fleet modernization to improve fuel efficiency, expansion of dedicated cargo networks, adoption of digital freight platforms for real-time tracking, investment in cold chain logistics for pharmaceuticals and perishables, and strategic alliances between airlines and logistics providers to optimize global capacity utilization.

Key trends aiding the market expansion include the high demand for pharmaceuticals and medical equipment and the growing need for oil and mining equipment.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Based on destination, the market is divided into domestic and international.

The leading end-use sectors in the industry are pharmaceutical, personal care, chemicals, automobile, and fashion, among others.

The key players in the market include Deutsche Post AG, United Parcel Service of America, Inc., FedEx Corp., The Emirates Group, Cargolux International Airlines S.A., Schenker AG, DSV A/S, Nippon Express Co., Ltd., Kuehne+Nagel International AG, Hellmann Worldwide Logistics SE & Co. KG, Air France-KLM S.A., AirFreight.com, C.H. Robinson Worldwide, Inc., CEVA Logistics, DB Schenker, DHL International GmbH, DIMOTRANS Group, GEODIS, Rhenus Group, and Ziegler Group, among others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a volume of around 381.49 MMT by 2035.

The Asia Pacific region held the largest share of the global market.

The booming e-commerce sector is the key driver of the air freight market.

The key challenges are high operational costs due to volatile fuel prices, stringent environmental regulations, limited cargo capacity during peak seasons, and infrastructure bottlenecks at major airports.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Destination |

|

| Breakup by Service |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share