Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global car leasing market was valued at USD 565.84 Billion in 2025. The industry is expected to grow at a CAGR of 6.20% during the forecast period of 2026-2035 to attain a valuation of USD 1032.62 Billion by 2035.

Base Year

Historical Period

Forecast Period

Value-added services such as insurance and telematics-based fleet management services

Significant uptick in the leasing of EVs

Subscription-based and flexible leasing models that offer all-inclusive packages

Compound Annual Growth Rate

6.2%

Value in USD Billion

2026-2035

*this image is indicative*

Car leasing includes a variety of functions, such as vehicle leasing and financing, health, and safety management, vehicle maintenance, licensing and enforcement, driver management, speed management, supply chain management, accident, and subrogation management, vehicle telematics, fuel management, and vehicle observation. Car leasing is a function that enables companies (that rely on business transport) to eliminate or reduce the risks linked with vehicle investment, improve efficiency and productivity, reduce overall transport, and staff costs and ensure total compliance with government legislation.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The car leasing market growth is expected to be driven by factors such as rising urbanisation and the rise of smart city initiatives around the world as smart cities require a proficient transportation system that aids avoid traffic jams and declining commute time. A major portion of the population utilises more vehicles, which aggravates road traffic blocking and parking concerns in urban zones. This has resulted in the prompt development of the public transportation system. The rise in the number of young consumers and demand for mobility among consumers with relatively low spending power is also boosting the car leasing market expansion. Furthermore, an increase in maintenance costs, taxes, and fuel costs associated with car ownership is prompting consumers to lease and use cars.

Growing demand for EV leasing; the rise of subscription-based models; the integration of advanced technologies; and the rising popularity of personalised and flexible leasing options are the major trends in the car leasing market

| Date | Company | News |

| Feb 15th, 2023 | Maruti Suzuki | Collaborates with SMAS Auto Leasing to launch a vehicle subscription program. |

| May 24th, 2023 | Selfdrive.ae | Expands its car leasing program to cater to corporate clients in the Gulf region. |

| Jun 30th, 2023 | SAIC's automotive brand MG | Introduces a new leasing offer for electric vehicles (EVs) in France. |

| Oct 5th, 2023 | Newable | Acquires the entirety of Synergy Automotive Limited, which operates under the name Synergy Car Leasing. |

| Topic | Information |

| Growing demand for electric vehicle (EV) leasing | With the global push towards sustainability and reducing carbon emissions, there is a significant increase in the leasing of electric and hybrid vehicles. |

| Rise of subscription-based models in leasing services | These models offer greater flexibility and often include insurance, maintenance, and roadside assistance, appealing to consumers who prefer an all-inclusive, hassle-free mobility solution. |

| Integration of advanced technologies in the leased vehicles | Leased vehicles are increasingly equipped with advanced technologies such as big data and AI for safety, connectivity, and driver assistance. |

| Rising popularity of personalised and flexible leasing options | Consumers and businesses are seeking more personalised leasing contracts that can be tailored to their specific needs, driving duration, and mileage requirements. |

One of the prominent trends in the car leasing market is the global push towards sustainability and the imperative to reduce carbon emissions, which is leading to an increased interest in the adoption of electric and hybrid vehicles (EVs). Electric and hybrid vehicles typically have higher upfront purchase prices compared to conventional vehicles, mainly due to the cost of battery technology. Leasing can mitigate this barrier by spreading the cost over the lease period and often demands a lower initial investment than purchasing. Further, many governments offer incentives, rebates, or tax breaks for owning or leasing electric and hybrid vehicles. Leasing an EV allows consumers and businesses to take advantage of these financial incentives, making them more affordable, and this further contributes to the car leasing market development.

Maruti Suzuki collaborated with SMAS Auto Leasing to launch a vehicle subscription program in February 2023. Through this program, customers can enjoy the benefits of driving a Maruti Suzuki vehicle without the long-term commitment and expenses associated with purchasing a car. The collaboration between these two companies signifies an innovative approach to meet the changing transportation needs and preferences of consumers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Car Leasing Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Lease Type

Market Breakup by Service Provider Type

Market Breakup by Tenure

Market Breakup by Region

The business lease segment maintains its dominance in the market due to the growing practice of car leasing in business organisations

The business lease segment is expected to occupy a significant car leasing market share during the forecast period. In recent years most organisations have been inclined towards leasing a car to their upper management employees. This allows the employees to go at their leisure rather than using company transportation. Further, when a team member's service in their organisation is completed, they have the choice to keep the vehicle. This allows the team member to save significant money as the organisation provides a brand-new car.

The private lease segment is also expected to experience growth in the automotive fleet leasing market as there is a growing preference for accessing services over owning assets, especially among younger consumers. This shift is evident in the rise of the sharing economy and subscription services and private leasing aligns with this trend, offering the benefits of a car without the responsibilities and costs of ownership. Private leasing typically involves a fixed monthly payment that covers the use of the vehicle, maintenance, and often insurance and taxes and this predictability is appealing to individuals who prefer budgeting certainty and want to avoid unexpected costs associated with repairs and maintenance.

The OEM segment is a major shareholder in the car leasing market due to brand trust and loyalty

The car leasing market demand is driven by the OEM service provider as consumers often have a certain level of trust and loyalty towards specific car brands and leasing directly from an OEM can enhance the sense of security and assurance about the quality and performance of the vehicle. OEMs can also offer integrated services, including maintenance, repairs, and warranties, as part of the leasing contract and this one-stop-shop approach is convenient for consumers and can ensure that the vehicle is serviced by trained technicians using genuine parts.

Furthermore, bank affiliated service providers are expected to witness considerable growth in the automobile leasing market, as banks are perceived as stable and trustworthy financial institutions. Customers might feel more secure entering a leasing agreement with a well-established bank, especially for a commitment as significant as a car lease. Banks also have access to substantial capital and can offer competitive interest rates and favorable terms on leasing contracts and their financial leverage allows them to provide attractive deals that might be harder for smaller, non-bank leasing companies to match.

North America and Europe are expected to be among the leading regions in the car leasing market because of the low interest rates offered by leasing companies in this region. Centralisation of fleet sourcing and control is driving the market in North America. Key players are currently working to centralise their car sourcing and management, ensuring better consistency and transparency of spending, and allowing better control and strategic focus to be achieved.

After North America, the vehicle leasing market in Europe is one of the most profitable markets with most global service providers providing all the primary fleet services starting from vehicle orders to disposal. Several other leading suppliers have also begun offering mobility solutions, such as ride-sharing. The regional market is also being aided by the rising trend of the creation of a single flexible budget for workers, which they are free to spend on all travel needs. Some of the companies further combine fleet and travel categories under a single mobility administrator.

The market players are increasing their collaborative efforts and partnerships to gain a competitive edge in the market

| Company | Specialisation | Additional Information |

| ALD Automotive Pvt Ltd | Mobility solutions, full-service leasing, and fleet management services | Operates in 43 countries |

| Arval BNP Paribas Group | Full-service vehicle leasing | Offers a wide range of cars and light commercial vehicles to its clients |

| LeasePlan Corporation N.V. | Car-as-a-Service | 1.9 million vehicles under management in over 30 countries |

| Wheels Inc. | Automotive fleet management and leasing | Provides a comprehensive suite of services for vehicle fleet leasing and management, serving corporations |

The market players are strategically launching new leasing offers for electric vehicles (EVs) in countries that exhibit significant potential for EV adoption. As awareness of environmental issues grows, there is an increasing demand for sustainable transportation options. Countries showing potential for EV adoption often have supportive government policies, infrastructure for charging, and an environmentally conscious consumer base. Such factors are expected to have a positive influence on the car leasing market.

Saudi Arabia Car Rental and Leasing Market

United Kingdom Car Rental Market

North America Car Rental Market

United States Car Rental Market

South Korea Car Rental Market

Australia Car Rental Market

Germany Car Rental Market

Europe Car Rental Market

Italy Car Rental Market

India Car Rental Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global car leasing market is expected to grow at a CAGR of about 6.20% in the forecast period of 2026-2035.

The major drivers of the market such as rising disposable incomes, increasing population, increasing traffic problems and parking issues, and centralisation of fleet sourcing and management in the industry are expected to aid the industry growth.

The increasing adoption of electric vehicles and a reduction of diesel cars are expected to boost the car leasing market in the coming years.

North America, Latin America, Middle East and Africa, Europe, and the Asia Pacific are the major regions in the market.

The market can be divided into private lease and business lease.

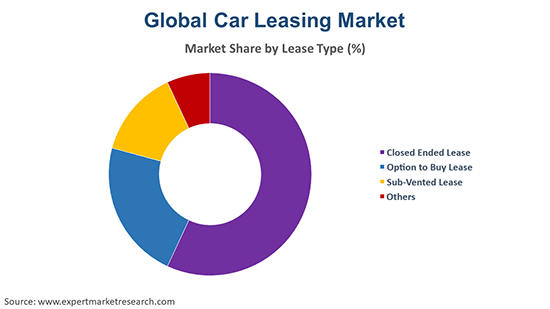

The significant lease types for car leasing in the market are closed ended lease, option to buy lease, and sub-vented lease, among others.

The major types of service providers for car leasing in the market are OEM, bank affiliated, and nonbank financial companies (NBFCs).

Short-term and long-term are the two tenures in the market.

The major players in the market are ALD Automotive Pvt Ltd, Arval BNP Paribas Group, LeasePlan Corporation N.V, Wheels Inc., and ORIX Corporation, among others.

In 2025, the market attained a value of nearly USD 565.84 Billion.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 1032.62 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Lease Type |

|

| Breakup by Service Provider Type |

|

| Breakup by Tenure |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share