Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Europe fish production market stood at 6.30 Million Tons in 2025 and it is expected to grow at a CAGR of 3.00% during the forecast period of 2026-2035 to reach a production volume of around 8.47 Million Tons by 2035. Rising demand for value-added fish products in ready-to-eat and frozen categories is driving innovation in packaging, processing, and cold-chain logistics across the Europe fish market.

The market has been witnessing a distinct shift, largely driven by sustainability regulations and consumer preference for responsibly sourced seafood. The European Union’s Common Fisheries Policy (CFP) has put strict quotas on overfished species while simultaneously encouraging aquaculture growth. According to the Europe fish market analysis, aquaculture farming in the EU yielded almost 1.1 million tons of aquatic organisms in 2023, worth EUR 4.8 billion, with salmon and mussels leading the expansion. This trend highlights how regulated and structured farming models are reshaping the industry’s fundamentals.

Equally important is the growing momentum around traceability and labeling. The European Commission’s “Farm to Fork” strategy mandates digital traceability across seafood supply chains by 2025, a move expected to strengthen consumer trust and reduce illegal, unreported, and unregulated (IUU) fishing, reshaping the Europe fish market dynamics. Industry reports indicate that the EU imported 5.9 million tons worth EUR 30.1 billion, underscoring the heavy reliance on imports despite local aquaculture growth.

Moreover, regional initiatives are aligning with climate-neutral goals. Norway, for instance, launched a EUR 94 million program in December 2023, to develop low-emission fishing vessels and electric-powered aquaculture cages. These efforts not only position Europe as a global leader in sustainable fisheries but also offer strategic opportunities for technology providers, logistics players, and feed manufacturers within the ecosystem.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3%

Value in Million Tons

2026-2035

*this image is indicative*

Aquaculture is at the core of the Europe fish market dynamics. Countries like Spain, France, and Greece are aggressively expanding fish farming capacity. Industry reports suggest that EU aquaculture production is led by seabass, seabream, and mussels. Moreover, the European Commission approved an investment package for the maritime, fisheries and aquaculture sectors of Greece totaling EUR 523.4 million in October 2015. This reduces import reliance while giving processors consistent supply, crucial for industries supplying retail and foodservice chains. Aquaculture also presents opportunities for equipment manufacturers, biotech firms, and feed innovators, making it one of the fastest-moving parts of the sector.

The European Commission is enforcing tighter digital traceability requirements to strengthen market transparency and fight IUU fishing. For example, all fishing vessels have been made to be tracked via a vessel tracking system (VMS) and all catches are to be recorded via electronic means since January 2024. Norway and Denmark have already piloted blockchain-based traceability solutions, giving buyers real-time access to sourcing details, accelerating demand in the Europe fish market. These initiatives are enhancing consumer trust while compelling B2B players including exporters, retailers, and logistics providers to invest in digital platforms. Companies offering data analytics, blockchain, and cloud solutions stand to benefit significantly from this regulatory-backed transformation.

Sustainability-driven consumption is increasingly shaping demand. Salmon, with certifications like ASC (Aquaculture Stewardship Council), has become a prime beneficiary. Retail giants like Carrefour and Aldi are actively promoting sustainable seafood ranges, indicating a growth opportunity within the premium certified fish market. This trend in the Europe fish market is influencing upstream supply chains, as producers are compelled to meet certification standards. Equipment suppliers, feed companies, and certification bodies now find new business opportunities in ensuring compliance, making sustainability a commercial imperative.

Decarbonization of fishing fleets and processing facilities is a major policy push across Europe. The EU’s Green Deal allocates funding for electrification and hybrid technologies in fishing vessels. Moreover, Norway’s Research Council funded a NOK 600 million project for hydrogen-powered trawlers in June 2024, making it a first in Europe. Such programs create opportunities for energy solution providers, marine equipment manufacturers, and port infrastructure developers, boosting growth in the Europe fish market.

The demand for ready-to-eat and frozen seafood formats has created a wave of innovation in processing and packaging. European Fishmeal and Fish Oil Producers report that exports in 2023 totaled 130,957 tons, down by 18% since 2021, but their value soared to EUR 530 million, mostly driven by retail and quick-service restaurants. Companies like Young’s Seafood and Nomad Foods are launching new product lines with microwave-ready fish fillets and protein-rich snacks targeting health-conscious consumers, accelerating the Europe fish market scope. Startups are introducing seaweed-coated packaging to extend shelf life while reducing plastic waste.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Europe Fish Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Fish Type

Key Insight: Beyond tuna and salmon, cod continues to be valued for its lean texture, particularly in frozen fillets. Hake and pollock dominate processed fish lines, while herring and mussel find strong growth potential through regional cuisines. Surimi and squid are witnessing rising traction from quick-service restaurants, accelerating overall demand in the Europe fish market. Each category caters to specific consumer and industrial needs, ranging from nutritional profiles to processing suitability, making this category highly diverse for both importers and domestic producers.

Market Breakup by Product Type

Key Insight: While frozen and fresh largely propel the Europe fish market value, canned fish continues to thrive due to affordability and convenience, with tuna being the leading product. Value-added “other” categories, including smoked, marinated, and preserved fish, are also growing steadily. Each product type aligns with specific consumer preferences and distribution models, from household consumption to hospitality supply, creating a diversified product categorization that supports growth across multiple channels.

Market Breakup by Distribution Channel

Key Insight: Retail dominates the Europe fish market by offering broad consumer access, convenience, and certified product ranges, while institutional buyers drive scale and premium demand through foodservice and catering. Both of these channels balance affordability with quality, ensuring consistent supply across households, restaurants, and catering services. Their combined influence supports sustainable sourcing, innovation in value-added seafood, and strong market stability, making them critical to the sector’s long-term growth trajectory.

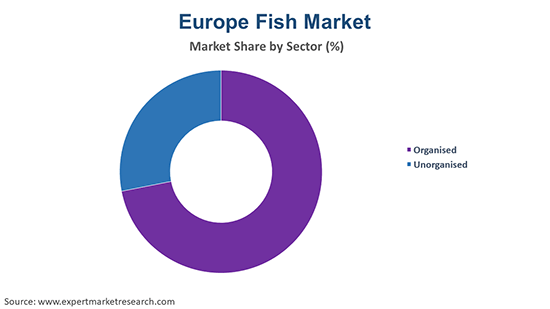

Market Breakup by Sector

Key Insight: Organized players dominate the market through standardization, certifications, and large-scale efficiency, ensuring reliable supply chains and consistent quality for retailers and institutions. In contrast, unorganized companies thrive on authenticity, locality, and cultural traditions, often serving niche and regional demands with fresh, seasonal varieties. Both these categories form a dual-structured market where organized players capture mass distribution while unorganized ones preserve heritage-driven consumption.

Market Breakup by Region

Key Insight: The United Kingdom leads in the Europe fish industry scale, while Germany records the fastest growth driven by health-conscious demand. France maintains strong fresh fish traditions, Spain and Italy emphasize culinary heritage, and the Netherlands, along with others, strengthens trade networks and processing hubs, collectively shaping a diverse and resilient landscape that balances tradition, innovation, and evolving consumer preferences.

By fish type, tuna accounts for the largest share of the market due to canned exports

Tuna remains Europe’s most traded fish, largely driven by its dominance in the canned category. Spain leads production, with canneries in Galicia supplying across the continent. In 2023, the EU-27 imported 6.627 tons of albacore tuna at a value of EUR 22 million, mostly frozen destined for the canning industry, reflecting the scale of this trade. The demand is supported by long shelf life, competitive pricing, and integration into European diets. Moreover, government-backed sustainability certifications are making European tuna more attractive to both retail and foodservice buyers.

Salmon has experienced accelerated growth in the Europe fish market, particularly in Norway and Scotland. Rising consumer demand for high-protein, omega-3-rich products has made salmon a preferred choice among health-conscious Europeans. Retailers and foodservice operators alike are expanding salmon-based menus, while innovation in smoked and frozen salmon formats further accelerates sales. Sustainability certifications like ASC and organic labeling also give salmon a competitive edge.

By product type, frozen fish holds the largest share of the market due to retail sales

Frozen fish has become Europe’s largest product category, supported by its convenience and strong demand in supermarkets. Frozen formats offer extended shelf life, affordability, and variety, which attract both households and foodservice chains. Logistics advancements in cold-chain storage and transportation have strengthened availability across Europe. Producers are also investing in eco-friendly packaging solutions to appeal to sustainability-conscious consumers.

Fresh fish consumption in Europe is rising, particularly among urban consumers seeking premium, locally sourced seafood. France, Italy, and Spain propel the overall demand growth, with wet markets and specialty stores driving sales. EU programs promoting short supply chains and labeling transparency have encouraged consumers to pay premiums for freshness and origin-specific fish. Restaurants are increasingly employing direct purchasing from local fisheries, propelling this category's growth. This "farm-to-plate" culture is driving demand for high-quality fresh fish.

By distribution channel, retail holds the largest share of the market due to consumer preference

Retail channels continue to drive Europe fish market expansion, catering to households in both the fresh and processed categories. Supermarkets, hypermarkets, and seafood specialty stores drive this category’s growth through steady demand for affordable and quality-approved fish. Retailers are increasingly investing in private-label seafood offerings, labelling them as affordable yet certified products. Moreover, marketing efforts on traceability and eco-labeling also appeal to consumers who are increasingly opting for sustainable seafood options.

The institutional channel, including hotels, restaurants, and catering services (HoReCa), is fast increasing their penetration in the Europe fish market as the eating culture in the region changes. In response to growing tourism, foodservice businesses are purchasing high-quality fish such as fresh salmon, cod, and mussels to add variety to menus. Higher demand for sushi, seafood platters, and global cuisine is driving growth in this category. Schools, hospitals, and corporate workplaces are also generating consistent institutional demand through contract catering. Additionally, foodservice operators are embracing sustainable sourcing commitments, further entrenching their dependence on certified suppliers.

Organized sector secures the largest share of the market due to certifications

The organized sector dominates the Europe fish market revenue share, supported by structured supply chains, certifications, and traceability. Large-scale processors and distributors offer consistency in quality, safety, and volume, appealing to retailers and foodservice operators. Certified aquaculture operations and sustainable fishing companies have gained traction as consumer awareness around eco-labels rises. Organized players also benefit from economies of scale, leveraging advanced cold-chain infrastructure, packaging technology, and efficient logistics networks.

Despite challenges, the unorganized sector remains highly relevant, particularly in Southern and Eastern Europe, where local wet markets and small-scale fisheries play a central role. These markets provide fresh fish directly from coastal or inland fisheries, appealing to consumers prioritizing local origin and authenticity, strengthening the Europe fish demand forecast. With rising “farm-to-plate” and short supply chain initiatives, the unorganized sector has gained renewed traction. Small vendors often supply niche, seasonal varieties, which organized players cannot easily replicate. Although lacking scale, the organized sector’s agility and community connection are fueling fast-paced growth.

United Kingdom holds the largest share of the market due to imports

The United Kingdom leads the European market, supported by its strong seafood consumption culture and high import levels. With cod, salmon, and tuna dominating menus, the United Kingdom’s reliance on imports complements its domestic aquaculture and processing industries. Major retailers like Tesco and Sainsbury’s drive consistent demand through certified seafood offerings. Government commitments to post-Brexit sustainable fisheries policies are also influencing sourcing practices.

Germany boasts lucrative Europe fish market opportunities fueled by rising awareness of health benefits associated with omega-3-rich seafood. Urban customers are adding salmon, herring, and mackerel to everyday diets. Expansion is also being fueled by Germany's robust foodservice sector, with seafood restaurants increasing appeal in urban centers such as Berlin and Munich. Retailers are expanding product offerings to address demand for sustainable, fresh, and ready-to-cook seafood formats.

Leading Europe fish market players are prioritizing sustainability, digital traceability, and value-added processing as areas of differentiation. Players are investing in environmentally certified supply chains and innovative packaging with extended shelf life and lower waste levels. Areas of opportunity include aquaculture technologies, blockchain-based transparency platforms, and high-end seafood categories like ready-to-eat salmon or tuna snacks. Strategic collaborations with retailers and foodservice operators are also transforming distribution models.

Europe fish companies are expanding product portfolios increasingly, providing plant-based seafood substitutes and nutrient-fortified fish products to capture changing consumer health aspirations. Several firms are also investing in renewable-powered cold chains and testing AI-based demand forecasting to improve efficiency. Partnerships with tech startups are assisting in improving efficiency across harvesting, logistics, and traceability.

Headquartered in Hirtshals, Denmark, and established in 1988, Nordic Seafood A/S is one of the leading European importers and distributors of seafood. The company specializes in sourcing over 1,500 frozen and fresh seafood products from sustainable fisheries globally. With close association with aquaculture farms and utilization of state-of-the-art cold-chain systems, Nordic Seafood provides guaranteed quality supply to retail and foodservice customers.

Established in 1999, Frigonova, s.r.o. is a prime processor and distributor of frozen fish and seafood. Frigonova specializes in sophisticated freezing technology to ensure freshness and shelf life, product safety throughout cross-border logistics, and innovative packaging and portion-controlled products for sophisticated retail and institutional customers.

Established in 1986 and headquartered in Netherlands, The Fish Company is a premium supplier focusing on fresh and value-added seafood. It specializes in traceable and sustainably sourced cod, haddock, and salmon, supplying major European retail and restaurant chains. The company integrates innovative processing lines with digital tracking systems, ensuring transparency from ocean to plate.

Founded in 1978 and headquartered in Netherlands, Marine Food B.V. focuses on delivering processed and frozen fish products across Europe. The company emphasizes innovative breaded and marinated fish lines targeted at retail and foodservice customers. By investing in product development, it caters to changing consumer preferences for convenient, ready-to-cook seafood.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Another key player in the market is Sykes Seafoods Ltd., among others.

Explore the latest trends shaping the Europe fish market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on Europe fish market trends 2026.

United States Fish and Shellfish Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Europe fish market reached an approximate production volume of 6.30 Million Tons.

The market is projected to grow at a CAGR of 3.00% between 2026 and 2035.

Companies are investing in eco-label certifications, adopting digital traceability, developing premium value-added seafood, expanding sustainable aquaculture partnerships, and strengthening logistics to meet growing demand in retail and institutional channels.

The key trends aiding the market include the introduction of new seafood recipes and the increasing awareness regarding the health benefits of consuming fish.

The major countries considered in the Europe fish market report include the United Kingdom, Germany, France, Italy, the Netherlands, and Spain, among others.

The leading fish types in the market are tuna, cod, salmon, alaska pollock, surimi, hake, herring, mussel, and squid, among others.

The major product types in the market are fresh, frozen, and canned, among others.

The significant distribution channels in the market are retail and institutional.

The leading sectors in the market are organised and unorganised.

The key players in the market include Nordic Seafood A/S, Frigonova s.r.o., The Fish Company, Marine Food B.V., and Sykes Seafoods Ltd., among others.

Rising raw material costs, strict sustainability regulations, fragmented supply chains, and increasing import dependency create competitive pressure across the Europe fish market.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Fish Type |

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Sector |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share