Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United States crayfish market size reached USD 852.21 Million in 2025. The market is expected to grow at a CAGR of 31.50% between 2026 and 2035, reaching almost USD 13176.62 Million by 2035.

Base Year

Historical Period

Forecast Period

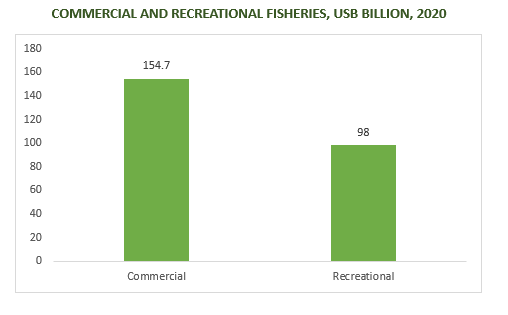

In 2020, NOAA reported fisheries sales worth $253 billion in the United States.

Louisiana's famous Crawfish Boil, a symbol of crayfish festivals, celebrates the culinary heritage with diverse cooking styles and local flavours, boosting the United States crayfish market.

Texas, in its southwest coastal region, attracts anglers, totalling 2.2 million, generating $2.01 billion in sales and 29,800 jobs.

Compound Annual Growth Rate

31.5%

Value in USD Million

2026-2035

*this image is indicative*

Crayfish, also known as crawfish, are freshwater crustaceans found in swamps, rivers, and lakes. They have a tough outer shell, compound eyes, a fused head and thorax, a pointed snout, and a segmented body that can be of various colours such as sandy yellow, dark brown, green, blue, and red. These creatures are packed with proteins, carbohydrates, fats, vitamins, and minerals.

According to the United States crayfish market report, crayfish are a popular choice for seafood, widely used as bait for fishing and kept as pets in aquariums. In comparison to other crustaceans, crayfish are inexpensive, delicious, pleasantly sweet, easy to cook, and have an appealing texture. They also promote bone strength, support brain function, aid in weight loss, and help with the production and circulation of blood, reducing the risk of anaemia and other iron-deficiency conditions.

The National Oceanic and Atmospheric Administration reported that commercial and recreational fisheries sales in 2020 amounted to $253 billion, which has helped to drive growth in the United States crayfish market.

The United States crayfish market growth is attributed to the aquaculture revolution, the health and nutrition boom, sustainable practices, and cultural significance.

The United States crayfish market developments are attributed to the innovative aquaculture methods, ranging from recirculating systems to onshore farms, which enhance crayfish yield to meet growing demand sustainably. This progress has notably bolstered the market , aligning production with environmental conservation goals.

Crayfish are increasingly favoured as a nutritious protein option, abundant in omega-3 fatty acids and vital minerals such as zinc and iron. This appeal among health-conscious consumers contributes to the United States crayfish market growth.

The United States crayfish industry prioritizes sustainable farming methods, embracing eco-conscious practices such as integrated multi-trophic aquaculture (IMTA) systems. These efforts are instrumental in minimizing the ecological impact.

Crayfish festivals, exemplified by Louisiana's renowned Crawfish Boil, honour crayfish as a culinary heritage, displaying a variety of cooking styles and local tastes. This celebration of tradition and flavour contributes to the growth of the sector.

Crayfish products diversify, ranging from whole-cooked specimens to specialized options like crayfish tails, addressing a variety of consumer preferences and culinary requirements. Innovations in agricultural technology, such as automated feeding systems and AI-driven water quality monitoring, improve productivity.

As per the United States crayfish market analysis, the impact of climate change on crayfish habitats underscores the need for conservation efforts to protect ecosystems and crayfish biodiversity.

United States Crayfish Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by Region

Based on type, the United States crayfish market share is led by Red Swamp since these are frequently incorporated into a range of culinary recipes, including soups, stews, pastas, and boils

Red swamp crayfish provide a valuable source of protein, with low-fat content, and are rich in essential nutrients like B vitamins, iron, and selenium. From an economic standpoint, these crayfish play a crucial role in supporting industries in regions where they are abundant, including fisheries, aquaculture, and the entire supply chain involved in processing and distributing crayfish products.

White river crawfish have a significant impact on aquatic ecosystems by helping to regulate populations of insects, algae, and other small organisms, thereby contributing to the balance of the ecosystem. They are often showcased in festivals, events, and traditional dishes, which in turn enrich the local heritage and identity of the area.

The Far West region stands out prominently, largely due to its increasing crayfish production, a crucial component in meeting the escalating market demand for crayfish across the United States.

In California, the CDFW Aquaculture Program plays a central role in overseeing the state's diverse aquaculture industry. Through its set of policies and regulations, CDFW, in collaboration with the California Fish and Game Commission, strikes a balance between conserving natural resources and promoting sustainable aquaculture practices.

As stated by the Texas Alliance for America's Fish and Wildlife, Texas, in the southwest region along its coast and waterways, is a prime destination for anglers. With a total of 2.2 million anglers in Texas, their combined spending reaches $2.01 billion in retail sales and supports 29,800 jobs. The success of this industry hinges significantly on the well-being of fish populations and the preservation of aquatic ecosystems.

Market participants are elevating the United States crayfish market growth through the provision of premium crawfish and seafood. Their dedication to sustainable practices guarantees high-quality products customized to meet the preferences of discerning consumers.

Riceland Crawfish, with its headquarters in Louisiana, USA, was founded in 1968 and has gained recognition for its fresh and flavourful crawfish. Since its establishment in Eunice, it has become an integral part of Louisiana's culinary scene, earning industry trust through its steadfast dedication to quality and tradition.

Acadia Crawfish, located in Louisiana, USA, was established in 1999 and has emerged as a leading provider of premium crawfish and seafood. Their commitment to sustainable methods ensures top-tier products tailored to the tastes of discerning customers.

The Louisiana Crawfish Company, based in Louisiana, USA, has been in operation since 1985, specializing in delivering the freshest crawfish and seafood. Their impressive offerings showcase a profound love for Louisiana's culinary legacy.

The Louisiana Seafood Company, founded in 2000 and situated in Louisiana, USA, is recognized as a paragon of excellence in the seafood sector. Their products perfectly encapsulate the diverse flavours and cultural heritage inherent in Louisiana's coastal cuisine.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the United States crayfish market are Live Aquaponics, Fruge Seafood, and Ju’s Crawfish Company among others.

Auto Parts Manufacturing Market

Cash In Transit Services Market

Database Management System (Dbms) Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market valued at USD 852.21 Million in 2025.

The market is projected to grow at a CAGR of 31.50% between 2026 and 2035.

The revenue generated from the crayfish market is expected to reach USD 13176.62 Million in 2035.

The United States crayfish market is growing due to the aquaculture revolution, health and nutrition boom, sustainable practices, and cultural significance.

The market is categorised according to its types, which include red swamp, white river crawfish and others.

The leading players in the market are Riceland Crawfish, Acadia Crawfish, Louisiana Crawfish Company, The Louisiana Seafood Company, Live Aquaponics, Fruge Seafood, and Ju’s Crawfish Company among others.

The major market areas include New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share