Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global fuel cell market size 435.42 Megawatt in 2025. The market is further expected to grow at a CAGR of 9.00% during the forecast period of 2026-2035 to reach a volume of 1030.80 Megawatt by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

9%

Value in Megawatt

2026-2035

*this image is indicative*

| Global Fuel Cell Market Report Summary | Description | Value |

| Base Year | Megawatt | 2025 |

| Historical Period | Megawatt | 2019-2025 |

| Forecast Period | Megawatt | 2026-2035 |

| Market Size 2025 | Megawatt | 435.42 |

| Market Size 2035 | Megawatt | 1030.80 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 9.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 10.1% |

| CAGR 2026-2035 - Market by Country | Japan | 11.6% |

| CAGR 2026-2035 - Market by Country | China | 9.7% |

| CAGR 2026-2035 - Market by Application | Stationary | 9.5% |

| CAGR 2026-2035 - Market by End Use | Fuel Cell Vehicles | 9.9% |

| Market Share by Country 2025 | Germany | 3.1% |

| Type of Fuel Cell | Usage | Reason |

| PEMFC | Fuel Cell Electric Vehicles (FCEVs) | Quick start-up time |

| MCFC | Large-scale, stationary power generation | High efficiency |

| SOFC | Distributed power generation | High efficiency and fuel flexibility |

Fuel cells are the cells that generate electricity through a mechanism that does not involve combustion. These cells transform the chemical energy in a hydrogen-rich fuel to electricity through an electrolytic process. This means fuel cells produce relatively fewer pollutants compared to conventional, combustion-based power generation technologies. Further, they are fuel-flexible, highly efficient, and operate at very low noise levels. Thus, they serve as an efficient alternative to traditional power generation technologies, offering improved reliability and environmental benefits.

The global fuel cell market growth is driven by the increasing demand for clean energy sources across the globe due to rising environmental concerns. Favourable government initiatives and advancements in fuel cell technologies, such as PEMFC, PAFC, and others, have further boosted the growth of the market. Over the forecast period, the growing adoption of fuel cell-based vehicles and the thriving power sector are expected to significantly contribute to the market share. The transportation sector's shift towards cleaner, alternative energy sources to power vehicles has led to increased interest in fuel cell electric vehicles (FCEVs), especially in the commercial and public transportation segments.

Growing focus on green hydrogen; integration of fuel cells with renewable energy systems; emphasis on energy security and decarbonisation efforts; and advancements in fuel technology are the major trends impacting the fuel cell market

| Date | Company/ Organisation | Event |

| Feb 5th, 2024 | Honda | Commenced mass production of fuel cells at its Fuel Cell System Manufacturing (FCSM) plant located in Brownstown, Michigan in a collaborative effort with General Motors. |

| Feb 6th, 2024 | Hyzon Motors Inc. | Disclosed a Joint Development Agreement (JDA) with New Way Trucks to develop fuel cell electric garbage truck tailored for the North American market. |

| Feb 6th, 2024 | Hyundai and Kia Corporation | Entered into a partnership with a U.S.-based materials company to advance the development of hydrogen fuel cell technology. |

| Feb 6th, 2024 | India Energy Week (IEW) | During the opening ceremony of India Energy Week (IEW), which began on February 6th in Goa, India unveiled its first bus powered by green hydrogen fuel cell technology. |

| Trends | Description |

| Growing focus on green hydrogen | There is a growing emphasis on producing hydrogen through renewable energy sources, known as green hydrogen, offering a zero-emission source of hydrogen for fuel cells. |

| Increased integration of fuel cells with renewable energy systems | Fuel cells are being integrated with renewable energy systems as they can store surplus renewable energy in the form of hydrogen and generate electricity when needed. |

| Growing emphasis on energy security and decarbonisation efforts | As countries seek to enhance their energy security and meet decarbonisation goals, fuel cells are becoming an increasingly attractive option. |

| Advancements in fuel technology | Ongoing research and development are leading to improvements in fuel cell performance, durability, and cost-effectiveness. |

The growing emphasis on producing hydrogen through renewable energy sources, leading to the production of what is known as green hydrogen, represents a significant shift towards more sustainable and environmentally friendly energy solutions. Green hydrogen is produced by splitting water (H2O) into hydrogen (H2) and oxygen (O2) using electrolysis, a process that requires electricity. When this electricity is sourced from renewable energy such as solar, wind, or hydroelectric power, the hydrogen produced is considered "green," since the entire process can be achieved without emitting carbon dioxide or other greenhouse gases.

Hyundai and Kia Corporation established a partnership with a U.S.-based materials company in February 2024, to advance the development of hydrogen fuel cell technology. This collaboration aims to leverage the specialised expertise of the materials company to improve the efficiency, durability, and affordability of hydrogen fuel cells. By combining Hyundai and Kia's automotive manufacturing capabilities with cutting-edge material sciences, the partnership seeks to push the boundaries of fuel cell technology, making it more viable for widespread use in vehicles.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Fuel Cell Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by End Use

Market Breakup by Region

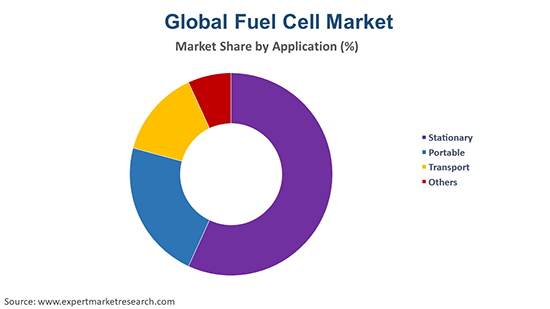

The stationary segment accounts for a major fuel cell market share due to the rising usage of fuel cells as a source of stationary power

Based on application, the stationary segment occupies a significant share in the market. Fuel cells can be used as stationary power units for primary power, backup power, or combined heat and power (CHP). The increasing demand for stationary fuel cells can be attributed to their ability to power anything from a laptop to a single-family home or even larger needs (200 kW and above), thus, becoming a versatile option for a wide range of markets like retail, residential, telecommunications, and others. This has significantly contributed to the growth of the fuel cell market.

Meanwhile, the transportation segment is expected to witness a significant growth in the forecast period owing to the increasing adoption of fuel cell-powered forklifts and favourable government initiatives, particularly in developed economies.

Fuel cell vehicles maintain their dominance in the market due to growing efforts regarding the reduction of carbon emissions

Fuel cell vehicles (FCV) dominate the fuel cell market due to the increasing emphasis on reducing carbon emissions, improving air quality, and the global shift towards sustainable transportation solutions. FCVs, including passenger cars, buses, and commercial vehicles, benefit from fuel cells' high energy efficiency and the ability to refuel quickly, making them particularly attractive for heavy-duty and long-range applications.

The utilities segment is also expected to grow robustly in the fuel cell market as these are used for distributed power generation, backup power, and as part of microgrids. The utility sector's interest in fuel cells is driven by the need for reliable, clean, and efficient energy solutions that can support grid stability and provide power in areas where grid access is challenging.

The market players are increasing their research investments, collaboration efforts, and are entering into joint ventures to gain a competitive edge in the fuel cell market

Development and manufacturing of energy systems, including hydrogen solutions such as hydrogen production systems, storage, and fuel cell systems.

Design, manufacture, and operation of fuel cell power plants, including solutions for on-site power generation, microgrids, and utility-scale power generation.

Provider of clean energy technologies, including fuel cells, traditional power generation systems, renewable energies, and next-generation technologies like solid oxide fuel cells (SOFCs).

Provider of hydrogen and direct methanol fuel cells, including EFOY Pro fuel cells for industrial and EMILY fuel cells for defence and security.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players in the fuel cell market include Plug Power Inc., and Nuvera Fuel Cells, LLC, among others. These companies are involved in various aspects of the fuel cell ecosystem, including manufacturing, technology development, and system integration, serving sectors such as transportation, stationary power generation, portable power, and speciality markets.

North America and Europe account for a significant share of the market owing to the stringent environmental regulations and increased government investments to encourage the adoption of renewable energy sources across the regions. The United States is one of the largest global manufacturers of fuel cells and a leading global exporter. It is also home to some of the leading companies and research institutions in fuel cell technology. This region has been pivotal in developing and commercialising various types of fuel cells, including PEM (Proton Exchange Membrane) and SOFC (Solid Oxide Fuel Cells), for a range of applications from portable power to large-scale stationary power generation.

| CAGR 2026-2035 - Market by | Country |

| Japan | 11.6% |

| China | 9.7% |

| India | 9.5% |

| USA | 9.0% |

| Brazil | 8.9% |

| Canada | XX% |

| UK | 8.7% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Mexico | XX% |

Meanwhile, the Asia Pacific fuel cell market is expected to witness a robust growth in the forecast period due to the increasing focus on reducing the economic dependence on fossil fuels, advances in fuel cell technology, and a growing shift from the grid to clean, onsite power production. Fuel cells, offering zero-emission power generation, are a crucial part of the clean energy transition, especially for sectors where electrification is challenging, such as transportation and industrial processes.

Protonic Ceramic Fuel Cell Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global fuel cell market, driven by the stationary fuel cell shipments which attained a volume of nearly 435.42 Megawatt in 2025.

The stationary fuel cell shipments market is projected to grow at a CAGR of 9.00% between 2026 and 2035, likely to aid the fuel cell market.

The major market drivers are increasing demand for stationary fuel cells, increasing adoption of fuel cell powered forklifts, and favourable government initiatives.

The increasing demand for clean energy sources and advancements in fuel cell technologies are the key trends supporting the market demand.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The different fuel cell types include proton exchange membrane fuel cells (PEMFC), molten carbonate fuel cells (MCFC), solid oxide fuel cell (SOFC), and phosphoric acid fuel cells (PAFC), among others.

The various applications of fuel cell include stationary, portable, and transport, among others.

The significant end uses of fuel cell include fuel cell vehicles, utilities, and defence, among others.

The major players in the market are Toshiba Energy Systems & Solutions Corporation, FuelCell Energy, Inc., Mitsubishi Heavy Industries, Ltd, SFC Energy AG, Plug Power Inc., and Nuvera Fuel Cells, LLC, among others.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of 1030.80 Megawatt by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share