Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global fulvic acid market attained a value of USD 864.79 Million in 2025 and is projected to expand at a CAGR of 11.60% through 2035. The market is further set to achieve USD 2591.51 Million by 2035. Increasing demand for organic, bio-based soil conditioners and plant growth stimulants is significantly boosting fulvic acid adoption in sustainable farming and eco-friendly agricultural input industries.

The market is also witnessing more manufacturers focussing on bio-based innovations and soil enhancement solutions to support regenerative agriculture. For example, Humic Growth Solutions offers a next-generation Fulvic Acid liquid concentrate, a precision-engineered fulvic formulation designed to improve nutrient uptake and carbon sequestration in degraded soils. According to the fulvic acid market analysis, over 33% of global soils are moderately to highly degraded, making such innovations critical for restoring soil vitality. This product launch indicates that the industry is steadily inclining toward technologically refined organic solutions that combine environmental sustainability with measurable agronomic performance.

Moreover, companies are leveraging AI and microbial science to advance product efficacy. Leading manufacturers such as BioAg and NPK Industries are investing in machine-learning-based soil diagnostics to develop fulvic acid blends optimized for different crop types and geographies. These tailored solutions help agribusinesses to improve yield to a considerable extent. These also reduce synthetic fertilizer dependency. In parallel, government programs like India’s Paramparagat Krishi Vikas Yojana and the EU’s Farm to Fork Strategy are promoting organic fertilizers, driving fulvic acid market expansion across emerging economies.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

11.6%

Value in USD Million

2026-2035

*this image is indicative*

Governments and agricultural institutions are prioritizing soil health restoration, leading to greater fulvic acid demand. For example, USDA’s Organic Certification Program and the EU’s CAP reforms have fueled organic farming, covering over 75 million hectares globally as of 2024. Fulvic acid enhances nutrient mobility, microbial activity, and crop resilience, aligning with regenerative farming goals. Agrochemical firms are integrating fulvic acid into customized biofertilizer blends to improve yield consistency under climate stress. For example, AgroLiquid announced in December 2024 that it will acquire Monty’s Plant Food Company to expand into soil health and other crop nutrition products. This growing shift toward eco-conscious cultivation is reshaping input demand patterns, benefiting suppliers that specialize in natural humic substances and bio-based growth stimulants.

The health supplement market is shifting toward traceable mineral sources, and fulvic acid is becoming a key bioactive ingredient. Its role in improving gut health, energy metabolism, and nutrient absorption has drawn clinical attention. For example, Shilajit, launched in March 2025, is recommended for its potential to enhance workouts owing to its anti-inflammatory properties and fulvic acid content. Backed by supportive studies from the NIH and EFSA, fulvic compounds are gaining regulatory recognition. This trend in the fulvic acid market is encouraging strategic collaborations between humic product manufacturers and dietary supplement companies to create premium, clean-label formulations appealing to health-conscious consumers.

Traditional alkali extraction is being replaced by green, enzyme-based, and microbial fermentation methods that deliver higher purity and consistency. For example, China’s leading bio-nutrient companies including Hebei Monband Water Soluble Fertilizer Co., Ltd are investing in continuous low-temperature extraction facilities to preserve fulvic acid’s molecular integrity, creating new fulvic acid market opportunities. On the other hand, Japan Conservation Engineers & Co., Ltd. also offers a highly concentrated fulvic acid solution called Fujimin that can be obtained by only the mass production technology using timber from forest thinning. Further, automation in quality testing and AI-driven composition analysis are also transforming product customization, helping manufacturers meet precise agricultural and nutraceutical specifications without compromising environmental standards.

Fulvic acid’s rich antioxidant and anti-inflammatory profile is revolutionizing skincare formulations. Cosmetic manufacturers are infusing it into serums, masks, and anti-aging products to enhance skin hydration and detoxification. For example, in February 2021, The Inkey List, a European skincare brand launched Fulvic Acid Cleanser targeting sensitive skin consumers. This aligns with the region’s strong consumer preference for botanical and mineral-based cosmetics, accelerating further demand in the fulvic acid market.

Public funding and R&D grants are accelerating fulvic acid innovation. The European Commission’s Horizon Europe program and India’s National Mission on Sustainable Agriculture also offers subsidies for organic bio-stimulant adoption. Academic collaborations in Canada and South Korea are resulting in full-fledged research on fulvic acid’s impact on carbon sequestration and sustainable farming. Such initiatives are creating an enabling environment for new product development and commercial trials, driving the fulvic acid market growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Fulvic acid Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Form

Key Insight: Both liquid and powder forms of fulvic acid are essential for varied industrial applications. While liquid formulations excel in agriculture due to their superior solubility and field adaptability, powder variants find favor in export and manufacturing due to stability and longer shelf life. Growth in the fulvic acid market is driven by advancements in processing, improved solubility, and the expanding use of fulvic acid across food, cosmetic, and nutraceutical industries.

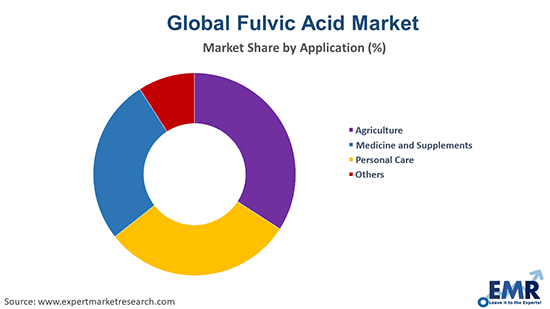

Market Breakup by Application

Key Insight: Among all the applications considered in the fulvic acid industry report, agriculture continues to dominate due to its role in sustainable farming, while medicine and supplements are rapidly emerging as growth engines. Fulvic acid’s versatility supports soil enhancement, crop yield improvement, and human health optimization, extending its use to personal care and veterinary products. Its rising integration into high-value consumer goods reflects a shift from purely agricultural use toward wellness and cosmetic markets.

Market Breakup by Region

Key Insight: Regional fulvic acid market dynamics are shifting as the Asia Pacific region continues to be the production hub while North America emerges as the innovation leader. Europe maintains steady demand driven by sustainable agriculture policies and clean beauty trends. Latin America is gradually adopting fulvic acid in soil rejuvenation programs, while the Middle East and Africa are exploring it for desert farming.

By form, liquid fulvic acid dominates the market owing to its fast absorption and ease of application

Liquid fulvic acid commands the largest share of the market due to its high solubility and fast nutrient delivery. It is extensively used in organic farming and hydroponics, offering consistent soil enrichment and foliar spray compatibility. Increasing demand for liquid bio-stimulants in precision agriculture is driving innovations in formulation stability and shelf life. In August 2025, Mineral BioSciences announced that it has invested in a turnkey liquid bottling line that provides capabilities for 16 oz & 32 oz bottles with private labeling opportunities. Companies are focusing on producing concentrated liquid variants with enhanced micronutrient binding for improved plant vitality.

Powdered form is witnessing strong demand in export fulvic acid markets due to its stability, lightweight nature, and longer shelf life. It allows easier transportation and bulk mixing with fertilizers and animal feed. Manufacturers are investing in spray-drying and freeze-drying technologies to retain nutrient integrity. The product’s growing use in nutraceuticals, particularly in capsules and powdered beverages, is fueling its adoption.

By application, agriculture leads the market with expanding organic and sustainable farming practices

Agriculture remains the dominant sector, accounting for the biggest share of the fulvic acid market revenue due to rising adoption of natural soil conditioners and bio-stimulants. Fulvic acid enhances nutrient uptake, root development, and stress resistance in crops. With governments promoting sustainable farming through subsidies for organic inputs, demand for fulvic acid-based fertilizers is accelerating. As a response, "Biostimulation 360º," a comprehensive, scientifically based approach to sustainability that maximizes producer income, was introduced by Rovensa Next in May 2025. As per the company reports, it satisfies the requirements outlined in the EU Fertilizing Products Regulation. Its ability to reduce chemical fertilizer dependency positions fulvic acid as a vital input for sustainable agriculture.

The pharmaceutical and nutraceutical industries are witnessing rapid fulvic acid consumption for its detoxifying and cell-regenerating effects. Increased clinical validation and consumer awareness of trace minerals are fueling supplement production. The trend reflects a broader market shift toward bio-based, natural health enhancers replacing synthetic chemical compounds.

Asia Pacific leads the market supported by expanding agricultural reforms and bio-based investments

Asia Pacific dominates the global market, driven by vast agricultural activity and increasing government incentives for organic farming. China and India are leading producers and consumers of humic substances. Programs like China’s Zero Growth Action Plan for fertilizer use and India’s National Organic Farming Mission are encouraging natural soil conditioners. The presence of major fertilizer manufacturers and growing export demand for humic products solidify the region’s hold in the market. Additionally, rising health supplement consumption in Japan and South Korea is diversifying fulvic acid’s industrial use.

The fulvic acid market in North America is witnessing strong growth momentum due to increased consumer preference for natural dietary supplements and organic crop cultivation. The United States and Canada are investing in sustainable agricultural practices and carbon farming. In October 2025, HGS BioScience acquired NutriAg Ltd., to expand on the latter’s bionutritional innovations. FDA approvals for natural humic-based ingredients in nutraceuticals are driving innovation. Moreover, expanding e-commerce distribution and higher adoption of regenerative soil management practices are broadening fulvic acid’s reach.

Most of the players are centering on scalable green extraction, product differentiation, and credible efficacy validation. Leading fulvic acid companies are investing in enzymatic and low-temperature extraction to boost yield and retain bioactivity while lowering energy consumption. Opportunities are appearing in co-branded soil health services, nutraceutical supply agreements, and personal-care ingredient licensing. Companies are offering tailored formulations for precision agriculture and are partnering with carbon-credit verifiers to monetize soil sequestration benefits. Regional tolling hubs are reducing logistics barriers for exporters.

Firms are also deploying AI-driven crop-response modeling and advanced analytics to demonstrate ROI for growers and are obtaining ISO and organic certifications to access premium channels. Overall, fulvic acid market players that are delivering consistent analytics, traceability, and clinically supported claims are securing premium contracts and enabling faster market penetration.

Valagro S.P.A was founded in 1980 and is headquartered in Atessa, Italy. Valagro produces fulvic-based biostimulants and specialized micronutrient blends for agriculture globally. With a strong R&D pipeline, it is developing precision foliar and root-applied fulvic formulations tailored to high-value crops.

AgTonik, LLC was established in 2001 and is headquartered in the United States. AgTonik focuses on producing concentrated fulvic and humic extracts for both agricultural and supplement markets. The firm is emphasizing clean-label, water-extracted products and is supplying formulators in the nutraceutical and personal care sectors.

Mycsa AG was founded in 2004 and is headquartered in Texas, United States. Mycsa specializes in high-purity fulvic fractions derived from engineered composting and microbial hydrolysis. The company is targeting pharmaceutical and cosmeceutical markets with validated safety data and is offering custom grades for topical and ingestible products.

Saint Humic Acid was established in 2010 and is headquartered in China. The company provides fulvic and humic products for soil remediation, livestock feed, and specialty supplements. It is innovating with pelletized and encapsulated fulvic blends to improve handling and dosing for large-scale agriculture.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Fulvic Acid Market includes Nutri-Tech Solutions Pty Ltd and Redox Industries Limited among others.

Unlock the latest insights with our Fulvic acid market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

United Kingdom Carbon Black Market

Point of Sale Materials (PoSM) Market

India Frozen Potato Products Market

Saudi Arabia Electric Motors and Transformers Maintenance Market

Latin America Flexible Packaging Market

Peru Construction Materials Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 864.79 Million.

The market is projected to grow at a CAGR of 11.60% between 2026 and 2035.

The fulvic acid market is estimated to reach about USD 2591.51 Million by 2035.

Stakeholders are investing in enzymatic extraction, forming long-term feedstock partnerships, pursuing clinical validation, developing traceable supply chains, piloting carbon-service bundles, and scaling tolling hubs globally.

The key market trends guiding the growth of the industry include the growing research activities regarding the therapeutic potential of fulvic acid in the treatment of chronic diseases and diabetes and the rising demand for natural supplements.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading forms of fulvic acid in the market are liquid and powder.

The significant application segments in the industry are agriculture, medicine and supplements, and personal care, among others.

The key players in the market include Valagro S.P.A, AgTonik LLC, Mycsa AG, Saint Humic Acid, Nutri-Tech Solutions Pty Ltd, Redox Industries Limited, and others.

High raw material variability, extraction cost intensity, regulatory ambiguity for supplements, scale-up hurdles, traceability demands, competition from synthetic chelates, and variable feedstock logistics are limiting margins and certification lag remains.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Form |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share