Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global electric cargo bikes market size reached approximately USD 3568.56 Million in 2025. The market is projected to grow at a CAGR of 34.90% between 2026 and 2035, reaching a value of around USD 71221.73 Million by 2035.

Base Year

Historical Period

Forecast Period

Growing efforts for decarbonisation in the transport sector have increased the adoption of electric cargo bikes.

Electric cargo bikes are becoming extremely popular for last-mile delivery solutions in densely populated urban areas.

These bikes are readily gaining traction in the Asia Pacific region due to rising sustainability efforts.

Compound Annual Growth Rate

34.9%

Value in USD Million

2026-2035

*this image is indicative*

Electric cargo bikes refer to battery-operated bikes and bicycles. These bikes are operated and powered by portable batteries like lithium-ion and nickel-based batteries. Electric cargo bikes are highly versatile and offer smooth rides as they are light in weight. They can serve as an efficient method of transport for carrying packages, cargo, food, and more. Further, the demand for these vehicles is increasing as they are environment friendly and have a low running cost.

The growing environmental consciousness around the globe is one of the major factors driving the electric cargo bikes market growth. The increasing government investments to encourage the adoption of renewable energy sources and environment-friendly alternatives have also significantly contributed to the market expansion. Moreover, with increased congestion in urban areas, electric bikes serve as an efficient means of transport for short-distance deliveries as the riders can use bike lanes to avoid heavy traffic to reach the destination quickly. The rapid technological advancements and innovations to develop affordable and low-emission transport alternatives are also expected to bode well for market growth in the coming years.

Expansion of electric vehicles worldwide; diverse models of e-bikes; innovations in technology; and net-zero transition and growing government support are the major trends in the electric cargo bikes market

| Date | Company | Event |

| Feb 2024 | Tern | Announced the expansion of its electric cargo range with the launch of an electric adventure cargo bike called Orox, which possesses 1,600Wh battery capacity. |

| Feb 2024 | Gocycle | Launched a new lineup of electric cargo bikes called the CX lineup, which features a foldable design and adjustable handlebar. |

| Dec 2023 | Amazon | Announced that it will be leveraging electric cargo bikes for the delivery of packages in Croydan, England to contribute to the decarbonisation initiative in the UK. |

| Sep 2023 | Maxion Wheels | Announced its partnership with Antric, an electric cargo bike provider to offer advanced mobility service through its inexpensive steel wheel design. |

| Trends | Impact |

| Expansion of electric vehicles worldwide | Electric vehicles are gradually establishing their presence in areas of the Asia Pacific and North America due to growing traffic congestion and environmental issues, thereby favouring the market for electric cargo bikes |

| Diverse models of e-bikes | The market players are manufacturing diverse models of electric bikes which cater to specific cargo services such as the transport of heavy goods or food delivery. |

| Innovations in technology | Technological advancements to increase battery life and range as well as enhance the charging speed are leading to the market development. |

| Transition towards net-zero emissions and favourable government initiatives | Increasing focus on net zero-transition and favourable government initiatives, such as the construction of bike lanes and parking facilities for electric bikes are expected to boost adoption. |

One of the prominent trends supporting the electric cargo bikes market development includes advancements in battery technology and charging efficiency of electric cargo bikes. Manufacturers are incorporating lithium-ion batteries with longer lifespans into modern bikes so they can last for a longer period of time. These batteries, apart from facilitating short charging time in modern bikes, offer more power without any significant increase in the weight or size of batteries due to their energy-dense nature.

The key market players are increasingly focusing on innovating their existing range and addressing challenges associated with battery technology. In February 2024, Tern announced to expand its electric cargo range with the launch of an electric adventure cargo bike called Orox. The bike, available in two specifications, possesses 1,600Wh battery capacity, can carry up to 210 kg of load, and promises to offer a range of over 300 km.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Electric Cargo Bikes Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Battery Type

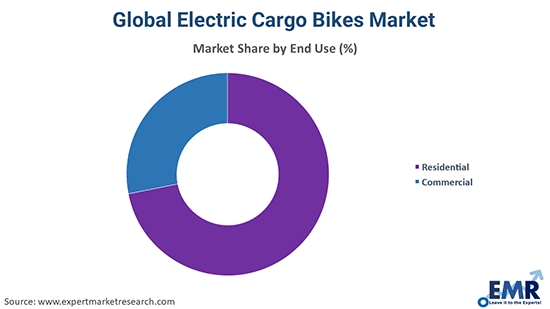

Market Breakup by End Use

Market Breakup by Region

The commercial segment is further divided, based on application, into courier and parcel service provider, service delivery, and retail supplier, among others.

Lithium-ion batteries account for a major electric cargo bikes market share due to their high energy density and longer lifespan

Lithium-ion batteries occupy a major share of the market as they possess high energy density compared to other battery types. This allows electric cargo bikes to travel long distances without charging the battery. These batteries also possess long life compared to other battery types and can last for years without any degradation in their efficiency and capacity. Additionally, their high efficiency in terms of charging makes them a viable option for electric cargo bikes.

Other battery types include battery technologies like lead-acid. Lead-acid batteries are generally preferred due to their cost-effective price, easy-to-manufacture design, and low discharge rate.

The commercial sector maintains its dominance in the electric cargo bikes market due to the rising adoption of these bikes for delivery purposes

The electric cargo bikes market is supported by the growing usage of these bikes in the commercial sector due to the rise of e-commerce. Electric cargo bikes have gained prominence as the last-mile delivery solution for quick and hassle-free delivery. They are also being readily used for food delivery services to facilitate quick delivery as they can avoid heavy traffic by travelling through bike lanes.

Meanwhile, the residential sector is also anticipated to contribute to the demand for electric cargo bikes in the coming years due to growing environmental awareness among individuals. This has led to an increase in demand for eco-friendly transport options such as electric cargo bikes compared to traditional cars and bikes.

The market players are increasing their collaboration efforts and are launching improved vehicle range to gain a competitive edge in the market

| Company | Founded | Headquarters | Product Range/Operations |

| Rad Power Bikes Inc | 2007 | Washington, United States | Electric vehicles and electric bikes/scooters |

| Yuba Bicycles LLC | 2007 | California, United States | Cargo bikes for families and businesses- FastRack, Kombi, Spicy Curry, Mundo EP8, Supercargo |

| Amsterdam Bicycle Company BV | 2017 | Delaware, United States | E-bikes, cargo bikes, and electric cargo bikes |

| Babboe BV | 2005 | Amersfoort, Netherlands | Cargo bikes, accessories, and spares |

Other players in the electric cargo bikes market are Worksman Cycles Company Inc., and DOUZE Factory SAS, among others. The market players are focused on developing advanced electric cargo bikes with enhanced performance and efficiency.

Europe is the leading region in the market and is expected to maintain its dominance in the forecast period as well. The market growth in Europe can be attributed to the thriving cargo bikes sector, the increasing adoption of electric vehicles (EVs), and the increasing usage of cargo bikes for private and commercial use in the region. The favourable government initiatives to promote clean transport are also significantly contributing to the market growth. Furthermore, Germany accounts for a major share of the European electric cargo bikes market and the country recorded sales of 15,000 e-cargo bikes in 2016. Besides Germany, Denmark, the United Kingdom, and the Netherlands are the other significant national markets in Europe.

Meanwhile, North America is expected to witness considerable growth in the forecast period. The growing focus on improving air quality, decarbonising transport, and regaining public street space is expected to favour the market growth in the coming years.

North America Electric Cargo Bikes Market

United States Electric Cargo Bikes Market

Electric Bike Market

Electric Cargo Bikes Companies

Electric Cargo Bike Adoption Policies

Cargo Bike Leasing and Subscription Models

Urban LEV Charging Infrastructure

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global electric cargo bikes market attained a value of nearly USD 3568.56 Million.

The market is estimated to witness a healthy growth during 2026-2035 to reach around USD 71221.73 Million by 2035.

The market is projected to grow at a CAGR of 34.90% between 2026 and 2035.

The market is being driven by the increasing preference of sustainable two-wheelers and favourable policies of various governments to promote green energy.

The key trend bolstering the market expansion include the rising environmental consciousness worldwide.

The major regions in the industry are North America, Europe, Asia Pacific and the rest of the world.

The different product types include two wheeled, three wheeled, and four wheeled.

The significant battery types include lithium ion, and others.

The major end uses include residential and commercial. Commercial is further segmented into courier and parcel service provider, service delivery, retail supplier, among others.

The major players in the market are Rad Power Bikes Inc., Yuba Bicycles LLC, Worksman Cycles Company Inc., DOUZE Factory SAS, Amsterdam Bicycle Company BV, and Babboe BV, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Battery Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share