Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global green packaging market reached a value of USD 226.62 Billion in 2025. The market is further expected to grow at a CAGR of about 6.60% between 2026 and 2035 to reach a value of approximately USD 429.41 Billion by 2035.

Base Year

Historical Period

Forecast Period

In the year 2023, a total of 40 bills were presented in 18 different states, all of which were focused on the concept of extended producer responsibility (EPR) specifically for packaging.

According to surveys, a significant majority of consumers, ranging from 60% to 70%, express their willingness to pay a higher price for sustainable packaging.

As per industry reports, 50% of consumers indicate their inclination to purchase a greater quantity of products that come with sustainable packaging.

Compound Annual Growth Rate

6.6%

Value in USD Billion

2026-2035

*this image is indicative*

Green packaging, or sustainable packaging, is the use of renewable products in manufacturing processes for the packaging of goods. This uses biodegradable and plant-based plastics together with recycled moulded packaging and polyethylene bags to make a range of items. Unlike traditional plastic packaging methods, green packaging has a lower carbon footprint, which helps to improve human and ecological safety in the long term. The green packaging approach also involves ways of minimising the amount of waste and pollution produced during the manufacturing process.

Factors that have influenced green packaging market development include the rise in awareness among consumers for luxury goods toward green packaging techniques that use bioplastics as raw material across various sectors, such as FMCG, personal body care, and pharmaceuticals. For instance, companies like L'Oréal and Unilever have made significant strides in adopting bioplastics for their packaging. Additionally, stringent government regulations and policies, particularly in Europe, are driving the market growth. For example, the European Union's Single-Use Plastics Directive aims to reduce single-use plastics by 80% by 2025. The rising focus of major brands and companies to achieve net zero goals and the growing demand for eco-friendly packaging options are also significant factors contributing to the growth of the market.

Rise of paper-based packaging, technological advancements in manufacturing, introduction of edible packaging are key trends fuelling the green packaging market expansion.

Consumers are inclined towards bioplastics as they are made from renewable biomass sources such as corn starch, rice husks, cotton, sugarcane, or potato starch, which reduce greenhouse gas emissions and are biodegradable. Huhtamäki Oyj introduced ice cream packaging composed of bio-based materials.

As per green packaging market analysis, edible packaging materials, such as cones and bowls for ice cream, edible straws, and compostable coffee cups, are gaining popularity. These products reduce waste and minimise environmental impact.

Reusable packaging is gaining popularity as companies and consumers seek to reduce waste and minimise environmental impact. Reusable packaging includes drums, plastic containers, and intermediate bulk containers, which are widely used in chemicals, food and beverages, and construction industries.

Technological advancements in manufacturing are playing a crucial role in the propelling green packaging market growth. Liner-free labels is one such advancement as these labels eliminate the need for backing paper, reducing waste and energy consumption in manufacturing process.

The shift towards sustainable packaging is motivated by governmental pressure to shift to environmentally friendly materials and negative consumer views about traditional packaging. In 2018, L'Oréal, a French-based personal care company, partnered with Quantis, a Swiss environmental sustainability consulting firm, to set up an initiative called the Sustainable Packaging Initiative for Cosmetics (SPICE). The initiative aimed to minimise the environmental footprint of cosmetics by creating a sustainable packaging strategy, encouraging developments based on eco-design standards, and meeting customer preferences by providing transparency on the environmental performance of goods.

In addition, the Sustainable Packaging Coalition, a US-based membership-based partnership, launched the Target Database & SPC Engage in 2020 to help top retailers and brand owners enhance sustainability in corporate and in packaging domain. Such developments have impacted the green packaging market outlook positively. Furthermore, specific companies have begun to incorporate green packaging as part of their Extended Producers Responsibility (EPR). Healthcare and food and beverage firms, for example, choose environmentally sustainable packaging items like paper, glass, metal, and plastic, which can be quickly recycled.

The EMR’s report titled “Green Packaging Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Packaging Type

Market Breakup by End Use

Market Breakup by Region

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Recycled and reusable packaging segments equally lead in the market as they help minimise environmental impact

The recycled content packaging segment is expected to hold the largest share in the market. This segment includes paper, metal, plastic, and glass. Paper is widely used in recycled content packaging due to its recyclability and biodegradability. Companies are adopting sustainable packaging strategies by reducing packaging weight and using more recycled and renewable materials.

The reusable packaging segment in green packaging market report is expected grow at a significant rate during the forecast period. This segment includes drums, plastic containers, intermediate bulk containers, and other reusable packaging means. Drums are the most versatile and flexible green packaging solutions, enabling large-scale end-user sectors like chemicals, food and beverages, and construction to operate with a low carbon footprint or waste production.

The food and beverage segment is driving the market’s expansion and the healthcare segment is expected to witness the fastest growth

The food and beverages segment holds the largest green packaging market share due to increasing demand for eco-friendly packaging in manufacturing of dairy products, food items, and beverages. In June 2024, PepsiCo partnered with GreenDot Group to eliminate virgin fossil-based plastic in its snack bags across Europe by 2030, transitioning to 100% recycled or renewable materials.

The healthcare segment is expected to witness the fastest growth due to the increasing demand for biodegradable and recyclable packaging in pharmaceuticals and medical devices. Companies like Johnson & Johnson and Pfizer have adopted eco-friendly packaging solutions for their pharmaceutical products. Moreover, e-commerce, chemicals, and home care industries are also using green packaging solutions. Companies like FedEx and UPS have adopted eco-friendly packaging solutions for their shipping operations.

Market players are focused on developing cutting-edge technology for switching to environmentally friendly packaging options to reduce waste from packaging.

Amcor plc was founded in 1947 and is based in Zurich, Switzerland. It offers flexible, rigid, and sterile packaging solutions for beverage, food, medical, household, industrial goods, pharmaceuticals, and tobacco industries. It is one of the world’s largest suppliers of flexible packaging and speciality folding cartons, with operations in over 218 sites across 41 countries.

DuPont de Nemours, Inc. was founded in 1802 and is based in Delaware, United States. It operates through various segments, including Electronics, which enables connectivity, smart technologies, and next-generation semiconductor chips and printed circuit boards. DuPont also offers specialised materials for healthcare, aerospace, defence, and clean energy sectors.

Mondi plc was established in 2007 and is headquartered in England, United Kingdom. It a packaging and paper company that provides a range of packaging products, including flexible and rigid packaging, and paper products such as corrugated packaging, bags, and tissues.

Sealed Air Corporation was founded in 1960 and is based in North Carolina, United States. It operates through two main segments, food packaging and product care. The company offers solutions for food safety, product protection, and supply chain efficiency.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the global green packaging market include Plastipak Holdings, Inc., among others.

North America to witness rapid adoption of eco-friendly packaging in lieu of rising packaging waste

North American region is witnessing significant growth in adoption of green packaging due to increasing consumer awareness of environmental issues and supportive government laws. For instance, the United States produces up to 80 million metric tons of packaging waste annually , with food and beverage goods accounting for around half of this waste. This creates a mandate for a transition towards green packaging. Companies like Nestle and Unilever have recently promised to reduce the environmental impact of their packaging. In addition, McDonald's plans to adopt 100% sustainable packaging by 2025.

Asia Pacific is expected to dominate the green packaging market in the future due to the increasing consumption of convenience food and beverage products in this region and rise of e-commerce. The region’s growth is further driven by increasing government initiatives and regulations. In 2019, China implemented a ban on single-use plastics, which has led to a significant shift towards reusable and biodegradable packaging materials. Many countries in the region are also investing in recycling infrastructure to support the growth of eco-friendly packaging. For instance, Japan has set a goal to recycle 60% of its waste by 2030.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the green packaging market reached an approximate value of USD 226.62 Billion.

The market is expected to grow at a CAGR of 6.60% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to USD 429.41 Billion by 2035.

The major drivers of the market include rising disposable incomes, increasing population, rising awareness of environmental protection, shift towards sustainable living, and the rising demands from healthcare, food, and beverage industries.

Key trends aiding market expansion include the stringent governmental regulations on environmental sustainability, rise of paper-based packaging, and technological advancements in manufacturing of packaging solutions.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The major types of green packaging in the market are recycled content, reusable, and degradable packaging.

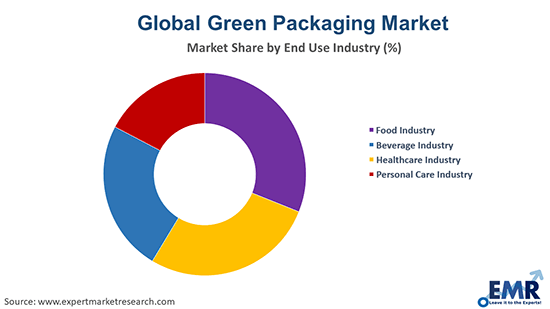

The major end uses include food, beverage, healthcare, and personal care industries.

Key players in the market are Amcor plc, DuPont de Nemours, Inc., Mondi plc, Sealed Air Corporation, and Plastipak Holdings, Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Packaging Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share