Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India wires and cables market size reached a value of nearly INR 1240.85 Billion in 2025. The market is projected to grow at a CAGR of 14.50% between 2026 and 2035 to reach around INR 4805.89 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

14.5%

Value in INR Billion

2026-2035

*this image is indicative*

| India Wires and Cables Market Report Summary | Description | Value |

| Base Year | INR Billion | 2025 |

| Historical Period | INR Billion | 2019-2025 |

| Forecast Period | INR Billion | 2026-2035 |

| Market Size 2025 | INR Billion | 1240.85 |

| Market Size 2035 | INR Billion | 4805.89 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 14.50% |

| CAGR 2026-2035 - Market by Region | West India | 15.4% |

| CAGR 2026-2035 - Market by Voltage | High Voltage | 15.3% |

| CAGR 2026-2035 - Market by Material | Copper | 15.1% |

| Market Share by Region | South India | 24.1% |

A wire is a metallic conductor, mainly made of copper, that is used for conducting electricity whereas a cable is a group of wires that are bonded and twisted together for the transmission of electrical or optical signals.

Globally, India is the third-largest producer and consumer of electricity. As of April 30, 2023, India had an installed power capacity of 416.59 GW. There is a growing number of investments in the power, telecommunication, and infrastructure sectors, including metros, railroads, smart grids, and data centres.

Some of the investments include Raipur Visakhapatnam Expressway (NH-130CD) with a funding of Rs 20,000 crore, Kala Amb smart grid project with an investment of Rs.19.44 crore, and USD 32.7 billion capital investment into the rail among several others.

Some of the factors driving the India cables and wires market growth are ongoing technological advancements and innovations by branded players. India aims to achieve 500 GW of renewable energy by 2030 and the Indian government is significantly investing in metro projects. The Government of India allocated approximately INR 19,518 crores in metro projects during the Union budget 2023-2024.

Government investments in metro projects; increasing adoption of renewable energy; rapid infrastructural development; and expansion of smart devices are favouring the Indian cables and wires market

The Indian government’s massive investment (19,518 crores) in budget FY23-24 is contributing to its expansion in tier-2 cities. Around 674.22 km are under construction, and 192.77 km have already been approved.

India’s aim is to achieve 500 GW of renewable energy by 2030, which fosters the installation of renewable energy sources such as solar and wind power.

Under the National Infrastructure Pipeline (NIP), an average of 0.5%-2% of the project expenditure is expected to be spent on wires and cables.

The Union Cabinet’s approval of the final phase of the last-mile optical fibre-based broadband connectivity plan for households in 6.4 lakh villages in August 2023, creates the market opportunities.

Due to increased consumer awareness of safety and quality, influenced in part by the introduction of the GST regime India's wires and cables market is transitioning to branded products.

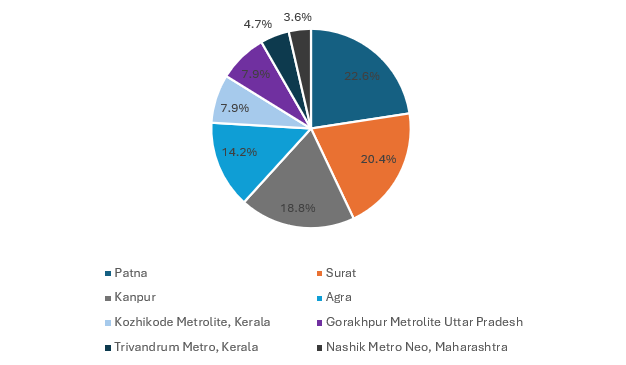

Figure: Funds allocated for Tier-2 City Metro Projects

Large-scale developments in the power, telecom, and housing sectors, driven by urbanisation, commercialisation, and smart city projects, are stimulating the need for wires and cables. The rapid digital transformation, development of data centres and cloud computing further also propels the India wires and cables market growth. The use of fibre optic cables for ethernet applications is expanding as IT infrastructure attains higher levels of availability and security.

Furthermore, the Indian Government National Infrastructure Pipeline (NIP) provides a projected infrastructural investment of around INR 111 lakh crore in the Indian infrastructural sector over FY 2020-2025. Under the NIP, an average of 0.5%-2% of the project expenditure is expected to be spent on wires and cables, providing manufacturers with an annual opportunity of around INR 100-450 billion.

"India Wires and Cables Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Voltage

Market Breakup by Product

Market Breakup by Material

Market Breakup by End Use

Market Breakup by Region

| CAGR 2026-2035 - Market by | Region |

| West India | 15.4% |

| East India | 14.8% |

| North India | XX% |

| South India | XX% |

High voltage is expected to dominate the India wires and cables market share as these are suitable for underground or underwater power transmission

The rising urbanisation in India and the growth of metro cities propel the demand for extra-high-voltage cables (EHV) in India. These cables are especially ideal for underground installations as they omit the risks of power theft and require reduced maintenance. High-voltage cables are ideal for power transmission and distribution. India's National Grid capacity is expanding continuously under the PM Gati Shakti National Master Plan, which is expected to add around 26,988 circuit km capacity by 2024-2025 in line with growing electricity generation and demand.

Low voltage wires and cables also occupy a significant share of the market due to their wide applications in the residential, commercial, and industrial sectors of the country. Low voltage wires are extensively implemented in building wiring for power distribution throughout the infrastructure. Moreover, they are utilised in electrical appliances such as lighting, switchboards, fans, and sockets, among others. Low voltage cables are also deployed in LAN networks and telecommunication for the transmission of audio, video, and internet data.

| CAGR 2026-2035 - Market by | Voltage |

| High Voltage | 15.3% |

| Medium Voltage | 14.6% |

| Low Voltage | XX% |

The demand for building wires is significantly increasing as they play an essential role in the commercial, residential, and industrial sectors

Building wires hold a significant share of the India wires and cables market. Building wires are extensively deployed in commercial, industrial, and residential establishments. These are essential components of branch circuit wiring in homes and businesses that carry electrical current for powering appliances. Through the Union budget 2023-24, the finance ministry of India allocated over Rs 79,000 crore (USD 9.64 billion) towards the Pradhan Mantri Awas Yojana (PMAY)), representing a 66% increase compared to the previous year. PMAY, launched in 2015, aims to provide affordable housing to all citizens.

Copper is expected to dominate the India wires and cables market share in the coming years

By material, copper wires are anticipated to grow significantly due to their high electrical conductivity, ductility, and thermal resistance. Copper wire and cables work as great electrical conductors. Copper wires are commonly deployed in commercial and household electrical wiring. As a result, rising residential construction due to increased disposable income drives the demand for copper wires for powering TVs, computers, and kitchen appliances.

| CAGR 2026-2035 - Market by | Material |

| Copper | 15.1% |

| Aluminium | 14.3% |

| Others | XX% |

Although aluminium wires and cables are not as strong as their copper counterparts, they are lightweight and cost-effective. Such wires have a 1.5 times larger cross-section than copper wires, hence they are used in high-voltage power lines.

North India is anticipated to hold a dominant position in the India wires and cables market in the forecast period. In March 2023, the International Telecommunications Union (ITU) inaugurated the ITU Area Office and Innovation Centre in Delhi to promote and develop new telecom technologies and expand the benefits of digitalisation to consumers. Additionally, the construction of a new interim terminal building for the upcoming international airport at Halwara, Punjab, further aids the growth of the market.

| 2025 - Market Share By | Region |

| South India | 24.1% |

| North India | XX% |

| East India | XX% |

| West India | XX% |

East India holds a growing market share and is driven by rapid installation of smart grids. For instance, in August 2023, the West Bengal State Electricity Distribution Company (WBSEDCL) announced the installation of 200,000 smart meters in selected urban geographies, including Asansol and Kharagpur by 2026-end.

Major players in the India wires and cables market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge in the market

Founded in 1968, headquartered in India, Polycab is a leading manufacturer and supplier of a wide range of wires and cables serving both retail and industrial applications.

Established in 1968 in India, KEI specializes in extra high voltage, high voltage, and low voltage cables, along with control cables, house wires, ESP cables, and flexible single-core and multicore solutions.

Founded in 1999 and based in India, R R Kabel offers household and fixed wiring products, including flat cables, bus cables, battery cables, and flexible single-core and multicore cable ranges.

Established in 1962 in India, Universal Cable manufactures low, medium, and extra high voltage XLPE power cables, along with PVC and rubber insulated power cables marketed under the UNISTAR brand.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the India wires and cables market include Gloster Cables Limited, Finolex Cables Ltd., V-Guard Industries Ltd., and Havells India Ltd., among others.

United Kingdom Wires and Cables Market

North America Wires and Cables Market

United States Wires and Cables Market

Asia Pacific Wires and Cables Market

Canada Wires and Cables Market

Europe Wires and Cables Market

Japan Wires and Cables Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was INR 1240.85 Billion.

The market is expected to grow at a CAGR of 14.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach INR 4805.89 Billion by 2035.

The major market drivers include rising government investment in Tier 2 city metro projects, expansion of IT and telecommunication centre, and rapid infrastructure development.

The key trends include increasing adoption of renewable energy, growth of social media and the proliferation of smart devices, rapid digital transformation, and the development of data centres and cloud computing.

The different segments based on voltage of wires and cables include low voltage, medium voltage, and high voltage.

Major end uses of wires and cables include construction, telecommunications, energy and power, automotive, and aerospace and defence, among others.

The major players in the market include Polycab India Limited, KEI Industries Limited, R R Kabel Ltd, Universal Cable Limited, Gloster Cables Limited, Finolex Cables Ltd., V-Guard Industries Ltd., and Havells India Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Voltage |

|

| Breakup by Product |

|

| Breakup by Material |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share