Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The wires and cables market attained a value of USD 285.27 Billion in 2025. The market is expected to grow at a CAGR of 3.50% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 402.40 Billion.

Rapid urbanization in emerging economies is leading to extensive investments in infrastructure projects. As per the United Nations, the worldwide population residing in urban areas is projected to rise to 68% by 2050. These developments require vast amounts of electrical wiring for lighting, elevators, HVAC systems, communication networks, and more. Power distribution cables, fire-retardant wires, and low-smoke zero-halogen variants are gaining popularity in urban infrastructure. As cities modernize and digitalize, there is increasing reliance on high-capacity power and data cables.

The global shift toward renewable energy is boosting the wires and cables market value. Solar power plants and wind farms require extensive cabling to transmit electricity from generation points to substations and distribution networks. In March 2023, LS Cable secured a USD 75–76 million contract to supply extra-high-voltage submarine cables for Taiwan’s First Offshore Wind Farm initiative, covering capacity expansion through 2035. As energy storage and grid connectivity increase, so does the need for high-performance, efficient cabling systems to support decentralized and intermittent energy generation sources.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

3.5%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The global transition to electric vehicles is fuelling the specialized wires and cables demand. As per the Global EV Outlook 2025, the sales of electric cars topped 17 million worldwide in 2024. EVs require high-voltage cables for batteries, charging, and electric drivetrains, while charging infrastructure demands robust, safe, and heat-resistant cabling.

Rail electrification projects, e-mobility solutions, and smart transportation grids depend on energy-efficient cables. These trends are creating new, high-margin opportunities for cable manufacturers who can meet stringent performance and safety requirements.

The rise of Industry 4.0 and automation is transforming factories, warehouses, and production lines. Smart manufacturing facilities deploy robotics, sensors, and real-time monitoring systems, all of which need high-speed, shielded, and durable cables for power and data transmission.

In May 2025, OKI unveiled flexible, bend resistant factory automation cables and flexible printed circuits for robotics and mobility equipment. The trend toward AI-driven manufacturing further intensifies the demand for advanced cabling systems.

The explosion in data usage, cloud computing, and AI is driving rapid growth in data centres worldwide, further boosting the wires and cables industry share. These facilities require structured cabling systems to ensure fast and reliable data transfer. Growing demand for OTT content, video conferencing, IoT, and 5G is increasing bandwidth needs.

In 2024, approximately 5.27 billion people used OTT services globally, with a penetration rate of 68.1% across internet users, further fuelling cable demand.

The need for energy access in rural and underdeveloped regions, coupled with grid modernization efforts in developed countries, is driving the expansion of transmission and distribution (T&D) networks. High-voltage and extra-high-voltage cables are essential in connecting power plants, substations, and end users.

Replacing aging grid infrastructure in developed nations and extending electricity access in Africa and Asia are key drivers supporting long-term cable demand.

Environmental regulations and corporate sustainability goals are prompting wires and cables manufacturers to adopt eco-friendly materials and recycling processes. Companies are innovating in cable reprocessing and reducing carbon footprint through green manufacturing. In October 2024, Nexans launched CableLoop to collect used cables across Europe, recycling them at RecyCâbles into raw materials for sustainable cable production.

As circular economy principles gain traction, cable recycling, material recovery, and product lifecycle transparency are becoming major differentiators in the global market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The Expert Market Research’s report titled “Wires and Cables Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

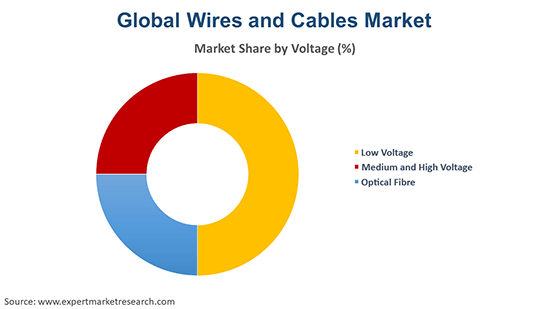

Market Breakup by Voltage

Key Insight: Medium and high voltage wires and cables industry is growing as they are critical for power transmission and distribution across cities and grids. These cables are used in substations, industrial plants, and cross-border transmission projects. For instance, LS Cable and Prysmian supply HV cables for national grids in Europe and Asia. With the global renewable energy push, these cables are being deployed to connect offshore wind farms and solar parks to grids. Upgrades to aging electrical infrastructure in the United States and Europe also boost demand.

Market Breakup by Material

Key Insight: Copper is the preferred conductor due to its superior conductivity and thermal performance. Despite its higher cost, copper’s reliability ensures dominance in critical systems. In May 2025, Amphenol Communications Solutions and Semtech introduced a 1.6 T OSFP Active Copper Cable, featuring Semtech’s CopperEdge™ equalizer/redriver ICs, delivering ultra-low power, sub-100 ps latency, and high reliability. As electric vehicles and solar systems proliferate, copper demand in cables is expected to surge.

Market Breakup by End Use

Key Insight: Building and construction is one of the largest application areas of the wires and cables market with primary uses in wiring, lighting, elevators, and fire alarm systems. Growth in urbanization, infrastructure spending, and smart housing fuels demand. In June 2024, LAPP introduced the ETHERLINE® FD bioP Cat 5e cable with a 43% bio‑based sheath and low environmental impact for uses in smart building automation. Green building codes are also driving demand for halogen-free and fire-resistant cables. Pre-wired conduit solutions and plug-and-play electrical systems are emerging to reduce construction time.

Market Breakup by Region

Key Insight: North America is a key consumer of wires and cables led by smart grid modernization, EV infrastructure, and data centre growth. Federal infrastructure bills and broadband expansion are key enablers. Stringent fire safety and performance standards drive innovation in cable insulation and sheathing. In June 2023, Prysmian Group launched its Lifeline® RC90 fire resistive cables, in line with the Canadian National Building and Electrical Codes for wide adopted in hospitals, high-rises, transit systems, and event venues. Growth in solar projects also drives demand for DC-rated cables.

Low Voltage & Optical Fibre Wires and Cables to Gain Popularity

The low voltage wires and cables demand growth is surging for residential, commercial, and industrial applications, including lighting, appliances, and building wiring. They are widely used in infrastructure, urban development, and smart city projects. For example, Finolex and Polycab produce LV wires for homes and real estate. The increasing electrification of rural areas and government housing schemes globally are fuelling demand for these cables, especially in Asia and Africa. Easy installation, safety features, and growing requirements in construction and renewable energy integration are boosting this segment.

Optical fibre cables are central to modern telecom, data centres, and internet backbone infrastructure. Companies are expanding production amid 5G rollout and rising internet penetration. In July 2024, STL introduced its high-density 864 fibre micro cables, designed for ultra-dense fibre deployments across the United States. In smart cities and Industry 4.0 environments, fibre enables real-time control and sensor networks. Additionally, the rising demand for submarine optical cables is significantly boosting this segment.

Surging Deployment of Aluminium & Glass Wires and Cables

Aluminium wires and cables market is gaining traction with usage in power transmission and distribution, especially for overhead lines and medium/high voltage systems. With increasing rural electrification, aluminium cables are gaining preference in cost-sensitive projects. Recent innovations include compact aluminium conductors with enhanced conductivity and corrosion resistance for harsh environments. For instance, in November 2024, Prem Cables secured commercial production of medium voltage covered aluminium conductors for urban and rural electrification lines.

Glass forms the core of optical fibre cables, enabling high-speed data transmission. It is engineered into ultra-pure silica strands that transmit signals with minimal loss. Companies lead in producing high-performance glass fibres used in FTTH (fibre to the home), submarine cables, and data centres. The expansion of smart infrastructure and cloud computing services is driving this segment. Additionally, flexible glass developments are enabling innovations in bend-resistant and micro fibre cables used in IoT and industrial automation.

Huge Wires and Cables Demand in Aerospace and Defence & Oil and Gas

The wires and cables market revenue is rising with need for specialized cables in aircraft, satellites, and military equipment to render lightweight, high-performance, and EMI-shielded properties. In July 2023, Harwin announced the availability of back shells for their Kona high-power connector line, made from aerospace-grade aluminium 6061. These cables operate under extreme temperatures and vibration. Additionally, the shift toward electric propulsion in aviation requires robust power cabling systems.

Harsh environments in upstream and downstream facilities demand flame-retardant, chemical-resistant, and armoured cables. Offshore platforms, refineries, and pipelines use high-specification cables for safety and reliability. Nexans and Prysmian provide umbilical and subsea cables for offshore rigs. With rising LNG infrastructure and exploration activities, especially in the Middle East and Africa, this sector shows steady demand. Specialized cable solutions, such as thermocouple extension wires and fire-survivable cables are gaining traction.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Europe & Asia Pacific to Drive Higher Wires and Cables Usage

The Europe wires and cables market is gaining traction with energy transition, offshore wind, and sustainable construction. The European Union’s Green Deal and Fit for 55 targets are accelerating HVDC cable deployment for cross-border transmission. For example, the United Kingdom’s Eastern Green Link and Germany’s TenneT projects use Prysmian and NKT cables. Retrofits in aging urban infrastructure and rising demand for fire-safe cables are significant. The region also leads in circular economy adoption for cable recycling.

The Asia Pacific is the largest and fastest-growing regional market due to urbanization, infrastructure growth, and government electrification programs. China leads in optical fibre cable production and deployment. As per CEIC, China’s optical cable production was reported at 22,895.000 Skm th in March 2025. India’s renewable energy and housing initiatives drive LV and MV cable demand. The rise of manufacturing and automation in the region supports industrial cable adoption.

Key players in the wires and cables market are adopting a multi-pronged strategy to maintain competitiveness and meet growing global demand. Product innovation is at the forefront, with companies investing in lightweight, high-performance, and EMI-shielded cables to cater to aerospace, defence, and high-speed communication sectors. Sustainability is another core strategy, as seen in the development of recyclable cables and eco-friendly manufacturing practices. Geographic expansion plays a crucial role as leading firms are setting up facilities in emerging markets to tap into electrification and infrastructure growth.

Players are also enhancing vertical integration, producing in-house materials to control costs and ensure quality. Additionally, digitalization and smart cable solutions for Industry 4.0 are gaining traction for offering data-rich, real-time monitoring capabilities. Customization to sector-specific needs, especially for telecom, energy, and renewables, rounds out the market strategy, aligning products with evolving industry standards and regulations.

Founded in 1902 and headquartered in St. Louis, the United States, Belden Inc. is a global leader in signal transmission solutions and has pioneered intelligent networking infrastructure. Belden continues innovating in cybersecurity, edge connectivity, and high-speed data transmission for smart buildings and mission-critical environments.

Established in 1884 and based in Tokyo, Japan, Furukawa Electric is renowned for its expertise in power and telecommunication cables as it developed the world’s first optical fibre fusion splicer and leads in FTTH deployment. The company also innovates in superconducting technology, automotive wiring, and sustainable cable materials.

Founded in 1910 with headquarters in Tokyo, Hitachi Ltd. is a diversified conglomerate with a strong presence in energy and cable technologies. The company has contributed to high-voltage direct current systems and submarine cable projects. Hitachi integrates advanced digital solutions to enhance energy transmission and smart infrastructure performance.

Incorporated in 1968 and headquartered in New Delhi, India, KEI Industries is a major player in electrical cables and wiring. The company has grown through backward integration and strong project execution in EPC. KEI is noted for its extra high-voltage cable solutions and expanding global reach across 45+ countries.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the wires and cables market are Leoni AG, LS Cable & System Ltd., Nexans S.A., Prysmian S.p.A, and Sumitomo Electric Industries, Ltd., among others.

Unlock critical insights into the wires and cables market trends 2026 with our expertly crafted report. Stay ahead with detailed forecasts, competitive intelligence, and innovation tracking that empowers strategic decisions. Download your free sample report now to explore the future of electrification, smart infrastructure, and cable manufacturing worldwide.

Asia Pacific Wires and Cables Market

Europe Wires and Cables Market

United Kingdom Wires and Cables Market

United States Wires and Cables Market

North America Wires and Cables Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 285.27 Billion.

The market is projected to grow at a CAGR of 3.50% between 2026 and 2035.

The industry is expected to expand in the forecast period to reach USD 402.40 Billion by 2035.

Key strategies driving the market include technological innovation, renewable energy integration, smart infrastructure development, capacity expansion, recycling initiatives, strategic partnerships, and regional diversification to meet rising global demand.

The increased investments in smart grids and power transmission and distribution systems is expected to define the market growth in the coming years.

North America, Latin America, Middle East and Africa, Europe, Asia Pacific are the major regions in the market.

The major voltage segments in the market are low voltage, medium and high voltage, and optical fibre.

The leading materials of wires and cables in the industry are copper, aluminium, and glass, among others.

The major end-use segments in the industry are building and construction, aerospace and defence, oil and gas, IT and telecommunication, and energy and power, among others.

The key players in the market report include Belden Inc., Furukawa Electric Co., Ltd., Hitachi Ltd., KEI Industries Limited, Leoni AG, LS Cable & System Ltd., Nexans S.A., Prysmian S.p.A, and Sumitomo Electric Industries, Ltd., among others.

North America dominates the market led by smart grid modernization, EV infrastructure, and data centre growth.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Voltage |

|

| Breakup by Material |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share